The UK Government Considers Ban on Crypto-Related Cold Calls

- The UK government believes banning cold calls will help the public easily identify scammers.

- UK authorities stated that the consultation will help determine how to design and implement the ban on cold calls.

- The UK has made several attempts to regulate cryptocurrencies, including classifying them as a financial activity.

As part of a bigger effort to combat fraud, the British government is considering banning cold calls that pitch financial services. Reports have confirmed that the UK government has initiated a new public poll to ascertain the possible consequences of such a ban on both individuals and companies.

Authorities claim that the poll will help determine how the ban should be designed and implemented. The UK introduced the consultation this month and plans to run it until late September.

British Economic Secretary to the Treasury Andrew Griffith wrote in a statement,

We want the public to know that any unsolicited call marketing financial products such as crypto assets or insurance is a scam and not to fall prey to fraudsters.

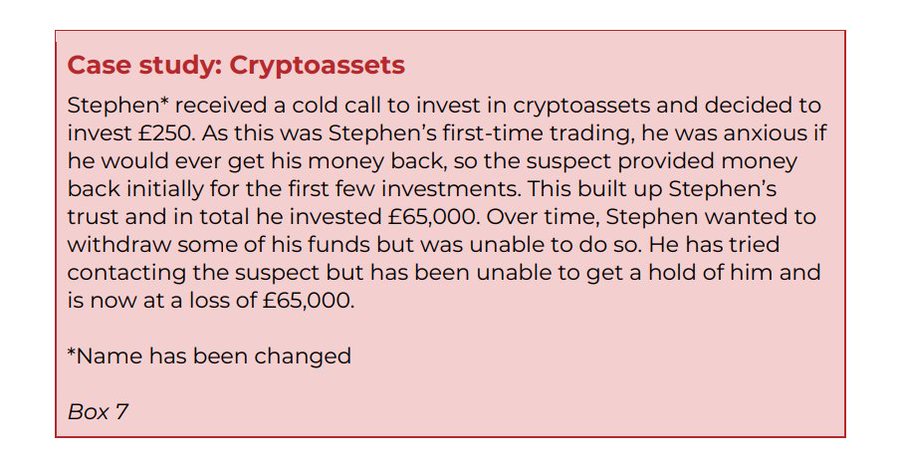

Cold calling, or unsolicited direct marketing, refers to calls made to individuals by organizations to advertise certain products. The consultation cited cases where an individual receives a cold call to invest a certain amount of money in a service. However, after an investment is made, the cold caller becomes unreachable.

The UK government believes banning cold calls will provide extra safety for the public, as individuals will know that no legitimate corporation will cold call them to invest in any financial product. This way, cold calls would be regarded as fraudulent attempts.

Some of the products and services the government plans to list within the scope of the ban include products or services related to banking or payments, including digital currency and crypto assets. In addition, the scope extends to mortgages, insurance, and investments, including physical products that are sold as investments, such as wine and whiskey.

“The ban is intended to be drawn broadly across the range of financial services and products to ensure that the public will be able to identify that any cold calls about financial products are a scam. This means that the scope of this ban will likely extend beyond the financial services and products regulated by the FCA,” Griffith wrote.

The consultation is part of the UK’s attempt at regulating cryptocurrencies. The Financial Conduct Authority (FCA) has been striving to strengthen consumer protection and create clear guidelines for businesses dealing with digital assets.

Interestingly, there’ve been calls for the UK government to regulate crypto activities like gambling. However, the government noted that such a strategy might completely contradict widely recognized recommendations made by international organizations and standard-setting agencies.