CoinSpot Review 2022: Pros, Cons and How It Compares

Overview

When it comes to cryptocurrency exchanges and investing in them, consumers situated in countries other than the United States typically choose selecting platforms that are local to their own nation. This offers a wide range of benefits to those who take use of it.

To begin, this implies that customers may very quickly deposit and withdraw cash in the currency of their country of residence from their respective accounts. It also has the extra benefit of guaranteeing that the exchange is regulated and trustworthy, which is a bonus in its own right. On the other hand, such local exchanges are quite uncommon, and it is typically rather challenging to locate such exchanges.

One such exchange is called CoinSpot, and it was developed with Australian customers in mind exclusively from the ground up. In this study of CoinSpot, we examine the trading platform and determine the kind of investors who would benefit most from using it.

What is CoinSpot?

CoinSpot is a cryptocurrency exchange that operates on the Australian continent and has its headquarters in the city of Melbourne. It was initially established in the year 2013 by Russell Wilson, and since that time, it has developed into one of the most significant cryptocurrency exchanges in the nation of Australia.

Users in Australia have access to a secure and dependable marketplace on which they may purchase and sell a wide range of cryptocurrencies using the platform.

The Australian Digital Commerce Association (ADCA), which is renowned for providing legal protection to consumers of licenced exchanges such as CoinSpot, is also one of the organisations that oversee the cryptocurrency exchange that CoinSpot operates. This ensures that CoinSpot provides a secure platform via which customers may purchase cryptocurrencies without worrying about the security of their assets. Because of this, CoinSpot users may purchase cryptocurrencies without worrying about the safety of their assets.

Individuals, corporations, and investors in Super Funds are the three primary categories of clients that have access to the CoinSpot platform for the purposes of trading and investing in cryptocurrencies. They have the power to quickly purchase or sell cryptocurrencies such as Bitcoin and others through the use of the platform.

CoinSpot Review – Pros

The trading platform provided by CoinSpot comes with a number of benefits, some of them are as follows:

Large Variety of Cryptocurrencies

The sheer amount of cryptocurrencies that CoinSpot supports and provides access to is a significant part of the reason why it is one of the most successful and well-known exchanges in Australia. CoinSpot is one of the largest and most popular exchanges in Australia.

Users have the ability to trade over 200 different cryptocurrencies by using CoinSpot. These cryptocurrencies include not just the most popular coins but also more obscure ones.

This number is not static and continues to increase on a regular basis as CoinSpot continues to expand its platform to support ever-evolving and increasingly popular cryptocurrencies.

Low Fees

For active traders, the fees they pay in order to trade on any given platform become a significant factor in the calculations they use to determine whether or not they are profitable. As a result, they are always looking for new platforms that will enable them to trade at costs that are more favourable to them.

One of these platforms is called CoinSpot, and it is well-known in the Australian blockchain market for having some of the lowest costs available. The fees that are linked with CoinSpot are some of the lowest in the business, as we will see in the portion of this review that is devoted to discussing costs.

Strong Security System

It is essential to highlight that CoinSpot is one of the most secure cryptocurrency exchanges in the world, as has been repeatedly demonstrated by the platform’s being the target of a cyberattack. It is crucial to note that CoinSpot is one of the most secure cryptocurrency exchanges in the world, as discussed in further detail in the review’s security section.

The platform makes use of a wide array of security measures in order to safeguard its users’ data as well as their financial holdings and personal information. CoinSpot has been the target of many cyberattacks, which is not surprising considering the huge trade volume that occurs on the site; nonetheless, the security protections that CoinSpot employs are on par with industry standards.

Schedule Automatic Purchases

Another new feature that CoinSpot has implemented in order to extend its portfolio of products is one that enables customers to make automatic recurring purchases of a certain cryptocurrency. This is one of the many new features that CoinSpot has added in order to expand its array of goods.

For illustration’s sake, let’s say you want to put away a certain percentage of each of your paychecks into Bitcoin every single month. You may do this automatically with CoinSpot’s new recurring investment function; to do so, pick a preset investment amount, and then set the frequency to monthly.

After you have completed these steps, CoinSpot will automatically add the specified amount to your CoinSpot account on a monthly basis and invest it in Bitcoin on your behalf. Those who are interested in investing for the long term and desire to Dollar-Cost Average their assets over extended periods of time will find this to be a useful option.

Instant Purchases

CoinSpot is a platform that provides its users with a number of benefits, one of which is the opportunity to buy cryptocurrencies using their credit or debit cards in a simple and immediate manner.

When you have finished verifying your account and are ready to start trading, you will be able to decide practically immediately whether or not to purchase any cryptocurrency of your choosing.

You may quickly acquire a cryptocurrency by going to the Marketplace, selecting the cryptocurrency you want to buy, entering the quantity you want to acquire, selecting the credit or debit card you want to use, and then clicking on the buy button. This procedure is quite straightforward.

Highly Regulated

As was just discussed, one of the most significant benefits that comes with utilising the CoinSpot platform is the fact that it is subject to a stringent level of regulation by the relevant Australian authorities.

For instance, we have already gone through how CoinSpot is a member of the Australian Digital Commerce Association, which provides an additional layer of safety for its clients by virtue of the association’s membership requirements.

Investors are provided with the peace of mind that their monies are being stored on a secure platform as a result of the fact that the platform has been granted a licence by AUSTRAC and has also been awarded a quality certification by ISO.

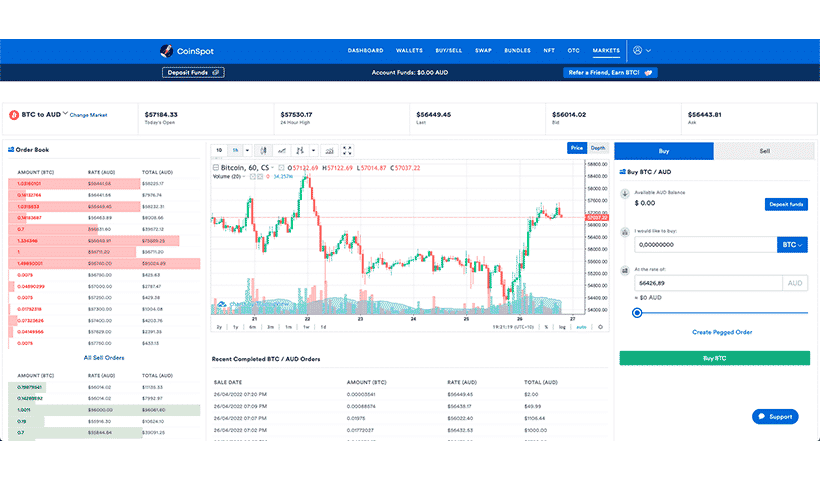

Easy to Navigate Platform

CoinSpot is a cryptocurrency trading platform and exchange that prioritises ease of use over the provision of the maximum amount of features, in contrast to most other trading platforms and exchanges. The fact that their platform can be navigated in a straightforward manner and is quite easy to understand further contributes to the platform’s attraction to customers.

Additionally, despite the fact that the trading platform has a good number of features and options for advanced traders, the primary goal is to simplify the process as much as is humanly possible. Because of this, the platform’s default settings are designed to provide the simplest settings possible, and then users are given the option to customise the interface according to their own individual preferences.

The app’s basic design guarantees that inexperienced traders and investors will not be deterred or frightened by the sheer amount of accessible features. Due to the nature of the application, individuals will be able to make the transition to become expert traders and investors at their own speed.

Strong Customer Support Team

The fact that most cryptocurrency exchanges do not have good customer service teams is one of the more common concerns among users who regularly trade through cryptocurrency exchanges. This lack of good customer service teams makes it very difficult to get questions answered or problems solved by the cryptocurrency exchange.

This is where the CoinSpot exchange stands out from the competition since it gives its customers access to a Live Chat support staff that is available around the clock. This team can answer the majority of their basic questions and make the trading process more pleasant for traders.

CoinSpot Review – Cons

CoinSpot trading platform is no exception to the rule that there are two sides to every coin. The following are some of the problems that might be encountered when using the platform:

Only Accepts AUD

Another drawback of using the site is that deposits and withdrawals may only be made using Australian Dollars (AUD), which is the country’s national currency.

The vast majority of traders and investors based in Australia will find this option to be quite useful; however, people based in Australia who work online and are paid in a number of different currencies may find it difficult to take use of this function.

Those who desire to deposit funds in a foreign currency into CoinSpot will be asked to pay a currency conversion charge, which is normally a time-consuming and expensive operation. Those who seek to deposit funds in a different currency into CoinSpot will be asked to pay this charge. Customers who plan to fill their CoinSpot accounts with a currency other than Bitcoin or Ethereum will be required to pay this fee.

Does Not Support Shorting

Going long and going short are the two primary types of transactions that traders often engage in while conducting business on cryptocurrency exchanges. When traders are bullish on an asset and anticipate that prices will rise, they will engage in long positions. When traders are bearish on an asset and anticipate that prices will fall, they will engage in short positions.

CoinSpot is unique among cryptocurrency exchanges in that it does not let customers to short cryptocurrency assets while using the site. CoinSpot’s appeal as a sophisticated trading platform is diminished as a result of the absence of this functionality due to the fact that a number of trading methods include going short on assets. This is a highly uncomfortable circumstance.

No Margin Trading

The capability to trade using margin is yet another really important function that is lacking from the platform. This is a feature that must be included on every platform that aspires to attract more experienced investors, but it is especially crucial for those platforms.

The phrase “margin trading” is commonly used to describe a trader’s capacity to borrow funds from an exchange in order to build positions. Because of this, traders can open positions with a greater value than the capital they have placed into the transaction. If a trader deposits AU$1,000 and borrows the remaining AU$9,000 from the exchange, the total position size is AU$10,000. This is due to the fact that AU$1,000 plus the AU$9,000 they borrowed from the exchange totals AU$10,000. That’s because they borrowed AU$9,000 in addition to the AU$1,000 they already had lying around from the deal, bringing the grand total to AU$10,000.

As a result, given that greater positions are being opened, this will amplify the gains (or losses) that the trader will experience as a result of their actions. Because experienced traders use margin trading so frequently, CoinSpot’s lack of this feature is a significant shortcoming of the platform. Margin trading is one of the most used forms of trading in the world.

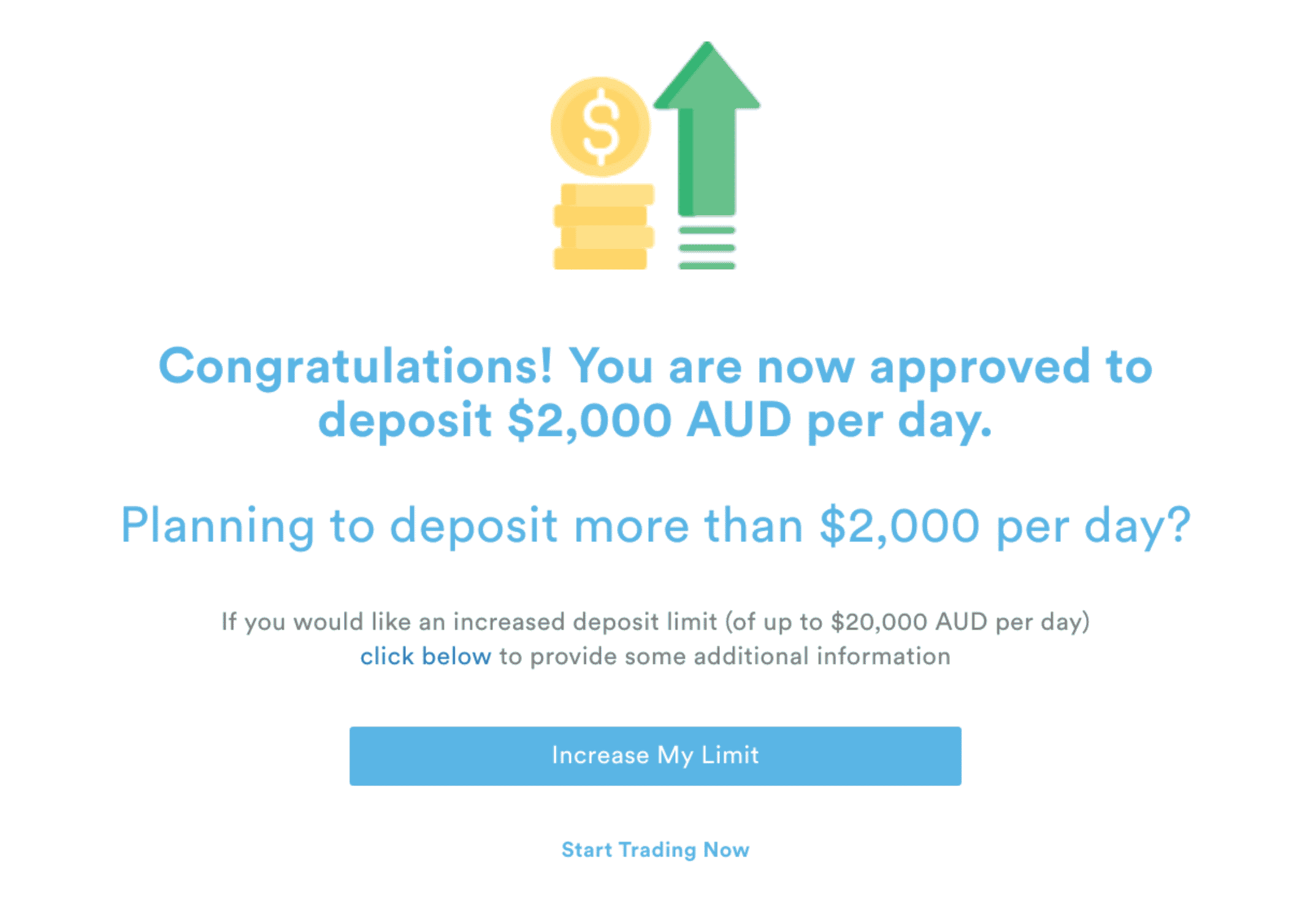

Trading Restrictions for New Users

The fact that the platform places several trading restrictions on new users makes it more difficult for those users to engage in unrestricted and profitable trading in the immediate aftermath of setting up their trading account with CoinSpot. This is another issue that users of the platform face, and it is one of the reasons the platform has a negative reputation.

For instance, there is a cap placed on the amount of trading volume a user may have during the first week after creating an account on the platform. This cap is only in place for the first seven days. The volume limit is then gradually raised over the course of the subsequent few weeks as the platform monitors the trading activity of the user and makes evaluations.

Despite the fact that this is a required legislative requirement that compels the exchange to make certain that experienced traders understand the dangers that they are facing, numerous investors and traders who use the platform have claimed that they feel as though the entire procedure is a headache.

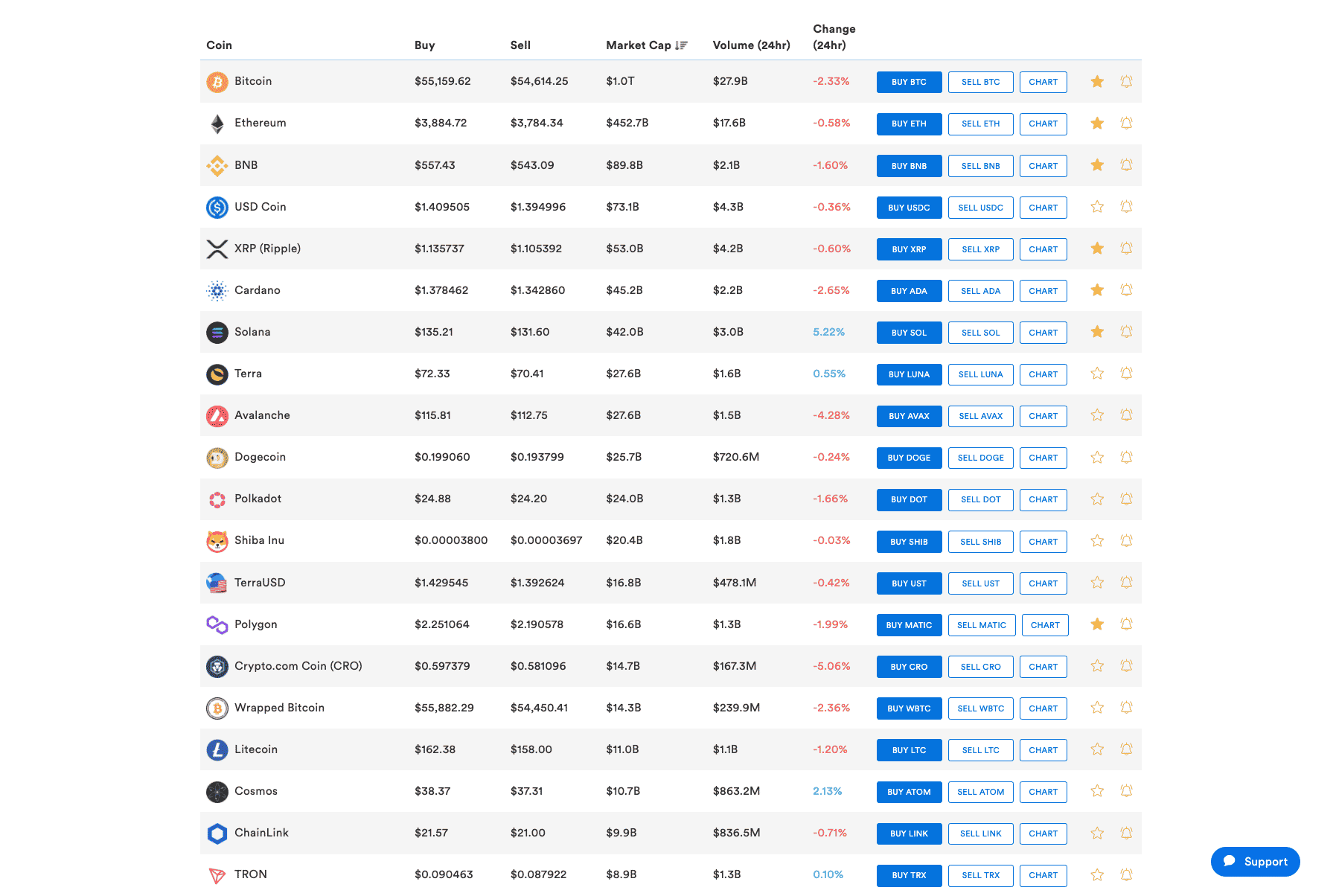

CoinSpot Review – Cryptocurrencies Supported

When CoinSpot first began operations as an exchange for cryptocurrencies, the first cryptocurrency that was supported was Bitcoin. Since that time, however, the platform has undergone development and now supports over 200 different cryptocurrencies. These cryptocurrencies include not just the most well-known coins but also some more obscure ones.

The following is a list of some of the most prominent cryptocurrencies that are supported by the platform:

Bitcoin

Ethereum

Litecoin

Ripple

EOS

Stellar

NEO

Tron

Bitcoin Cash

The CoinSpot app will also take a wide number of additional DeFi tokens and coins in addition to these cryptocurrencies. Some examples of these tokens and coins are the AAVE token, the Uniswap token, and the COMPOUND token.

CoinSpot Review – Fees

There are two categories of fees that are charged by any trading platform: trading fees and non-trading costs.

CoinSpot Trading Fee

Trading fees, also known as order execution fees, are the costs incurred by users when placing orders on a platform and having those orders carried out. The vast majority of cryptocurrency exchanges collect trading fees in one of two ways: they either charge spreads or commissions. Spreads are the more common of the two.

Spreads

Spreads are defined as the difference in price that exists between a bid price and an ask price. This concept is predominantly utilised by market-maker trading platforms, who take on the role of the trade’s counterparty in order to facilitate the transaction. Because of this, it might be said that you are trading against the platform itself.

When this occurs, there is typically a disparity between the price at which you can acquire the asset and the price at which it can be sold at any given moment. This is because the price at which you can buy the asset affects how quickly it can be sold. The spread is the difference between the asking price and the purchasing price, which is often referred to as the bid price. The buying price is nearly always greater than the asking price.

You would lose money if you bought and sold an asset at the same time.

Commissions

A flat commission will be applied to each and every deal that you execute, which is the other type of trading cost that an exchange may charge you for. This is often a relatively tiny proportion of the trading volume and is calculated in a manner that decreases over time. This means that the bigger your trading volume, the lower the fees that you will be required to pay in this respect.

CoinSpot Fee Structure

The pricing model that CoinSpot use for its fees is known as a flat commission-based structure.

A one percent transaction fee is applied to any and all trades that take place on the platform for the purpose of buying, selling, or exchanging cryptocurrencies.

In a same fashion, a flat cost of 1% is charged on each transaction for some specialised orders, such as stop-loss orders, take-profit orders, and recurring purchase orders.

CoinSpot, in contrast to the vast majority of other exchanges, does not collect fees based on a maker-taker structure. Instead, a single 1% trade fee is applied to all types of trades conducted on the platform.

On the other hand, if traders utilise the OTC function of the platform, then the cost that they are paid on this deal is merely 0.1%. This rate is significantly lower than the average commission.

CoinSpot Non-Trading Fee

In addition to the price for conducting trades, cryptocurrency platforms may frequently levy a wide range of other fees and levies as well. These are covered in further depth in the next section.

Deposit Fees

In order for consumers to be able to deposit money into their accounts, the majority of cryptocurrency exchanges need users to pay a fee.

CoinSpot does not charge any fees for adding funds to your account, whether those monies be in the form of fiat cash or cryptocurrency. This holds true regardless of the kind of money used to deposit the funds (fiat or cryptocurrency). This is the case whether you use fiat currency or a cryptocurrency like bitcoin to finance your account. If you choose to proceed forward, the only thing that will ultimately be your responsibility is paying the deposit-related network fees.

There is a bonus available for those who wish to fund their accounts with fiat currency or cash. To cover its transaction processing expenses and a surcharge, the exchange charges a fee of either 2.5% (for cash deposits) or 0.9% (for BPAY deposits).

Withdrawal Fees

If you want to take money out of the platform, the majority of cryptocurrency exchanges will charge you fees when you do so. These costs are comparable to the deposit fees. When you want to take money out of your CoinSpot account, there are no withdrawal fees connected with the process if you opt to take the money out of your CoinSpot account and put it directly into your bank account.

On the other hand, if you decide to withdraw funds into another cryptocurrency wallet, you may be subject to a gas cost. The amount of this fee is determined by the coin and network to which you choose to transfer your assets.

CoinSpot Review – Platform Features

The CoinSpot ecosystem is comprised of a number of components, each of which contributes to the exchange platform’s robust position in the competitive cryptocurrency trading market in Australia. These are covered in further depth in the next section.

Instant Trading

As was just said, CoinSpot gives its users the ability to buy and sell cryptocurrencies without having to go through a cumbersome process beforehand.

After you have validated your account and added a form of payment, you will be able to buy any cryptocurrency you want without having to haggle the price through an order book. This will become possible as soon as you have completed these steps.

In addition, the price charts that are provided by the platform are highly sophisticated. They include a wide variety of charting and analytical tools, which make it much simpler for traders to make decisions that are based on accurate information.

Affiliate Program

Because CoinSpot’s pricing is mostly based on a commission-based approach, the company makes more money as a percentage of the total number of transactions that are processed through its platform.

This basically indicates that it is to the platform’s best advantage to make sure that as many users as possible sign up for the platform and start trading through it as soon as they possibly can. As a result, it developed an affiliate programme with the purpose of encouraging people to bring in new users to the network by offering financial incentives.

Through the affiliate programme, users may acquire their own referral IDs and potentially earn money or cost rebates for referring new users.

Through the usage of the affiliate referral programme, customers have the opportunity to not only experience a reduction in the trading costs that they themselves incur but also to earn commissions on the trading fees that their referrals incur.

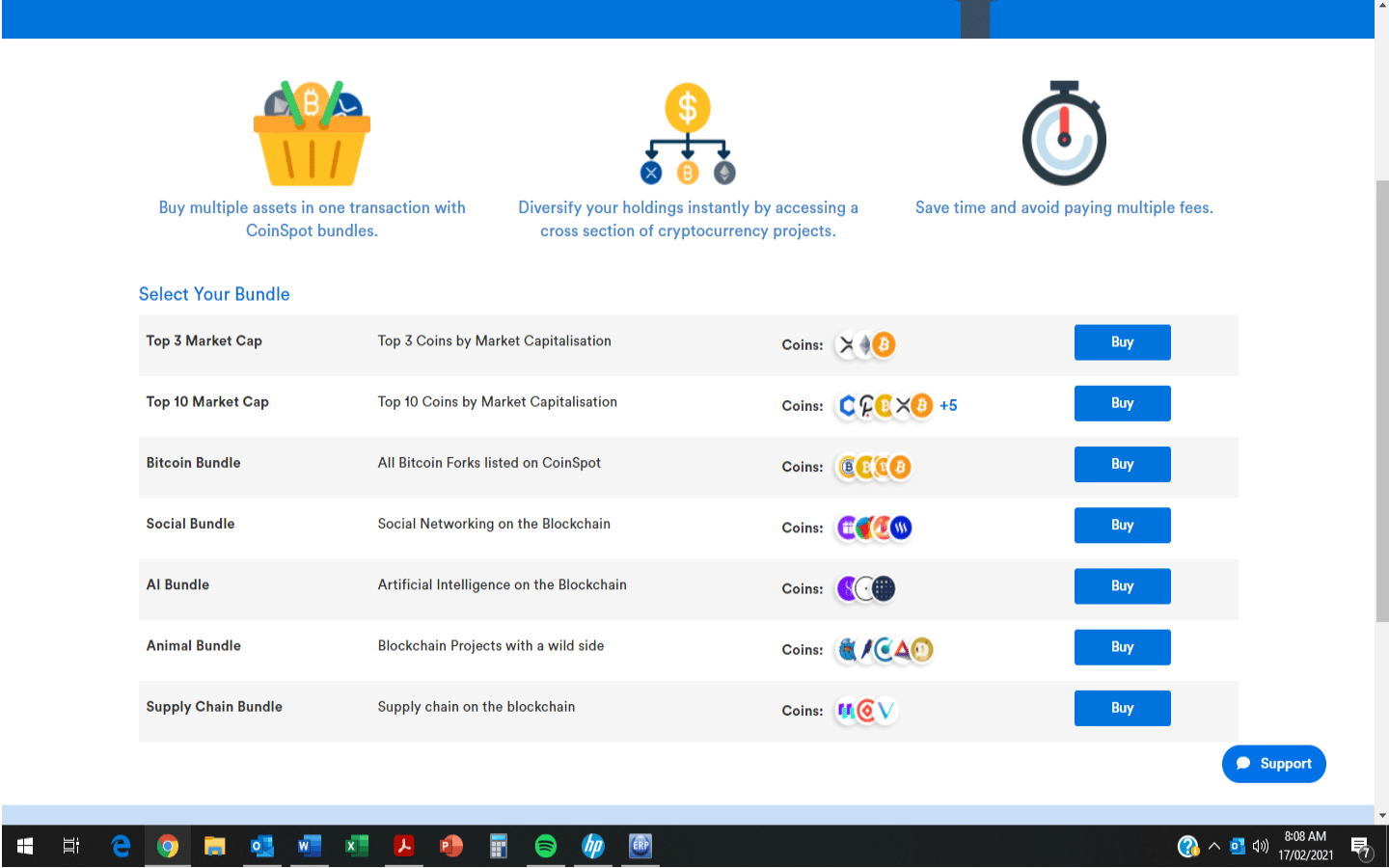

CoinSpot Bundles

Additionally, CoinSpot members have access to bundled products, which can be utilised to immediately diversify their investment portfolios.

For a trader to increase their portfolio’s diversification, for instance, it is not necessary to physically buy a wide variety of assets. The only thing they need to do is adopt a diversified investing approach. Instead, they may buy one of CoinSpot’s pre-made bundles and use it to spread out their bitcoin holdings. To boost portfolio diversification, for instance, a trader need not really go out and purchase new assets. If they want to spread their risk, they need just raise the share of their portfolio that is invested in diverse assets.

The website offers a variety of packages, such as the ability to sort coins by market capitalization, ESG score, and industry (NFTs or DeFi). One of the packs, for instance, categorises currencies by market cap. A sample of such a package is shown as an example below.

Multi-coin wallet

When you engage in a transaction using the CoinSpot network, your assets are afterwards saved on the internal wallet that CoinSpot makes available to its users.

This is a multi-asset wallet that has the capacity to hold over 300 distinct digital currencies. Additionally, you will have the capability to move cryptocurrencies to and from other third-party wallets, such as Metamask, when using this wallet.

Earning on CoinSpot

The vast majority of traders do not always engage in cryptocurrency trading, and many of them have the option of keeping their holdings even when the market is through a bad period.

Trading through an exchange that offers interest on your inactive cryptocurrency holdings is always the best option in cases like these. You may make the most of the time when your resources are idling in this way. One example of such a marketplace is CoinSpot.

Users have the ability to stake their cryptocurrencies on CoinSpot and then receive rewards on them based on the currency and the period for which they have staked the asset. These rewards are determined based on both the coin and the duration.

However, you can only stake a certain amount of coins, such as DOT, AVAX, and MATIC. This option is not accessible for all currencies.

NFT marketplace

Additionally, CoinSpot provides users located in Australia with access to an NFT marketplace that was developed with the express purpose of making the process of buying and selling NFTS as uncomplicated and hassle-free as is humanly feasible.

Although the number of NFT collections that are available through this marketplace is somewhat restricted, it does include some of the more well-known collections, such as the Bored Ape Yacht Club collection.

NFTs are ordinarily priced in ETH tokens due to the fact that the majority of them have been developed on the Ethereum blockchain. Nevertheless, you are free to use any wallet or token of your choosing in order to buy and sell NFTs.

SMSF support

CoinSpot also provides help for customers who may want to add cryptocurrencies to SUper FUnds that are being handled by them. These users can contact CoinSpot for assistance.

For this reason, the staff at CoinSpot includes a number of specialists in Self-Managed Super Funds (SMSF), who are able to offer guidance to customers who already have SMSFs or who are considering establishing their own SMSF.

Because the procedure that is connected with establishing an SMSF may be rather hard, the staff at CoinSpot is available to guarantee that clients who are interested can do so in a way that is simple and does not involve any challenges.

OTC trading

Customers of CoinSpot who intend to engage in significant deals worth more than $50,000 each have the option of accessing the company’s over-the-counter (OTC) service.

The Over-the-Counter (OTC) desk at CoinSpot gives investors a way to purchase and sell cryptocurrencies without going via an exchange.

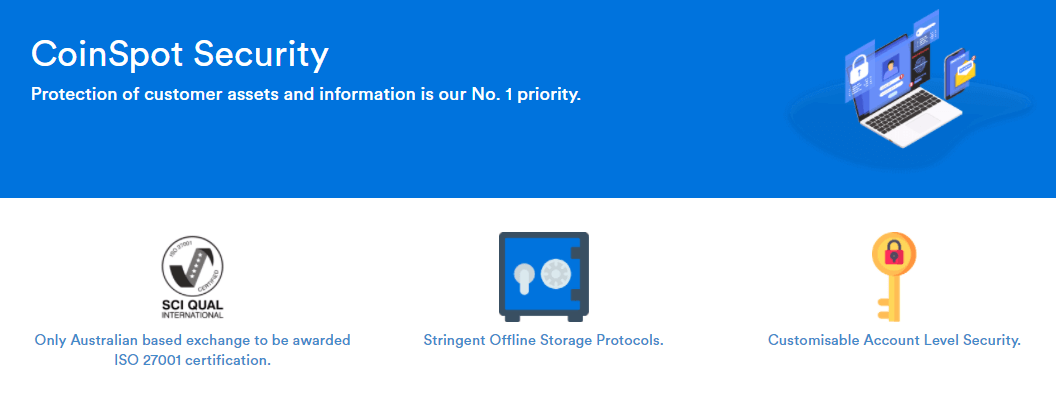

CoinSpot Review – Safety Measures

When consumers are considering which cryptocurrency exchange they want to use in order to trade, one of their primary concerns should be the exchange’s level of security. This is true not just for users who are just starting out with cryptocurrencies but also for more advanced users.

CoinSpot provides a solid industry-grade security architecture, which helps relieve the minds of prospective investors regarding the safety of their assets and the data they save on the site. The fact that the CoinSpot has never been hacked, which is a testament in some respects to the effectiveness of its security protocols, has not changed as of yet.

CoinSpot has been recognised as a member of both the “Australian Digital Commerce Association” and the “Blockchain Australia” community. It is also registered with AUSTRAC, Australia’s body for combating money laundering and terrorism financing. This shows the platform is serious about tackling these serious issues, which provides an extra degree of safety for users.

As was also said, CoinSpot is unique among Australian exchanges in that it is one of the few to have received ISO accreditation for its dedication to a safe trading environment. CoinSpot was recognised as a safe trading platform since it is one of the few in Australia that give this assurance to its customers.

Traders must submit a code generated on a mobile device that is registered with CoinSpot in order to access the site or withdraw funds. Two-factor authentication, often known as 2FA, is an extra safety measure. This is done so that users’ money can’t be stolen by hackers or other criminals and their security can’t be compromised in any manner.

CoinSpot Review – Final Verdict

Due to the fact that it is one of the top cryptocurrency exchanges in Australia, CoinSpot enjoys a great deal of popularity among locals who are interested in becoming engaged with digital currencies.

Trading through CoinSpot comes with a number of benefits, the most notable of which are the fact that it is subject to stringent regulations, that it facilitates immediate purchases through its platform, and that it provides a choice of payment ways, all while charging extremely minimal costs.

The platform does not yet support shorting, and there is no maker-taker fee structure in place either. This is one of the negative aspects of the platform. Therefore, any user who is considering trading through CoinSpot should first ensure that they have a thorough understanding of the dangers and drawbacks involved with using the exchange before getting started.