Bitcoin Stable, Altcoins Sluggish; QNT Spikes 8%, LUNC up 16%: Market Report

- Bitcoin was stuck at $16.8k while Ether struggled to hold the $1,200 price level on Tuesday.

- The best performers in the top 100, except top 10, are Luna Classic (LUNC), Quant (QNT), EthreumPoW (ETHW), and Litecoin (LTC).

- The worst performers in the top 100, except top 10, are Toncoin (TON), Solana (SOL), Chain (XCN), and ImmutableX (IMX).

- The total crypto market liquidation in the last 24 hours amounts to $29.45 million of which ETH makes up around $9.72 million.

The crypto market did not witness much gain as another week dawned upon investors which was marked by extremely low volatility in the crypto space as investors continued to move their crypto holdings to hardware external wallets. Interestingly, the world’s biggest crypto coin, Bitcoin (BTC), was also stagnant for almost the entire year, and it seems that investors are no longer interested in the leading crypto coin and are looking for alternatives.

Some of the altcoins today were marked by significant gains, including Terra Classic (LUNC), Quant (QNT), and Filecoin (FIL), breaking the trend and making strong profits for their holders. However, it will be interesting to see if the situation remains similar in the near future because there is a significant chance that the “take-profit” sentiment of the traders might capitalize on the price gains sooner rather than later.

The accumulation phase of the leading crypto coin is not in full effect, but the levels confirm that slowly but surely, investors are making sure to add Bitcoin to their wallets so that they can enjoy the gains when the bulls arrive. However, the crypto market is known for its uncertainty and volatility.

No one can predict the future of the oldest cryptocurrency, but it is clear that even governments and institutions are working on ways to integrate blockchain technology into traditional finance. Additionally, it can be confirmed that this is a strange period for the crypto space, with even giants like Solana (SOL) losing their edge and witnessing a more than 90% drop in Total Value Locked (TVL).

As of 8:35 am ET, the price of Bitcoin (BTC) stands at $16,835 and it is clear that this is unlikely to change in the coming days as there is a strong resistance towards the $20k price zone. Interestingly, there is a strong chance that the current support at the $16k price level might hold for a considerable amount of time in the near future. It is clear that the upcoming year might not be as bullish as investors hope for due to unfavorable macroeconomic conditions.

In the last seven days, the price of Bitcoin (BTC) has jumped only 0.04%, which is quite lower than investors expected, and this might be due to a huge decline in the trading volume of the leading coin in the past few weeks. It is clear that the market cap of the token has declined 0.14% in the last 24 hours, while the value currently stands at $323.8 billion. Additionally, the market share of BTC has dropped to 39.91%.

Furthermore, the majority of the altcoins are also sluggish, with leading meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) gaining 0.57% and losing 1.69%, respectively, in the last seven days. Meanwhile, Ether has retained the $1,200 price zone for the same duration. Metaverse tokens The Sandbox (SAND) and Decentraland (MANA) have dropped 0.87% and spiked 3.62% this past week.

It is also crucial to note that, as per analysis from popular blockchain analytics firm Glassnode, the “Amount of Supply Last Active 1y-2y (1d MA)” for Bitcoin has reached a 5-month low of 3,829,784.567 BTC, which means that the holders of BTC are now interested in shorting their coins and it is possible to see a sluggish price movement due to a lack of volumes.

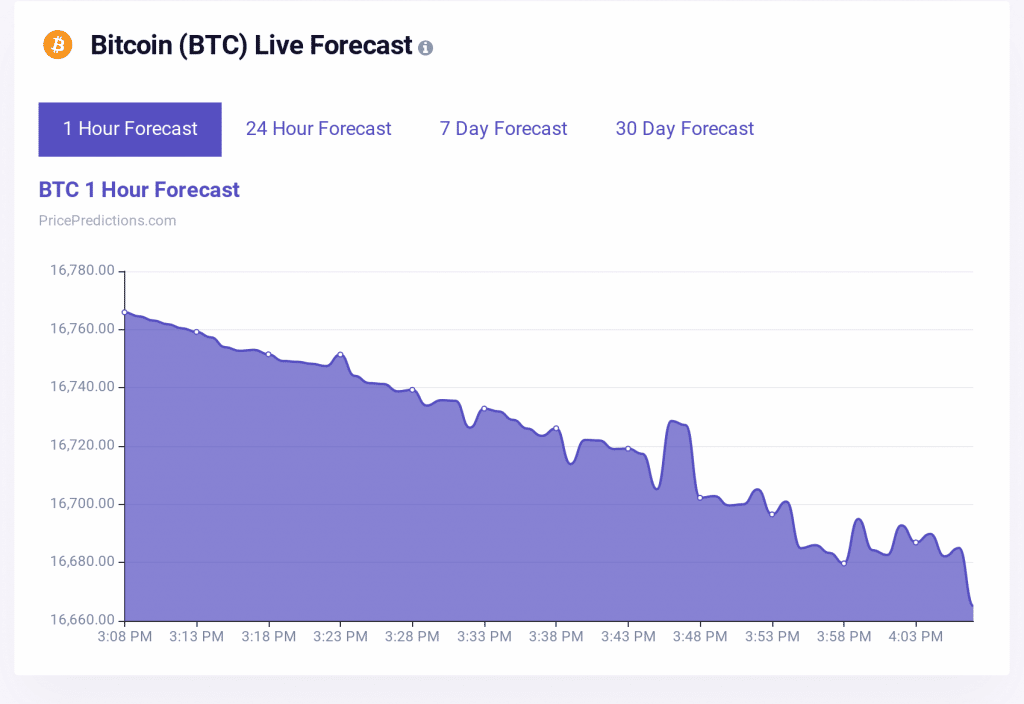

As per the 1 hour forecast chart below from PricePredictions, the Bitcoin price action is expected to follow a downtrend in the near future, and traders are advised not to place their positions during such a scenario as uncertainty prevails currently in the crypto space.

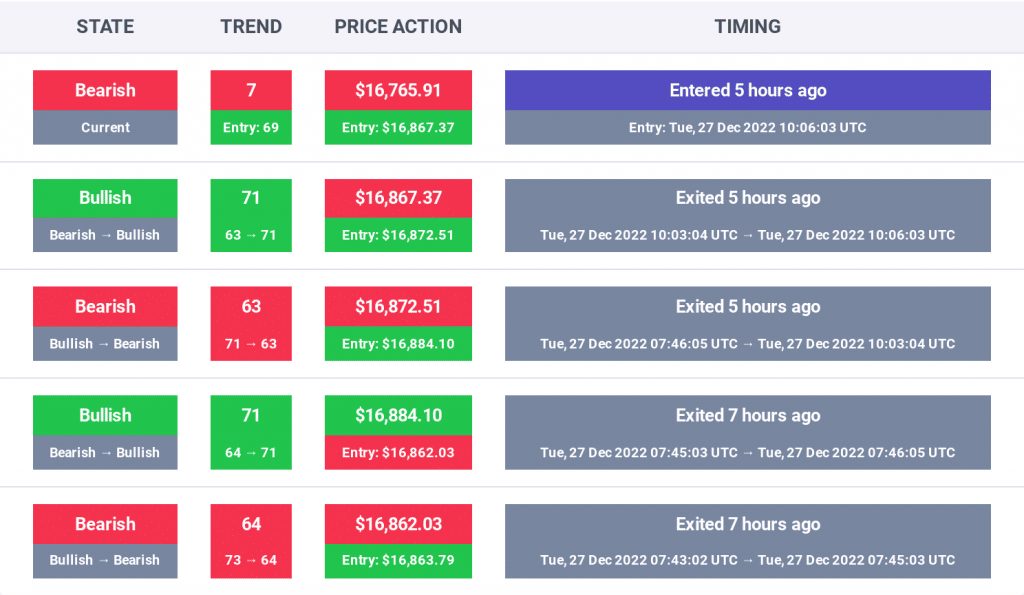

The Bitcoin sentiment is current bearish and any trade executive in the last few hours would not have resulted in substancial gains.

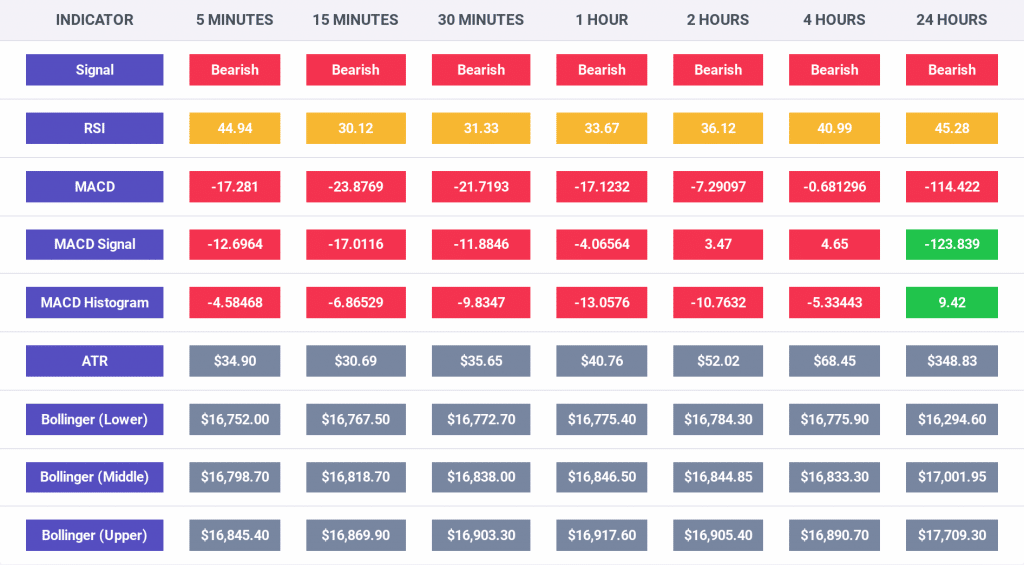

The indicators for the Bitcoin price action are all bearish due to the leading crypto coin’s inability to breach through the $17k price level and reclaim the $20k price region in the near future. It can also be seen that the RSI indicator is bearish on all the time frames and reads a value below 50. This confirms that bears might remain in charge of BTC price action as selling pressure remains higher than the pressure exerted by buyers.

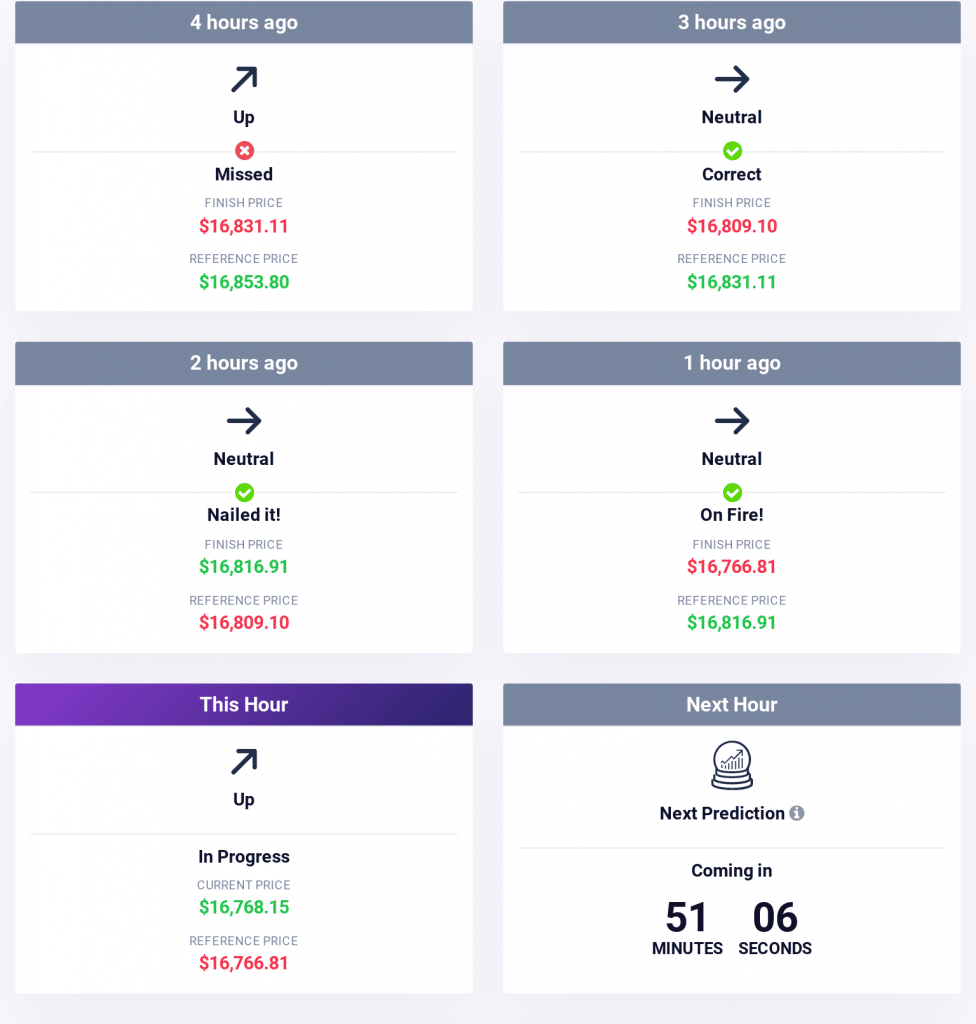

The Bitcoin price trend is currently ranging from neutral to up, which means that on a shorter time frame, PricePredictions expects BTC to make higher highs. However, it is also likely that an opposite outcome might be seen if the bulls don’t take over the trajectory soon.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has dropped to 27, after dropping to 28 from 29 noted in our Crypto Market Performance Report for Dec. 26. Furthermore, the investors’ sentiment currently reads “fear.”

Moreover, the market cap of the entire crypto space at the time of publication stands at $812 billion, and this value has gone up by 0.05 % in the last 24 hours. Additionally, the number of cryptocurrencies is 22,131, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up down by 0.36% in the last 24 hours and is currently priced at $1,212. The trading volume of the cryptocurrency has surged by 0.06%, while the market dominance has dropped to 18.33% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $29.45 million, of which, Bitcoin made up $4.72 million and Ether made up $9.72 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies showed mixed movement with BNB up 0.43% to $244.10; XRP up 3.61% to $0.3688; DOGE down 1.85% to $0.07438; ADA down 0.22% to $0.2612, and MATIC up 1.32% to $0.812.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Toncoin (TON), Solana (SOL), Chain (XCN), and ImmutableX (IMX).

Interestingly, TON was down 4.75% to $2.25; SOL was down 3.38% to $10.92; IMX was down 3.68% to $0.4125; and XCN was down 8.39% to $0.01483.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are Luna Classic (LUNC), Quant (QNT), Filecoin (FIL), and EthereumPoW (ETHW).

LUNC was up 14.49% to $0.0001799, QNT was up 7.77% to 115.22, FIL was up 7.07% to $3.18, and ETHW was up 4.22% to $3.09.