Bitcoin Bulls Feeling Blues, ETH Retains $1.2k, Altcoins Sluggish: Market Report

- Bitcoin currently holds at $16.8k while Ether remains above $1.2k and their trading volumes have crashed.

- The worst performers in the top 100, except top 10, are Fantom (FTM), Aptos (APT), Chain (XCN), and Lido DAO (LIDO).

- The worst performers in the top 100, except top 10, are Cronos (CRO), XDC Network (XDC), Huobi Token (HT), and Maker (MKR).

- The total crypto market liquidation in the last 24 hours amounts to $25.28 million of which BTC makes up around $8.43 million.

The crypto market on Wednesday did not make any interesting moves, and it seems that the bulls are currently kept at bay as the world’s biggest crypto coin has already touched December lows. It seems that the oldest cryptocurrency, Bitcoin (BTC), will be ending the year below the much-anticipated $20k price region, and investors are advised to take advantage of these lower prices and HODL on to their tokens.

Despite some of the most bullish events in the crypto space in 2022, such as the collapse of various crypto firms and the fear created in the market due to a more than 70% decline in the price of Bitcoin (BTC), there is a strong chance that 2023 might begin at a relatively slower pace. The regulatory uncertainty and lack of clear principles currently prevent crypto investors from putting their money in the crypto sector, which is indeed not very good news.

Many investors have lost money this year to crypto scams, hacks, decentralized finance, and NFT rug-pulls. Some have even gotten their money stuck on exchanges and crypto lenders like Celsius Network and Sam Bankman-Fried’s FTX. As a result, investors are advised to remain cautious about where they invest and where they store their money during this prolonged crypto winter.

Along with Bitcoin, in the past seven days, we have seen metaverse tokens, Decentraland (MANA) and The Sandbox (SAND) lose more than 20% of their value despite many firms entering the industry of virtual reality and metaverse. On the other hand, the top two meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), are down 20% and 10% in the past week, respectively. Stablecoin Neutrino USD (USDN) lost its peg to the US Dollar and is down almost 30% in the same period as well.

It is crucial to note that, as per blockchain analysis firm Glassnode, the “Number of Addresses Holding 0.01+ Bitcoins” reached an all-time high of 11,346,977, which confirms that even small investors are bullish on the world’s biggest cryptocurrency. Furthermore, the analysis firm also confirmed that crypto addresses holding at least 10 bitcoins or more have also reached a 2-year high of 155,006.

While the price of Bitcoin hasn’t moved much in the past 24 hours, it is clear that the accumulation of the leading cryptocurrency is gradually on the rise. However, the confirmation of a rally is yet to come, as 2022 is coming to an end.

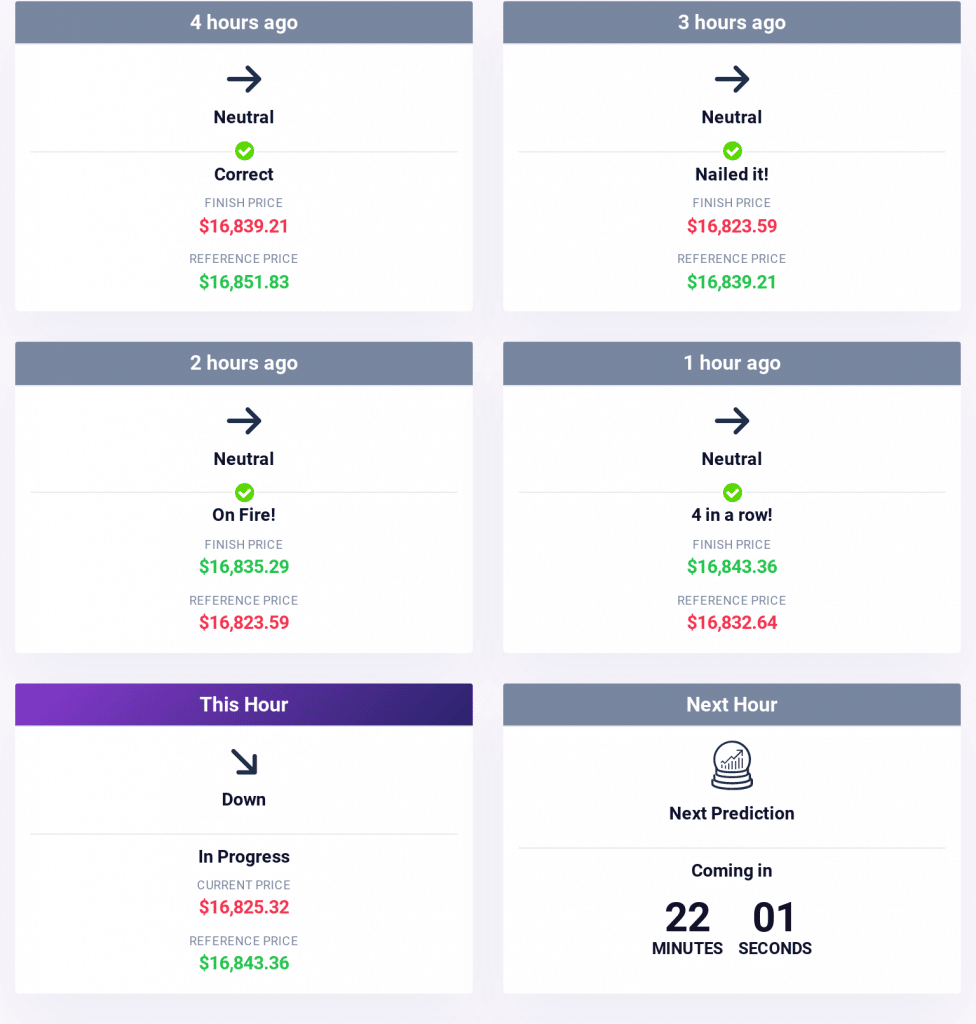

As of 2:31 am ET Wednesday, the price of 1 Bitcoin (BTC) stands at $16,844, up 0.24% in the last 24 hours, which is just not enough volatility to confirm a breakout towards the nearest resistance of BTC, i.e., the $18k-$20k price region. While this region has been acting as resistance for quite some time, the nearest support at $16.5k has been holding for a considerable amount of time as well. The bulls and the bears are at war, and it will be interesting to see on which side the breakout happens.

The trading volume of Bitcoin has dropped 12.83% in the last 24 hours, while the market dominance of the leading cryptocurrency went up to 39.99%. Furthermore, the market cap of BTC stands at $323.996 billion, which is quite low compared to the all-time high witnessed last year at around $1.2 trillion.

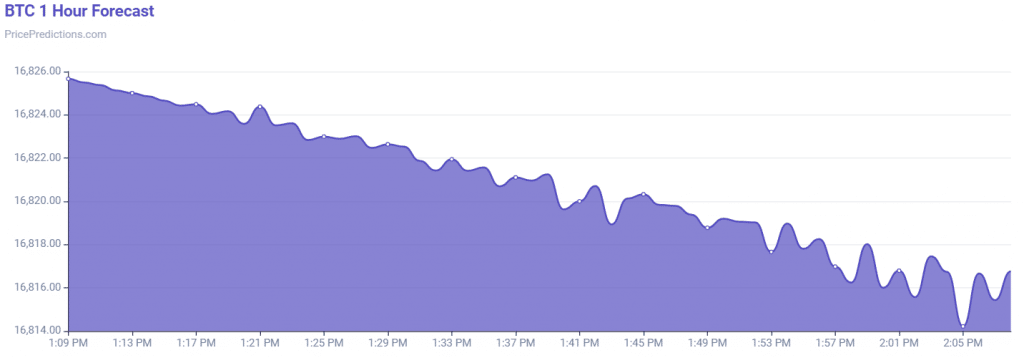

Furthermore, as per the chart below from PricePredictions, Bitcoin currently forms lower lows on the daily chart, which indicates a lack of buying pressure and higher chances of the formation of a downward trajectory on the higher time frames.

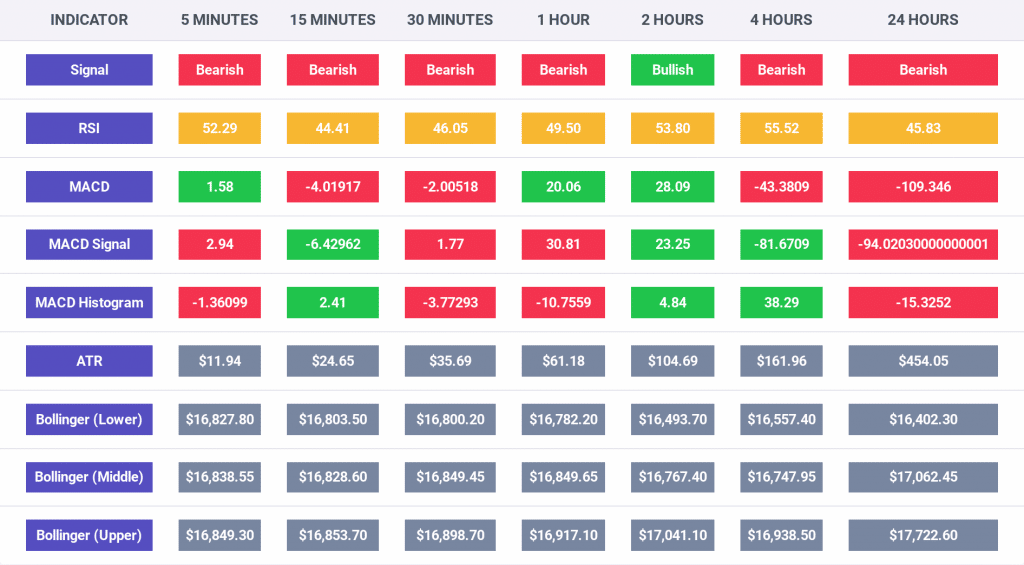

The indicators are bearish on the 5 minute, 15 minute, 30 minute, 1 hour, 4 hour, and 24 hour time frames but they are bullish on the 2 hour time frame, which confirms that the Bitcoin bulls are trying to break into the $17k price region in the near future.

The RSI indicator is above 50 for 5 minute, 2 hour and 4 hour time frame which means that if there is a slightly spike in buying pressure this holiday season, investors can expect the leading cryptocurrency to break into the $17k price level and aim for $20k.

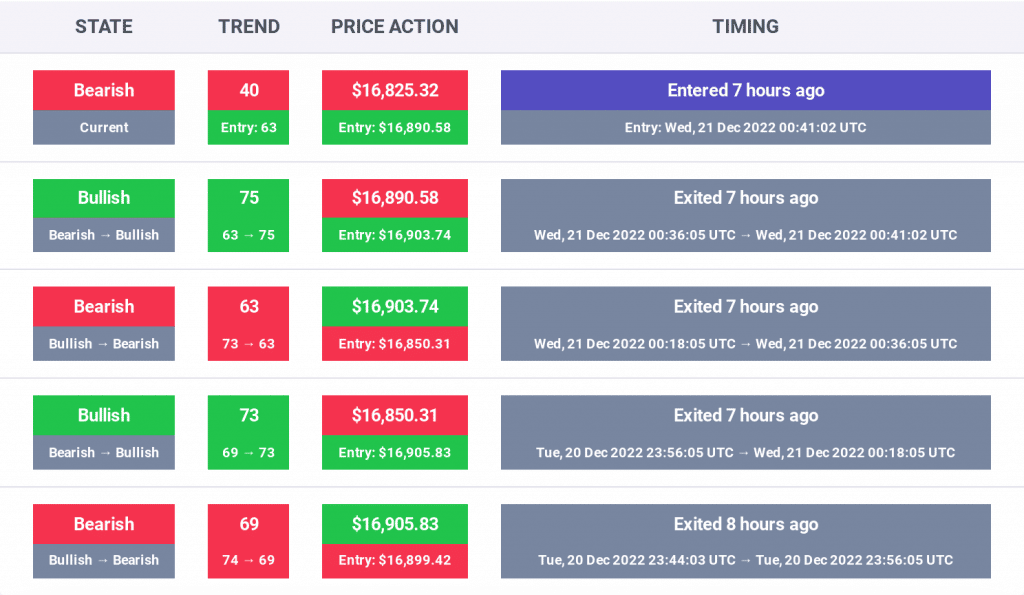

The trader sentiment is currently bearish and therefore, it is advised to not invest in Bitcoin (BTC) right now due to a decrease in the price volatility and bears prevailing in the crypto space. The trading volume of the cryptocurrency is also too low to form an uptrend.

The Bitcoin price action trend has been neutral for quite some time, and this could be due to a decline in the general interest in the crypto market. It is crucial to note that the neutral trend also doubles down on the fact that BTC trading volumes are low.

Moreover, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has once again dropped to 26, and it rose to 29 from 26 at the start of the week, as noted in our Crypto Market Performance Report for Dec. 20. Furthermore, the investors’ sentiment currently reads “fear” and might change to “extreme fear” if $16k is lost.

Additionally, the market cap of the entire crypto space at the time of publication stands at $808 billion, and this value has dipped by 0.18% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,088, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up only by 0.30% in the last 24 hours and is currently priced at $1,212. Ether, the biggest rival to Bitcoin’s dominance, has been holding above the $1,200 price level, which is a good signal for ETH investors. The trading volume of the cryptocurrency has also dipped by 13.30%, while the market dominance has surged to 18.32% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $25.28 million, of which, Bitcoin made up $8.43 million and Ether made up $7.84 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies are red with BNB down 0.09% to $248.18; XRP down 0.85% to $0.3404; DOGE down 2.51% to $0.07264; ADA down 1.86% to $0.2528, and MATIC down 0.56% to $0.795.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Fantom (FTM), Aptos (APT), Chain (XCN), and Lido DAO (LIDO).

Interestingly, FTM was down 3.19% to $0.1996; APT was down 3.31% to $3.78; XCN was down 5.35% to $0.203; and LIDO was down 3.22% to $0.9615.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are Cronos (CRO), XDC Network (XDC), Huobi Token (HT), and Maker (MKR).

CRO was up 1.54% to $0.0571, XDC was up 5.77% to $0.02793, HT was up 1.56% to $5.39, and MKR was up 1.33% to $552.82.