Bitcoin Accumulation Continues, Altcoins Sluggish: Market Report

- Bitcoin retested $16.5k and is attempting to break out of $17k while Ether has retained $1,200 for quite some time.

- The worst performers in the top 100, except top 10, are Chain (XCN), Helium (HNT), Toncoin (TON), and Monero (XMR).

- The worst performers in the top 100, except top 10, are THORChain (RUNE), Near Protocol (NEAR), Neutrino USD (USDN), and Enjin Coin (ENJ).

- The total crypto market liquidation in the last 24 hours amounts to $38.45 million of which ETH makes up around $15.53 million.

Just a few days before Christmas, the crypto industry is currently witnessing a stagnant crypto market, which is quite different from what investors saw last year during the Santa bull run when the price of the world’s biggest cryptocurrency, Bitcoin (BTC), suddenly spiked during the holiday season. Interestingly, during the current market conditions, it seems that witnessing higher highs are not very much possible.

On the other hand, altcoins are also quite sluggish, and the trading volume in the crypto market remains low. It is crucial to note that investors continue to witness a slight decline in interest due to an increase in the number of ransomware attacks and exploits in the crypto industry. Furthermore, regulators around the globe are becoming increasingly skeptical about the benefits of blockchain and crypto technology.

However, despite the bearish development of the crypto market, the accumulation of the world’s oldest crypto coin, Bitcoin (BTC), remains low, which suggests that long term holders continue to play their part. Those who have been involved in the crypto space for some time, continue to buy the dip so that it becomes easier to average the losses faced during the 70% decline in the price of the world’s biggest coin.

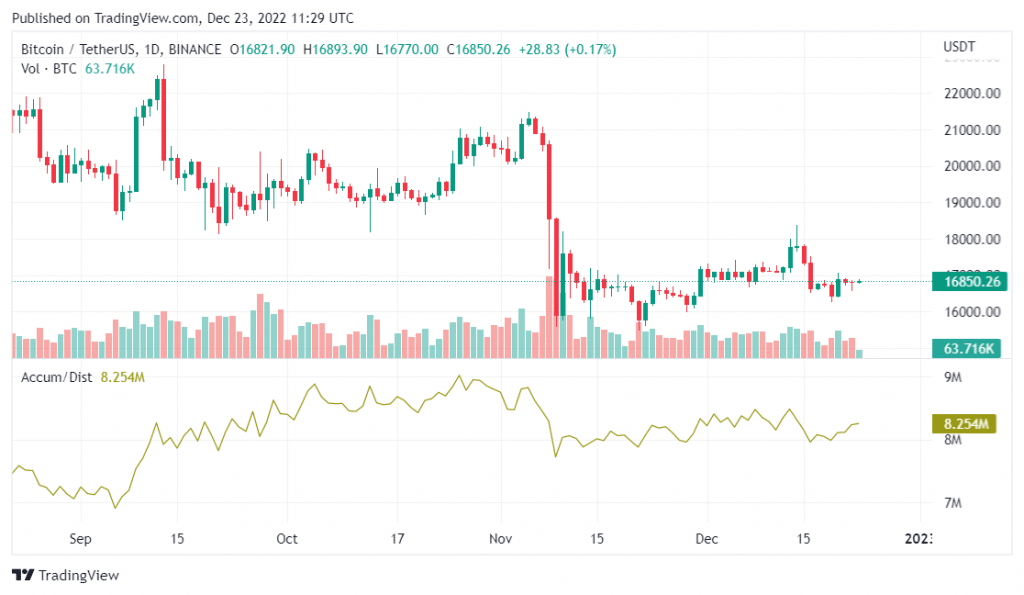

As of 5:56 am ET, the price of 1 BTC stands at $16,869, while the trading volume of Bitcoin has jumped 19.01% in the last 24 hours. Additionally, in the same duration, the market dominance of the token dropped to 39.93%, while the market cap of the coin stands at $324.5 billion, which is quite low from the all-time high of over $1.2 trillion witnessed in the month of November last year.

On the other hand, altcoins are also bearish, with leading meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) losing 5.58% and 3.09% of their prices in the last seven days, while Bitcoin has dropped 0.80% in the same duration. Metaverse tokens The Sandbox (SAND) and Decentraland (MANA) have dropped 12.93% and 13.36% this past week, and it seems that the bearish trend in the crypto market might continue for a while.

Interestingly, popular blockchain analysis firm Glassnode announced via social media platform Twitter that the percentage of Bitcoin supply last active 2+ years have reached a new 22-month high of around 46.540%, which confirms that the holders of BTC are no longer trading the leading crypto coin and might’ve withdrawn their investments to hardware crypto wallets as well. This means that long-time investors remain bullish on the leading crypto coin.

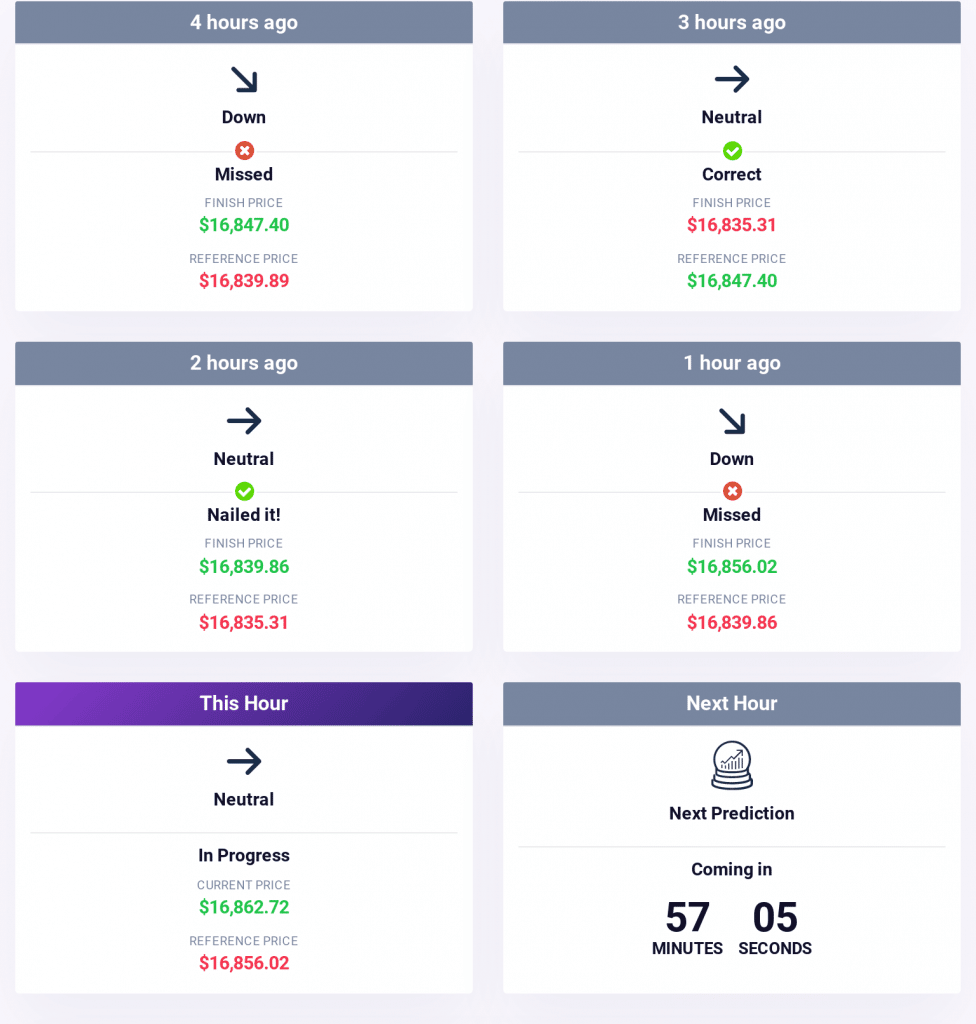

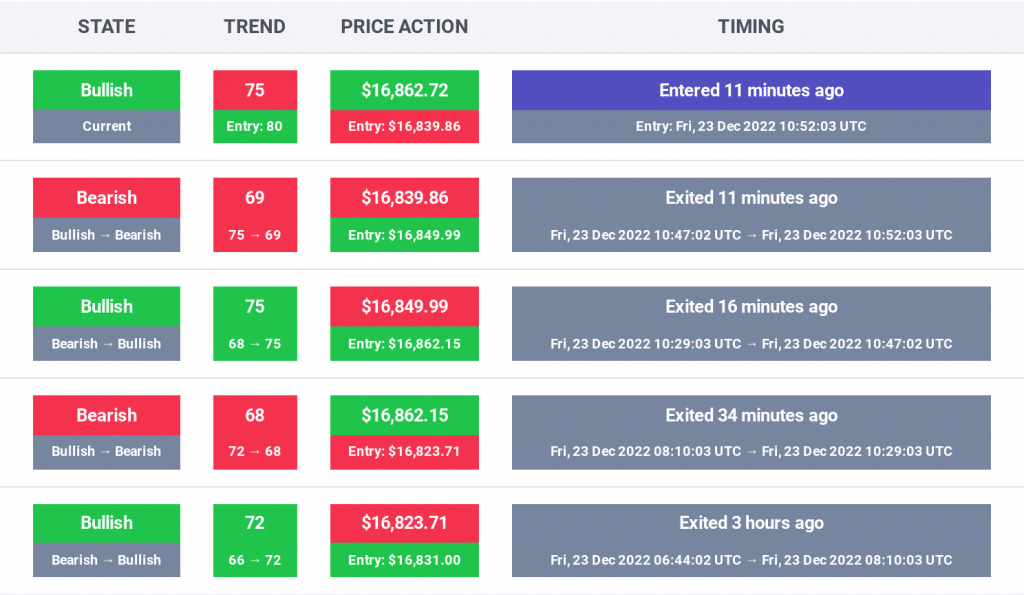

Additionally, the current trend of the Bitcoin price action ranges from down to neutral, which confirms that bears are still in charge of the overall crypto market and selling pressure remains dominant.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

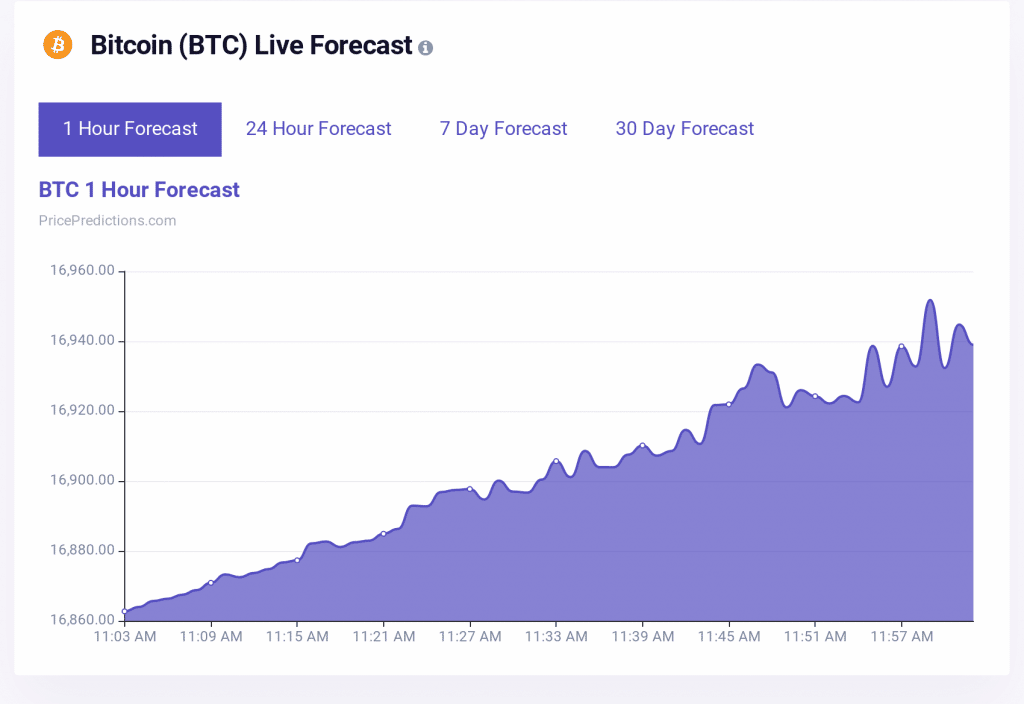

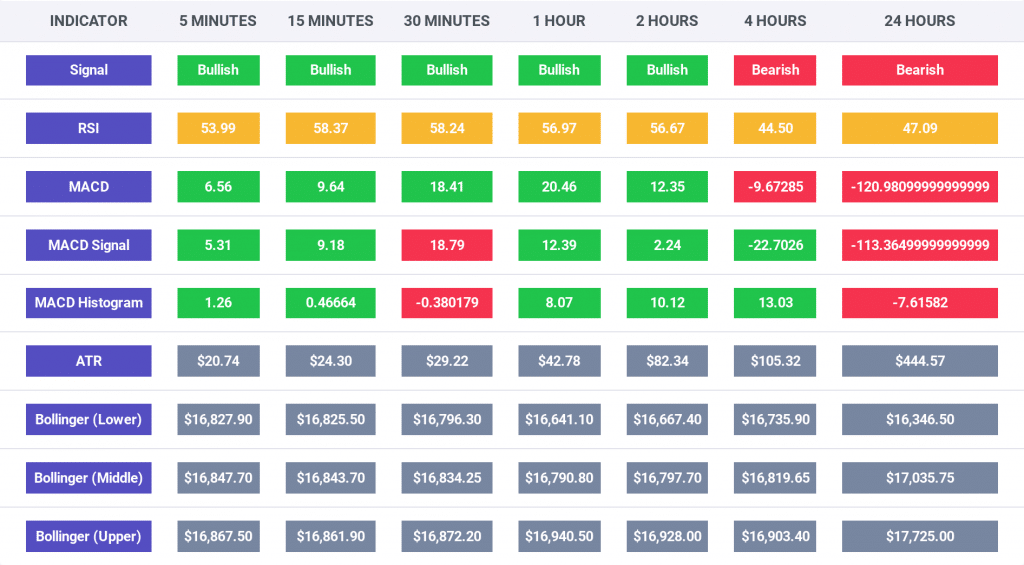

Furthermore, as per the chart below from PricePredictions, Bitcoin has gradually started forming higher highs on the 1 hour chart, and the surge in trading volume today is a proof of the same. However, in order to break above $17k, a higher buying pressure is imperative.

The market sentiment currently reads bullish on a shorter time frame, which is also depicted in the chart above. However, traders are still advised against placing positions due to the uncertainty that currently clouds the market.

After Bitcoin successfully retested the $16.5k price level, the indicators have turned bullish on the short time frame, which proves that trades placed in the last 24 hours might’ve resulted in small gains. However, the longer time frames of 4 hour and 24 hour show that indicators are still bearish.

The RSI indicator for Bitcoin is above 50 on the 5 minute, 15 minute, 30 minute, 1 hour, and 2 hour time frames. On the other hand, the 4 hour and 24 hour frames remain bearish.

Furthermore, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has dropped to 27, after rising to 28 as noted in our Crypto Market Performance Report for Dec. 22. Furthermore, the investors’ sentiment currently reads “fear.”

Additionally, the market cap of the entire crypto space at the time of publication stands at $812 billion, and this value has gone up by 0.14% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,109, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up only by 0.50% in the last 24 hours and is currently priced at $1,223. The trading volume of the cryptocurrency has spiked by 48.93%, while the market dominance has risen to 18.42% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $38.45 million, of which, Bitcoin made up $9.39 million and Ether made up $15.53 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies are green with BNB up 0.14% to $246.16; XRP up 1.08% to $0.3515; DOGE up 5.18% to $0.07783; ADA up 2.89% to $0.2602, and MATIC up 1.31% to $0.8028.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Chain (XCN), Helium (HNT), Toncoin (TON), and Monero (XMR).

Interestingly, XCN was down 5.79% to $0.0182; HNT was down 11.09% to $1.89; TON was down 3.24% to $2.41; and XMR was down 5.12% to $140.20.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are THORChain (RUNE), Near Protocol (NEAR), Neutrino USD (USDN), and Enjin Coin (ENJ).

RUNE was up 2.47% to $1.40, NEAR was up 3.25% to $1.36, USDN was up 3.16% to $0.5409, and ENJ was up 2.17% to $0.2639.