Circle wycofuje wsparcie dla kont indywidualnych

- Circle zauważyło, że nowa decyzja nie dotyczy rachunków instytucjonalnych ani biznesowych.

- USDC straciło ogromną część swojego udziału w rynku w 2023 r., podczas gdy USDT niedawno osiągnęło nowy najwyższy poziom.

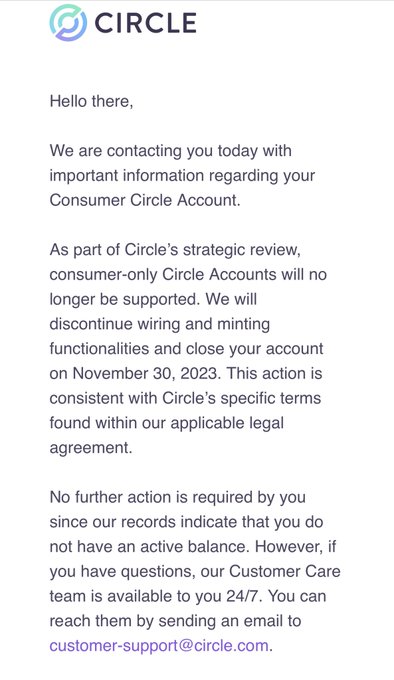

Circle, firma stojąca za stablecoinem USDC, już to zrobiła ogłoszony planuje wycofać konta indywidualne lub konta klientów do 30 listopada. Firma potwierdziła tę wiadomość we wtorek, 31 października, zaznaczając, że będzie nadal wspierać mennice instytucjonalne i biznesowe.

Rzecznik Circle powiedział w e-mailu:

Firma Circle wycofuje obsługę dotychczasowych kont konsumenckich i powiadomiła konsumentów indywidualnych o tej decyzji. Zamknięcie kont nie dotyczy kont biznesowych ani instytucjonalnych Circle Mint.

Rzecznik potwierdził, że użytkownicy detaliczni mogą nadal uzyskiwać dostęp do USDC za pośrednictwem giełd kryptowalut, domów maklerskich i usług portfela aktywów cyfrowych. Kilku użytkowników Circle skontaktowało się z X (dawniej Twitterem), aby spekulować na temat możliwego powodu tej decyzji. Jeden z użytkowników zasugerował, że konta indywidualne wykorzystywane do prania pieniędzy mogą drenować rezerwy Circle.

Inny użytkownik przedstawił teorię, według której rachunki detaliczne mogły zostać zamknięte w ramach „działania polegającego na cięciu kosztów/restrukturyzacji”. W swoim oświadczeniu Circle określiło niektóre konta użytkowników jako „starsze konta konsumenckie”, co wydaje się wskazywać, że nie były one używane tak często, jak w przeszłości.

Jednak dyrektor generalny Circle, Jeremy Allaire, odrzucił te twierdzenia w swoim artykule ćwierkać na X. Napisał:

Dużo hałasu na temat Circle ograniczającego pojedyncze osoby w korzystaniu z Circle Mint. Nie ma tu nic nowego. Od lat nie zezwalamy osobom fizycznym na otwieranie kont Circle i przez lata działaliśmy wyłącznie dla instytucji. Mamy wspaniałych partnerów detalicznych na całym świecie, w tym naszego partnera strategicznego Coinbase, który oferuje doskonały dostęp detaliczny do USDC bez opłat i zawsze 1:1.

Allaire dodał, że „jedyna zmiana polega na tym, że dla kilku tysięcy indywidualnych kont użytkowników, które nadal były u nas otwarte, nie będziemy już ich obsługiwać. Proszę zignorować FUD, teorie spiskowe itp. Dziękuję.”

Decyzja Circle o wycofaniu kont indywidualnych naśladuje praktykę przyjętą przez jej głównego rywala, Tether, który ogranicza emisję i wykup USDT do minimum $100 000. USDC firmy Circle, druga co do wielkości moneta typu stablecoin, odnotowała w tym roku ogromny spadek swojego udziału. USDC straciło prawie 43% swojej kapitalizacji rynkowej, podczas gdy USDT wzrósł do najwyższego w historii poziomu prawie $84 miliardów.

Co ciekawe, dotyczy to kilku krajów pracujący w kierunku wydania przepisów, które będą kierować rynkiem monet stabilnych w 2024 r.