Gary Wang Shares More Shocking Insight in Friday’s Testimony

- Gary Wang claimed Alameda enjoyed special benefits from FTX, including making direct withdrawals.

- Bankman-Fried ordered Wang to tweak FTX’s code to enable Alameda Research to trade more than it had available.

- Prosecutors claim Bankman-Fried deceived FTX customers by using their funds without their consent.

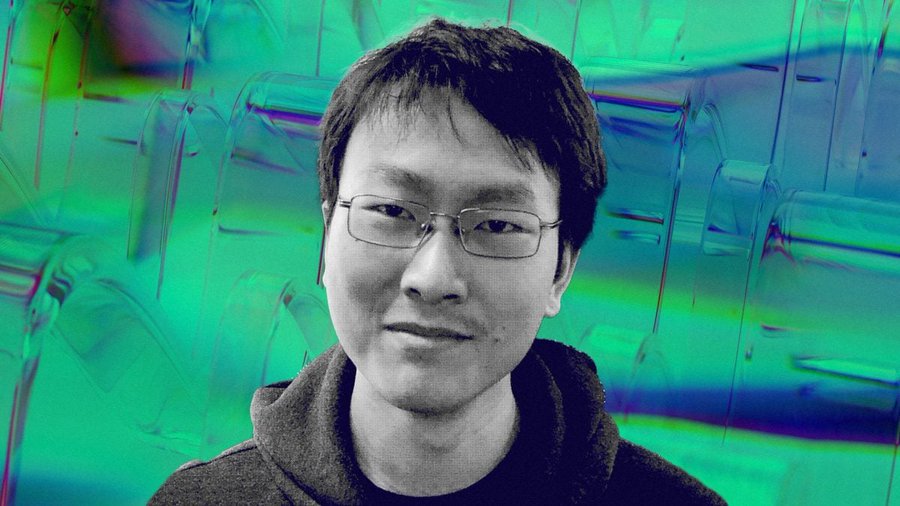

Friday marked the fourth day of Bankman-Fried’s criminal trial, and FTX co-founder and former chief technology officer Gary Wang made another court appearance to discuss the ties between FTX and Alameda Research.

Wang shared more shocking insights into the relationship between both sister companies, adding that Alameda’s account on FTX allowed them to trade more than it had available—a feature known as “allow negative.” According to reports, the former FTX executive said Bankman-Fried wanted special treatment for Alameda Research.

Bankman-Fried allegedly ordered Wang and former FTX engineering director Nishad Singh to tweak FTX’s code in 2019 to allow Alameda to withdraw unlimited funds. Wang explained that this feature was one of the benefits Alameda Research enjoyed that was not disclosed to the public.

According to Wang, the “allow negative” tweak to the FTX rules allowed Alameda to get a negative balance of $200 million as opposed to FTX’s income of $150 million in 2020. He allegedly claimed that, despite making false claims about the relationship between the two companies, Bankman-Fried had granted Alameda a $65 billion line of credit.

Wang reportedly said in court:

We had said we wouldn’t use funds like this. After I said the Alameda balances were off by billions, [Bankman-Fried] asked to meet in the Bahamas office. He asked me about the bug, and then he told Caroline Alameda can go ahead and return the borrows.

Wang noted that Alameda was allowed to make direct withdrawals from FTX. Prosecutors charged Bankman-Fried with fraud. However, at the heart of their case against the former crypto mogul is that he oversaw the use of FTX customers’ funds without their permission.

Wang and other FTX executives have pleaded guilty to charges and are cooperating with prosecutors in their case against Bankman-Fried. Interestingly, Wang and Bankman-Fried were college roommates before working together at FTX.

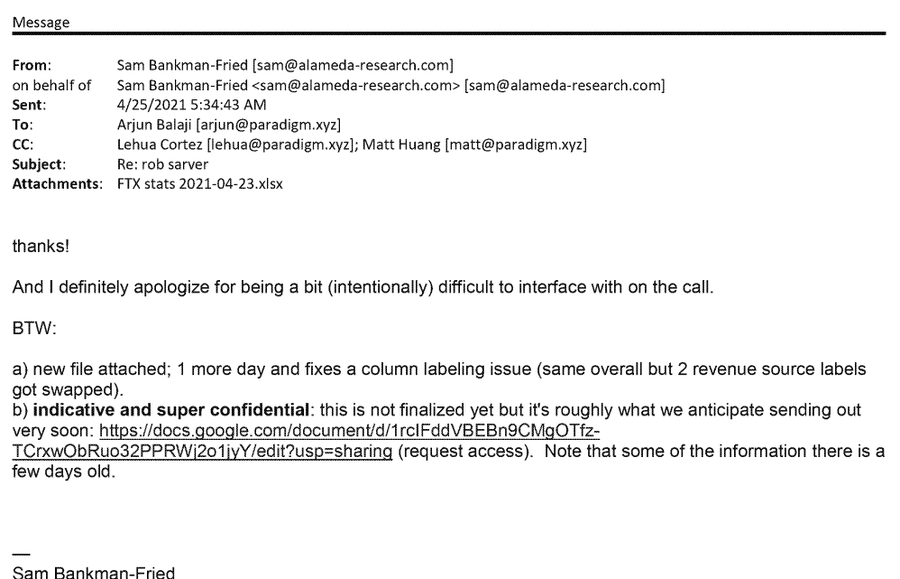

Wang is the first on the list of former FTX executives to testify, but the jury has already heard testimony from three other witnesses. Former FTX users said that they were unable to withdraw their money when the exchange went out of business, while Matt Huang, the manager of a crypto-focused firm that made an investment in FTX, claimed to have been informed that Alameda enjoyed “no preferential treatment” on the system.

Former FTX computer programmer Adam Yedidia, who worked under Wang, said that he alerted Bankman-Fried to his suspicions months before the disastrous collapse. Yedidia grew concerned after discovering that Alameda had borrowed $8 billion from FTX. He claimed that Bankman-Fried expressed similar concerns about the company’s future, admitting that they were not as “bulletproof” as they had been months earlier.