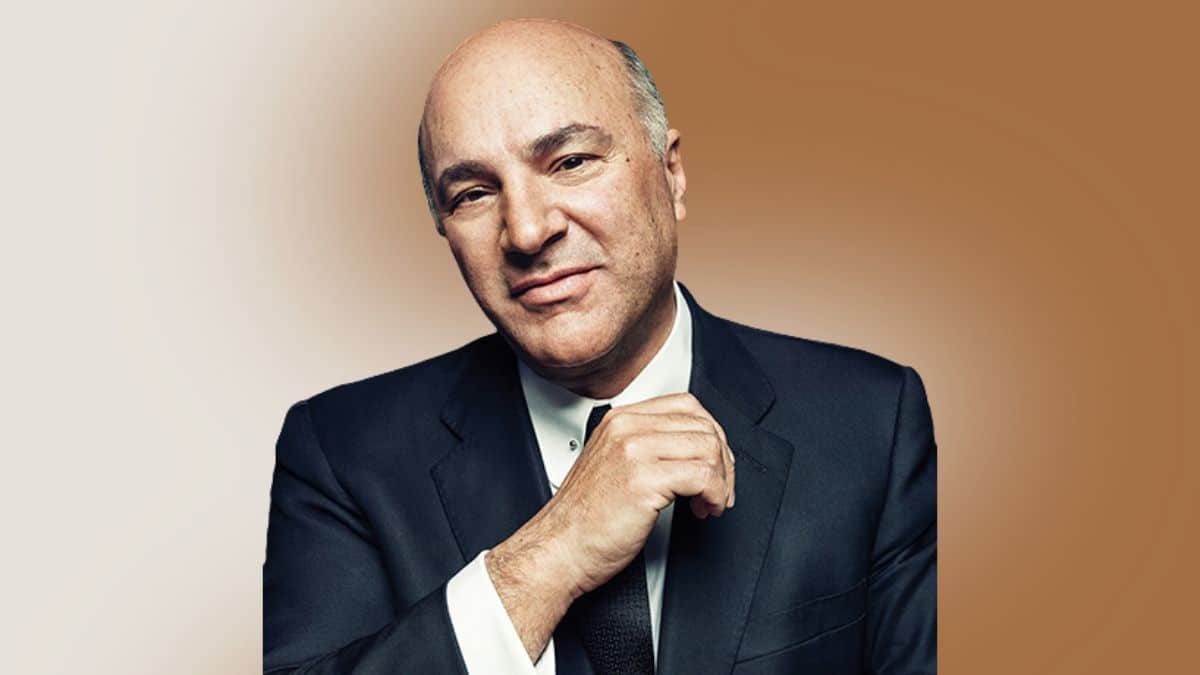

Кевин О'Лири дает показания перед Конгрессом

- Кевин О'Лири сказал, что потерял $15 миллионов из-за краха FTX.

- Однако знаменитый инвестор считает, что недавний крах никак не повлияет на будущее криптоиндустрии.

Ведущий Shark Tank Кевин О'Лири свидетельствовал перед Банковским комитетом Сената о крахе FTX и сказал, что он уничтожил $15 миллионов, которые ему заплатили за представление фирмы. Однако знаменитый инвестор сказал законодателям, что, по его мнению, у отрасли все еще есть потенциал роста.

Канадский бизнесмен утверждал что «в крахе FTX нет ничего нового». Он отметил, что «хотя эта ситуация болезненна для акционеров, сотрудников и владельцев счетов, в долгосрочной перспективе она не меняет перспективы этой отрасли».

Кевин О'Лири по-прежнему инвестирует в другие криптовалютные компании, несмотря на убытки от FTX. Независимо от судьбы FTX, О'Лири считает, что у криптоиндустрии есть все необходимое, чтобы выжить и процветать, как и другие отрасли с заметными неудачами. Далее 68-летний мужчина перечислил популярные неудачи, которые не повлияли на американский рынок. Он сказал,

Enron пришла и ушла, не оказав никакого влияния на энергетические рынки. Кончина Bear Stearns и Lehman Brothers не повлияла на долгосрочный потенциал американских долговых и фондовых рынков.

В дополнение к поддержке инициатив по разработке «хорошо регулируемой стабильной монеты», привязанной к доллару, О'Лири одобрил новые правила для криптовалютной индустрии в целом. Популярный инвестор отметил, что начинающая криптоиндустрия постепенно избавляется от плохих игроков. Он сказал,

Уходят или уходят неопытные или некомпетентные менеджеры, слабые бизнес-модели и мошеннические нерегулируемые операторы. Надеемся, что эти получившие широкую огласку события вновь привлекут внимание к реализации внутреннего регулирования, которое застопорилось на годы.

К О'Лири присоединились в его показаниях Дженнифер Шульп, директор по исследованиям в области финансового регулирования в Центре денежно-кредитных и финансовых альтернатив Института Катона; актер Бен Маккензи Шенккан и профессор права Хилари Аллен из Вашингтонского колледжа Американского университета.

Дженнифер Шульп утверждала, что правила не должны ограничивать рыночные силы в криптопространстве. По ее словам,

Хотя осмотрительность в отношении нового класса активов и технологий более чем справедлива, она полностью отличается от активного предотвращения доступа отдельных лиц к инструменту, который примерно каждый пятый американец по некоторым параметрам уже решил использовать для различных целей, от торговли до отправки денежных переводов. .

Однако профессор права Хиллари Аллен предостерегает от укрепления связи между цифровыми активами и банковской системой посредством любого регулирования криптовалют. Кроме того, голливудский актер и известный скептик криптовалюты Бен Маккензи Шенккан сказал, что криптовалюты — это плохое средство обмена, расчетная единица и средство сбережения.

Бэнкман-Фрид был арестован в начале этой недели, и с тех пор законодатели увеличение количества звонков для регулирования всей криптоиндустрии.