Circle supprime la prise en charge des comptes individuels

- Circle a noté que la nouvelle décision ne s'applique pas aux comptes institutionnels ou professionnels.

- L'USDC a perdu une grande partie de sa part de marché en 2023, tandis que l'USDT a récemment atteint un nouveau sommet.

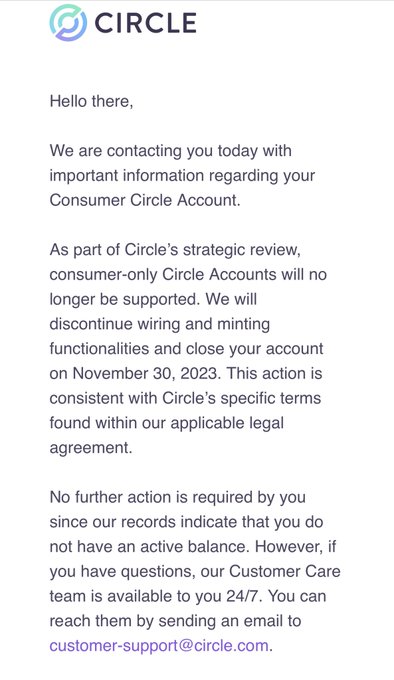

Circle, la société derrière le stablecoin USDC, a annoncé prévoit de supprimer progressivement les comptes individuels ou clients d'ici le 30 novembre. La société a confirmé la nouvelle le mardi 31 octobre, notant qu'elle continuerait à soutenir les monnaies institutionnelles et commerciales.

Un porte-parole du Cercle a déclaré dans un e-mail :

Circle supprime progressivement la prise en charge des anciens comptes grand public et a informé les consommateurs individuels de cette décision. Les fermetures de compte ne s'appliquent pas aux comptes professionnels ou institutionnels de Circle Mint.

Le porte-parole a confirmé que les utilisateurs particuliers peuvent continuer à accéder à l'USDC en utilisant des services d'échanges cryptographiques, de courtage et de portefeuille d'actifs numériques. Plusieurs utilisateurs de Circle se sont tournés vers X (anciennement Twitter) pour spéculer sur la raison possible de cette décision. Un utilisateur a suggéré que les comptes individuels utilisés pour des activités de blanchiment d'argent pourraient épuiser les réserves de Circle.

Un autre utilisateur a avancé une théorie affirmant que les comptes de détail auraient pu être fermés dans le cadre d'un « exercice de réduction des coûts/de restructuration ». Circle a décrit certains comptes d'utilisateurs comme des « anciens comptes de consommateurs » dans sa déclaration, ce qui semble indiquer qu'ils n'étaient pas utilisés aussi fréquemment que par le passé.

Cependant, le PDG de Circle, Jeremy Allaire, a réfuté ces affirmations dans un communiqué. tweeter sur X. Il a écrit :

Beaucoup de bruit à propos de Circle limitant l'utilisation de Circle Mint par les individus. Il n'y a rien de nouveau ici. Nous n'avons pas autorisé les particuliers à ouvrir des comptes Circle depuis des années et nous sommes également réservés aux institutions depuis des années. Nous avons d'énormes partenaires de vente au détail partout dans le monde, y compris notre partenaire stratégique Coinbase, qui offre un excellent accès au détail à l'USDC sans frais et toujours 1:1.

Allaire a ajouté que « le seul changement est que pour quelques milliers de comptes d'utilisateurs individuels qui étaient encore ouverts chez nous, nous n'allons plus prendre en charge ces comptes. Veuillez ignorer le FUD, les théories du complot, etc. Merci.

La décision de Circle de supprimer progressivement les comptes individuels imite une pratique adoptée par son principal rival, Tether, qui plafonne la frappe et les rachats d'USDT à un minimum de $100,000. L'USDC de Circle, le deuxième plus grand stablecoin, a connu une énorme baisse de sa part cette année. L'USDC a perdu près de 43% de sa capitalisation boursière, tandis que l'USDT a atteint un sommet historique de près de $84 milliards.

Il est intéressant de noter que plusieurs pays sont fonctionnement vers la publication de réglementations pour guider le marché du stablecoin en 2024.