Bitcoin Down 2% this Week; XCN, AXS, FLOW, Crash Hard: Performance Report

- Bitcoin retained price action above $16k while Ether bulls attempt to breach the $1,200 price level once again.

- The best performers in the top 100, except top 10, are Solana (SOL), OKB (OKB), Gemini USD (GUSD), and Lido DAO (LIDO).

- The worst performers in the top 100, except top 10, are Quant (QNT), Chain (XCN), Flow (FLOW), and Axie Infinity (AXS).

- The total crypto market liquidation in the last 24 hours amounts to $55.90 million of which ETH makes up around $9.13 million.

This week has been increasingly bearish for the crypto space, and it seems that investors are in for a not-so-gentle crypto winter. Interestingly, there has been a surge in selling activity in the crypto space recently, although it is a fact that investors continue to withdraw their coins to cold storage and are preparing for a bullish market in the near future. The oldest cryptocurrency, Bitcoin (BTC), has been successfully holding above the $16,000 price zone, which is a crucial support level.

Additionally, the nearest resistance zone stands at the $17,000 price region, which Bitcoin (BTC) has not been able to break for quite some time, and it is clear that the bearish pressure is directing the leading crypto coin to a downward trajectory. However, if the current retest of lower price levels is successful, we can expect BTC to once again make a move towards $17k.

In early December, Bitcoin was able to successfully break the $18,000 price region, but it wasn’t able to maintain price action above it, which resulted in a retest of the $16,800 price level, which failed to hold, and at the time of publication, BTC can be seen retesting the $16.5k price zone. If this holds, the next target lies towards $20k.

As of 7:52 am ET, the price of a single bitcoin stands at $16,508, which is down 0.56% in the last 24 hours and close to 76% below its all-time high of $69,000 witnessed in November 2021. However, the trading volume of BTC has dropped by 11.95%, which further confirms that the crypto winter has severely affected investors’ bullish sentiment that was seen in 2021. The market dominance of Bitcoin stands at 40.11%, while the market capitalization of the cryptocurrency has dropped 0.61% in the last 24 hours to a value of $346.7 billion.

We have witnessed some of the best performers of 2021 crash violently in the past few days, with meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) crashing 12.81% and 3.59%, respectively, in the past seven days. Moreover, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) crashed 14.60% and 7.80%, respectively, this past week as well.

As per the data shared by blockchain analysis firm Glassnode, the Bitcoin “Number of Addresses Holding 1+ Coins” reached a new all-time high of 978,015, which means that investors are taking advantage of lower BTC prices and adding more and more coins to their bags. These investors could make huge profits if the crypto coin were to touch its all-time high once again.

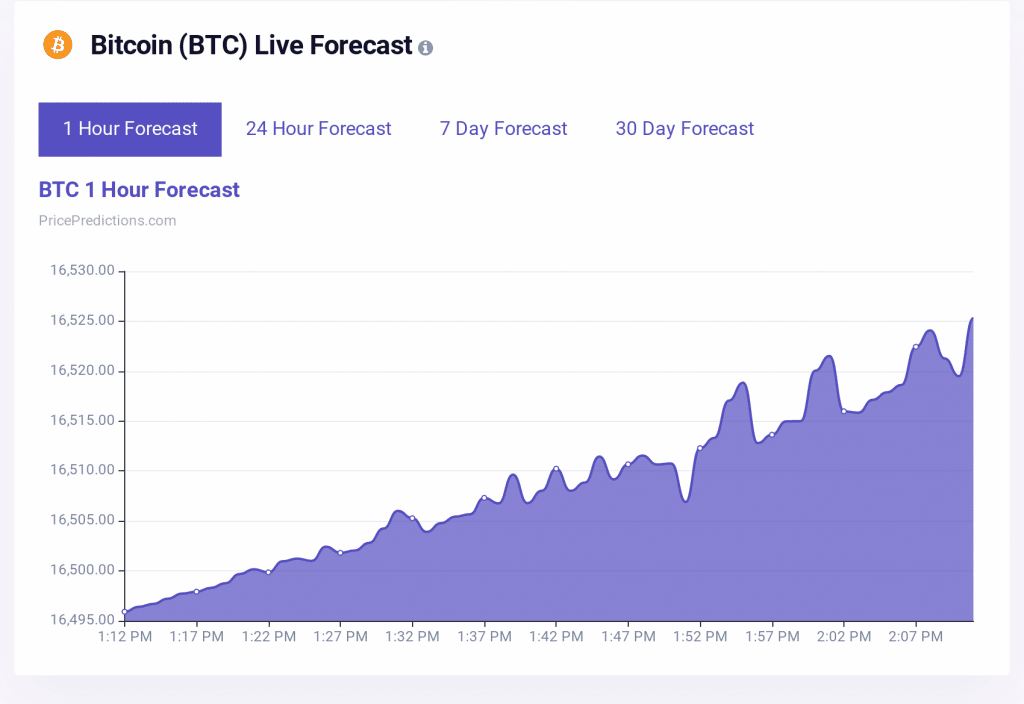

As per the 1 hour forecast chart below from PricePredictions, Bitcoin is expected to retain price action above $16k and make higher hourly highs. However, the trading range will remain small due to declining trading volumes amid the crypto winter.

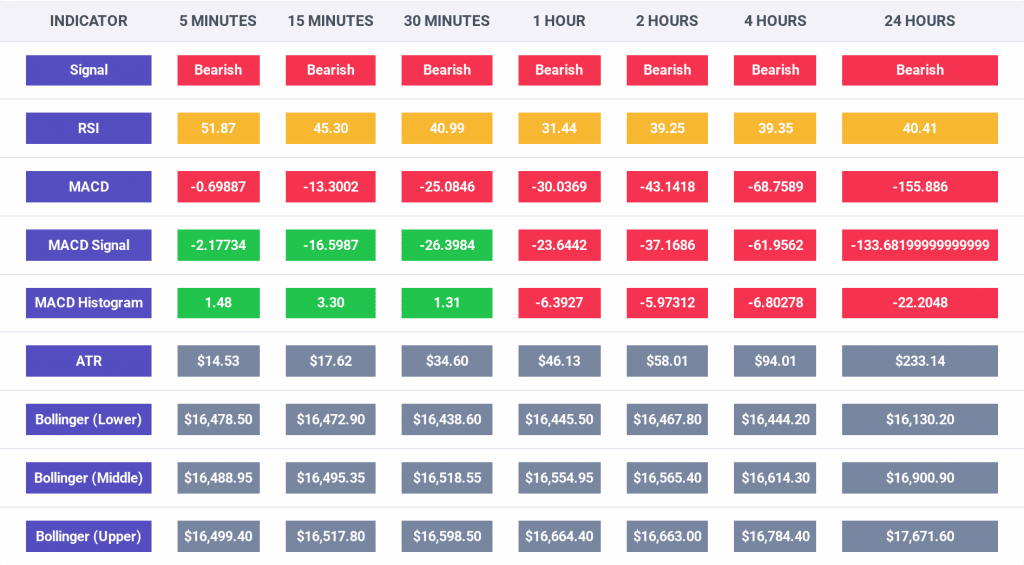

The chart below shows all the major indicators in the crypto space, and it can be confirmed that all of these are bearish for the entire time frame chart. This means that the cumulative reading from all these important chart indicators suggests that the selling pressure for Bitcoin will remain high.

The RSI indicator is also below 50 for all the time frames except, the 5-minute time frame. However, the volume remains low, which suggests that a slight surge during this time period might be possible.

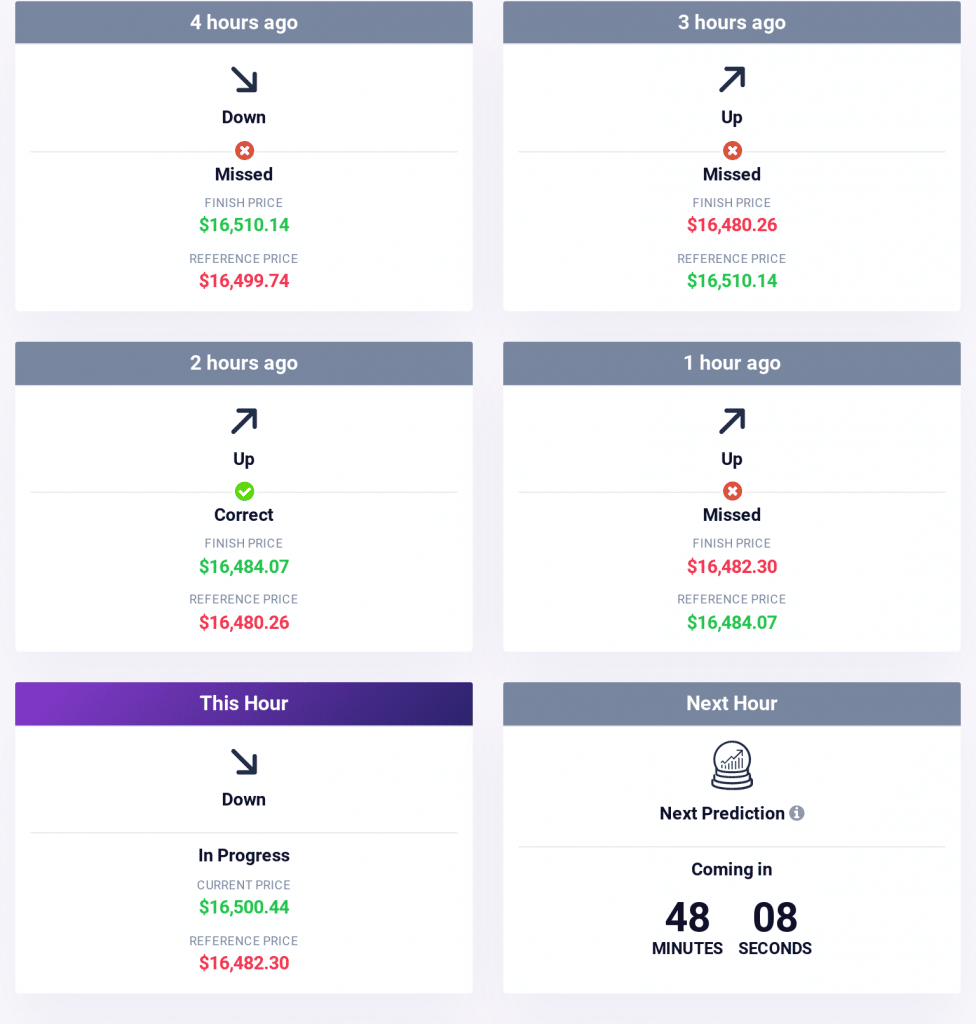

The prediction algorithm stated that Bitcoin is expected to continue its downtrend despite the expectation of it becoming slightly bullish in the short term. The trend ranges from neutral to bearish.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

Also, as per the publicly available data, the crypto market’s Fear and Greed Index’s value stands at 28, which has been the constant value from the past few days, as noted in our Crypto Market Performance Report for Dec. 29. Furthermore, the investors’ sentiment currently reads “fear.”

Moreover, the market cap of the entire crypto space at the time of publication has dropped below the $800 billion mark and currently stands at $790.7 billion, and this value has gone down by 0.86% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,147, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is down by 0.50% in the last 24 hours and is currently priced at $1,193. The trading volume of the cryptocurrency has dropped by 13.55%, while the market dominance has jumped to 18.42% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $55.90 million, of which, Bitcoin made up $8.86 million and Ether made up $9.13 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies showed bearish movement with BNB down 0.74% to $243.89; XRP down 1.63% to $0.3395; DOGE down 3.78% to $0.06801; ADA down 1.40% to $0.242, and MATIC down 3.07% to $0.7581.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Quant (QNT), Chain (XCN), Flow (FLOW), and Axie Infinity (AXS).

Interestingly, QNT was down 6.18% to $104.42; XCN was down 11.16% to $0.1222; FLOW was down 5.18% to $0.6532; and AXS was down 5.22% to $5.93.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies, are Solana (SOL), OKB (OKB), Gemini USD (GUSD), and Lido DAO (LIDO).

SOL was up 2.22% to $9.61, OKB was up 3% to $24.92, GUSD was up 1.50% to $0.9977, and LIDO was up 1.20% to $0.9574.