Bitcoin Price Action Remains Flat, LUNC Jumps 4%: Market Report

- Bitcoin continued attempts to breach $17k while Ether retained $1,200 as the trading volume for both crashed.

- The best performers in the top 100, except top 10, are Osmosis (OSMO), Luna Classic (LUNC), Decentraland (MANA), and Stacks (STX).

- The worst performers in the top 100, except top 10, are Synthetix (SNX), Chain (XCN), ImmutableX (IMX), and Solana (SOL).

- The total crypto market liquidation in the last 24 hours amounts to $11.03 million of which BTC makes up around $4.50 million.

The crypto market might be in a bit of a slump right now, but the fundamentals remain as bullish as they were a year ago. However, due to a series of unfortunate events in the crypto space this year, the world’s biggest cryptocurrency, Bitcoin (BTC), has crashed significantly, and many other crypto coins have witnessed a 90% decline in price as well. As 2022 comes to an end, investors can effectively see that the only way to profit is to HODL all the way down.

The majority of altcoins in the crypto market today are sluggish as well, with some cryptocurrencies witnessing a price surge in the last 24 hours. On the other hand, leading crypto coins Bitcoin (BTC) and Ether (ETH) were unable to break their respective resistances, which suggests that these tokens might end the year on a bearish note, a rather unfavorable outcome for investors.

Furthermore, as per the Bitcoin daily chart, the accumulation of the token rose in October, but the levels dropped in November, following which a slight surge in accumulation has been witnessed in December. However, this is not enough to confirm that the oldest cryptocurrency in the market will make higher highs and retest the previous all-time high of $69k in the coming months.

As of 7:46 am ET, the price of 1 BTC stands at $16,836, while the trading volume of Bitcoin has jumped 16.04% in the last 24 hours. Additionally, in the same duration, the market dominance of the token has risen slightly to 39.97%, while the market cap of the coin stands at $323.9 billion, which is quite low from the all-time high of over $1.2 trillion witnessed in the month of November last year.

In the last seven days, the invention of Satoshi Nakamoto, Bitcoin, has jumped 0.76%, and it is very likely that the situation won’t change in the coming days. The sluggish price action is the result of lack of trading volume in the crypto space due to the collapse of FTX and whales moving their tokens to cold storage. Centralized exchanges might soon be the subject of the wrath of the regulators, and as a result, investors are currently being careful.

On the other hand, altcoins are also sluggish, with leading meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) losing 0.22% and gaining 1.41% in the last seven days, while Ether has retained the $1,200 price zone in the same duration. Metaverse tokens The Sandbox (SAND) and Decentraland (MANA) have dropped 5.91% and 2.30% this past week.

It is also crucial to note that, as per a Twitter post from popular blockchain analysis firm Glassnode, the “Bitcoin Percent Supply Last Active 3 Years” has reached a new monthly high of 38.886%, which confirms that the month of December has seen investors withdraw their BTC and move it to cold storage in order to prepare for a brutal crypto market winter.

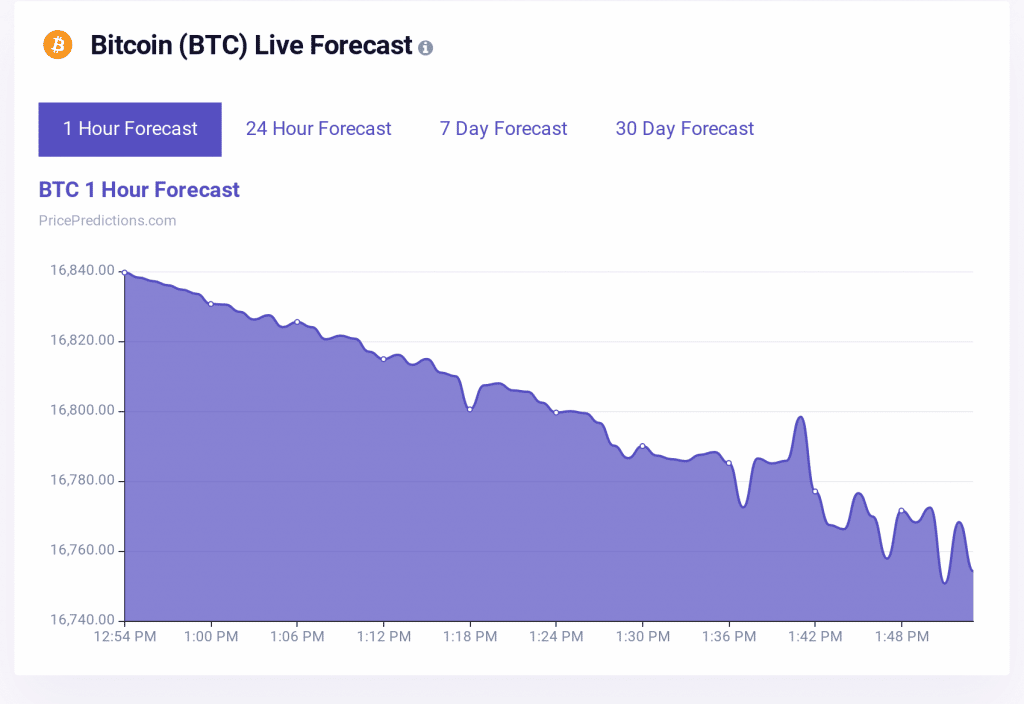

The 1 hour forecast chart below from PricePredictions confirms that Bitcoin will be following a downtrend path, which is not what investors expected from the leading crypto coin. Moreover, it can also be confirmed that BTC might be unable to break the $17k price level if the conditions don’t improve drastically.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

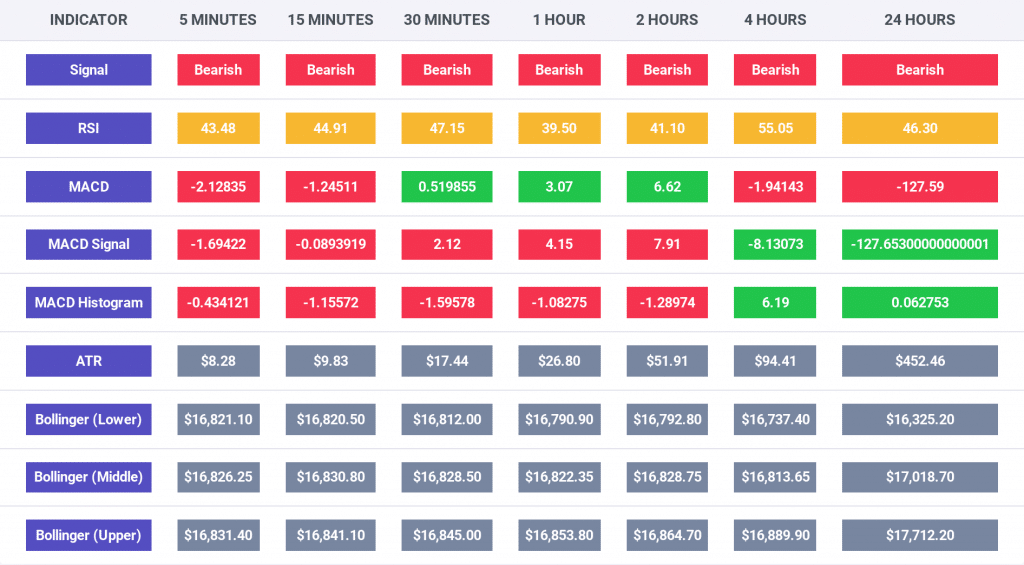

The indicators on the chart below are all bearish on all the time frames, which is not a very suitable outcome for crypto investors. The RSI indicator reads a value below 50 for all the time frames, and interestingly, a brutal price crash might follow if the trend continues and the readings don’t change in the coming days.

Furthermore, the MACD indicator is also bearish, which confirms that the selling pressure is currently higher than the buying pressure and investors need to be careful while traders are advised not to place trades.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has risen to 29, after dropping to 27 from 28 as noted in our Crypto Market Performance Report for Dec. 23. Furthermore, the investors’ sentiment currently reads “fear.”

Additionally, the market cap of the entire crypto space at the time of publication stands at $810 billion, and this value has gone down by 0.30% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,111, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up down by 0.47% in the last 24 hours and is currently priced at $1,218. The trading volume of the cryptocurrency has dipped by 27.34%, while the market dominance has risen to 18.41% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $11.03 million, of which, Bitcoin made up $4.50 million and Ether made up $3.06 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies showed mixed movement with BNB down 0.76% to $244.31; XRP up 0.13% to $0.352; DOGE down 0.93% to $0.07723; ADA down 0.35% to $0.2584, and MATIC down 0.97% to $0.7961.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Synthetix (SNX), Chain (XCN), ImmutableX (IMX), and Solana (SOL).

Interestingly, SNX was down 3.21% to $1.53; XCN was down 2.91% to $0.01758; IMX was down 3.51% to $0.4259; and SOL was down 4.84% to $11.32.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are Osmosis (OSMO), Luna Classic (LUNC), Decentraland (MANA), and Stacks (STX).

OSMO was up 5.17% to $0.7663, LUNC was up 4.04% to $0.0001436, MANA was up 4.03% to $0.3274, and STX was up 5.95% to $0.2426.