Gary Wang comparte una visión más impactante en el testimonio del viernes

- Gary Wang afirmó que Alameda disfrutaba de beneficios especiales de FTX, incluida la realización de retiros directos.

- Bankman-Fried ordenó a Wang que modificara el código de FTX para permitir que Alameda Research negociara más de lo que tenía disponible.

- Los fiscales afirman que Bankman-Fried engañó a los clientes de FTX al usar sus fondos sin su consentimiento.

El viernes marcó el cuarto día del juicio penal de Bankman-Fried, y el cofundador y ex director de tecnología de FTX, Gary Wang, hizo otra comparecencia ante el tribunal para discutir los vínculos entre FTX y Alameda Research.

Wang compartió ideas más sorprendentes sobre la relación entre ambas empresas hermanas y agregó que la cuenta de Alameda en FTX les permitía comerciar más de lo que tenía disponible, una característica conocida como "permitir negativo". Según los informes, el ex ejecutivo de FTX dijo que Bankman-Fried quería un trato especial para Alameda Research.

Bankman-Fried supuestamente ordenó a Wang y al exdirector de ingeniería de FTX, Nishad Singh, que modificaran el código de FTX en 2019 para permitir que Alameda retirara fondos ilimitados. Wang explicó que esta característica era uno de los beneficios de los que disfrutaba Alameda Research y que no se reveló al público.

De acuerdo a Para Wang, el ajuste de "permitir negativo" a las reglas de FTX permitió a Alameda obtener un saldo negativo de $200 millones en comparación con los ingresos de FTX de $150 millones en 2020. Supuestamente afirmó que, a pesar de hacer afirmaciones falsas sobre la relación entre las dos empresas , Bankman-Fried había concedido a Alameda una línea de crédito de $65 mil millones.

Según se informa, Wang dijo en el tribunal:

Habíamos dicho que no utilizaríamos fondos como este. Después de que dije que los saldos de Alameda estaban desviados en miles de millones, [Bankman-Fried] pidió reunirse en la oficina de las Bahamas. Me preguntó sobre el error y luego le dijo a Caroline Alameda que podía seguir adelante y devolver los préstamos.

Wang señaló que a Alameda se le permitió realizar retiros directos de FTX. Los fiscales acusaron a Bankman-Fried de fraude. Sin embargo, el centro de su caso contra el ex magnate de las criptomonedas es que supervisó el uso de los fondos de los clientes de FTX sin su permiso.

Wang y otros ejecutivos de FTX se declararon culpables de los cargos y están cooperando con los fiscales en su caso contra Bankman-Fried. Curiosamente, Wang y Bankman-Fried fueron compañeros de cuarto en la universidad antes de trabajar juntos en FTX.

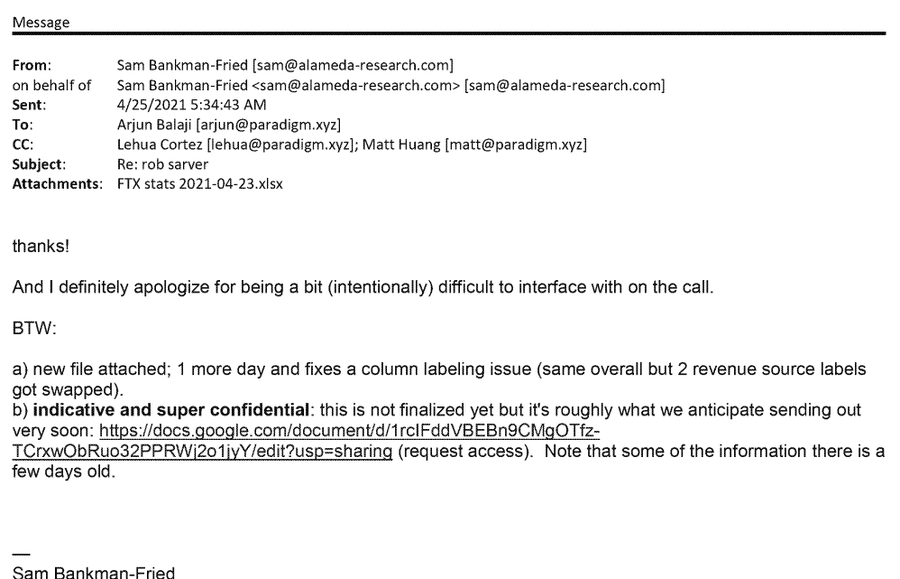

Wang es el primero en la lista de ex ejecutivos de FTX en testificar, pero el jurado ya escuchó el testimonio de otros tres testigos. Los antiguos usuarios de FTX dijeron que no pudieron retirar su dinero cuando el intercambio cerró, mientras que Matt Huang, el gerente de una empresa centrada en criptomonedas que hizo una inversión en FTX, afirmó haber sido informado de que Alameda no disfrutaba de "ningún trato preferencial". tratamiento” en el sistema.

El ex programador informático de FTX Adam Yedidia, que trabajó con Wang, dijo que alertó a Bankman-Fried sobre sus sospechas meses antes del desastroso colapsar. Yedidia se preocupó después de descubrir que Alameda había pedido prestado $8 mil millones a FTX. Afirmó que Bankman-Fried expresó preocupaciones similares sobre el futuro de la empresa, admitiendo que no eran tan "a prueba de balas" como lo habían sido meses antes.