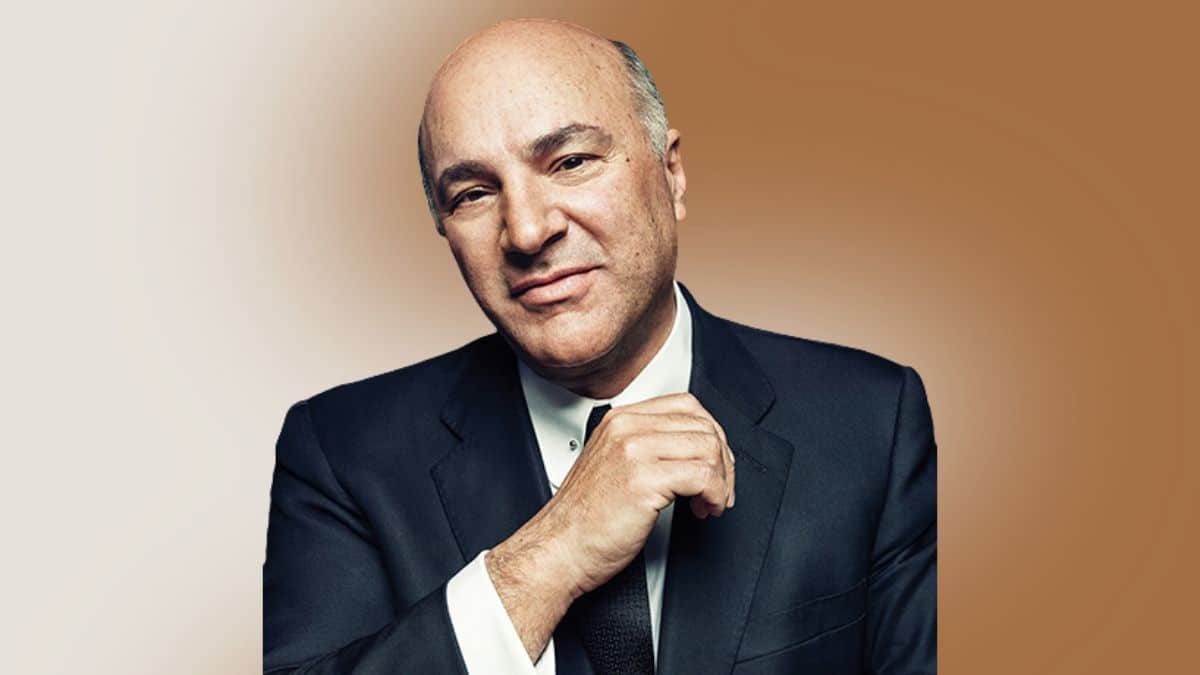

Kevin O’Leary Testifies Before Congress

- Kevin O’Leary said he lost $15 million to FTX’s collapse.

- The celebrity investor, however, believes the recent collapse has no effect on the future of the crypto industry.

Shark Tank host Kevin O’Leary testified before the Senate Banking Committee on the FTX collapse and said it wiped off the $15 million he was paid to represent the firm. The celebrity investor, however, told lawmakers that he believed the industry still has upside potential.

The Canadian businessman argued that “the collapse of FTX is nothing new.” He noted that “while this situation is painful for shareholders, employees, and account holders, in the long run, it does not change this industry’s promise.”

Kevin O’Leary still has investments in other cryptocurrency companies despite the loss from FTX. Regardless of FTX’s fate, O’Leary believes the crypto industry has what it takes to survive and thrive like other industries with notable failures. The 68-year-old went on to list popular failures that had no effect on the American market. He said,

Enron came and went and had no impact on the energy markets. Bear Stearns and Lehman Brothers’ demise had no impact on the long-term potential of American debt and equity markets.

In addition to backing initiatives to develop a “well-regulated stablecoin” pegged to the dollar, O’Leary endorsed new regulations for the cryptocurrency industry as a whole. The popular investor noted that the budding crypto industry is gradually getting rid of the bad players. He said,

Going or gone are the inexperienced or incompetent managers, weak business models, and rogue unregulated operators. Hopefully, these highly publicized events will put renewed focus on implementing domestic regulation that has been stalled for years.

O’Leary was joined in his testimony by Jennifer Schulp, director of financial regulation studies at the Center for Monetary and Financial Alternatives for the Cato Institute; actor Ben McKenzie Schenkkan, and law professor Hilary Allen at American University Washington College.

Jennifer Schulp argued that regulations should not limit market forces in the crypto space. According to her,

While circumspection around a novel class of asset and technology is more than fair, it is entirely different from actively preventing individuals from accessing an instrument that approximately one in five Americans by some measures already have chosen to use for diverse purposes, from trading to sending remittances.

Professor of law Hillary Allen, however, cautioned against promoting a stronger bond between digital assets and the banking system through any regulation of cryptocurrencies. Additionally, Hollywood actor and prominent cryptocurrency skeptic Ben McKenzie Schenkkan said cryptocurrencies are a bad means of exchange, unit of account, and store of value.

Bankman-Fried was arrested earlier this week, and since then, lawmakers have increased calls for regulating the entire crypto industry.