Bitcoin Breaks $17k, ETH Above $1,300; ZIL, GALA Explode: Market Watch

- Bitcoin finally broke above the $17k price level, while Ether went above $1,300 and Ziliqa (ZIL) and Gala (GALA) exploded by almost 50%.

- The worst performers in the top 100, except top 10, are Fei USD (FEI), Pax Dollar (USDP), Numeraire (NMR), and Gemini USD (GUSD).

- The best performers in the top 100, except top 10, are Solana (SOL), Lido DAO (DAO) and Curve DAO Token (CRV).

- The total crypto market liquidation in the last 24 hours amounts to $219.58 million of which ETH makes up around $65.40 million.

The crypto market has been sluggish for the last couple of months, with many cryptocurrencies failing to break into an uptrend due to the current sluggish conditions in the crypto space. A prolonged crypto winter has engulfed the digital asset space, but, after weeks of back and forth movement, the world’s biggest cryptocurrency, Bitcoin (BTC), has finally broken above the $17k price region, and now, an uptrend can be expected in the short term.

Bitcoin (BTC) has found support at the $16,000 price region, which has been holding for a very long time, and investors have witnessed a huge decrease in trading volumes in the recent few months. It is crucial to note that beyond the $17k price zone stands a huge resistance towards $18k–$20k, and if the bulls are successfully able to retain prices above $17k and break into $20k, investors might finally witness the formation of an uptrend.

As of 9:39 a.m. ET today, the price of Bitcoin (BTC) stands at $17,236; this value is up 1.72% in the last 24 hours. The trading volume of the world’s oldest crypto coin has surged by 112.83% in the same duration, while the market dominance of the leading digital asset has dropped to 39.01%. This drop in dominance confirms the fact that the altcoins in the crypto market are outperforming BTC, and it seems that the global adoption of Satoshi Nakamoto’s crypto coin has been continuously dropping.

The market capitalization of Bitcoin currently stands at $322.132 billion, and it is up 1.76% in the last 24 hours. While the all-time high of the market cap stands at $1.2 trillion, which was noted in the month of November 2021, the crypto coin’s worth has reduced by more than 74% in the past few months. As a new year begins, investors are hoping for positive ROIs on their BTC investments.

Bitcoin has formed two straight bullish daily candles, and the accumulation of the leading coin has risen considerably in the past few months following the 2021 market bull run. Whales are gradually adding more cryptocurrencies to their bags while the accumulation/distribution line of the oldest cryptocurrency continues to form higher highs. While BTC witnessed a period of distribution in September 2022, situations have improved recently.

On the other hand, Ether (ETH), the world’s 2nd largest cryptocurrency, has also turned bullish as it held its position strongly above the $1,100 price region. Moreover, ETH also consistently maintained $1,200 as the crypto market bears turn ETH sluggish. However, on Monday, Ether was successfully able to breach the $1,300 price region.

The leading crypto coins, Bitcoin and Ether, have risen 3.36% and 8.91%, respectively, in the last seven days, and their respective weekly candles have been initiated on a bullish note for the second week of 2023.

Ethereum killer Solana (SOL), has been one of the biggest gainers in 2023 and is up 48.13% in the last seven days. On the other hand, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) are up 28.18% and 29.14%, respectively, this past week. Leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), are ranked among the top 20 coins in the crypto market, and DOGE is up 8.60% while SHIB is up 8.59% in the same duration.

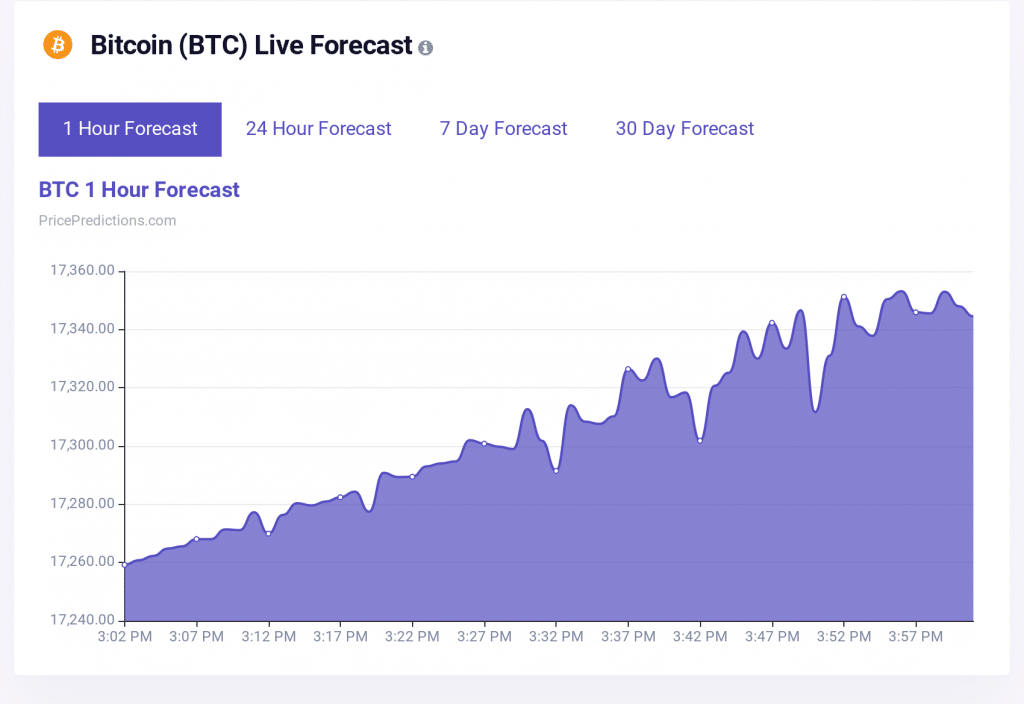

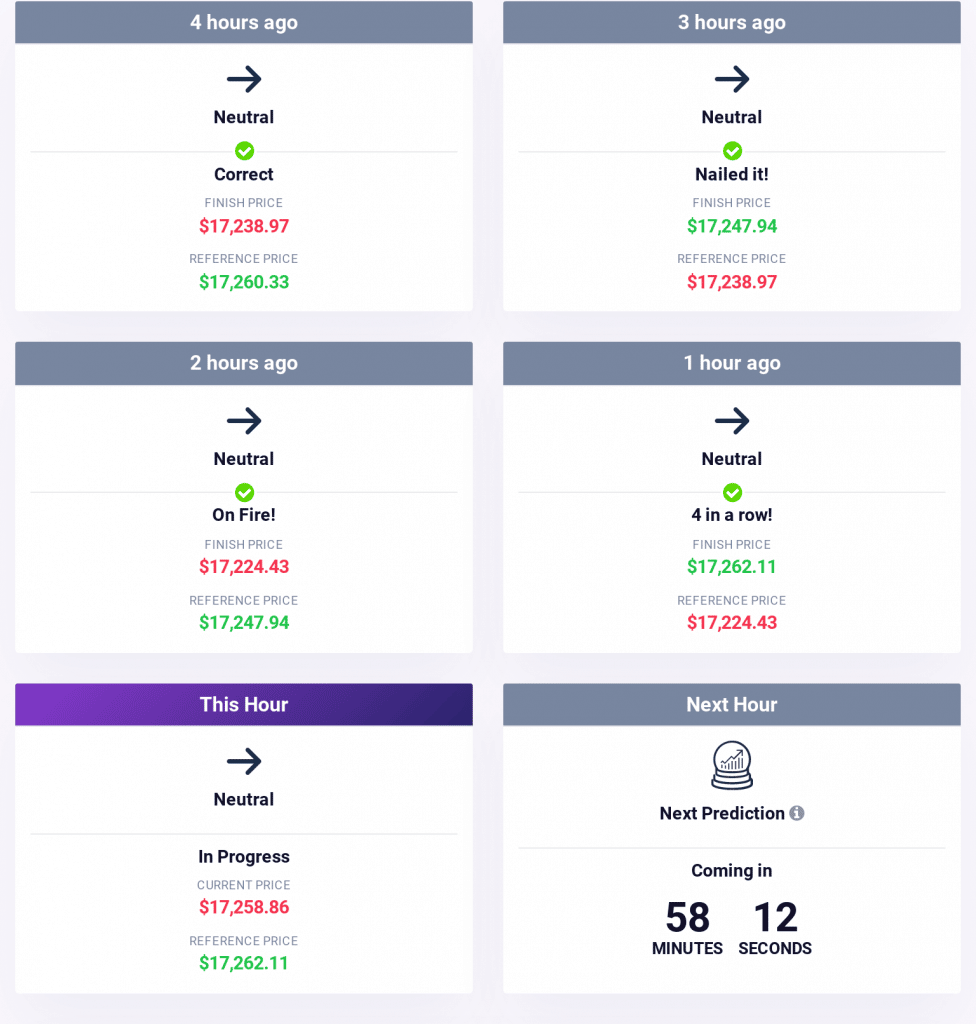

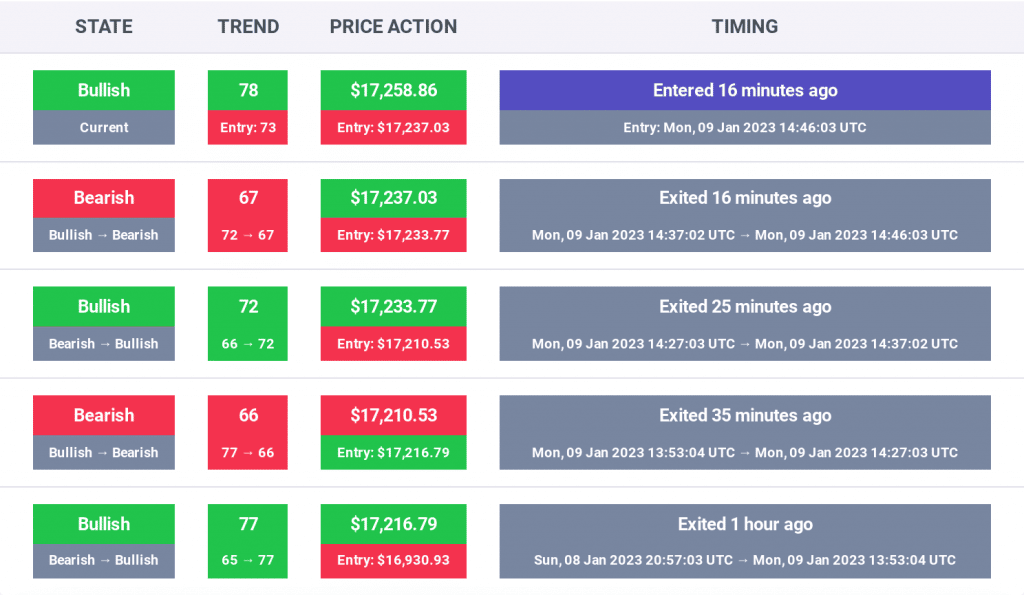

As per the prediction algorithm from PricePredictions, the Bitcoin price trend is expected to remain bullish, and the world’s biggest cryptocurrency is predicted to follow an uptrend and form higher highs in the near future. Furthermore, all the trades placed in the last 24 hours might’ve ended on a bullish note, and BTC is forecasted to hold $17k for the next hour.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

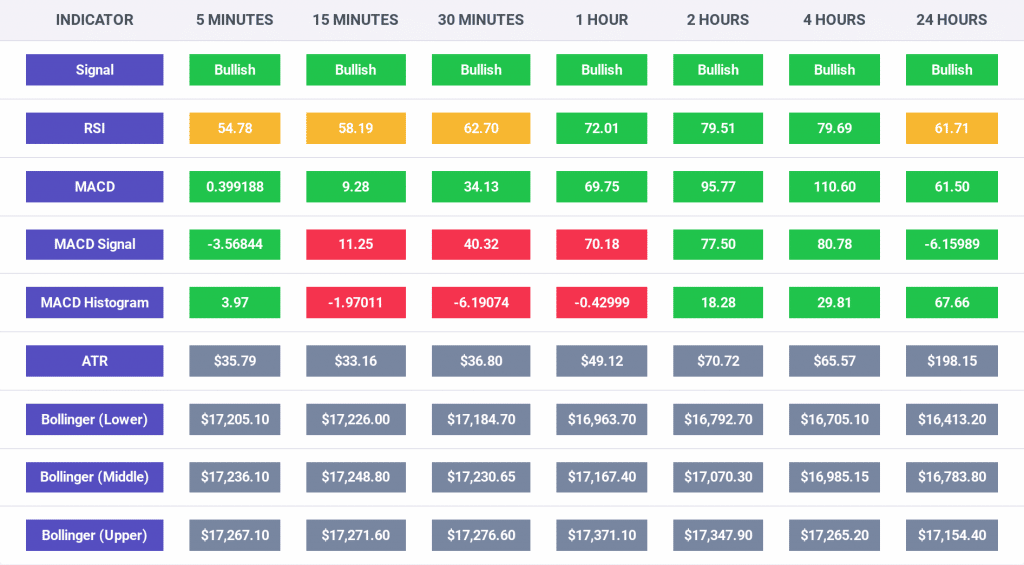

The indicators in the chart below confirm that the crypto market has turned bullish and the buying pressure has surged, which confirms the fact that higher prices will be witnessed in the near future. However, it all depends on the presence of bulls in the crypto space and if Bitcoin is actually able to break the $17k price level and make higher highs in the coming days.

The indicators are bullish for all the time frames mentioned in the chart below, and the RSI indicator reads a value above 50 for them as well. This means that the number of buy orders for Bitcoin is way higher than the number of selling orders at the time of writing.

The crypto market has remained neutral, as seen in the image below, and it can be confirmed that while the trading volumes have doubled in the last 24 hours for Bitcoin, it is still not enough for the leading coin to breach the $20k price region and form an uptrend.

The market sentiment is currently bullish, and there are chances of the leading crypto coin, Bitcoin, making higher highs in the coming days.

An interesting analysis from blockchain analysis firm, Glassnode, confirms that the “BUSD Exchange Inflow Volume (7d MA) just reached a 1-month high of $6,830,796.31,” which confirms that the stablecoin is being increasingly used by traders and investors to buy the current crypto market dip. Interestingly, investors have witnessed a surge in trading volume due to the same as well.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value stands at 25, after dropping from 29 to 25 earlier this week, as noted in our Crypto Market Performance Report for January 8. It is also crucial to note that the investors’ sentiment has changed from “fear” to “extreme fear.”

Additionally, the market cap of the entire crypto space at the time of publication is moving closer to the $900 billion mark and currently stands at $853.21 billion, and this value has gone up by 3.29% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,235, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up 4.79% in the last 24 hours and is currently priced at $1,327. The trading volume of the cryptocurrency is up by 204.57%, while the market dominance has jumped to 19.02% in the same time period.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $219.58 million, of which, Bitcoin made up $27.07 and Ether made up $65.40 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies displayed bullish movement, with BNB up 5.70% to $280.11; XRP up 4.11% to $0.3554; DOGE up 8.19% to $0.07828; ADA up 12.13% to $0.3226; and MATIC up 6.90% to $0.8659.

On the other hand, the worst performing tokens in the last 24 hours are Fei USD (FEI), Pax Dollar (USDP), Numeraire (NMR), and Gemini USD (GUSD).

Interestingly, FEI was down 0.88% to $0.9906; USAP was down 0.01% to $0.9985; NMR was down 2.93% to $14.21; and GUSD was down 0.33% to $1.01.

Finally, the best performers among the top 100 cryptocurrencies, not considering the top 10 cryptocurrencies, are Solana (SOL), Lido DAO (DAO), Ziliqa (ZIL), Gala (GALA), and Curve DAO Token (CRV).

SOL was up 17.30% to $24.76, LIDO was up 16.17% to $1.90, ZIL was up 47.09% to $0.0259, and GALA was up 60% to $0.04309, and CRV was up 19.90% to $0.6637.