California’s DFPI Launches Crackdown on Crypto Platforms Operating Like Ponzi and Pyramid Schemes

- DFPI noted that the reported crypto firms allegedly used investor funds to pay purported profits to other investors, similar to a Ponzi scheme.

- The DFPI noted that crypto firms are classic examples of high-yield investment programs (HYIPs).

- Some of the mentioned crypto firms include; Elevate Pass LLC, GreenCorp Investment LLC, Pegasus, Remabit, Sity Trade, Sytrex Trade, and Vexam Limited, among others.

The Department of Financial Protection and Innovation (DFPI) in California, United States, disclosed through a press release on September 27 that it has issued cease and refrain orders against 11 different crypto firms for violations of the state’s securities laws. This comes a week after the White House published a cryptocurrency regulatory framework that prohibited predatory behaviour in the market.

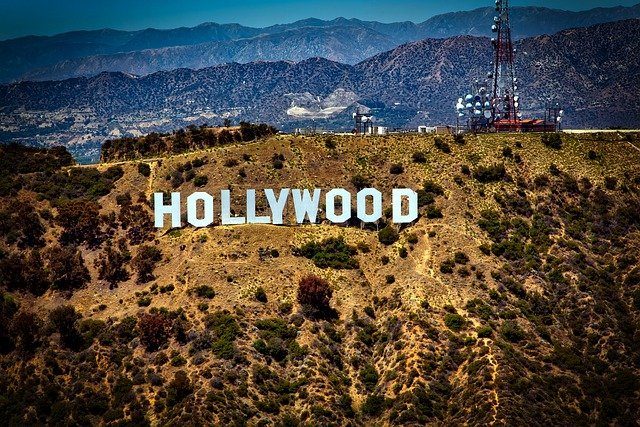

California wants to position itself as a secure cryptocurrency and blockchain hub. Thus the top priority is to eliminate scams and bad actors in the digital assets industry within the state.

“Each of the 11 entities allegedly offered and sold unqualified securities, and ten of them also made material misrepresentations and omissions to investors. Nine of these entities solicited funds from investors to purportedly trade crypto assets on behalf of the investors. One of the entities solicited crypto assets to develop metaverse software, and one entity claimed to be decentralised finance, or DeFi, platform,” the report noted.

Reportedly, the named crypto firms promised to pay investors commissions if they managed to recruit new members. DFPI noted that the reported crypto firms allegedly used investor funds to pay purported profits to other investors, similar to a Ponzi scheme.

Crypto In the Precipice of Global Adoption

Two years after the Covid pandemic broke out, countries from different continents are easing restrictions by reopening their borders. However, in the new norm, most professionals are shifting towards blockchain technology, particularly in the digital asset industry.

As such, regulators from different countries are drafting crypto policies to sell themselves as the most friendly market. Countries like El Salvador and the Central African Republic have adopted Bitcoin as a legal tender to cushion their economies from imminent inflation.

In this case, California has long been the tech centre through Silicon Valley. As a result, the state may want to retain its status in the next technology.

“The DFPI will continue to protect California consumers and investors from crypto scams and frauds,” said DFPI Commissioner Clothilde Hewlett. “These actions protect consumers and ensure California remains the premier global location for responsible crypto asset companies to start and grow.”

The DFPI noted that crypto firms are classic examples of high-yield investment programs (HYIPs). Some of the mentioned crypto firms include; Elevate Pass LLC, GreenCorp Investment LLC, Pegasus, Remabit, Sity Trade, Sytrex Trade, Vexam Limited, among others.

The cryptocurrency market has been making headlines in different jurisdictions across all continents. While around 300 million people have used crypto assets in the past, billions more are waiting to be banked through the blockchain and cryptocurrency market.

Australia announced a CBDC program for its eAUD through the Ethereum blockchain on Monday. Other global countries are also looking into the digital asset industry, including European nations.