Bitcoin Near $17k Once Again; SOL, ETC, LIDO Skyrocket: Market Watch

- Bitcoin went up by almost 1% but failed to break above $17k while ETH outperformed BTC but was unable to push through $1,300.

- The best performers in the top 100, except top 10, are Solana (SOL), Ethereum Classic (ETC), Near Protocol (NEAR), and Lido DAO (LIDO).

- The worst performers in the top 100, except top 10, are MIOTA (IOTA), GMX (GMX), OKB (OKB), and UNUS SED LEO (LEO).

- The total crypto market liquidation in the last 24 hours amounts to $97.25 million of which ETH makes up around $48.45 million.

The crypto market was slightly green today, with some altcoins printing huge gains while the leading crypto coins, Bitcoin (BTC) and Ether (ETH), continued to make higher highs, although, the former was unable to break $17k and the latter was unable to push through the $1,300 price level. It is also crucial to note that the crypto market is currently experiencing a “crypto winter,” and as a result, the trading ranges of the leading cryptocurrencies remain low.

Bitcoin has a major resistance level beyond the $17k price level, and ever since the crypto coin lost that region last month, we haven’t seen the leading cryptocurrency break through it again. Last year, BTC also dipped to a two-year low, while the trading volume on crypto exchanges followed the same trend. Additionally, there has also been a decline in institutional interest in crypto assets. However, prominent members of the crypto space believe that the implementation of regulations will change this situation.

While the majority of altcoins have been on a downward trend for most of the week, some cryptocurrencies have turned bullish as well. It is also crucial to note that native tokens of crypto exchanges did fairly well last year when compared to DeFi tokens, which rose to huge popularity in 2021 with sky-high valuations.

However, 2022 was a rather slow year for the adoption of DeFi due to increased speculation following the collapse of Anchor Protocol and the Terra ecosystem, along with numerous hacks and scams. The greatest number of exploits were witnessed in October, when even a BNB chain bridge was exploited, striking fear in the hearts of investors.

Moreover, as of 6:26 am ET Wednesday, the price of 1 bitcoin stands at $16,852, up 0.68% in the last 24 hours and the leading crypto coin is very close to the $17k price level. However, to break through this region, a strong buying pressure is needed which currently the market lacks. The trading volume of BTC has jumped by 41.41% in the last 24 hours, while the market dominance of the token has dropped to 39.62% due to several altcoins outperforming the world’s oldest cryptocurrency.

Additionally, the market capitalization of Bitcoin has jumped 0.65% in the last 24 hours and currently stands at $324.35 billion. This confirms that investors might need to gear up for an upcoming bullish event if the surge in trading volume is sustainable. At the time of writing, the price of Bitcoin is around 75.5% lower than its all-time high, which stands at $69k and was witnessed in November 2021.

On the other hand, Ether (ETH), the world’s second-largest crypto coin, currently rests above $1,200, but has failed to break above $1,300. The token retained price support above $1,100 and then successfully broke above the $1,200 price level earlier this week. In the last seven days, Bitcoin and Ether went up by 1.03% and 4.40%, which confirms that Vitalik Buterin’s cryptocurrency is outperforming Satoshi Nakamoto’s invention.

The crypto market fundamentals are also gradually improving, as according to blockchain analysis firm Glassnode, the “Bitcoin Amount of Supply Last Active 5y-7y just reached a 5-year high of 1,430,042.994 BTC.” This confirms that investors are no longer actively selling or trading the BTC they have but are rather holding them and waiting for the bull market. This means that with a slight bullish push, BTC can finally break $20,000.

Ethereum killer, Solana (SOL), has finally started generating an uptrend to make up for all the losses that the SOL token has recently faced due to FUD and fear in the crypto market. Interestingly, SOL is up 37% in the last seven days, while the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) are up 3.97% and 3.83%, respectively, this past week as well.

Leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), have successfully retained their positions in the top 20 of the crypto market, and DOGE is up 1.07% while SHIB is up 3.30% in the last seven days. As per an earlier report from Bitnation, the Dogecoin Foundation has announced a Core Development Fund to increase the efficiency and decentralization of the network.

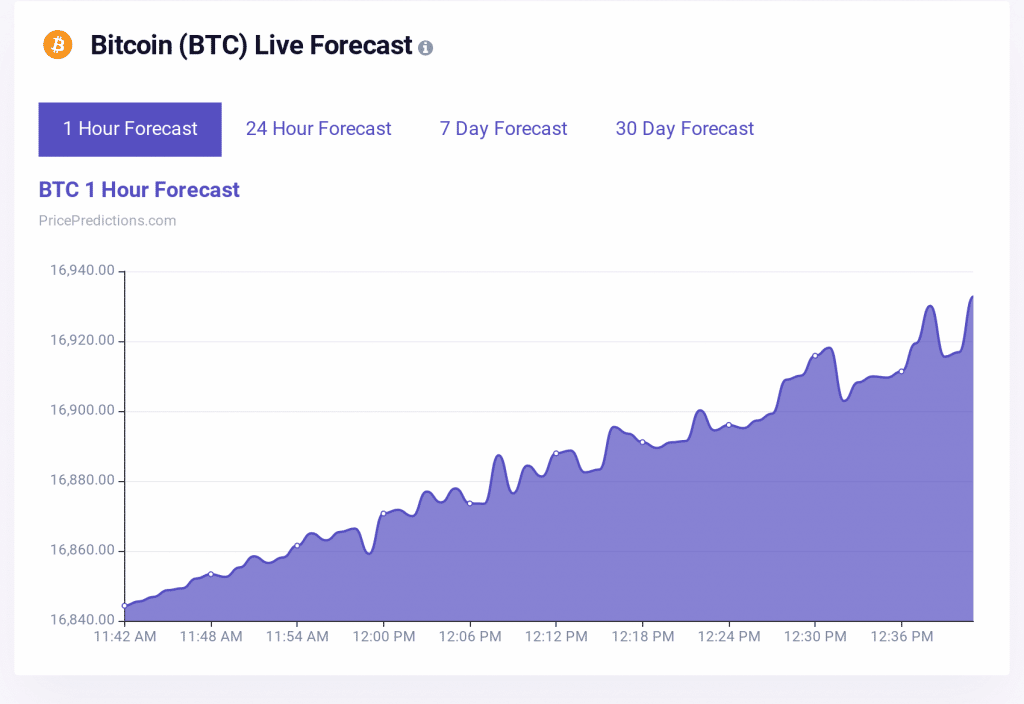

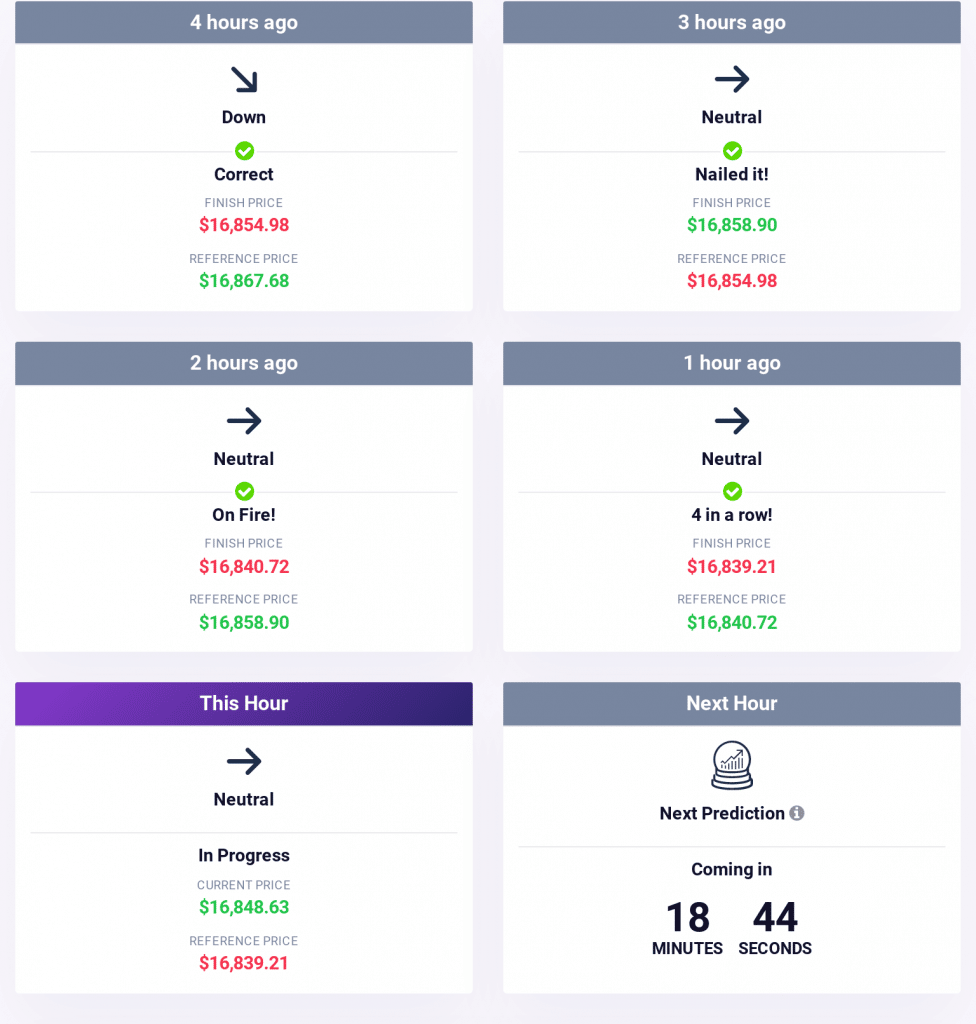

According to the prediction algorithm from PricePredictions, Bitcoin is expected to continue its uptrend in the next hour, and investors might see the leading crypto coin hold above the $16.8k price level if the buying pressure remains high.

The market sentiment is bullish for Bitcoin, as the surge in trading volume and buying pressure have traders betting on BTC breaking the $17,000 price resistance.

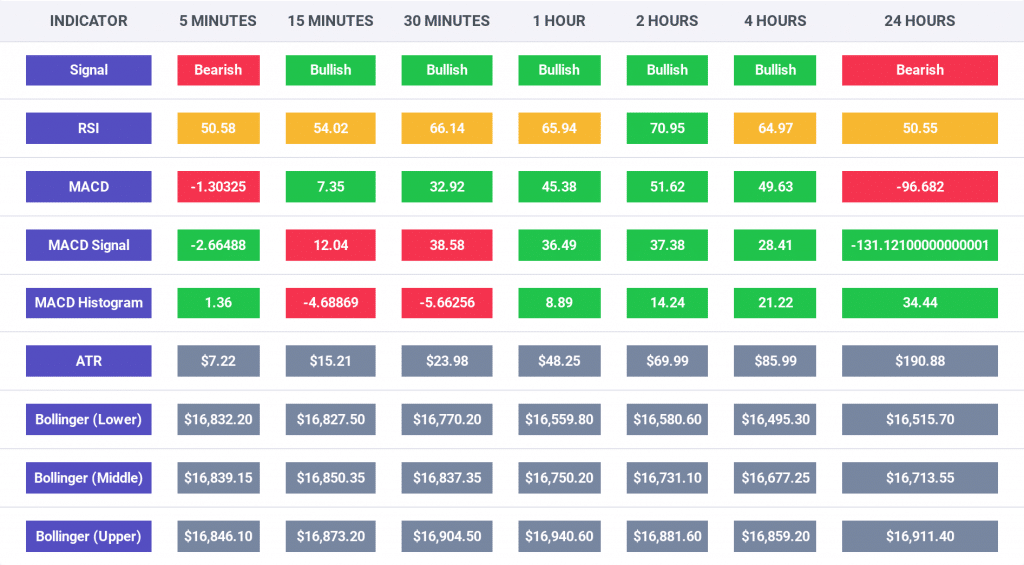

The indicators on the chart below are bullish for all the time frames except the 24 hour and the 5 minute frames. However, for the 10 minute, 15 minute, 1 hour, 2 hour, and 4 hour time frames, almost all the indicators are bullish. However, it is crucial to note that the RSI indicator reads a value above 50 for all the above time frames, which confirms that Bitcoin might finally be able to touch the $17,000 price zone.

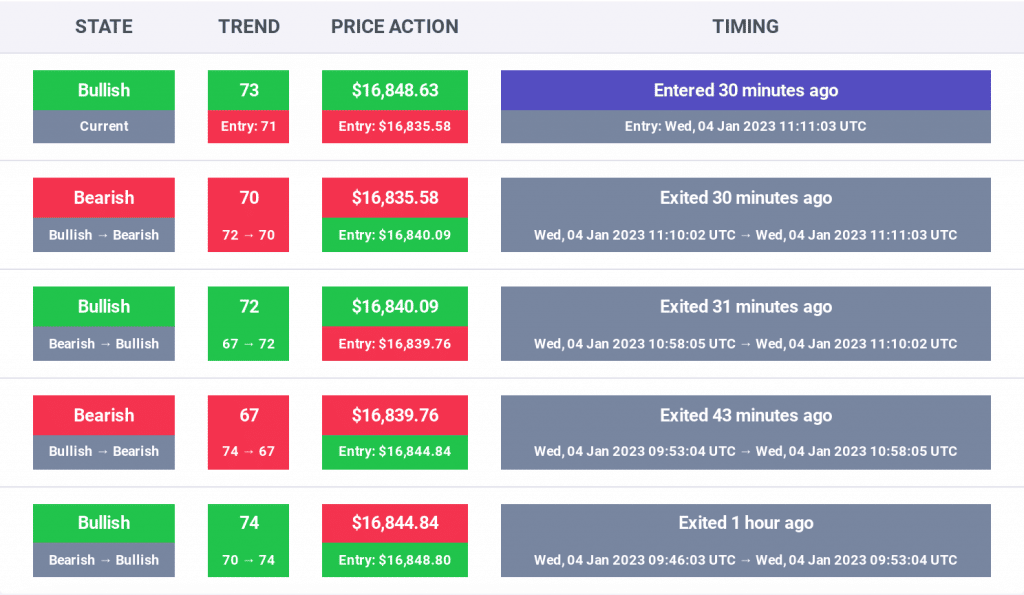

The market trend for the past few hours has not been interesting and ranges from neutral to bearish, which suggests that the bullish momentum might gradually die out owing to the crypto winter and investors might have to see BTC retest lower price levels.

Also, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has risen to 29 after dropping to 26 from 27 earlier this week, as noted in our Crypto Market Performance Report for January 3. It is also crucial to note that the investors’ sentiment currently reads “fear.”

Moreover, the market cap of the entire crypto space at the time of publication is once again above the $800 billion mark and currently stands at $819 billion, and this value has gone up by 1.30% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,179, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up 2.82% in the last 24 hours and is currently priced at $1,250. The trading volume of the cryptocurrency is up by 73.13%, while the market dominance has risen to 18.68% in the same time period.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $97.25 million, of which, Bitcoin made up $10.03million and Ether made up $48.45 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies showed bullish movements, with BNB up 3.69% to $254.83; XRP up 1% to $0.3488; DOGE up 0.65% to $0.07206; ADA up 4.20% to $0.2645; and MATIC up 2.56% to $0.8013.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are MIOTA (IOTA), GMX (GMX), OKB (OKB), and UNUS SED LEO (LEO).

Interestingly, IOTA was down 2.04% to $0.178; GMX (GMX) was down 2.17% to $41.30; OKB was down 7.95% to $27.60; and LEO was down 1.44% to $3.50.

Finally, the best performers among the top 100, not considering the top 10 cryptocurrencies, are Solana (SOL), Ethereum Classic (ETC), Near Protocol (NEAR), and Lido DAO (LIDO).

SOL was up 14.97% to $13.69, ETC was up 12.78% to $18.08, NEAR was up 12.33% to $1.50, and LIDO was up 11.80% to $1.38.