Bitcoin Aims to Retake $17k, Helium (HNT) Explodes 30%: Market Analysis

- Bitcoin has been holding close to $17k while Ether maintains price action above $1,200.

- The worst performers in the top 100, except top 10, are Synthetix (SNX), XDC Network (XDC), Algorand (ALGO), and Lido DAO (LIDO).

- The worst performers in the top 100, except top 10, are Helium (HNT), Toncoin (TON), Ethereum Classic (ETC), and Internet Computer (ICP).

- The total crypto market liquidation in the last 24 hours amounts to $11.18 million of which BTC makes up around $2.80 million.

As the holiday season approaches, investors are looking for safer investment options. It seems as though the capital inflow into the crypto space seems to have declined significantly as the price of the world’s biggest cryptocurrency, Bitcoin (BTC), has remained almost the same since the beginning of this week after it lost the $18,000 price region not much longer after reclaiming it. Meanwhile, the volatility of the altcoins has also dropped considerably recently.

It is crucial to note that the collapse of FTX has put a lot of stress on investors, while reports of the world’s biggest crypto exchange, Binance, having issues with its PoR report have further struck fear in the hearts of investors. As reported earlier by Bitnation, media outlet Reuters claims that the exchange is fooling its customers and not following the principles of transparency that its co-founder and CEO, Changpeng Zhao, preaches via his official Twitter account.

The Bitcoin (BTC) price action has been feeling the pressure created by the prolonged crypto winter that has witnessed the collapse of crypto lenders like Celsius Network and BlockFi, along with exchanges like FTX. Furthermore, stablecoins like the Terra USD and the Neutrino USD backed by Waves have also lost their peg to the US dollar.

As of 3:10 am ET, the price of 1 Bitcoin stands at $16,824 and has declined almost 70% in the past few months. It was in November 2021 that we witnessed the all-time high of the world’s oldest crypto coin at a price of $69,000, and since then, the crypto space has fallen considerably. Regulatory uncertainty and speculations from investment banks like Standard Charted have added fuel to the fire.

The trading volume of Bitcoin has dropped 23.36% in the last 24 hours, and investors can expect further price drops in the near future if the nearest resistance around the $18k-$20k price region is not broken. While BTC did break above $18k last week, the victory was only short-lived. Since then, investors have been waiting for the leading cryptocurrency to break the $20,000 price level before the year ends.

2022 has been one of the worst years for Bitcoin as well as the crypto market. Countless crypto investors have lost their money to scams and rug pulls, and many have suffered exploits as well. Some have their money stuck on exchanges as well.

Altcoins haven’t performed quite extraordinarily recently as well. The leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), have dropped 16.10% and 6.66%, respectively, in the last seven days as well. On the other hand, Bitcoin has dropped 4.94% in the same duration, while in the last 24 hours, it is up by merely 0.03%, which suggests that there is a huge lack of volume in the crypto space and traders are advised not to place positions in these conditions. The market dominance of BTC remains at 39.99%.

Furthermore, popular metaverse tokens The Sandbox (SAND) and Decentraland (MANA) have crashed 19.17% and 19.33% in the last seven days as well.

According to blockchain analysis firm, Glassnode, the percent supply last active for Bitcoin for 2+ years has hit a 22 month high at 46.430%, which confirms the fact that most of the BTC in the market is being held and long time investors are still faithful to the leading cryptocurrency. Interestingly, investors are advised to maintain their balances and remove money from centralized exchanges.

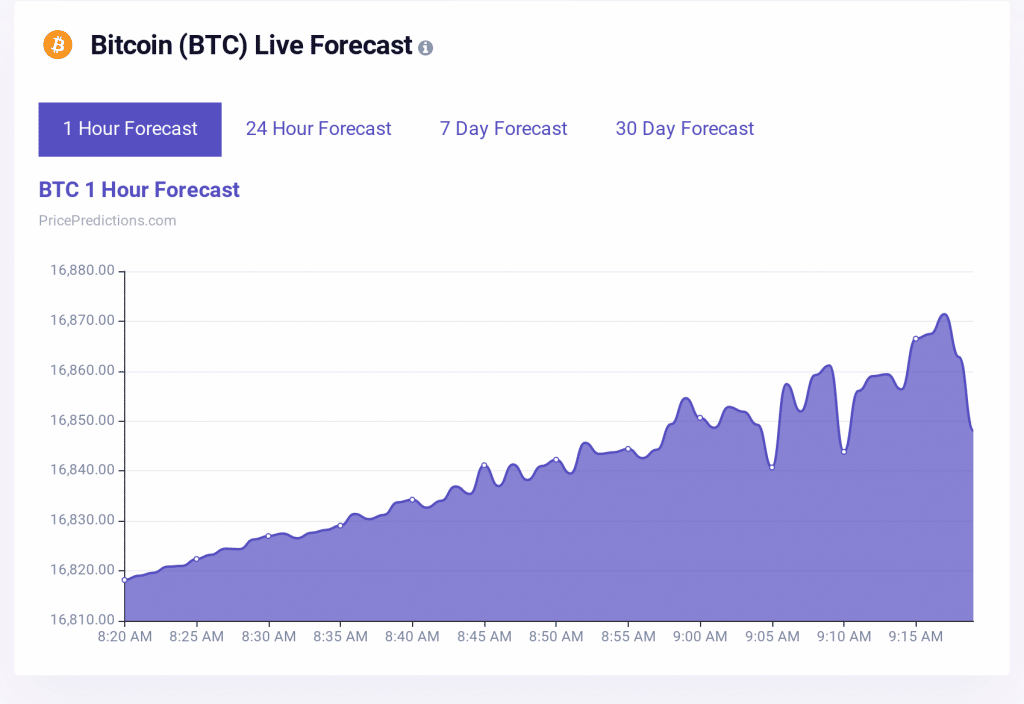

Furthermore, as per the chart below from PricePredictions, Bitcoin has gradually started forming higher highs on the 1 hour chart, which confirms the fact that a short-term spike might be seen. However, the trading range for the higher highs is very low, which further depicts the lack of trading volume.

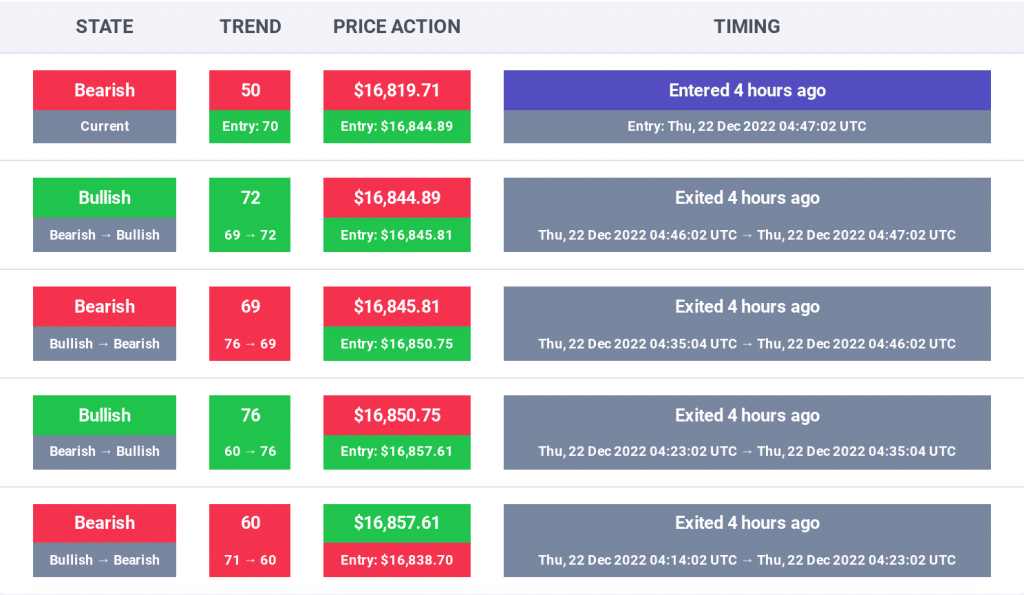

The trend of the Bitcoin price action is currently bearish on the whole as there are significant charges of an increase in volatility in the near future.

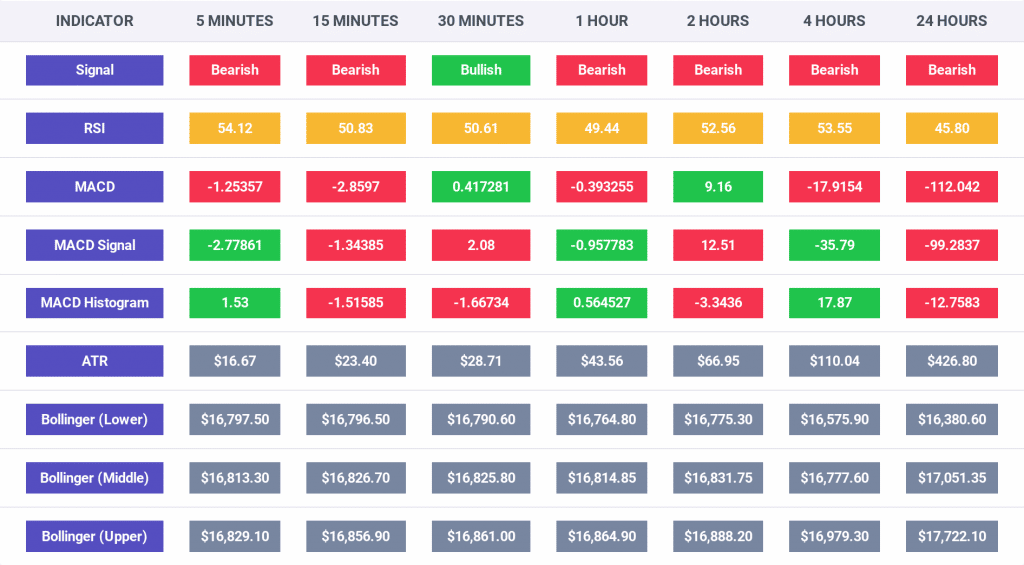

The indicators for the Bitcoin price action are bearish for every time frame except the 30 minute time frame. However, it is crucial to note that the RSI indicator is above 50 on the 5 minute, 15 minute, 30 minute, 2 hour, and 4 hour time frames. It seems like Bitcoin accumulation is gradually taking place.

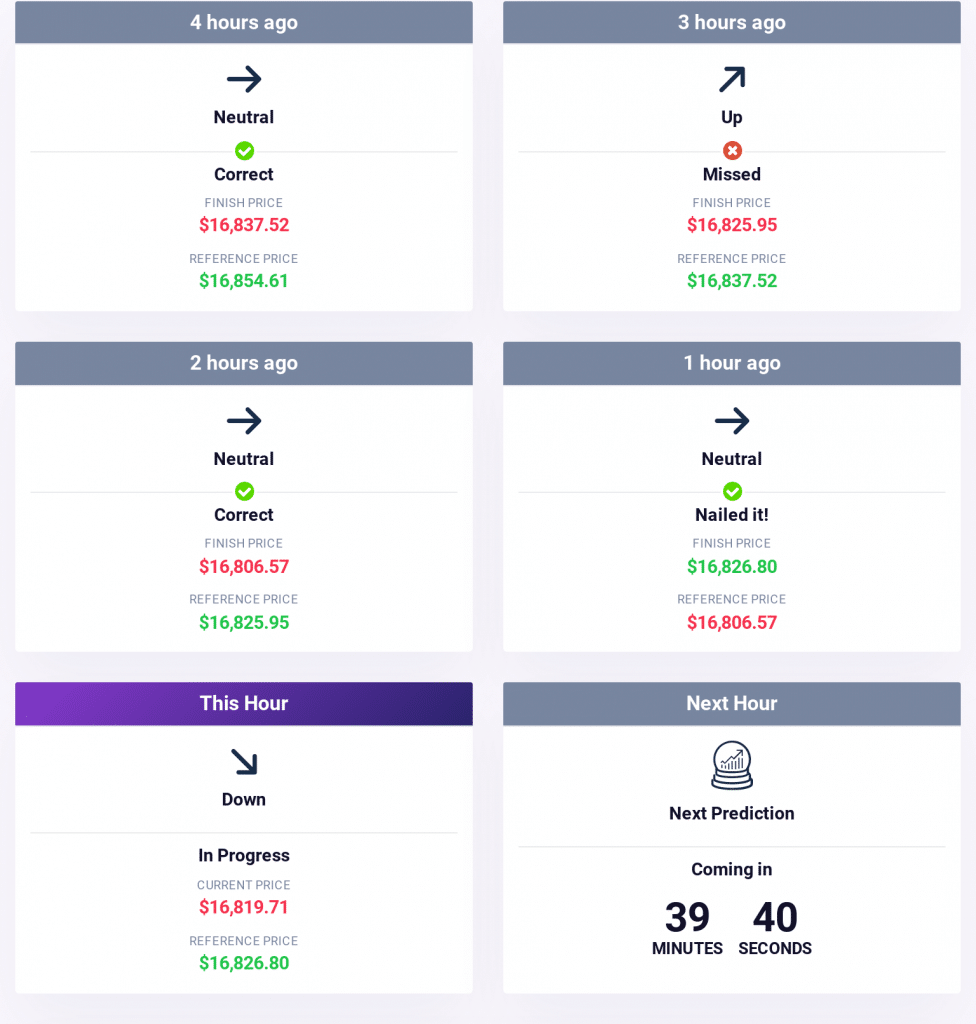

The overall Bitcoin price action remains neutral for the day and this has been the situation for the past few days, which confirms that BTC trading volume is lower than expected and crypto winter has sent BTC fulls to the jungle.

Furthermore, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has risen to 28, after dropping to 26 as noted in our Crypto Market Performance Report for Dec. 21. Furthermore, the investors’ sentiment currently reads “fear” and might change to “extreme fear” if $16k is lost.

Additionally, the market cap of the entire crypto space at the time of publication stands at $809 billion, and this value has dipped by 0.04% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,099, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up only by 0.63% in the last 24 hours and is currently priced at $1,216. Ether, the biggest rival to Bitcoin’s dominance, has been holding above the $1,200 price level. The trading volume of the cryptocurrency has dipped by 30.34%, while the market dominance has risen to 18.36% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $11.18 million, of which, Bitcoin made up $2.80 million and Ether made up $2.02 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies are green except BNB which is down 0.26% to $246.88. XRP is up 1.08% to $0.3444; DOGE is up 1.94% to $0.07384; ADA is up 0.43% to $0.2529, and MATIC is up 0.18% to $0.791.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Synthetix (SNX), XDC Network (XDC), Algorand (ALGO), and Lido DAO (LIDO).

Interestingly, SNX was down 3% to $1.55; XDC was down 3.39% to $0.02708; ALGO was down 4.84% to $0.1696; and LIDO was down 4.45% to $0.9114.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are Helium (HNT), Toncoin (TON), Ethereum Classic (ETC), and Internet Computer (ICP).

HNT was up 30% to $2.16, TON was up 3.27% to $2.54, ICP was up 3.20% to $3.71, and ETC was up 3.98% to $16.71.