Bitcoin Above $17k, Ether Retains $1,300: Altcoins Sluggish Again: Market Report

- Bitcoin has retained price action above $17k while Ether has outperformed BTC and broken above $1,300.

- The worst performers in the top 100, except top 10, are Frax Shares (FXS), Ziliqa (ZIL), Toncoin (TON), and Ethereum Classic (ETC).

- The best performers in the top 100, except top 10, are Aptos (APT), Chiliz (CHZ), Apecoin (APE), and Lido DAO (LIDO).

- The total crypto market liquidation in the last 24 hours amounts to $108.6 million of which ETH makes up around $26.12 million.

Once again, the crypto market has turned slightly sluggish as investors worry about the future of their investments and the possibility of higher highs in the coming days. After witnessing huge gains on the first day of the week, the majority of altcoins are now printing sluggish daily candles for Monday while the world’s biggest cryptocurrency, Bitcoin (BTC), continues to retain the $17k price level.

Beyond the $17k price level lies a region of resistance for Bitcoin (BTC) which the leading crypto coin has been unable to break for quite some time. Investors are waiting for the time when the oldest crypto coin in the market will breach the $20k price region and make way for higher prices. However, the chances of the same are currently quite low due to a decrease in buying volume in the industry.

Bitcoin (BTC) has a support zone at the $16,000 price zone, which has been holding for a significant number of weeks, and several analysts believe that the bottom for the leading crypto coin is already in, and now, we might witness a trend reversal. However, such bold statements cannot be made as the prevailing crypto winter might worsen if additional crypto firms collapse and file for restructuring.

As of 7:56 am, the price of 1 Bitcoin stands at $17,229, and this value is down by 0.16% in the last 24 hours, which is a sign of bullish movement. Additionally, the trading volume of the world’s oldest crypto coin has surged by 4.26% in the same duration, while the market dominance of the leading digital asset has dropped to 39.03%. There has been a steady drop in dominance of the world’s largest crypto coin in the past few months due to the fact that the altcoins in the crypto market are outperforming BTC.

The market capitalization of Bitcoin currently stands at $331.830 billion, and it is down 0.15% in the last 24 hours. Additionally, the all-time high of the market cap stands at $1.2 trillion, which was noted in the month of November 2021. Moreover, the crypto coin’s worth has reduced by more than 74% in the past few months following the collapse of multiple crypto firms and blockchain-based service providers.

Interestingly, Bitcoin has now formed three bullish daily candles, but the volume in the crypto space remains low and the situation in the industry has failed to improve. An uptrend in the short term can only be confirmed when the leading cryptocurrency breaks above the $20k price level, which is an area of major resistance. However, the crypto coin is following a downtrend trajectory in the longer term.

The accumulation of Bitcoin is once again on the rise, and it seems that the whales are gradually adding more BTC to their wallets, taking advantage of lower prices for the leading crypto coin. Moreover, there is also a chance that this increasing accumulation of Bitcoin might eventually lead to higher prices. It is crucial to note that the fundamentals for BTC are still strong.

On the other hand, Ether (ETH), the world’s 2nd largest cryptocurrency, has also turned bullish as it has held its position strongly above the $1,100 price region and has also consistently maintained $1,200, finally breaking above $1,300 as the second week of 2023 began. Ether has outperformed BTC for a number of weeks as well.

The leading crypto coins, Bitcoin and Ether, have risen 3.09% and 9.17%, respectively, in the last seven days, and their respective weekly candles have been initiated on a bullish note for the second week of 2023. Ethereum killer Solana (SOL), has been one of the biggest gainers in 2023 and is up 48.13% in the last seven days.

On the other hand, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) are up 25.46% and 27.83%, respectively, this past week. Leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), are ranked among the top 20 coins in the crypto market, and DOGE is up 6.61% while SHIB is up 13.36% in the same duration.

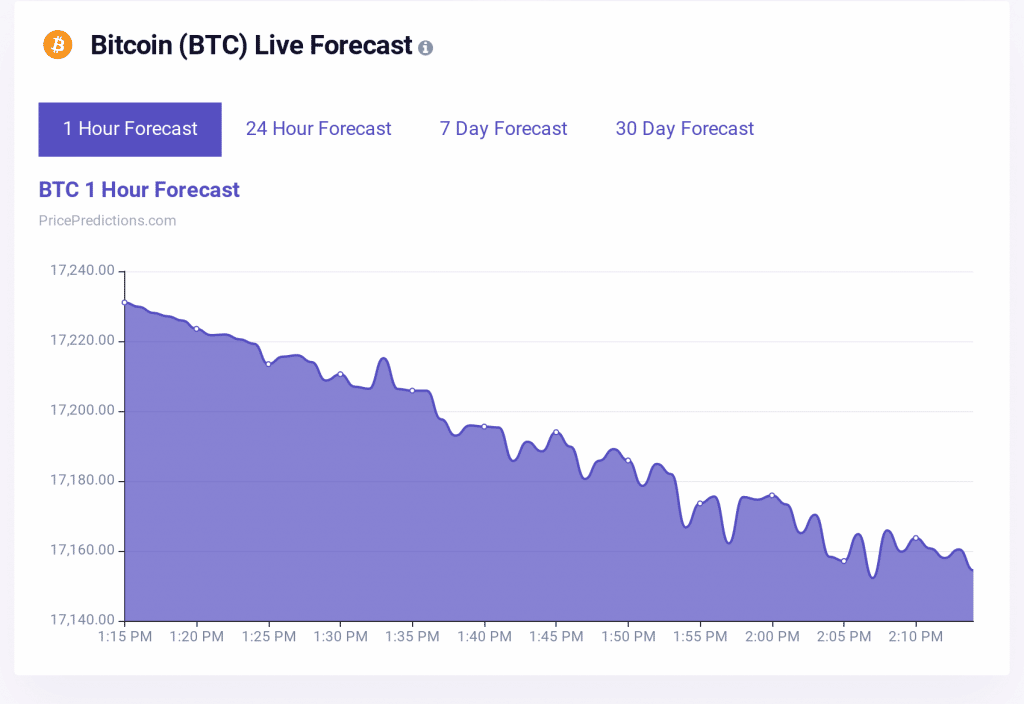

As per the prediction algorithm from PricePredictions, the Bitcoin price trend is expected to follow a downtrend as the trading volume of the crypto coin has declined slightly in the past few hours and traders are selling BTC to cash in the profit that they have made in the past few hours. Interestingly, investors can also expect similar movement for the next hour and a retest of $17,000 is likely.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

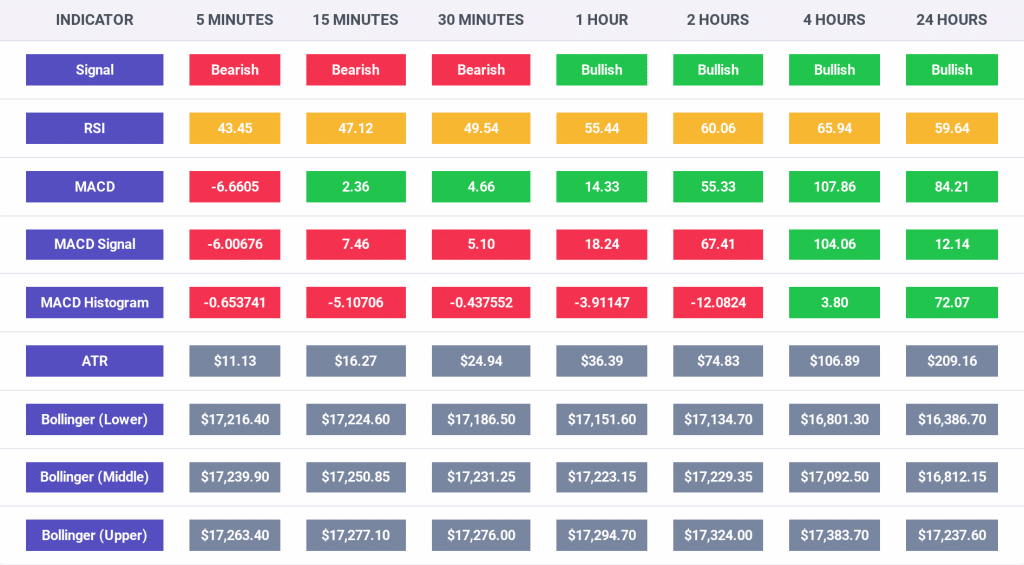

The indicators in the image below confirm that the Bitcoin price action has turned bearish in the short term, while for the longer run, the indicators for the leading crypto coin are bullish. This confirms that there are strong chances of BTC bulls pursuing higher highs, and traders can place trades if they are confident enough and have a strong knowledge of technical indicators and the BTC price trajectory.

The RSI indicator reads a value below 50 for the 5 minute, 15 minute, and 30 minute charts, while it is also clear that the value is above 50 for the 1 hour, 2 hour, 4 hour, and 24 hour time frames. Interestingly, this bullish phase for the crypto market might improve in the near future.

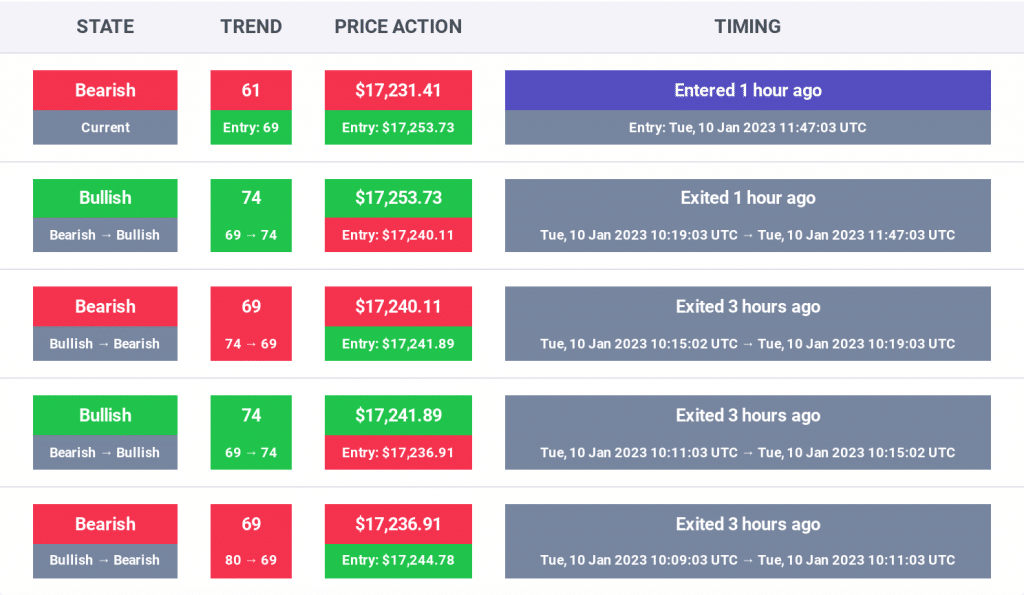

The Bitcoin price trend is currently bearish, and any trades placed in the last 1 hour would’ve generated losses. However, the trading range of BTC remains low, which means that significant losses can be avoided.

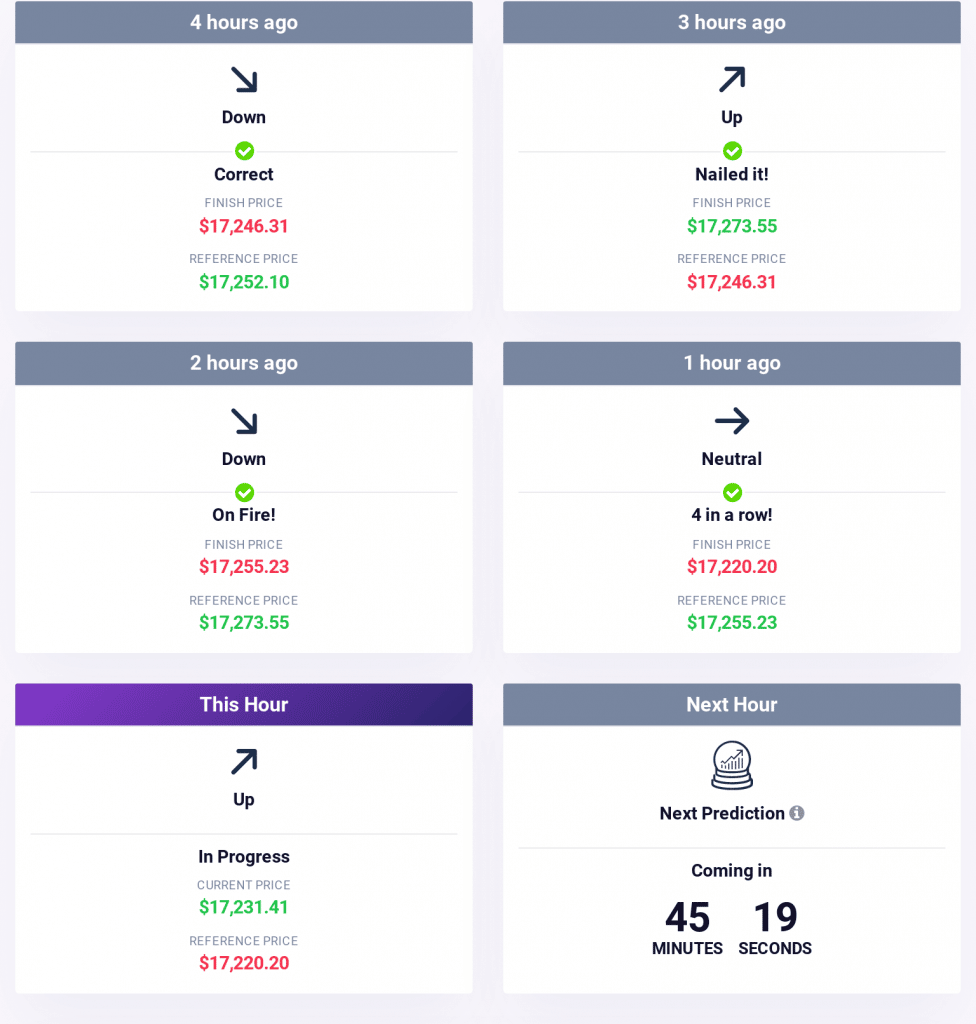

The Bitcoin price sentiment is currently bullish but began the day on a slightly bearish note. However, after turning neutral, BTC is once again following an uptrend, which is positive news for the bulls in the crypto space.

An interesting analysis from blockchain analysis firm Glassnode confirms that the “Bitcoin Percent Supply Last Active 1+ Years just reached a 1-month low of 66.383%” which means that the percentage of BTC supply that is inactive has reached a new monthly low. This confirms that after weeks of sluggishness, BTC is being actively bought and sold in the crypto space.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value stands at 26, after dropping to 25 earlier this week, as noted in our Crypto Market Performance Report for January 9. It is also crucial to note that the investors’ sentiment has changed from “extreme fear” to “fear.”

Additionally, the market cap of the entire crypto space at the time of publication is moving closer to the $900 billion mark and currently stands at $851.46 billion, and this value has gone down by 0.03% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,249, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up 0.30% in the last 24 hours and is currently priced at $1,326. The trading volume of the cryptocurrency is down by 12.13%, while the market dominance has jumped to 19.07% in the same time period.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $108.5 million, of which, Bitcoin made up $15.62 and Ether made up $26.12 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies displayed bearish movement, with BNB down 1.61% to $274.35; XRP down 1.21% to $0.3481; DOGE down 2.43% to $0.07605; ADA down 2.52% to $0.3152; and MATIC down 2.62% to $0.8402.

On the other hand, the worst performing tokens in the last 24 hours are Frax Shares (FXS), Ziliqa (ZIL), Toncoin (TON), and Ethereum Classic (ETC).

Interestingly, FXS was down 4.85% to $5.47; ZIL was down 6.95% to $0.02405; TON was down 5.35% to $2.12; and ETC was down 3.34% to $20.04.

Finally, the best performers among the top 100 cryptocurrencies, not considering the top 10 cryptocurrencies, are Aptos (APT), Chiliz (CHZ), Apecoin (APE), and Lido DAO (LIDO).

APT was up 33.06% to $5.51, CHZ was up 4.97% to $0.1193, APE was up 7.81% to $5.04, and LIDO was up 3.97% to $1.97.