Circle Withdraws Support for Individual Accounts

- Circle noted that the new decision does not apply to institutional or business accounts.

- USDC lost a huge chunk of its market share in 2023 while USDT recently hit a new high.

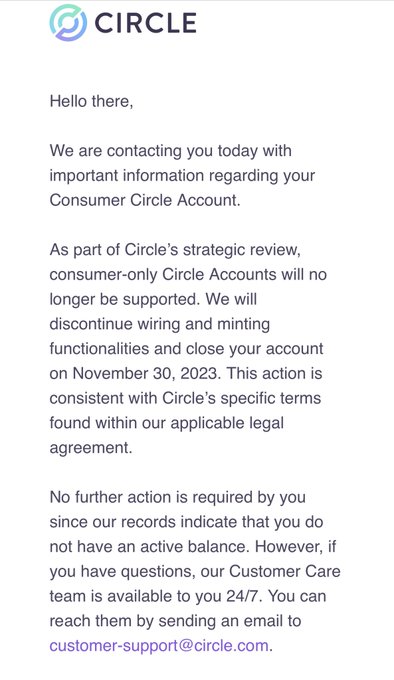

Circle, the company behind the USDC stablecoin, has announced plans to phase out individual or customer accounts by November 30. The company confirmed the news on Tuesday, October 31, noting that it will continue to support institutional and business mints.

A Circle spokesperson said in an email:

Circle is phasing out support for legacy consumer accounts and has notified individual consumers of this decision. Account closures do not apply to business or institutional Circle Mint accounts.

The spokesman confirmed that retail users can continue to access USDC using crypto exchanges, brokerages, and digital asset wallet services. Several Circle users took to X (formerly Twitter) to speculate on the possible reason behind this decision. One user suggested that individual accounts used for money laundering activities could be draining Circle’s reserves.

Another user provided a theory claiming that retail accounts could have been closed as part of a “cost-cutting/restructuring exercise.” Circle described certain user accounts as “legacy consumer accounts” in its statement, which appears to indicate that they were not being used as frequently as they had been in the past.

However, Circle CEO Jeremy Allaire rubbished these claims in a tweet on X. He wrote:

Lots of noise about Circle limiting individuals from using Circle Mint. There is nothing new here. We haven’t allowed individuals to open Circle accounts in years and have been institution-only for years as well. We have tremendous retail partners all around the world, including our strategic partner Coinbase, who offers excellent retail access to USDC without fees and always 1:1.

Allaire added that “the only change is that for a few thousand individual user accounts that were still open with us, we are no longer going to support those accounts. Please ignore the FUD, conspiracy theories, etc. Thanks.”

Circle’s decision to phase out individual accounts imitates a practice adopted by its primary rival, Tether, which caps USDT minting and redemptions at a $100,000 minimum. Circle’s USDC, the second-largest stablecoin, has seen a huge decline in its share this year. USDC has lost almost 43% of its market cap, while USDT has surged to an all-time high of nearly $84 billion.

Interestingly, several countries are working towards releasing regulations to guide the stablecoin market in 2024.