Bitcoin Almost Touches $17k, ETC, SAND, MANA Skyrocket: Performance Report

- Bitcoin has almost touched $17k while Ether remains below the $1,200 price level as the leading coins await a bullish breakout.

- The worst performers in the top 100, except top 10, are BitDAO (BIT), EthereumPoW (ETW), Neutrino USD (USDN), and Casper (CSPR).

- The best performers in the top 100, except top 10, are Lido DAO (LIDO), Ethereum Classic (ETC), The Sandbox (SAND), and Decentraland (MANA).

- The total crypto market liquidation in the last 24 hours amounts to $60.26 million of which ETH makes up around $16.59 million.

The crypto market has once again turned slightly green due to the world’s biggest crypto coin, Bitcoin (BTC), tapping to its weekly high and almost touching the $17K price level, which has been a major resistance for the leading crypto coin for a number of weeks. Interestingly, investors can expect BTC to make higher highs and since altcoins follow BTC’s price action, a slight uptrend can be seen for altcoins in the last 24 hours as well.

Following a few weeks of bearish movement and sluggishness, a slightly green market in the prevailing crypto winter comes as a blessing for crypto investors. Most of the coins have crashed more than 70% in the past few months, and with the passing of 2022, investors are anxious to see if 2023 will do any good for the crypto market. Interestingly, the new year has been mostly sluggish for Bitcoin (BTC) as it has spent most of time trying to reclaim the $17,000 price region.

There are many things that are responsible for the development of a market, and the crypto market is related to NASDAQ, which is governed by global macroeconomic conditions. Additionally, the year 2022 was marked by increasing inflation and stricter regulations on crypto assets, and it seems that the trend might continue in 2023 due to regulators’ vows to crack down increasingly on the crypto industry.

As of 12 a.m. ET today, the price of 1 bitcoin stands at $16,953, which is up 0.68% in the last 24 hours, and it seems that the trend might continue in the near future because the trading volume of the crypto coin has surged by almost 2.76% in the same duration. Additionally, the market capitalization of the world’s oldest cryptocurrency has gone up by 0.71% and currently stands at $326.386 billion.

Following the price decline of BTC of more than 75% from $69k in November 2021 to around $17k now, the market capitalization of Bitcoin has also dropped by similar numbers. BTC was once worth $1.2 trillion in market cap, but now, it has fallen significantly following the 2022 market sell-off. Additionally, the market dominance of BTC has also declined recently, with Ether (ETH) performing better than it. The dominance currently stands at 39.57%.

While Ether was unable to push above $1,300, it has successfully retained the $1,200 price level, which is a positive sign for investors. In the last seven days, Bitcoin and Ether went up by 2.38% and 5.98%, and it is clear that the market performance of ETH is better than BTC. The rivalry between the top two coins has lasted for almost a decade, but it is crucial to note that the dominance of BTC is way higher than that of Ether in terms of number of addresses.

According to the analysis done by blockchain analysis firm Glassnode, the “Bitcoin Number of Addresses Holding 0.01+ Coins just reached an ATH of 11,444,918.” This means that there is a gradual rise in the purchase of the world’s biggest cryptocurrency, and even the investors with lower budgets are doubling down on their investments, and the accumulation of BTC is gradually on a rise. As noted earlier, Glassnode confirmed that the “BTC Number of Addresses Holding 0.1+ Coins” just reached an ATH of 4,209,356.

Ethereum killer Solana (SOL), has been one of the biggest gainers this week and is up 36.76% in the last seven days. On the other hand, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) are up 21.56% and 18.64%, respectively, this past week. Leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), are ranked among the top 20 coins in the crypto market, and DOGE is up 5.85% while SHIB is up 5.44% in the same duration.

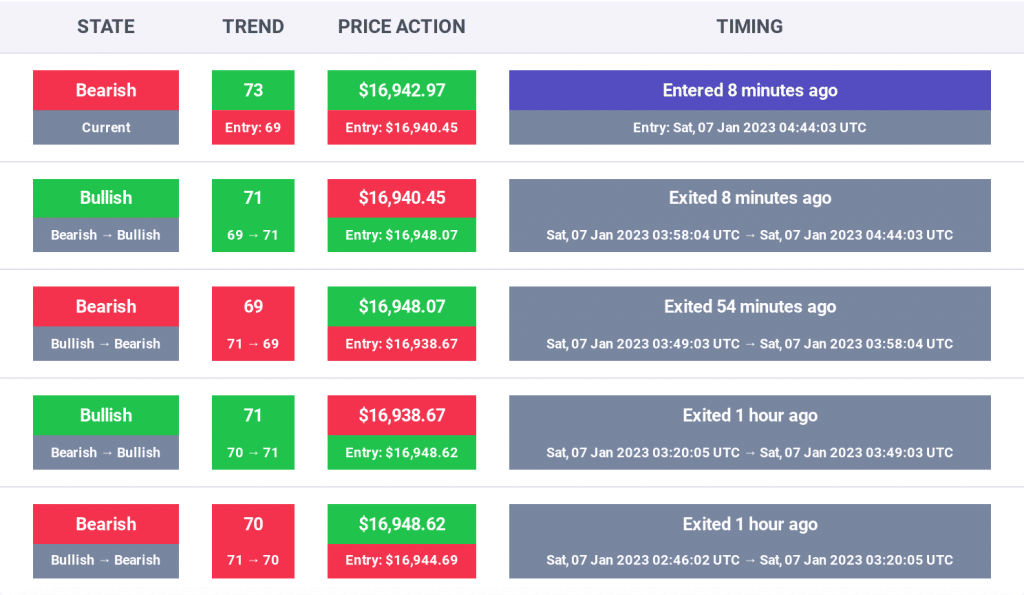

According to the prediction algorithm from PricePredictions, Bitcoin’s uptrend is expected to continue in the near future, and investors are advised to maintain caution in the near future. This is because if BTC is unable to push through the $17,000 price level in the next 24 hours, a retest of $17,000 is very likely.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

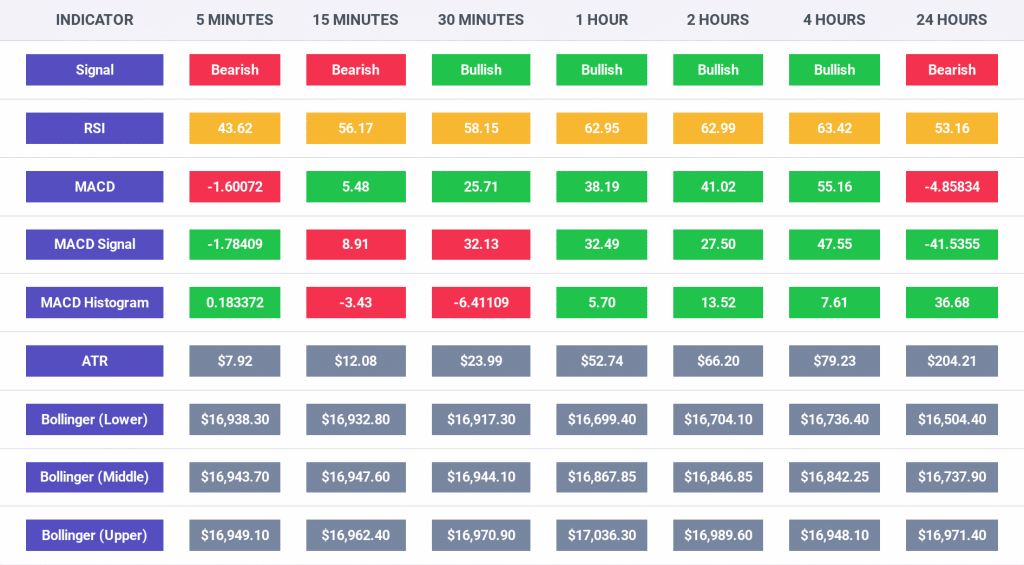

Additionally, as per the chart below, the buying volume of bitcoin has jumped in the last 24 hours, and it is crucial to note that the indicators have turned bullish on the smaller time frames. However, the longer time frame of 24 hours and the shorter ones of 5 minutes and 15 minutes remain bearish for now, and investors can expect things to change if BTC breaks $17k.

Moreover, the RSI indicator reads a value above 50 for all the time frames except the 5 minute time frame, which suggests that the buying pressure is gradually fading away and that it is possible that Bitcoin won’t be able to breach the $17,000 price region.

The market sentiment has turned slightly bearish after being bullish earlier. It is very much possible for the conditions to remain bullish but for that, as mentioned above, the BTC buying volume must increase and the trading range as well. Currently, BTC is confined between $16k and $17k, but, it must break through the latter to confirm an uptrend while crashing below the $16k price region will confirm the continuation of a downtrend.

Furthermore, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has dropped to 25, after dropping from 29 to 26 earlier this week, as noted in our Crypto Market Performance Report for January 5. It is also crucial to note that the investors’ sentiment has changed from “fear” to “extreme fear.”

Additionally, the market cap of the entire crypto space at the time of publication remains above the $800 billion mark and currently stands at $824 billion, and this value has gone down by 0.80% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,222, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up 1.18% in the last 24 hours and is currently priced at $1,265.82. The trading volume of the cryptocurrency is up by 22.63%, while the market dominance has risen to 18.78% in the same time period.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $60.26 million, of which, Bitcoin made up $10.58 and Ether made up $16.59 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies displayed bullish performances, with BNB down 1.55% to $261.29; XRP up 1.98% to $0.343; DOGE up 1.64% to $0.0723; ADA up 1.64% to $0.2725; and MATIC up 2.53% to $0.8031.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are BitDAO (BIT), EthereumPoW (ETW), Neutrino USD (USDN), and Casper (CSPR).

Interestingly, BIT was down 1.36% to $0.4181; ETW was down 0.65% to $3.26; USDN was down 6.63% to $0.4355; and CSPR was down 1.39% to $0.02783.

Finally, the best performers among the top 100 cryptocurrencies, not considering the top 10 cryptocurrencies, are Lido DAO (LIDO), Ethereum Classic (ETC), The Sandbox (SAND), and Decentraland (MANA).

LIDO was up 13.40% to $1.48, ETC was up 11.07% to $20.14, SAND was up 12.35% to $0.4687, and MANA was up 10.23% to $0.3488.