Bitcoin Falls Flat as Week Ends, MKR, GRT Touch Monthly Highs: Performance Report

- Bitcoin has failed to retain the $17k price level this week, while Ether outperformed BTC and remains above the $1200 price zone.

- The worst performers in the top 100, except top 10, are OKB (OKB), Axie Infinity (ENJ), The Sandbox (SAND), and Enjn Coin (ENJ).

- The best performers in the top 100, except top 10, are Lido DAO (LIDO), Maker (MKR), The Graph (GRT), and Aave (AAVE).

- The total crypto market liquidation in the last 24 hours amounts to $12.38 million of which ETH makes up around $1.49 million.

The crypto market entered this week on a bearish note, but as the days passed, the situation was reversed and several crypto coins achieved monthly and weekly highs, with coins like Solana (SOL) making up for all the losses suffered in the month of December 2022. Interestingly, the world’s biggest cryptocurrency, Bitcoin (BTC), was able to touch the $17,000 price region this week, which has been a major area of resistance for the crypto coin. However, it wasn’t able to retain price action above this level.

Additionally, the nearest support for Bitcoin (BTC) stands at $16k and it is crucial to note that this price level has been holding for a very long time. While last year, BTC witnessed its lowest price in two years, investors have set their eyes on the $20k price level as a new year has begun. In the past two years, the BTC fundamentals have changed by a huge margin, and investors can already see signs of recovery in the crypto market.

As of 6:49 am ET, the price of 1 Bitcoin (BTC) stands at $16,940 and is up 0.11% in the last 24 hours. Interestingly, the situation might change in the near future if BTC is able to break $17k and retain price action above it. Furthermore, the trading volume of the oldest crypto coin has dropped 41.09% in the same duration which indicates a huge damage taken by the bulls in the market. It is crucial for the volumes to rise once again, or we can expect another retest of $16k.

Additionally, the market dominance of Bitcoin (BTC) stands at 39.55% and has dropped significantly over the past few months due to the world’s 2nd largest crypto coin outperforming BTC. Another crucial fact to note is that the market capitalization of BTC currently stands at $326.203, which is up 0.09% in the last 24 hours. However, comparing it to the market cap of BTC during the 2021 market bull run, the effects of a prolonged crypto winter can be clearly seen.

The accumulation of Bitcoin has currently turned stagnant, as is clear from the accumulation/distribution indicator. However, on a fundamental basis, if we zoom out, one can easily confirm that the number of BTC holders have increased significantly over the past few years and many billionaires have turned pro-crypto from being vocally against it. Moreover, many countries have even turned to crypto and BTC for the development of their economies.

On the other hand, Ether (ETH) has been able to hold price action above the $1,200 price level, and it is a fact that the 2nd largest coin by market cap has strong support at the $1,100 price zone, which was retested earlier this week. However, ETH broke in at $1,200 as a new week is about to begin for the crypto market. The leading crypto coins, Bitcoin and Ether, have risen 2.26% and 5.46%, respectively, in the last seven days, and their respective weekly candles end on a bullish note for the first week of 2023.

Ethereum killer Solana (SOL), has been one of the biggest gainers this week and is up 36.29% in the last seven days. On the other hand, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) are up 18.58% and 19.42%, respectively, this past week. Leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), are ranked among the top 20 coins in the crypto market, and DOGE is up 2.95% while SHIB is up 4.46% in the same duration.

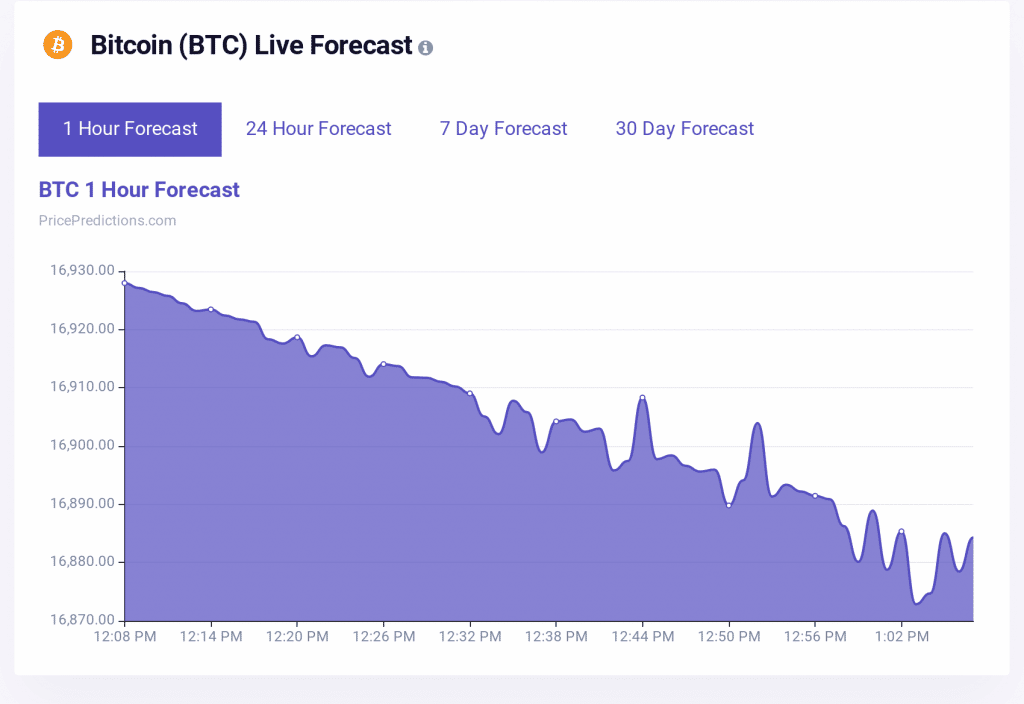

According to the prediction algorithm from PricePredictions, Bitcoin’s uptrend is expected to fade away in the near future because the trading range of the leading crypto coin, Bitcoin (BTC), will remain low which suggests that the trading volume of BTC will also decline in the next hour. Investors can expect a downtrend according to the algorithm from PricePredictions, as is clear from the image below.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

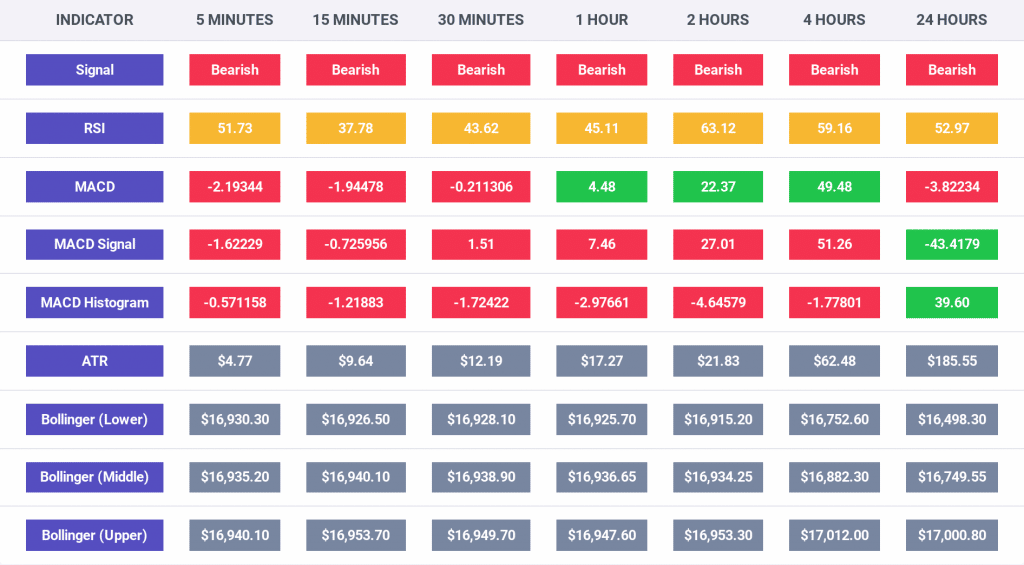

The indicators in the image below from PricePredictions confirm that bears are now in overall control of the Bitcoin price action. The oldest cryptocurrency’s inability to break the $17k price region has caused bearish pressure to rise as the trading volume of the token has also fallen considerably in the last 24 hours.

The RSI indicator reads a value below 50 for the 15 minute, 30 minute and 1 hour time frames, which confirms the fact that buyers haven’t withdrawn completely from the market. Over, the RSI value for the 24 hour time frame is also above 50, which is a positive time for traders, but, positions should only be taken after assessing the risks.

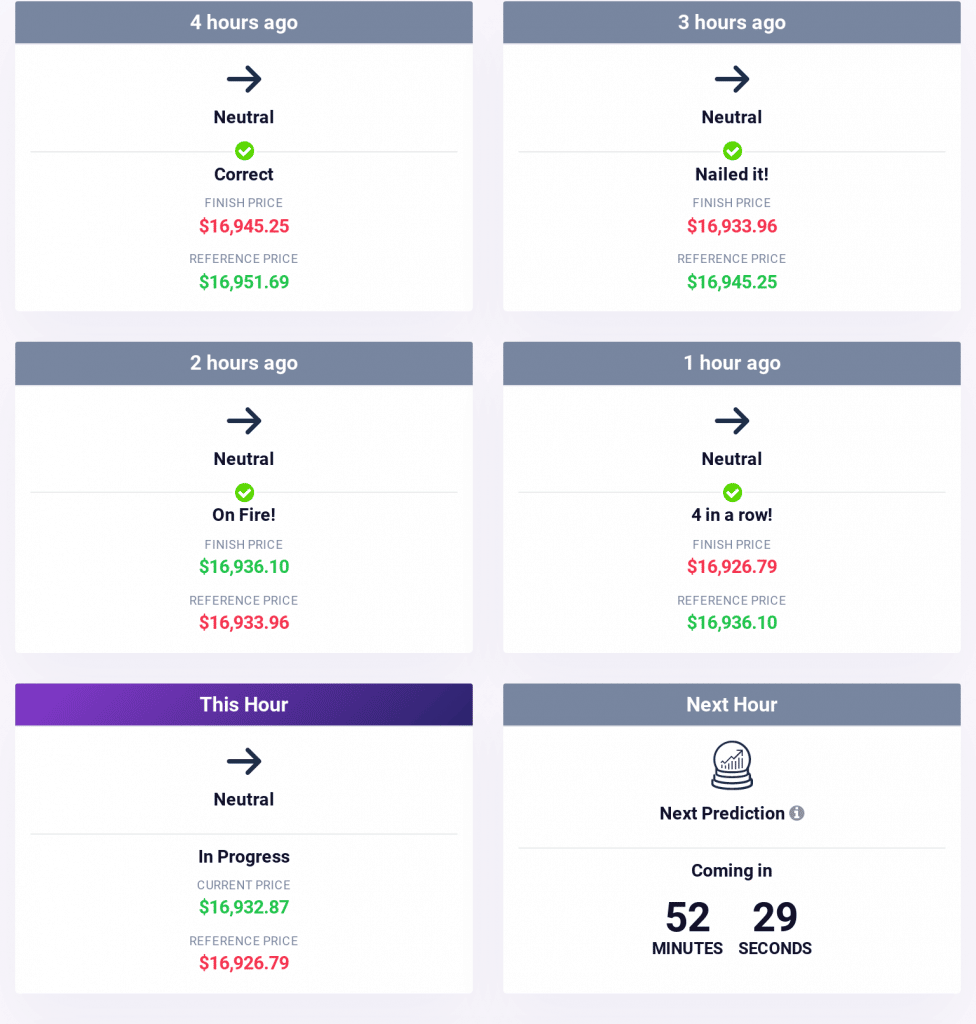

The Bitcoin price action sentiment remains neutral due to a severe lack of trading volume and a market driven by the bears. It is also crucial to note that there is a substantial chance that BTC will once again attempt to break the $17k price level if buyers take charge.

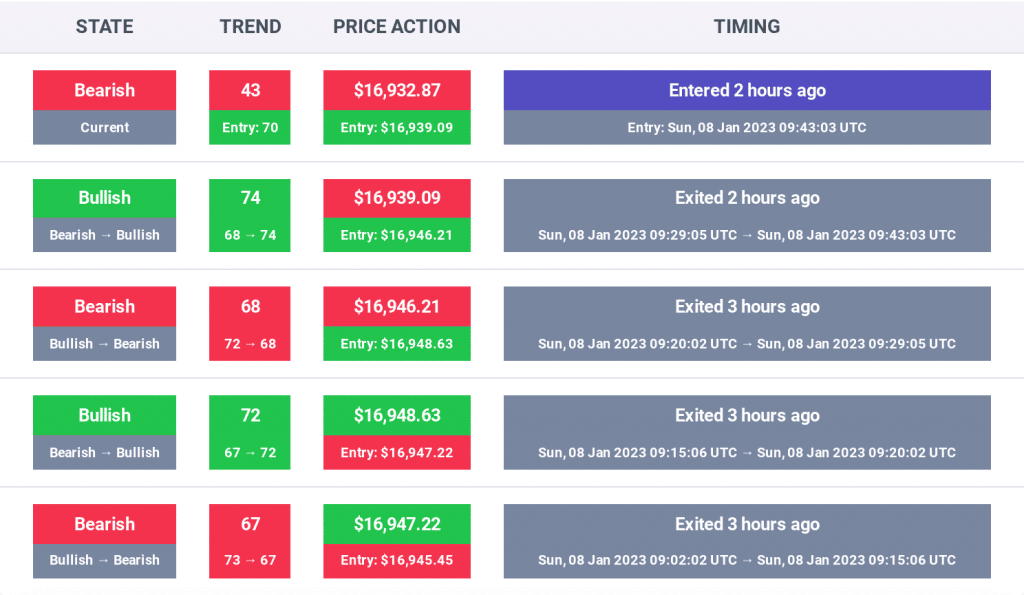

The Bitcoin price trend has changed to bearish, as noted in the chart below, and investors can expect lower prices in the next 24 hours if BTC maintains a similar sluggish outlook.

According to a Twitter post from blockchain analysis firm Glassnode made earlier today, the “Bitcoin Number of Addresses Holding 0.01+ Coins just reached an ATH of 11,455,132,” which means that people continue to purchase the current dip in the price of the world’s biggest digital asset despite it being down more than 75% in the last few months. Moreover, this confirms that the fundamentals of BTC remain strong.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value stands at 25, after dropping from 29 to 26 earlier this week, as noted in our Crypto Market Performance Report for January 7. It is also crucial to note that the investors’ sentiment has changed from “fear” to “extreme fear.”

Additionally, the market cap of the entire crypto space at the time of publication remains above the $800 billion mark and currently stands at $824 billion, and this value has gone up by 0.16% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,227, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is down 0.06% in the last 24 hours and is currently priced at $1,262.34. The trading volume of the cryptocurrency is up by 44.71%, while the market dominance has dropped to 18.74% in the same time period.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $12.38 million, of which, Bitcoin made up $431.48k and Ether made up $1.49 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies displayed mixed performances, with BNB up 0.28% to $261.22; XRP down 0.84% to $0.3395; DOGE down 0.44% to $0.07172; ADA up 5.20% to $0.2883; and MATIC up 0.05% to $0.8023.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are OKB (OKB), Axie Infinity (ENJ), The Sandbox (SAND), and Enjn Coin (ENJ).

Interestingly, OKB was down 2.70% to $26.50; AXS was down 2.15% to $6.85; SAND was down 2.24% to $0.4536; and ENJ was down 1.72% to $0.2605.

Finally, the best performers among the top 100 cryptocurrencies, not considering the top 10 cryptocurrencies, are Lido DAO (LIDO), Maker (MKR), The Graph (GRT), and Aave (AAVE).

LIDO was up 8.85% to $1.61, MKR was up 5.16% to $568.15, GRT was up 8.70% to $0.06694, and AAVE was up 4.23% to $58.24.