Investors Have Poured Over $1 Billion In Crypto Investments

- CoinShares reports that investors have better public opinions about the crypto market.

- BlackRock is preparing for a new Ethereum-related investment, expanding the range of available investment alternatives.

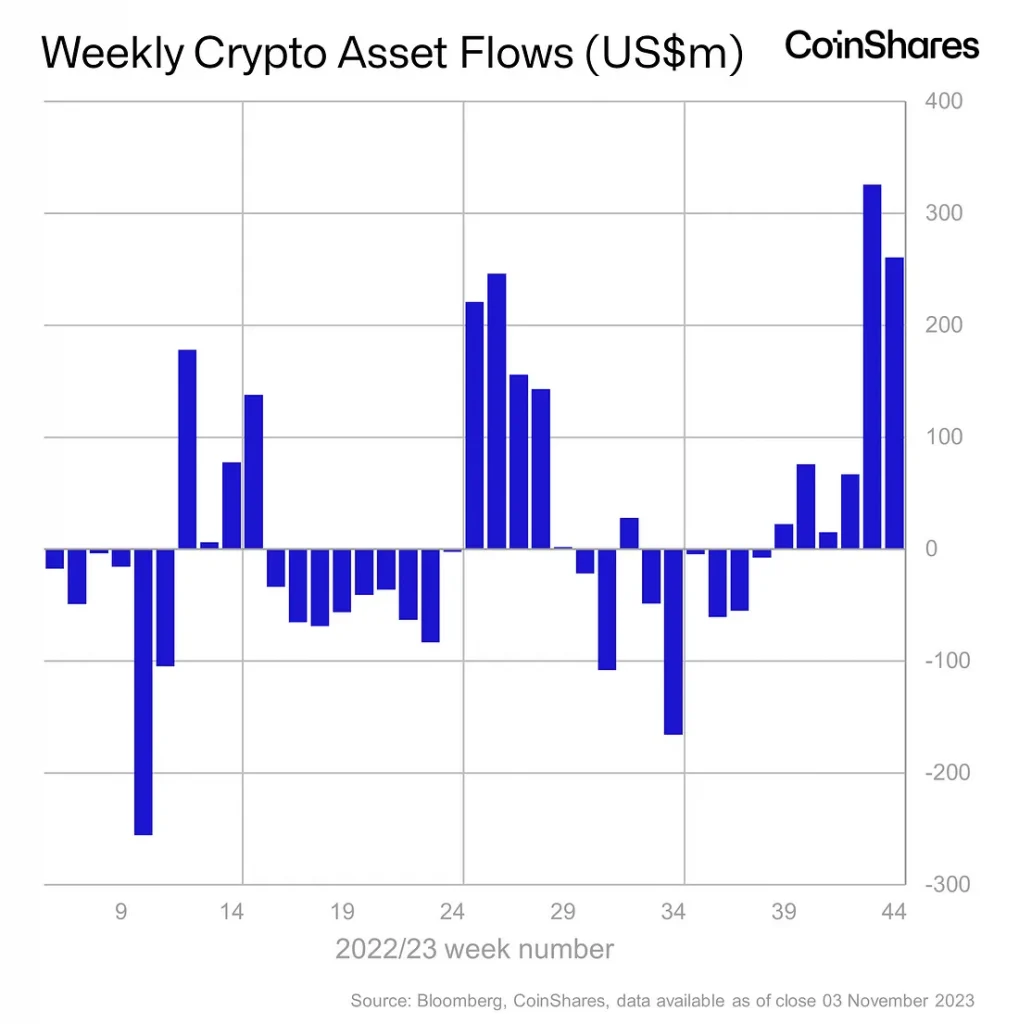

James Butterfill, the Head of Research at CoinShares, recently shared a report noting that investors have poured in more than $1.07 billion in the crypto industry this year. The current activity is a significant increase when compared to the $847 million in yearly inflows that CoinShares reported on Monday.

The report features investments made in various investment products, such as Bitwise’s 10 Crypto Index Fund (BITW) and Grayscale’s Bitcoin Trust (CBTC). Butterfill claimed that 2023 saw “a lot of demand, a lot of interest, and I’ve not experienced this level of interest since 2021.”

Butterfill explained that the market’s resilience inspired renewed confidence in investors and their resolve to invest in crypto assets. Wall Street has shown strong interest in Bitcoin, which many believe is behind Bitcoin’s recent performance. CoinShares data reveals that investments in Bitcoin-related products amounted to a whopping $1.03 billion, or 96% of all capital invested this year.

Furthermore, Butterfill pointed to a positive shift in public perceptions of investing in digital assets. He claimed that there is less stigma attached to making money in this industry. Unlike previous years, 2023 has seen major asset managers like Franklin Templeton and BlackRock embrace the cryptocurrency space.

BlackRock and other managers have applied for a spot on Bitcoin ETF from the US Securities and Exchange Commission (SEC). However, the regulator has yet to approve such a request, citing concerns about market manipulation.

In addition, recent reports suggest that BlackRock is preparing for a new Ethereum-related investment, expanding the range of available investment alternatives. Interestingly, Ether’s value has surged since BlackRock confirmed its interest in a spot ETF.

Butterfill believes that investors will gradually realize that Ethereum is the only asset that is both yielding and deflationary. The shifts in Ethereum and Bitcoin investments demonstrate that a growing number of financial institutions are interested in digital currencies.