Florida Governor Calls for CBDC Ban

- Ron DeSantis believes a CBDC would grant much power to the government and raise privacy concerns.

- The Florida governor noted that CBDCs will stifle innovation and enable government-sanctioned surveillance.

- The proposed law also bans foreign CBDCs from being used in Florida.

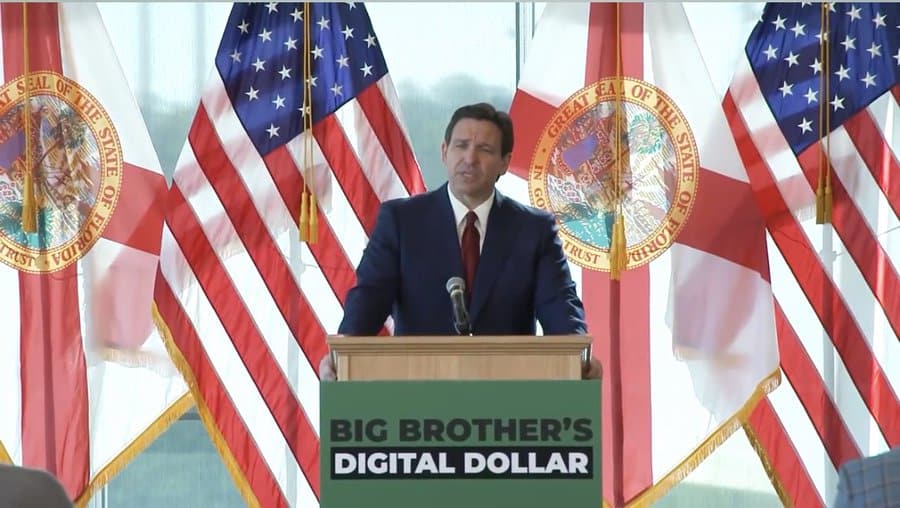

The Governor of Florida, Ron DeSantis, who many believe will run for president of the United States in 2024, proposed a ban on central bank digital currencies (CBDCs). While speaking at a press conference on Monday, DeSantis expressed concerns about the Federal Reserve issuing and controlling a digital dollar.

He noted that a CBDC would give the government “more power.” Governor DeSantis mentioned several government initiatives that directly impact American consumers, including worries about inflation, the Fed raising interest rates, and pressure on banks.

The Republican politician remarked, “Today’s announcement will protect Florida consumers and businesses from the reckless adoption of a ‘centralized digital dollar’ which will stifle innovation and promote government-sanctioned surveillance.”

DeSantis’ proposed law would also ban using any CBDC issued by a foreign central bank in Florida. In his statement, the governor encouraged other states to pass laws along those lines. According to DeSantis, “CBDCs provide the government with a direct view of all consumer activities. Any way they can get into society to exercise their agenda, they will do it. So, what the central bank digital currency is all about is surveilling Americans and controlling the behavior of Americans.”

Without providing any supporting view, DeSantis largely dismissed the arguments that the Fed should issue a digital currency in order to serve the unbanked and address environmental issues. He cited China’s introduction of the digital yuan as an example of an effort “to monitor citizen behavior, allowing for the surveillance of spending habits, and to cut off access to goods and services,” along with the treatment of CBDCs by the governments of the Bahamas and Nigeria.

DeSantis claimed that a federal CBDC would undermine the importance of community banks and credit unions in addition to raising privacy issues. His statement comes months after President Joe Biden issued an executive order directing the federal government to research the potential benefits and drawbacks of a CBDC.