Robinhood Review 2022: Is It A Good Pick?

Overview

Very few of the several exchanges and trading platforms that have contributed to the rise in popularity of retail investing in the past have achieved the same level of success as Robinhood. Despite the fact that Robinhood was once a revolutionary brokerage service that simplified investing and trading for individual investors, a significant portion of that competitive edge has been eliminated as a result of later changes in the business.

In this review of Robinhood, we will examine Robinhood as a broker and make an effort to determine the types of investors and traders for whom it is the best option.

What is Robinhood?

The trading and investment platform known as Robinhood was first introduced with the intention of upending the traditional brokerage business.

The fact that Robinhood did not levy any commissions on trades gave the company a significant edge over its rivals in the market. Additionally, the company gave users access to a wide range of trading instruments, such as stocks, options, and cryptocurrency trading, in addition to traditional forex trading.

At the time, this move was hailed as being very well-liked, and Robinhood received a lot of attention as a result, which helped to fuel the latter’s rapid ascent to popularity. However, over time, the bulk of the brokerage industry noticed that they were losing ground to Robinhood, and as a response, they matched it by likewise eliminating fees from the pricing system that they employ.

In the current market, relatively few brokers in the business charge commissions for transactions. Instead, they rely on other means to gain income, such as PFOF or spread-based approaches. However, Robinhood still has a huge audience since it created a high degree of customer loyalty within the younger part of the trading industry. This is one of the reasons why it has such a wide audience.

With a simple design and a focus on the basics, Robinhood has been able to continue growing, albeit at a slower rate than it had been previously. This has allowed the firm to draw in younger and more tech-savvy investors. In addition, they just unveiled a brand-new range of services, including a cash management account and regular investment features. Later on in this examination, each of these issues will be discussed in more detail.

Robinhood Review – Pros

The Robinhood trading platform has several pros associated with it, which include:

Easy to Use Robinhood App

The market may be traded and invested in via the mobile app, which can be downloaded on both iOS and Android-powered smartphones. You have a quick and easy way to do this thanks to the app.

In contrast to other trading platforms and exchanges, which are often developed to maximise the number of features supplied, Robinhood prioritises ease of use instead. The company’s app has been developed such that it is simple to navigate and relatively intuitive, both of which contribute to the app’s overall attractiveness to customers.

The trading app also has a good number of features and customization options for advanced traders; however, the primary goal of the app is to simplify the trading process as much as is humanly possible. Because of this, the platform’s default settings are designed to provide the simplest settings possible and then permit users to customise the interface according to their individual preferences.

Because of the app’s user-friendly design, new investors and traders won’t be scared or turned off by the abundance of options that are accessible to them. Instead, thanks to the architecture of the programme, individuals will be able to advance to being knowledgeable traders and investors at their own speed.

Large Variety of Assets to Trade

Users of the Robinhood mobile app may quickly trade a very big range of assets, which is one of the reasons why the programme has become so popular. Another reason is that the service is completely free.

To begin, you may quickly purchase and sell the majority of major cryptocurrencies by using the mobile app, and there are very low to zero fees associated with the deal.

Despite this, Robinhood is not only a platform for trading cryptocurrencies; rather, it is also a brokerage service that gives users access to a wide variety of other asset classes. You are able to trade equities, exchange-traded funds (ETFs), and derivative contracts such as options using the mobile app, for instance.

Because of this, Robinhood has gained an enormous amount of popularity, particularly among younger investors who dislike the idea of having to use various applications in order to trade different asset classes. When compared to its competitors, Robinhood has an edge in this area due to the fact that it enables trading across all asset classes from a single, unified platform. This makes trading with Robinhood far more convenient and gives the company a market advantage.

Fractional Purchases

The vast majority of popular assets, whether they be equities or cryptocurrencies, are often offered at very high prices. If we take the example of cryptocurrencies, for instance, the majority of investors, particularly those who are just starting out on their learning curve, might not be able to afford the $30,000 required to purchase one Bitcoin.

Bitcoins, on the other hand, are divisible into smaller units, and the majority of the main cryptocurrency exchanges allow customers to acquire Bitcoins for as little as one dollar each. On the other hand, the stock market, where individual equities might likewise cost thousands of dollars, does not have nearly as much familiarity with this characteristic, despite the fact that it is highly popular in the cryptocurrency world.

Robinhood offers a solution to this issue by facilitating the acquisition of fractional shares by traders and investors. Therefore, individuals have the option of buying a very little portion of any asset that they choose to trade with the amount of money that they determine for themselves.

Cash Management Account

In addition, Robinhood provides a number of services for managing your funds that enable you to earn up to 0.30% annual percentage yield (APY) on any idle cash you may have. This is in excess of the interest that the majority of banks in the United States are now providing to customers for the balances in their checking accounts, which is in most cases 0 percent.

The simplicity of being able to withdraw money from any of the more than 75,000 ATMs that are a part of the network that Robinhood maintains is another benefit of the cash management tools provided by Robinhood.

Fully Digital Account Opening

The procedure of creating an account with Robinhood is likewise very quick and easy to understand, and it requires the trader or investor to commit very little, if any, time at all.

For instance, if you want to sign up for an account with Robinhood, you can do so immediately through the app, and the steps involved in the process are very straightforward. It won’t take you more than a few minutes to create an account with Robinhood, and as soon as your identity has been confirmed, you’ll be able to start trading as soon as you deposit money to your account.

Educational Resources

The world of cryptocurrencies is extremely fluid and dynamic, with new technology appearing every day and rendering previous ones outdated. This rapid pace of change makes it difficult to keep up. In such a world, it might be difficult to keep track of all the advances, which can be daunting to users. Users may be concerned that they will be left behind.

In addition, there are a number of users of Robinhood who are just beginning out in the realm of blockchains and cryptocurrencies, and it is possible that they do not understand how these systems work or what the fundamental components are.

Robinhood offers its consumers a package of instructional tools that is extraordinarily helpful for users in this category. Users of the Robinhood platform may access a series of video lessons as well as examinations designed to educate them on cryptocurrency trading as well as the most recent advancements in the sector.

No Account Minimum

Because of the reputation that the cryptocurrency markets have for being volatile, many novice investors and traders may be hesitant to commit a significant portion of their wealth to investments related to cryptocurrencies.

Because Robinhood does not require users to make a minimum deposit into their accounts before they can begin trading on the platform, it is the ideal platform to focus on when attempting to attract customers in this category. For example, customers may begin trading stocks, options, and cryptocurrencies through the platform with a deposit as low as one dollar and continue to do so at any amount they want.

It is a very helpful platform for newbie investors because there is no requirement for a minimum investment to open an account.

Highly Regulated

Because Robinhood is a publicly traded exchange on the equity markets, it is also one of the exchanges that is most strictly regulated, especially in the area of cryptocurrencies. One of the cryptocurrency markets’ most strictly regulated exchanges is Robinhood.

As a result of the trading app’s public listing, it is required to keep a particular level of openness at all times and is frequently examined by authorities like the Securities and Exchange Commission (SEC) to guarantee that the platform is in a satisfactory level of overall financial health.

As a result, in a world in which the majority of cryptocurrency exchanges are completely unregulated, the Robinhood trading platform provides a helpful alternative by offering investors and traders a secure platform in which they can park their cryptocurrency assets. This makes the Robinhood trading platform a useful alternative in a world in which there is a majority of unregulated cryptocurrency exchanges.

Robinhood Review – Cons

The Robinhood trading platform is not an exception to the rule that there are two sides to every coin. The following are some of the disadvantages that are connected with using the platform:

No Mutual Funds or Fixed Income Products

Because Robinhood does not offer any mutual funds, it is rather difficult for users to invest their money in a passive manner unless they prefer to do so using exchange-traded funds (ETFs). This is one of the most significant drawbacks connected with trading through Robinhood.

On the other hand, Robinhood does not allow trading in a significant number of goods that provide stable income, such as commodities or bonds. In addition, even though Robinhood allows trading in derivatives, only options may be bought and sold; buying and selling futures contracts is not an option.

For a company that claims a significant portion of its popularity to the fact that it enables users to readily trade any asset class of their choosing, the fact that it has these weaknesses makes it significantly less desirable as a platform for more experienced investors.

Additionally, Robinhood does not handle IRAs or other types of retirement savings.

No PFOF Data

In light of the fact that Robinhood does not levy commission fees on transactions executed through its platform, the company has developed a second method of generating money which it refers to as the Payment For Order Flow (PFOR) mechanism.

This suggests that when you place an order on Robinhood, the order is forwarded to a market maker, who is then in charge of executing the order on your behalf. This gives the market maker access to liquidity, which they may employ to reduce the risk they are exposed to. However, there are a number of issues with the PFOF method that, over the past several years, have made it problematic.

The quality of the market maker that a PFOF broker uses will be one of the most essential aspects to consider when determining how quickly a broker can execute transactions. This is a crucial point to keep in mind given the context of the current discussion. The majority of such brokers provide PFOF statistics on a regular basis so that investors and traders may then evaluate these statistics in relation to those of other brokers and utilise this information to make the most informed choices possible.

On the other hand, Robinhood does not disclose this kind of information; as a result, it is quite difficult to compare Robinhood’s performance and execution times to those of other brokers. As a result, there is no way to determine if the order execution procedures utilised by Robinhood are more precise or speedier than those utilised by its rivals.

Weak Customer Support

Another difficulty that arises while utilising the mobile app is that its customer support has a reputation for being fairly subpar and inattentive. This is especially true when it comes to resolving significant safety concerns or answering serious questions from customers.

Robinhood’s lacklustre customer service is a red flag for a trading platform designed for inexperienced users who may have questions or problems. For certain investors, this may reduce the platform’s allure, and as a result, their likelihood of using it.

Trading Restrictions

One of the most significant drawbacks of the PFOF model, which we covered earlier, is that it puts Robinhood at the mercy of the market makers through which it chooses to direct its orders. These market makers typically also have investment divisions, which could be adversely affected by the volume of retail trading. This can result in power outages and other difficulties of a similar nature.

Notably, Robinhood has had issues in the past, like the time the company stopped trading related to GameStop shares. This is just one example of the company’s struggles. The company had a number of disruptions, and at various times, the mobile application simply would not permit consumers to submit orders. In addition to this, a number of investors have voiced their dissatisfaction with the platform for forcibly liquidating their investments against their will.

Although this is not a significant problem for long-term investors, it is nonetheless alarming, and it gives insight into the quality of the platform as well as the number of trading limits that might be imposed by the PFOF model that is implemented by Robinhood.

Robinhood History

As was said previously, Robinhood was first released in 2015 as a method for users to participate in the stock market without having to pay the large charges that were prominent within the retail investing area. This was Robinhood’s primary selling point when it was first introduced.

However, in response to the increasing popularity experienced by Robinhood, a number of other brokers began to cut the costs that they charged customers and finally eliminated commissions entirely. This resulted in Robinhood’s competitive edge being eroded, and the company started diversifying its product offerings by adding ETFs, options, and cryptocurrencies to its roster of available investments.

However, in 2021 the firm was hit with a significant amount of criticism as a result of the GameStop incident. At that time, some customers complained about outages and full periods during which they were unable to engage in any form of trading at all. As part of the inquiry into the event, hearings were held before Congress, and Robinhood was given the opportunity to appear before those sessions.

Robinhood ultimately reached a settlement with the regulatory agencies investigating its actions by agreeing to pay a fine of $70 million in order to close the chapter on the affair. In addition to this, Robinhood was subjected to a great deal of criticism in relation to its deceptive advertising and communications. This included the company’s practise of misleading customers, the approval of novice traders for risky strategies, and technical difficulties that made it difficult for users to access the platform when they required it.

In order to retain its attractiveness to the younger population it formerly attracted, the platform has also begun to build a new set of features, including dividend reinvestment programmes, financial management tools, and a recurring investment plan. This is being done to maintain the platform’s interest among the younger population. Each of these traits has been thoroughly examined in our investigation.

More recently, in April 2022, it stated that it will be rolling out cryptocurrency wallets, which will be distributed to a queue of over 2 million users located all over the world. Customers who sign up for this wallet will get the ability to send and receive any of the cryptocurrencies that are available for trading on the Robinhood platform with ease as a consequence of their participation.

Additionally, the business revealed that it would be constructing a completely new non-custodial web3 wallet, for which it will shortly begin taking applications for a waitlist. It is anticipated by Robinhood that the beta version of this wallet will be available by the third quarter of 2022, and the company plans to provide the final product to all of the users who are currently on the waitlist by the end of 2022.

Robinhood Cryptocurrencies Available

The cryptocurrency offering on Robinhood is relatively restricted and only consists of seven of the most popular currencies. On the other hand, they contain the majority of the most important cryptocurrency tokens that are being traded on the market at the moment.

The following is an exhaustive list of all of the coins that Robinhood’s cryptocurrency products currently support for trading:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

Robinhood Fees

Trading costs and non-trading fees are the two primary types of fees that are generally charged to customers of any crypto trading platform. A brief description of each of these categories of fees, along with the pricing structure of Robinhood, has been provided below.

Trading Fees

These fees can relate to a variety of different types of fees. The vast majority of cryptocurrency exchanges collect transaction fees in one of two ways: either by charging spreads or commissions. Spreads are the more common method.

Spreads

Spreads are defined as the difference in price that exists between a bid price and an ask price. This concept is predominantly utilised by market-maker trading platforms, which take on the role of the trade’s counterparty in order to facilitate the transaction. Because of this, it might be said that you are trading against the platform itself.

When this occurs, there is typically a disparity between the price at which you can acquire the asset and the price at which it can be sold at any given moment. This is because the price at which you can buy the asset affects how quickly it can be sold. The spread is the difference between the asking price and the purchasing price, which is often referred to as the bid price. The buying price is nearly always greater than the asking price.

Due to the fact that you would be conducting both transactions at the same time, buying and selling an asset at the same time would actually result in a loss for you.

Commissions

A flat commission will be applied to each and every deal that you execute, which is the other type of trading cost that an exchange may charge you for. This is often a relatively tiny proportion of the trading volume and is calculated in a manner that decreases over time. This means that the bigger your trading volume, the lower the fees that you will be required to pay in this respect.

The Fee Structure of Robinhood

Instead of charging consumers spreads or fees of any kind, Robinhood generates the majority of its income via the PFOF mechanism, which we covered in the previous section.

Non-Trading Fee

In addition to the trading fee, cryptocurrency platforms will typically also charge a wide variety of other incidental fees and charges. These fees and charges are not directly related to the trading activity that takes place on the platform and are therefore considered to be incidental. These are covered in further depth in the next section.

Deposit Fees

In order for consumers to be able to deposit money into their accounts, the majority of cryptocurrency exchanges need users to pay a fee. When you make a deposit using Robinhood, the platform will not charge you any fees.

Withdrawal Fees

If you want to take money out of the platform, the majority of cryptocurrency exchanges will charge you fees when you do so. These costs are comparable to the deposit fees. If you desire to take money out of your account, you won’t be subject to any fees because doing so is not considered a withdrawal.

Robinhood Platform Features

Robinhood provides its users with a wide choice of services and options to choose from. Even while Robinhood’s initial purpose was to provide customers with a method to invest and trade without having to pay fees, the platform has since expanded to become so much more than that. We covered some of these developments before. The most important parts of the Robinhood Ecosystem are going to be broken down in the following paragraphs.

Dividend Reinvestment Program

You have the option with Robinhood to reinvest any profits you get back into your initial investment, which is one of the platform’s most valuable features. Investors in stocks will find this information to be especially helpful.

You have the ability to compound your profits over extended periods of time by using Robinhood’s auto-invest feature. This feature allows you to reinvest any dividends you earn on stock back into that company, giving you the possibility to achieve even greater returns.

Recurring Payments

Allowing customers to make regular payments to a specific security is another one of the new features that Robinhood has implemented in order to broaden its array of products. This is another one of the new features that Robinhood has added.

For illustration’s sake, let’s say you want to put away a predetermined percentage of each of your paychecks from your bank account into Bitcoin every single month. You can do this automatically with Robinhood’s new recurring investment function; to do so, connect your bank account, pick a preset investment amount, and then set the frequency to monthly. Robinhood will handle everything else.

After you have completed these steps, Robinhood will automatically add the specified amount to your Robinhood account on a monthly basis and invest it in Bitcoin on your behalf. Those who are interested in investing for the long term and desire to Dollar-Cost Average their assets over extended periods of time will find this to be a useful option.

Robinhood Gold

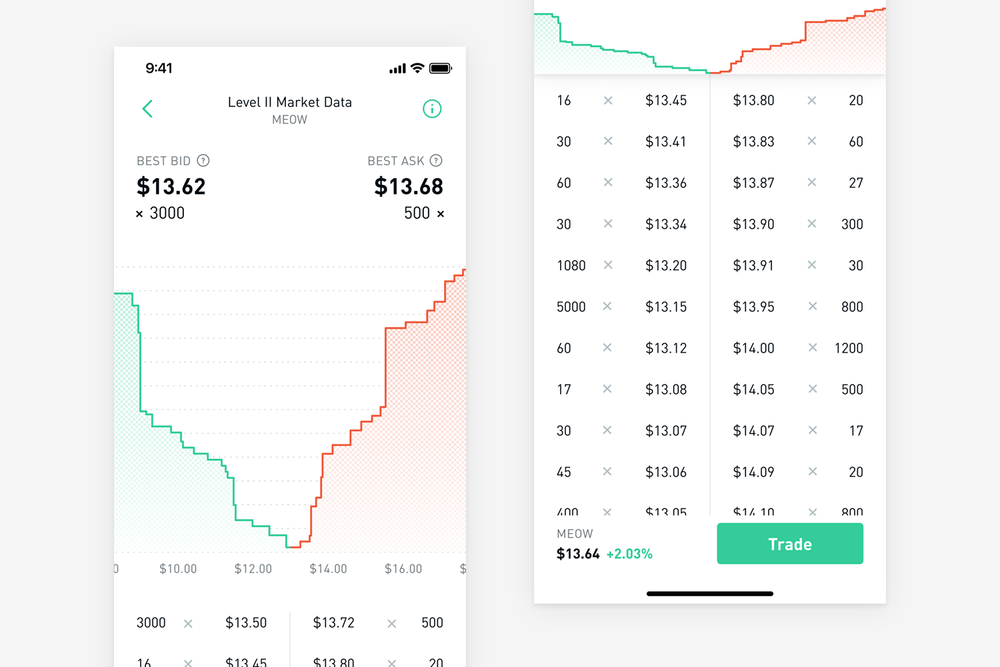

The Robinhood Gold account is the company’s newest premium service product, and it caters largely to more seasoned investors as its target demographic. Traders are given access to premium research as well as the ability to purchase securities using a margin. Traders may also buy securities using a margin.

To join Robinhood Gold, all that is needed is a $5 flat-rate monthly membership. Access to Morningstar, which offers research information on more than 1,500 different companies, is available to members. If experienced traders have access to margin loans and Level 2 Quotes through Robinhood Gold, they can place bigger orders after doing more thorough research on the company.

When you sign up for Robinhood Gold, the first $5 monthly fee that you pay includes a range of perks, one of which is the payment of interest on the first $1,000 that you borrow. This implies that you may make a transaction of up to $1,000 more than the capital that you have without risking any more of your own money, which enables traders to amplify the gains that they make from every particular trade that they participate in. Trading through a margin account, however, comes with the risk that users may see their losses multiplied; as a result, the margin of error that you have on any particular trade is narrowed as a result of this risk.

Any additional margin that you borrow in order to use it on the platform will incur a 2.5% annual interest charge. This pricing is really reasonable. These interest payments will be billed to you annually and applied to your account. Any account that plans to sign up for Robinhood Gold and make trades on margin has to have a minimum balance of $2,000 to meet the margin requirements. This is a crucial aspect of the circumstance to bear in mind.

Robinhood Safety

Due to its huge daily trading volume, Robinhood is open to hacking and online assaults. To counteract this risk, it must maintain a very effective and strong security system. Due to its huge daily trading volume, Robinhood is vulnerable to hacking and online threats. It achieves this purpose by making use of a variety of traits, such as the following:

Biometric Authentication

If their smartphone supports the capability, users of the Robinhood app may log in using their biometric identity. A fingerprint ID is one instance of this kind of biometric identification.

Users also have the option of creating a personal identification number (PIN) consisting of six digits to use when logging into their accounts.

Two-Factor Authentication

Them of Robinhood are strongly encouraged to install a method known as “two-factor authentication” on their respective devices. This will shield users from any potential cyberattacks.

For instance, in order to withdraw money from an account, the user will be needed to input a pin from the Google Authenticator app, which can only be accessible through the user’s phone. This is to ensure that the user is the one making the withdrawal. This guarantees that the account can only be accessed by its rightful owner and cannot be used by any other person.

Insurance

Additionally, Robinhood is a member of the Securities Investor Protection Corporation (SIPC), which is an organisation that enables Robinhood to secure the deposits that customers make onto the site. The Securities Investor Protection Corporation (SIPC) will safeguard deposits made with Robinhood for up to $500,000, or up to $250,000 if the claim is filed for cash.

Robinhood Review – Final Verdict

If you are someone who is just starting out in the world of investing and are looking for a straightforward and risk-free way to get started, then Robinhood is the perfect place for you to get your feet wet. This is because it provides access to a diverse selection of products, a straightforward trading platform, and the option to engage in transactions without incurring any fees or commissions.

Despite the fact that Robinhood’s reputation has been tarnished as a result of the controversies that have been associated with the company and that these controversies have caused users to doubt Robinhood and the brokerage account that it provides, the company still offers a variety of helpful services and features that make for a very good experience when trading. Having said that, it is essential to keep in mind that the platform does not possess any transparency in connection with the PFOF strategies it utilises while trading, even though this might soon change due to the intervention of regulatory authorities such as the Securities and Exchange Commission.