Bitcoin Price Remains Stagnant; LTC, LUNC Skyrocket: Performance Report

- “Number of Addresses Sending to Exchanges (7d MA)” for Bitcoin has reached a new 1-month low of 4,520.946, confirms Glassnode.

- The best performers in the top 100, except top 10, are Luna Classic (LUNC), Lido DAO (LIDO), The Graph (GRT), and Litecoin (LTC).

- The worst performers in the top 100, except top 10, are Toncoin (TON), Neutrino USD (USDN), Chain (XCN), and Stacks (STX).

- The total crypto market liquidation in the last 24 hours amounts to $26.15 million of which ETH makes up around $10.79 million.

The crypto market did not show any major gains this week as the world’s biggest crypto coin, Bitcoin (BTC), did not move much in the last seven days but has been holding strong above the $16,500 price region. Crypto investors have been waiting for BTC to break into the $20k price level for a very long time, but the conditions remain bearish.

Interestingly, altcoins have also not shown significant price gains, and it seems that the trend might continue as the year ends. A year ago, this period was marked by the bullish Santa Run, which pushed the leading cryptocurrency above $50,000. However, it is clear that the current trading volume in the market is not enough to confirm higher prices.

While the accumulation of Bitcoin is rising, the rate at which it is rising is quite slow, which suggests that there is a significant lack of demand for cryptocurrencies in the market. This can be due to the declining interest of institutional investors and low levels of capital inflow in the industry. The macroeconomic conditions and various companies shutting down their operations could also be reasons why crypto investors are no longer engaging in volatile assets.

As of 8:46 am ET, the price of bitcoin stands at $16,852 and is up close to 0.24% in the last 24 hours. This suggests that the crypto market is currently not in a very good position since the price of BTC has been almost constant for over a week. A new year is almost up on the crypto market, and such bearish conditions are certainly not doing good for the reputation of the volatile asset class.

In the last seven days, the price of Bitcoin has moved up by 0.71%, which further confirms the lack of trading volume in the industry, and it is very much possible that BTC’s price might retest the $16.5k price region if the current zone doesn’t hold. In early December, BTC was able to reclaim $18,000, but the bulls failed to hold the price action above this region.

Additionally, in the last 24 hours, the trading volume of Bitcoin has gone up 35.28%, while its market dominance stands at 40%. Furthermore, the market cap of the token is currently at 324.1 billion, which is quite low from the all-time high of $1.2 trillion noted in the month of November in 2021.

On the other hand, the majority of the altcoins are also sluggish, with leading meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) losing 2.39% and 4.37%, respectively, in the last seven days, while Ether has retained the $1,200 price zone in the same duration. Metaverse tokens The Sandbox (SAND) and Decentraland (MANA) have dropped 4.19% and spiked 0.29% this past week.

According to an important reading from blockchain analysis firm Glassnode, the “Number of Addresses Sending to Exchanges (7d MA)” for Bitcoin has reached a new 1-month low of 4,520.946. This means that the number of holders of BTC is increasing, and in the current bearish period for the leading crypto coin, investors are not willing to part with their tokens. Furthermore, the reading also confirms that crypto investors no longer trust exchanges as much as they used to.

Another crucial reading from Glassnode confirms that the “BTC Exchange Outflow Volume (7d MA)” has reached a new 8-month low, which confirms that the selling pressure for the leading cryptocurrency has significantly declined in the past few months and that the bottom might be coming sooner than expected.

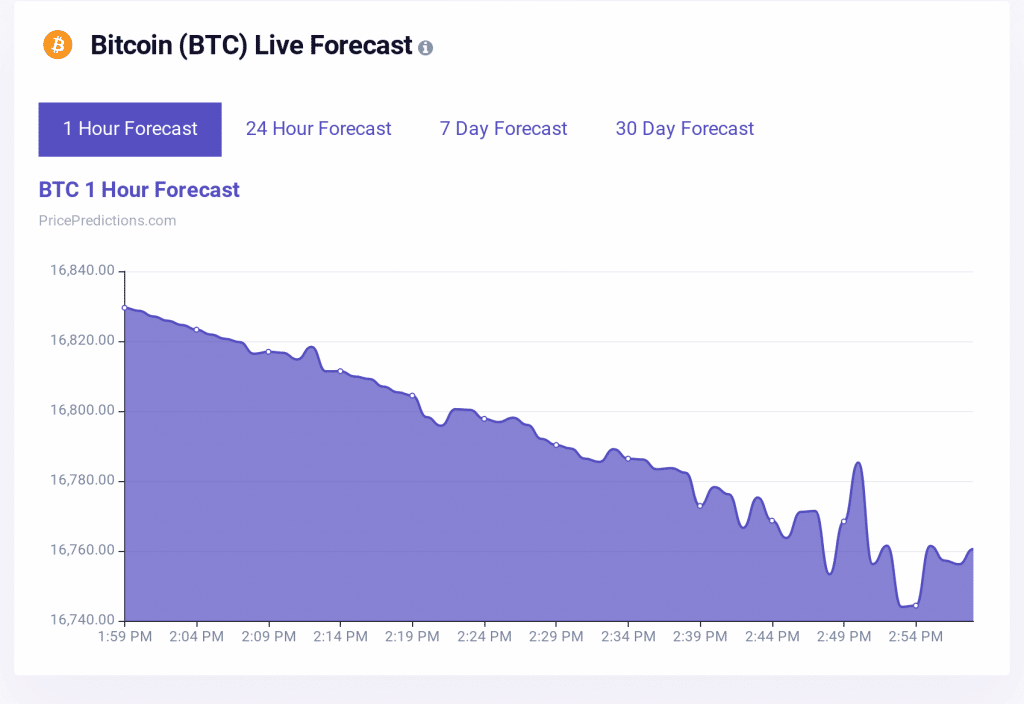

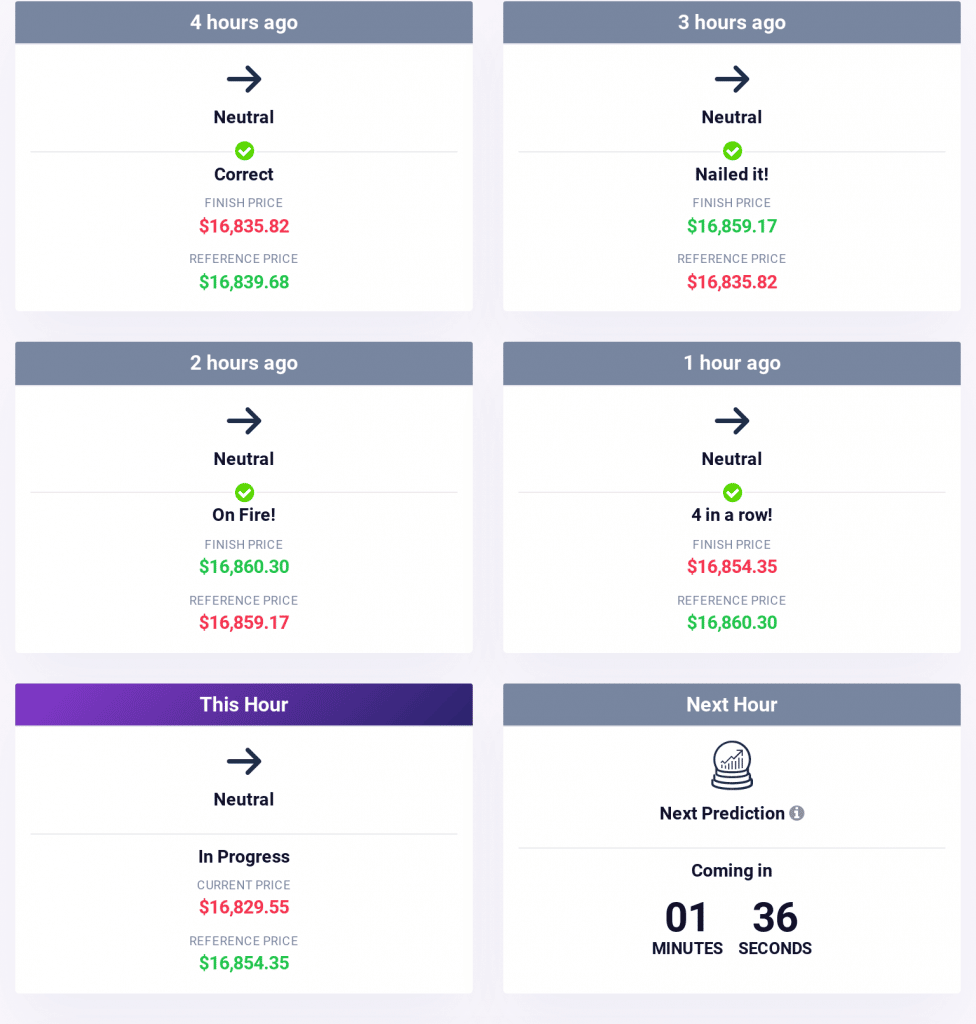

As per the 1 hour forecast chart below from PricePredictions, Bitcoin is expected to resume its downtrend in the near future, and investors might witness BTC retest the $16.5k price region if the sellers take charge.

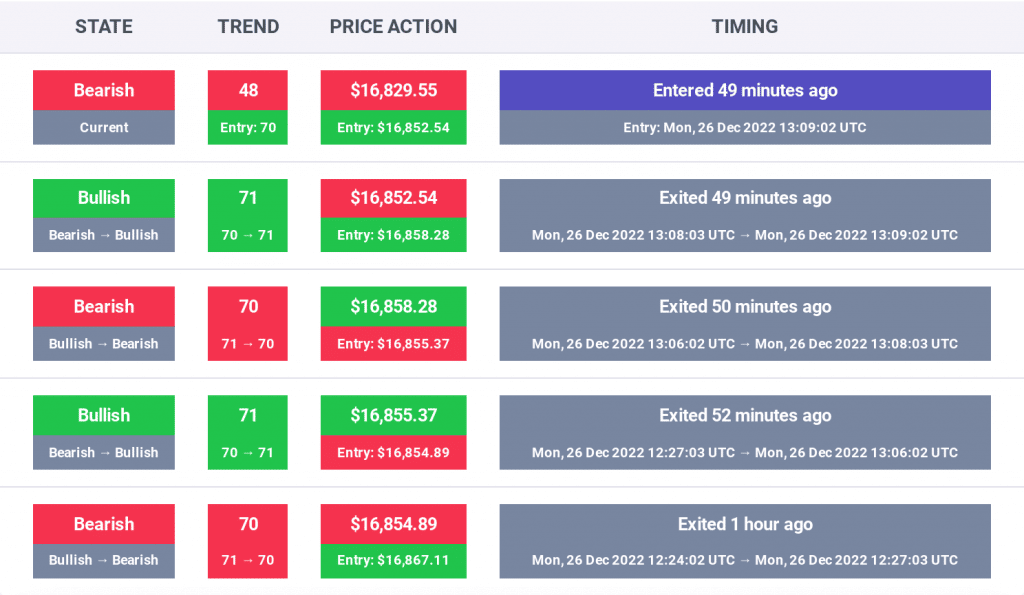

The trader sentiment is currently bearish due to the lack of buying pressure and a fearful crypto market that has been adversely affected by the crypto winter.

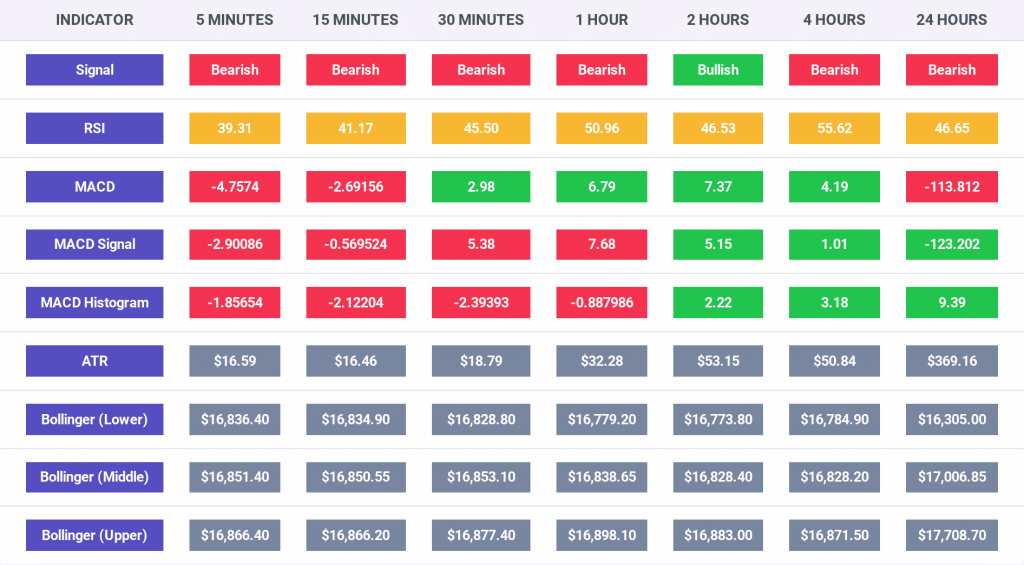

The indicators for the Bitcoin price action are bearish on all the time frames except the 2 hour time frame, as seen in the chart below. Additionally, the RSI indicator is above 50 only for the 1 hour, 2 hour, and 4 hour time frames, which suggests that the situation is improving on a larger scale and that the buying volume is also gradually increasing.

The market trend remains neutral for the Bitcoin price action, a situation which has remained the same for a number of days. Moreover, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has dropped to 28, after rising to 29 as noted in our Crypto Market Performance Report for Dec. 24. Furthermore, the investors’ sentiment currently reads “fear.”

Moreover, the market cap of the entire crypto space at the time of publication stands at $811 billion, and this value has gone up by 0.18% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,126, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up down by 0.13% in the last 24 hours and is currently priced at $1,216. The trading volume of the cryptocurrency has surged by 73.42%, while the market dominance has dropped to 18.36% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $26.15 million, of which, Bitcoin made up $3.18 million and Ether made up $10.79 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies showed mixed movement with BNB down 0.52% to $242.88; XRP up 2.19% to $0.3551; DOGE down 1.02% to $0.075573; ADA up 1.49% to $0.2617, and MATIC up 0.64% to $0.8004.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Toncoin (TON), Neutrino USD (USDN), Chain (XCN), and Stacks (STX).

Interestingly, TON was down 2.98% to $2.37; Neutrino USD (USDN) was down 5.20% to $0.5222; STX was down 2.69% to $0.2258; and XCN was down 4.44% to $0.01598.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are Luna Classic (LUNC), Lido DAO (LIDO), The Graph (GRT), and Litecoin (LTC).

LUNC was up 9.60% to $0.0001578, LIDO was up 6.36% to $1.02, GRT was up 5.98% to $0.05988, and LTC was up 6.92% to $70.43.