15 Of The Best Crypto to Buy In 2022 (Freshly Updated)

Because there are presently over 10,000 cryptocurrencies that can be traded or invested in, selecting the best crypto to buy may be an exceedingly challenging task, particularly for those who are just starting out in the cryptocurrency market.

To make things easier for you, we are going to go over some of the best cryptocurrencies, based on all types of cryptocurrencies, that you can buy in November of 2022 before their value skyrockets in the near future. This will help you buy cryptocurrencies before their value skyrockets in the near future. It is my sincere hope that you will use this information to find the next major cryptocurrency.

Continue reading to the conclusion; we will discuss the top cryptocurrencies and hidden gems to invest in for 2022, as well as digital coins, crypto options, cryptocurrency firms, the future of cryptocurrency, and even alternatives to Bitcoin. Make sure you read this entire post all the way to the end so you can find the hidden extra gem that we have prepared for you here.

What is Cryptocurrency?

People may purchase, sell, and trade cryptocurrencies on digital currency exchanges in the same manner that we buy, sell and trade anything using fiat cash. A cryptocurrency is just digital money. The primary distinction is that cryptocurrencies are not physical objects, and they may be freely traded from one user to another without the intervention of any centralised authority like a government or bank.

As of November 2022, there were over 21,000 different cryptocurrencies available for purchase, and there is a good chance that figure will continue to rise in the future if the cryptocurrency industry continues to flourish.

Should You Buy Cryptocurrencies Right Now?

Due to the volatile nature of the cryptocurrency market, there is no easy way to answer the question of whether or not it would be prudent to invest in cryptocurrencies at this time (as of the second half of 2022). Even the most well-known projects, like Bitcoin and Ethereum, are susceptible to experiencing sudden and significant price shifts.

You will become more proficient at making an educated decision after taking into consideration a variety of issues, such as the consequences of inflation, increasing interest rates, and political and economic upheaval, just as you will become more adept at buying or trading stocks on the stock market.

You can determine the market’s low and high points by employing technical analysis tools such as support and resistance levels. The cryptocurrency market tends to move in cycles, and utilising these tools will help you identify the market’s low and high points.

Bitcoin (BTC)

The first coin was crucial in laying the groundwork for the creation of subsequent cryptocurrencies and digital assets. Bitcoin, which had a market capitalization of slightly more than 350 billion dollars at the time this article was written, holds the largest share of the entire cryptocurrency market.

Bitcoin is built on the idea of scarcity, and its capacity to act as a store of value is one of the factors that continues to entice investors to purchase the asset. There can never be more than 21 million bitcoins available for purchase, yet around 19.15 million are now in circulation.

Additionally, Bitcoin utilises a Proof-of-Work (PoW) validation mechanism, which appeals to risk-averse investors who are more concerned about the safety and security of their funds. These investors are drawn to Bitcoin because of this feature. Notably, Bitcoin is neither supported by any governmental body, nor does it have a central bank that may assist its usage. This is a significant disadvantage for Bitcoin.

Additionally, many companies, such as Visa and MasterCard, permit the use of Bitcoin and other cryptocurrencies to facilitate payments. Because of this, the likelihood of cryptocurrency’s widespread adoption is increased, as more people shop with cryptocurrency. As a consequence of its expansion, the leading digital asset is also witnessing an increase in the amount of institutional usage.

In September 2022, the Nasdaq (NDAQ), which is the United States’ second-largest stock market operator, made the announcement that it would begin offering a cryptocurrency custody service. The mission of Nasdaq is to build a business that can profit from the rising interest in cryptocurrencies among institutional investors. In August, the world’s largest asset management company, BlackRock (NYSE: BLK), made an announcement that it would begin offering cryptocurrency services to its institutional clients. These services would include support for Bitcoin.

It is also important to note that the investment giant Fidelity has included Bitcoin exposure in some of its exchange-traded funds (ETFs), while at the same time the value of Bitcoin ETFs continues to increase. This easily adds Bitcoin to our list of the best crypto to buy.

Your capital is at risk.

Ethereum (ETH)

After Bitcoin, Ethereum is the blockchain network that has the second-largest market cap, and therefore it is also a worthy addition to our list of the best crypto to buy. Ethereum is arguably the largest smart contract platform on the market, and it was released in July 2015 by a team of developers led by Vitalik Buterin. Ethereum attracts multiple developers due to its ability to support multiple use cases, such as non-fungible tokens, and it was initially developed by a team of developers led by Vitalik Buterin (NFTs).

Ever since it was first introduced, Ethereum has had phenomenal growth that, as of the beginning of September 2022, is at 14,155%. Ethereum is far ahead of the majority of cryptocurrency projects and currently only Bitcoin stands between it and first place in terms of market cap among cryptocurrencies.

Because of its innovative blockchain technology, Ethereum is now one of the most promising cryptocurrencies to invest in. For instance, it enables developers to design their own currency and implement smart contracts by utilising blockchain technology.

Importantly, since it successfully completed “The Merge” upgrade on September 15, 2022, which saw its transition from a Proof-of-Work consensus mechanism to a Proof-of-Stake (PoS) consensus mechanism, it is anticipated that it will gain more traction. This is significant. The purpose of this improvement is to make the network more easily expandable while also lowering the amount of energy it uses and the fees it incurs for using gas.

As a result of these modifications, it is anticipated that the Ethereum blockchain will attract a greater number of investors who will be interested in taking advantage of the reduced gas expenses.

In spite of this, the processing time for transactions on the Ethereum network remains longer than usual owing to the increased volume of traffic. Those who are interested in purchasing Ethereum should be aware that the platform’s security has historically been a bit of an issue; however, the upgrade will hopefully make the platform more secure, and prove our thesis about why the crypto market agrees that Ethereum is among the best crypto to buy.

Your capital is at risk.

Cardano (ADA)

Cardano is a blockchain that has greater scalability qualities and utilises the Proof-of-Stake consensus method. Cardano is able to facilitate the growth of decentralised finance (DeFi) initiatives and NFTs because of these qualities. On its blockchain, the development of decentralised applications, commonly known as dApps, may also be carried out in a range of different sectors, including gaming, polling, and access management.

The Alonzo hard fork, which went live in September 2021, was an important upgrade for Cardano since it contained the introduction of smart contract features. As a direct result of this hard fork, ADA is now able to scale and perform its operations at a far faster rate than it was previously capable of. In addition to these capabilities, it allowed ADA to give the developer community a DeFi application development platform and better programmability. This was made possible by the fact that it enabled ADA to do so.

In addition, the upgrade included the capacity to execute smart contracts on the Cardano blockchain. In particular, the Plutus smart contracts made it possible to construct decentralised applications in a reliable, quick, and safe manner. In addition to this, on September 22, 2022, a second hard fork with the name Vasil was made available to the public. It is predicted that this split would improve the network’s capability of scaling even more.

Cardano has also received extensive acceptance, as seen by the announcement made by Sygnum Bank, the world’s first digital asset bank, that its “customers may quickly and securely stake Cardano” on the bank’s institutional-grade platform “to generate staking incentives.”

While the Georgian wine industry entered into a relationship with the Cardano Foundation to deploy a traceability solution based on the latter’s blockchain technology, they did so in order to guarantee the genuineness and quality of Georgian wine.

In conclusion, Cardano intends to launch an incubator programme in Africa with the goal of fostering creativity and assisting in the resolution of day-to-day problems. It will add to the reasons why it is one of the best cryptocurrencies to invest in right now if it is successful in meeting the objectives of that strategy and if it continues to scale.

Your capital is at risk.

Binance Coin (BNB)

The cryptocurrency known as Binance Coin (BNB) is the currency that the Binance ecosystem is based on. BEP-20 criteria have been adhered to in the production of this currency, which was coined on the blockchain of the Binance Smart Chain (BSC).

In addition, Binance Coin is the native token for the world’s largest crypto exchange, Binance, where it may be exchanged, in addition to being traded on a variety of other platforms and exchanges. BNB customers receive a plethora of extra benefits, including but not limited to cost reductions, the opportunity to make investments, the facilitation of loans and transfers, donations to charity organisations, and the purchase of virtual presents, amongst others.

When it was originally made available to the crypto world in 2017, each BNB coin was worth only ten cents. On May 10, 2021, the value of the currency went on to achieve an all-time high of $690.93, breaking a new record for itself in the process. As the Binance ecosystem has evolved from a straightforward token trading platform into a multifaceted and diverse market, the BNB token has shown to be an extremely valuable asset for the Binance platform.

Binance Coin is not just the native cryptocurrency that can be found inside this developing ecosystem, but its usage has also developed significantly. For example, users of BNB can:

Earning staking rewards by staking on the BSC blockchain;

Paying for products and services with the Binance Card feature;

Earning staking rewards by staking on the BSC network.

Utilizing the Binance Pay service for both receiving and making payments;

Obtaining reductions in the costs of transaction fees for trades in the spot, margin, and futures markets

Binance, following its launch, developed a system for the quarterly buy-back or burning of its tokens. This was done with the intention of reducing the total quantity of its circulating tokens and boosting the value of those tokens.

The firm started the quarterly auto-burn process in December 2021. This procedure enables on-chain automatic calculations to determine how much of the token has to be burnt based on its current price and the number of blocks that are issued on the BNB chain during a specific quarter.

However, consumers should be informed that BNB is susceptible to regulatory concerns as well, which is maybe something that they should be aware of. During the initial coin offering (ICO) that Binance had in 2017, for instance, the Security and Exchange Commission (SEC) initiated an inquiry into whether or not Binance complied with the rules. This led to a precipitous drop in the price of BNB in June 2022.

Your capital is at risk.

Ripple (XRP)

XRP is a crypto project that was developed by Ripple Labs Inc., and its primary use case is as a blockchain that enables more convenient and affordable international financial transactions.

Neither the Proof-of-Work nor the Proof-of-Stake consensus mechanisms are implemented in XRP. Instead, it makes use of validating servers, which are responsible for ensuring that the requested modifications to the previous ledger are accurate. XRP is built on a decentralized protocol, which means that there is no governing body that decides who is allowed to set up a node or confirm transactions. This enables it to handle transactions involving different currencies in an instant, and it also makes it more appealing to investors who are looking for alternatives to the antiquated SWIFT network, which may result in delays.

Because new ledgers are generated every three to five seconds on the XRP blockchain, the transaction settlement time is extremely fast. According to Ripple’s estimations, the XRP ledger is capable of processing 1,500 transactions per second (TPS) on average and has the potential to grow up to 65,000 TPS. In comparison, the speeds of settlement for Bitcoin and Ethereum are five and fifteen transactions per second (TPS), respectively.

More crucially, despite the fact that Ripple is still engaged in a legal battle with the SEC that has already lasted for two years, the business is certain that it will prevail. In point of fact, the organisation is working closely with educational institutions all around the world in order to assist and expedite academic research, technological development, and innovation through the use of blockchain technology, cryptocurrencies, and digital payment systems.

For example, the XRP Ledger is managed by over 150 separate organisations, some of which are monetary institutions, others are educational institutions, and yet others are cryptocurrency exchanges.

The price of XRP might experience a considerable increase as a result of these developments, which would likely attract further investors.

Your capital is at risk.

Polygon Network (MATIC)

Polygon is a cryptocurrency asset that was produced from the Ethereum blockchain. Its primary objective is to enhance the scalability and infrastructure of Ethereum. It does this by embracing the “layer two” idea, which transforms the Ethereum blockchain into a multi-chain network in order to increase the speeds at which transactions and confirmations take place.

In addition to this, Polygon features excellent levels of both security and scalability, as well as interoperability. It provides a robust experience for both users and developers, with frameworks that are adaptable and configurable. Each decentralised application (dApp) hosted on Polygon has access to its own dedicated resources and a technology stack that may be completely customised.

Polygon’s token, known as MATIC, has received backing from cryptocurrency exchanges such as Binance and Coinbase, and it is now being utilised on many platforms as a settlement currency, as well as for fees and payment services. The coin is made accessible to a large number of people as a result of its existence on prominent crypto exchanges; as a result, its value may improve as a result of this.

Polygon introduced its zkEVM scalability solution in July of 2022. This solution makes use of the zero-knowledge Proof technology, which helps to cut transaction costs while simultaneously improving throughput. It is possible that the value of the MATIC token may rise by the time August 2022 rolls around, when it will have supported around 37,000 decentralised apps.

Onboarding has already begun for a number of significant organisations, including Meta and Stripe, on the Polygon platform. In addition, Polygon invests in carbon neutrality and supports the stablecoin Tether (USDT), both of which have the potential to contribute to the company’s future expansion. This easily adds Polygon to our list of the best crypto to buy.

Your capital is at risk.

Decentraland (MANA)

Users of Decentraland, a virtual reality platform that runs on the Ethereum blockchain, will be able to create, experience, and make money from their own content and apps. Decentraland maintains its position as the dominant metaverse platform, with a market capitalization of more than one billion dollars, and as a result, it continues to draw in an increasing number of users and investors in the video game industry.

One of the most notable features of Decentraland is its implementation of the Decentralized Autonomous Organization, or DAO, technology. The DAO technology guarantees actual decentralised governance, in which users have complete control over the experiences and material that are created on a particular piece of virtual land.

Decentraland has produced millions of dollars in revenue over the course of the past year via the sale of virtual land, which can only be purchased using MANA, the platform’s in-house currency. With increases of over 20,000% since its official introduction in February 2020, Decentraland is bound for much greater success, making it one of the greatest cryptocurrencies to invest in right now.

Your capital is at risk.

Solana (SOL)

One of the benefits of Solana’s platform is that it has cheaper transaction costs than other blockchains, which encourages more people to participate in the platform. Solana is a very efficient blockchain.

Because of its Proof-of-Stake mechanism, which enhances validation speed, Solana is capable of processing up to 50,000 transactions per second. In September 2022, Solana-based transactions reached the 100 billion milestone. In addition to this, it utilises Proof of History, which is a time-tracking extension of its consensus process that has been tuned.

Even though it faces intense competition from Ethereum, Solana has managed to climb its way into the top 10 cryptocurrencies by market capitalization thanks to its lightning-fast network and minimal transaction costs. The most crucial distinction between Solana and Ethereum is how each one stores and updates data. Solana is extremely distinct from Ethereum in this regard. For example, it isolates and places state data and executable code in distinct locations.

Since its introduction in 2020, the price of SOL has seen an incredible increase of approximately 4,000%, reaching an all-time high of $260.06 in November 2021 after beginning the year at $0.77. Specifically, SOL tokens are native assets that are used for value transfer inside Solana-based NFT marketplaces such as Solanart, Solsea, and Margin Eden. These markets are all powered by Solana. SOL is utilised throughout the production process, as well as throughout the selling and purchase of these NFTs.

In conclusion, as Solana is a PoS network, it is possible for entities to stake their SOL tokens and either run validator nodes themselves or delegate their shareholder rights to validators in exchange for a payment.

Your capital is at risk.

Polkadot (DOT)

Polkadot (DOT) is another relatively new crypto asset that is considered to be one of the finest cryptocurrencies to purchase right now. This is due to the fact that it is interoperable with other cryptocurrencies as well as having long-term potential, all of which might offer it a stable future.

Polkadot also provides an excellent technology, which is one of the main reasons why more users and investors are drawn to the platform. For instance, it runs on a Nominated Proof-of-Stake (NPoS) system, which enables all of its native tokens to participate in the network’s voting.

holders to participate in the protection of the network by staking their tokens. holders are required to do this. The Polkadot blockchain is interoperable because to a mechanism called “Bridges,” which enables it to connect with other blockchains outside of its own system, such as Bitcoin and Ethereum.

Polkadot is a great offering for investors who are searching for a blockchain platform that addresses the problem of interoperability, enhances scalability, and offers a multi-chain network. This easily adds Polkadot to our list of the best crypto to buy.

Your capital is at risk.

Avalanche (AVAX)

Avalanche is a layer one blockchain that aims to enhance the scalability of the system while also making the basic protocol more efficient. It is made up of thousands of subnets that come together to build a varied and interoperable network of many blockchains. A highly scalable blockchain, the Avalanche network is capable of processing up to 4,500 transactions per second per subnet.

Avalanche was initially released as a rival to Ethereum, and it includes three separate blockchains that operate independently to validate each transaction that takes place on the network. The network can accommodate tens of thousands of validators at once and is designed to be decentralised. In addition to this, it has a low latency, which enables it to accomplish confirmation within three seconds, with the majority of confirmations requiring less than one second. Every transaction is fully irrevocable and cannot be altered in any way.

When compared to Ethereum, the Avalanche blockchain is more scalable and has a superior capacity for processing large numbers of transactions. As a result of this, its popularity among Ethereum projects has risen. AVAX was first offered for sale in 2020, and since then, its price has increased significantly, reaching an all-time high of $146.22 in November 2021.

Avalanche is gaining traction as the world’s quickest platform for smart contracts, despite the fact that it is still a relatively new project and does not have much of a track record to compare it to. Even though a bear market has been in effect for most of 2022, AVAX has still nearly quadrupled in value from when it was first introduced. This easily adds Avalanche to our list of the best crypto to buy.

Your capital is at risk.

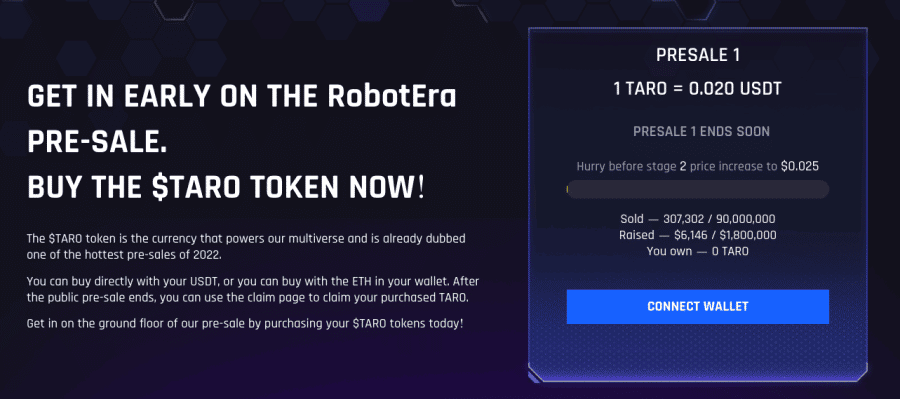

RobotEra

The new metaverse world of RobotEra has both traditional and non-traditional financial transactions (NFTs) as a means of providing players with possibilities to earn in-game currency. The native cryptocurrency, TARO, is an ERC-20 token that is presently being sold in a presale. Buyers may get in on the action now.

RobotEra is a comprehensive virtual gaming environment that follows in the footsteps of other famous metaverse games such as The Sandbox and Decentraland. Players may buy non-fungible token (NFT) plots of land and then build and harvest those plots in order to gain resources.

The other primary non-fictitious tokens on this platform, in addition to the virtual real estate, are the Robots, which stand in for a player’s avatar. A limited edition set of 10,000 Robots will be minted by RobotEra. These Robots will belong to one of seven different campaigns. On the planet Taro, which serves as this project’s environment, each Robot campaign takes place on one of seven distinct worlds.

On the marketplace of RobotEra, TARO may be used to buy and sell all of the in-game NFTs that are available. Token staking, mining, and the sale of non-fungible tokens (NFTs) are some of the ways players will be able to earn rewards in RobotEra, which is one of the most highly awaited projects involving NFTs in the metaverse.

According to the RobotEra whitepaper, participants that stake its native token are eligible to take part in the RobotEra DAO (decentralised autonomous organisation) and have voting rights on the route the project takes.

There will be a total quantity of 1.8 billion tokens, of which 5%, or 90 million, will be reserved for the first round of the presale. At this time, you can acquire TARO at a cost of $0.020 USDT. After the second round, the price of a token will have increased to $0.025 USDT, and after the third and final round, it will have reached $0.032 USDT.

Assuming that Bitcoin will reach the level of $15,000 in the fourth quarter of 2022 and that altcoins will drop much more, the best cryptocurrency to buy right now may be one that is on presale and is thus untouched by the market correction. This easily adds RobotEra to our list of the best crypto to buy.

Your capital is at risk.

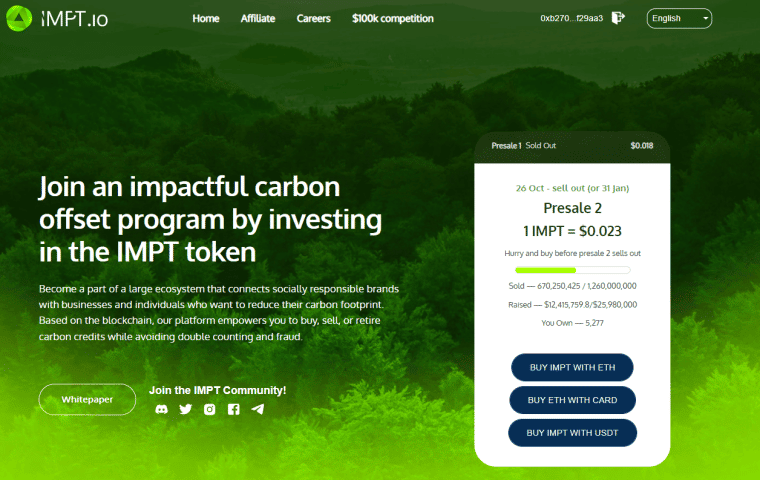

IMPT tokens

Have you ever been curious about the process of investing in carbon credits? Carbon credits may be acquired in a variety of ways, including shopping with IMPT, purchasing them on the IMPT marketplace, or acquiring them through other means. IMPT is a really innovative idea that enables users to do so. Individuals, in addition to large enterprises or organisations, will be able to contribute in this manner to the battle that is being waged against the climate problem.

IMPT has had a tremendous amount of interest in its presale, which resulted in the company selling more than $11 million in only three weeks and completely exhausting its stage 1 allotment four weeks earlier than expected.

This is the greatest carbon offset programme available, and it has teamed with over 10,000 of the major merchants in the world to enable consumers to offset their carbon impact while purchasing. Amazon, Microsoft, and LEGO are among the companies that have already worked with IMPT.

Each company decides for themselves what proportion of their profit margin they will allocate to impact projects. The user’s account will hold onto the selling margin in the form of IMPT tokens until the user reaches the threshold required to buy a carbon credit with those tokens.

Users are also able to make direct purchases of carbon credits through the IMPT carbon marketplace. On the IMPT platform, users have the option of selecting from among hundreds of environmental projects that have previously been evaluated. Users will have the choice of selling their carbon credits, retiring them, or holding them as investments in the event that they want to do so. In addition, customers will get compensation for the retirement of their carbon credits through the site. According to the idea for the project, after making use of their carbon credits, users would be able to get one-of-a-kind NFT souvenirs that were created by artists.

After the completion of the first stage of the presale, the project will move into the second stage at an increased price of $0.023. During the third and final stage of the presale, the price of tokens will grow by 22% to $0.028, which is also an increase of 55% from stage 1.

During the presale, a total of 1.8 billion tokens, or sixty percent of the maximum supply of 3 billion, will be available for purchase; there will be no vesting time for presale tokens.

The remainder of the allotment came from a private sale (10%), the team (15%), development (10%), and marketing (10%).

CoinSniper has done a doxxing and KYC verification on the project’s developers, while Hacken has performed an audit on the smart contract.

Readers interested in learning more about the IMPT project can refer to the Whitepaper, as well as sign up for the official Telegram channel to ensure that they are kept abreast of all the most recent developments. This easily adds IMPT to our list of the best crypto to buy.

Your capital is at risk.

Calvaria

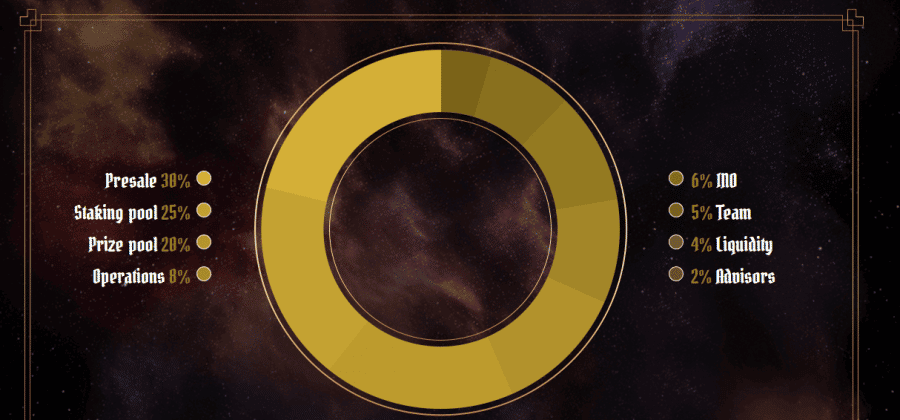

Calvaria is a new play-to-earn card game that provides players and participants in the ecosystem with incentives in the form of two rewards tokens: $RIA and $eRIA. Players that win tournaments are awarded with eRIA tokens as a sign of their accomplishment. By combining cards of equal power, players may earn eRIA, which can then be used to pay for new cards that are one level higher.

Players are required to acquire an NFT deck of cards using Calvaria cryptocurrency in order to participate in the game and win tokens. Players that make in-game purchases with eRIA tokens will become the owners of the corresponding assets and will be able to resell them. 10% of each purchase goes towards the staking pool, which is maintained by Calvaria. Tokens may also be earned in this game using a second method, which is described here.

While the eRIA token is employed for making in-game purchases and accumulating prizes for participation in games, the RIA token is what keeps the economy of this ecosystem on a solid footing. Staking is one method the developers are using to accomplish this goal. Coins owned by investors can be “staked” to earn interest in the form of RIA tokens. Staking in Calvaria’s ecosystem allows users to make a long-term investment with their coins while still receiving benefits on a regular basis.

According to the whitepaper for Calvaria, investors who stake their coins will also be able to participate in the voting mechanism and, eventually, will have decision-making authority over the ecosystem. The amount of tokens an investor owns will be the determining factor in how much weight is given to their vote.

Players will be relieved to learn that there are no transaction fees associated with either coin, as NFT collections play a significant part in the progression of the game, and as eRIA tokens are necessary for the purchase of NFT collections, Calvaria is resolute in its mission to increase the value of the coins by incorporating additional features that broaden the scope of the tokens’ potential applications.

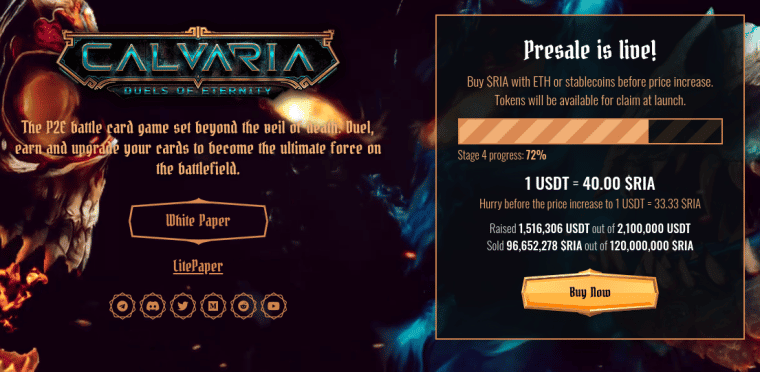

At the moment, Calvaria is working quickly through its crypto presale and is now providing the RIA token in the fourth stage of its cryptocurrency presale at a price of $0.025 for each token.

If an investor is seeking for the finest cryptocurrency to buy right now in the P2E niche, they may want to participate in the presale now since the price of the coin will grow at each step of the sale.

Tokens will cost $0.055 each by the end of the tenth and final step, which is a rise of 120% from the present price.

Your capital is at risk.

The Hideaways

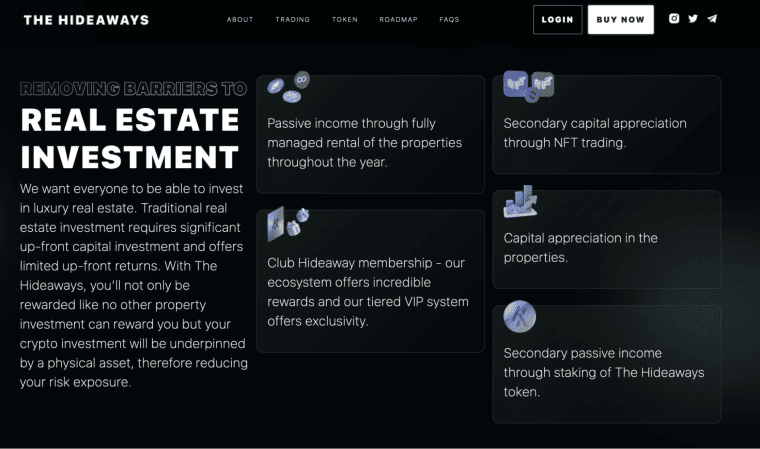

The Hideaways is the cryptocurrency for you if you’re looking for one that aims to revolutionise the real estate industry while also having real-world utility. The project is the first luxury real estate investment platform in the world. It gives users the opportunity to invest in a fully managed portfolio of luxury properties for as little as $100. Additionally, the project has the potential to increase in value by 20–50 times while maintaining a realistic market capitalization.

Each of the opulent residences in The Hideaways’ portfolio is connected to a separate NFT.

Because of this, the minimum value of the NFT is inextricably linked to the value of the underlying physical property at all times. After then, the NFT is fractionalized into smaller parts, making it possible for different investors to purchase a stake in it with a minimum initial investment of $100.

Users are able to benefit from the following thanks to the ecology that The Hideaways is built on:

The increase in the property’s value over time

Secondary market NFT gains

Earnings from rentals taken on a passive basis

HDWY Staking yields

If you own the NFTs, you will acquire exposure not just to the potential capital appreciation of the luxury property but also to the potential exposure from the secondary market for NFTs. In addition, the rental revenue that is generated by luxury residences is an excellent source of cash flow for their owners.

Each investment property is acquired through the use of a specialised acquisition vehicle, which is a legally recognised business complete with its own bank account for depositing rental payments. At the conclusion of each month, once the expenditures have been removed, the remaining earnings from the rental is divided to the NFT holders.

In addition, ownership of the NFTs grants access to Club Hideaways, which come with a variety of bonuses, including the following:

Drawings for prizes once a month

Access to travel experiences all over the world at a discounted rate

Entry to the lounge

You could win trips that include everything.

5* Luxury holidays

Private jet flights

Gaining access to off-market real estate and development opportunities

SolidProof, which is a crypto security company that specialises in code audits, has already performed an audit on their contract. And they are going to freeze team tokens for the next two years; the $HDWY is a coin that you do not want to pass up.

The Hideaways are in the process of conducting a presale for their HDWY tokens, which will officially begin on the first of January 2023. This is your opportunity to get in on the ground floor of a coin that could eventually rank among the top 20 cryptocurrencies by market capitalization. This easily adds The Hideaways to our list of the best crypto to buy.

Your capital is at risk.

Battle Infinity (IBAT)

Battle Infinity is the project that we believe has the potential to become the most successful cryptocurrency currently available, despite the fact that there are hundreds of other projects to take into consideration. Battle Infinity is a forthcoming metaverse-based ecosystem that has already been confirmed as compliant with KYC standards by CoinSniper. It is packed with enticing play-to-earn (P2E) components. Within this metaverse, players have the ability to design their own avatars and participate in the games offered by Battle Infinity in order to accumulate substantial prizes.

Battle Infinity is now in the process of development and intends to build upon the growing popularity of metaverse-based platforms. It was one of the crypto presales that sold out the quickest so far in 2018. Players have the opportunity to participate in one of six distinct platforms inside the Battle Infinity ecosystem. One of the most popular is the IBAT Premier League, which offers a blockchain-based fantasy sports league for the very first time, replete with non-fungible tokens (NFTs).

In addition to this, Battle Infinity features a built-in NFT marketplace. Here, players may mint and sell their own works of art, as well as buy products to personalise their avatars. In addition, players will be able to purchase parcels of digital land within Battle Infinity. This property may then be utilised to place billboards within the game itself. Within the framework of the Battle Infinity ecosystem, there will even be a DeFi exchange known as IBAT Battle Swap that will facilitate smooth token trading.

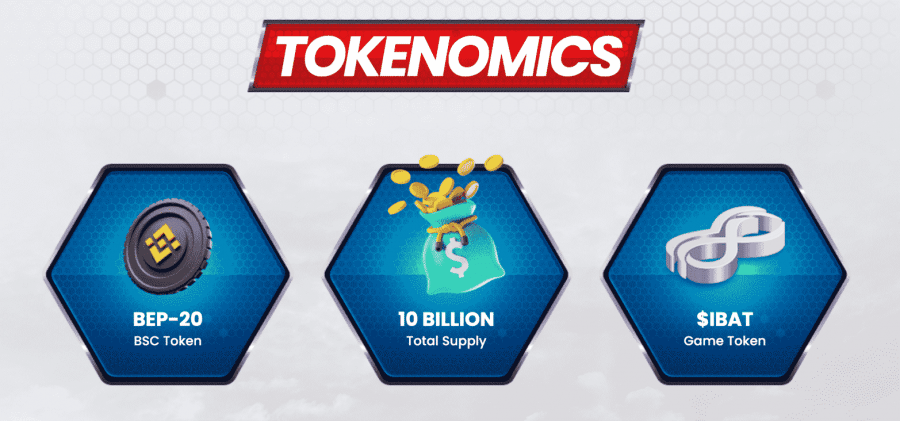

The $IBAT token, which is the world’s native BEP-20 token, will be used to make the Battle Infinity ecosystem a reality. There will be a total amount of 10 billion tokens available for the $IBAT cryptocurrency, which will be utilised for rewards distribution and staking. During the course of the presale, there was an offering of 28% of the total supply that was made available for purchase by investors.

Overall, it seems probable that $IBAT will become one of the finest metaverse currencies of the year since it rewards good players through the thrilling fantasy league aspect that is included into the platform. When putting together a team, the fact that the participants in the fantasy league are organised as NFTs makes for a novel opportunity to make trades and formulate strategies.

Remember that admins will never direct message you first on Battle Infinity’s Telegram group; this is the greatest location for individuals who are interested in the project to keep track of its development and release timeline.

Due to an extraordinary level of demand, the Battle Infinity (IBAT) presale concluded yesterday having sold out well in advance of its deadline. The placement of it on PancakeSwap was the next step on its route to success.

IBAT pumped 700% from its presale price on the day of its introduction, achieving a market valuation of $60 million. IBAT pumped again once it was listed on LBank in late August, hitting another market cap of $60 million.

The cryptocurrency has a market cap of $40 million at the moment, but it seems to be undervalued at the moment due to the fact that additional listings are going to be scheduled in the near future, and the developers have also revealed that staking will be live very soon.

Token holders will have the option of locking up their holdings for 30, 60, 90, or 360 days in order to collect incentives; however, the annual percentage yield (APY) for these awards has not yet been disclosed.

Your capital is at risk.

How we rated the top crypto picks

Every crypto asset comes with the promise of large returns and other advantages. On the other hand, not every single one of them delivers what they offer. The following criteria were taken into consideration while choosing the cryptocurrency that is currently the best investment:

Technology

More than 21,000 distinct cryptocurrencies are now operational inside the crypto realm, each of which is powered by a unique technology. We analysed how one cryptocurrency stacks up against others in terms of both its usefulness and its level of security.

Documentation of performance

There are crypto projects that have been operational for more than a decade and have established a solid history and reputation. Others have just been around for a little over two years. We did not have any preconceived notions about new projects, so we looked at how a crypto asset has fared throughout the course of the period it has been in operation to get an idea of how stable its price is, how popular it is, and how widely it is used.

Longevity

The historical data of a crypto asset is one of the ways in which similar projects now available on the market may be compared to it. The duration of the projects was one of the factors that this guide analysed while evaluating their success from the time of their debut to the present.

Adoption

Since their launches, several cryptocurrency projects have seen a decline in the number of people engaged in their day-to-day workings. When ranking the various cryptocurrencies, we took into consideration a number of factors, including investor interest and acceptance. Projects that have a high degree of adoption typically have better liquidity, which means that buying, selling, or spending them is less difficult and more convenient.

Mistakes in Deciding Which Crypto to buy now

Even if buying cryptocurrencies isn’t very difficult, investing in cryptocurrency is nonetheless fraught with significant danger. Before settling on a crypt to purchase, there are a few preventative measures that should be taken beforehand. In spite of the fact that there is evidence to suggest that the number of cryptocurrency investment scams has been decreasing recently, it is still extremely important to steer clear of typical blunders and perform in-depth research and due diligence on one’s own before making any investments in order to minimise losses and maximise gains.

In the midst of the Sam Bankman-FTX Fried’s bankruptcy scandal and the meltdown of the cryptocurrency lending platform Celsius, after the earlier Terra (LUNA) ecosystem crash, adding the largest-ever Ponzi-scheme type crypto scam, these events show how extremely volatile the cryptocurrency market still is and that investments come with a high risk. In addition, these events show that the cryptocurrency market is still extremely young.

Therefore, although it is possible for the majority of people to invest without having prior knowledge, it is not something that can be mastered fast, and it is essential to exercise extreme caution when investing in cryptocurrencies. As a result of the FTX meltdown, the creator of Binance, Changpeng Zhao, has issued a warning to investors on Twitter.

Before picking which cryptocurrency to invest in and on which platform, it is important to gain knowledge from the blunders made by others and to take the following preventative measures:

Choose the appropriate cryptocurrency exchange (one that is lucrative, has low fees, does not have any hidden costs, is secure, has a good reputation, is user-friendly, and provides instructional information, etc.);

Avoid investing in businesses that want to sustain themselves by selling their own tokens;

Steer clear of ventures that offer generous rewards for keeping your tokens locked up;

Steer clear of coins that have a huge total quantity, but only a tiny percentage of that supply actually in circulation;

Projects involving cryptocurrency and loans;

You can’t trust everything that you read, and you shouldn’t rely on just one piece of information (such as blindly accepting the project’s white paper and road plan without considering anything else);

Diversify your holdings and avoid putting all of your money into a single cryptocurrency by expanding your portfolio.

Don’t trade solely on your fear of missing out;

Carry out your own investigation (DYOR).

Final Thoughts

Even if investing in cryptocurrency right now can be a smart move, investors need to exercise extreme caution. Even if there is a fantastic chance to purchase cryptocurrency, this does not exclude the likelihood of the hazards that are often associated with the market. The cryptocurrency market is quite unpredictable, thus anything might take place at any time.

Despite this, the crypto assets that are discussed in this book continue to be among the most advantageous investments available right now and have strong reputations in the sector. The vast majority of them may be purchased on major cryptocurrency exchanges like Coinbase, Kraken, and Binance, as well as their respective equivalents.