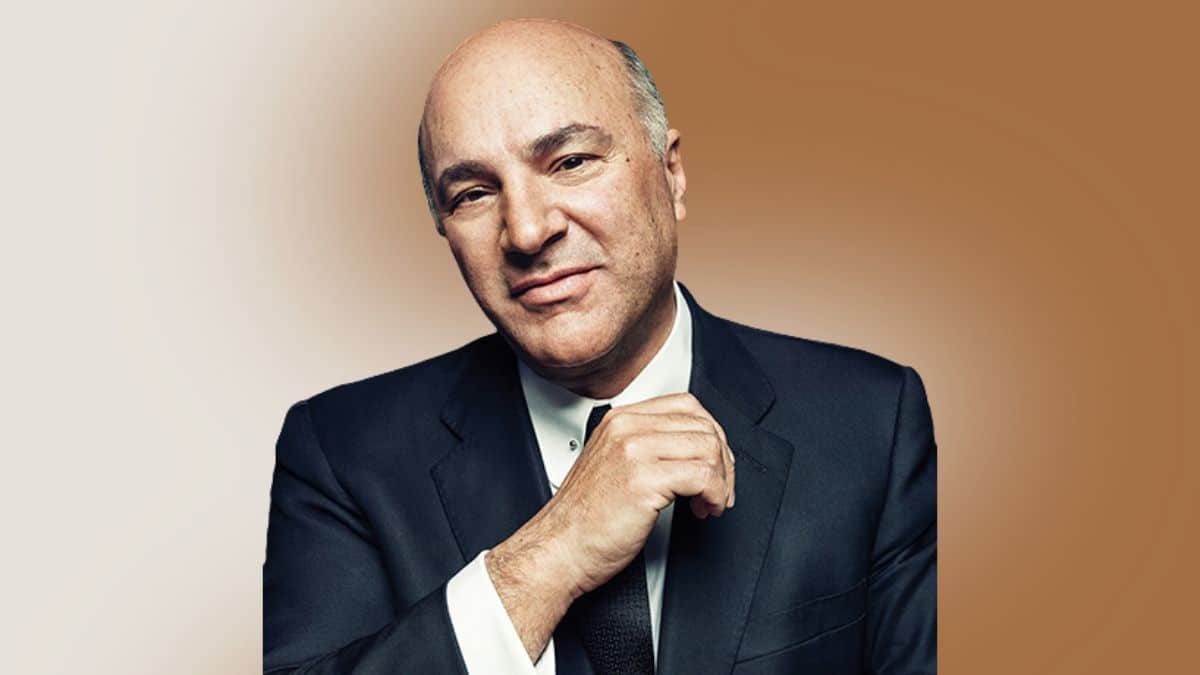

Kevin O'Leary testimonia davanti al Congresso

- Kevin O'Leary ha dichiarato di aver perso $15 milioni a causa del crollo di FTX.

- Il famoso investitore, tuttavia, ritiene che il recente crollo non abbia alcun effetto sul futuro dell'industria delle criptovalute.

Il conduttore di Shark Tank Kevin O'Leary ha testimoniato davanti al Comitato bancario del Senato sul crollo di FTX e ha affermato di aver cancellato i $15 milioni che gli erano stati pagati per rappresentare l'azienda. Il famoso investitore, tuttavia, ha dichiarato ai legislatori che ritiene che l'industria abbia ancora un potenziale di rialzo.

L'uomo d'affari canadese discusso che "il crollo di FTX non è una novità". Ha osservato che "sebbene questa situazione sia dolorosa per azionisti, dipendenti e titolari di conti, a lungo termine non cambia la promessa di questo settore".

Kevin O'Leary ha ancora investimenti in altre società di criptovaluta nonostante la perdita di FTX. Indipendentemente dal destino di FTX, O'Leary crede che l'industria delle criptovalute abbia quello che serve per sopravvivere e prosperare come altre industrie con notevoli fallimenti. Il 68enne ha continuato elencando fallimenti popolari che non hanno avuto alcun effetto sul mercato americano. Egli ha detto:

Enron andava e veniva e non ha avuto alcun impatto sui mercati dell'energia. La scomparsa di Bear Stearns e Lehman Brothers non ha avuto alcun impatto sul potenziale a lungo termine del debito americano e dei mercati azionari.

Oltre a sostenere le iniziative per sviluppare una "stablecoin ben regolamentata" ancorata al dollaro, O'Leary ha approvato nuove normative per l'intero settore delle criptovalute. Il famoso investitore ha notato che l'industria delle criptovalute in erba si sta gradualmente sbarazzando dei cattivi giocatori. Egli ha detto:

Andare o sparire sono i manager inesperti o incompetenti, i modelli di business deboli e gli operatori canaglia non regolamentati. Si spera che questi eventi altamente pubblicizzati porranno una rinnovata attenzione sull'attuazione della regolamentazione interna che è stata bloccata per anni.

O'Leary è stato affiancato nella sua testimonianza da Jennifer Schulp, direttrice degli studi sulla regolamentazione finanziaria presso il Center for Monetary and Financial Alternatives per il Cato Institute; l'attore Ben McKenzie Schenkkan e il professore di diritto Hilary Allen all'American University Washington College.

Jennifer Schulp ha sostenuto che i regolamenti non dovrebbero limitare le forze di mercato nello spazio crittografico. Secondo lei,

Sebbene la circospezione intorno a una nuova classe di asset e tecnologia sia più che giusta, è completamente diversa dall'impedire attivamente alle persone di accedere a uno strumento che circa un americano su cinque secondo alcune misure ha già scelto di utilizzare per scopi diversi, dal commercio all'invio di rimesse .

La professoressa di diritto Hillary Allen, tuttavia, ha messo in guardia dal promuovere un legame più forte tra le risorse digitali e il sistema bancario attraverso qualsiasi regolamentazione delle criptovalute. Inoltre, Ben McKenzie Schenkkan, attore di Hollywood ed eminente scettico sulle criptovalute, ha affermato che le criptovalute sono un pessimo mezzo di scambio, unità di conto e riserva di valore.

Bankman-Fried è stato arrestato all'inizio di questa settimana e da allora i legislatori lo hanno fatto chiamate aumentate per regolamentare l'intero settore delle criptovalute.