How To Make Money With A Yield Farming Strategy

DEFINITION

To participate in yield farming, you must deposit your bitcoin into a pool with the cryptocurrency of other users in order to receive incentives or interest. Smart contracts, such bitcoin lending, may be executed with the pooled money, which can then be utilized to earn interest income. Yield Farming is a great way to make money online passively.

Explanation and Illustration of Yield Farming

The term “yield farming” refers to a system where cryptocurrency holders can pool their holdings with those of other holders in order to receive a return on their investments, often in the form of interest on their loans of the pooled cryptocurrency. Farming for yield is a high-stakes venture with potentially lucrative payoffs.

Key Points

Farming yields is a strategy for increasing the profitability of cryptocurrency investments.

Yield farms are smart contract-based investment instruments in the decentralized financial sector.

Yield farms may provide extremely high interest rates, sometimes even in excess of 100%, to investors who place a premium on high rates of return.

When investing in yield farms, you run the risk of losing everything.

Yield farms can be located on cryptocurrency exchanges like Bitrue or decentralized finance (DeFi) platforms like PancakeSwap.

On PancakeSwap, for instance, you may find possibilities to invest in yield farms with APRs ranging from over 200% to just over 2%. Bitrue also showcases high-yield farms with financing rates in excess of 100% APR. Costs associated with making purchases, lending money, or participating in a proof-of-stake liquidity pool all contribute to these high annual percentage rates. Keep in mind, though, that it is possible to lose everything.

Note

The cryptocurrency market is quite volatile. It’s important to do your homework before putting money into something so you don’t end up losing everything. Few investors should choose yield farms because of the high degree of risk and complexity involved.

The Science Behind Yield Farming

Similar to putting money into a bank’s savings account, where the funds are pooled and loaned out to others while the depositor earns interest, yield farming functions in a similar fashion. The bitcoin in a yield farm is invested in smart contract applications rather than being used to pay off mortgages or finance businesses.

Most digital currencies rely on blockchain technology, which is also used in smart contracts.

To participate in yield farming, users deposit their bitcoin (or “stake”) with other users who are also investing in the same farm. If you want to stake, you might have to leave your money there for a while. Depending on where you put your bitcoin, it might be used as collateral or as a source of liquidity for mining pools.

Note

The value of cryptocurrencies fluctuates widely. While your money is sitting in a liquidity pool or yield farm, the value of your currency might rapidly decline. It’s called “temporary loss” for this reason.

The first step in yield farming is amassing a collection of bitcoin assets. The following procedures are carried out in order to yield farm:

Forming a pool of available cash: In order to increase your crop output, you must first amass a pool of liquid assets. A smart contract is used to streamline the process of investing and borrowing money for a particular yield farm.

Investors add to the liquidity pool by depositing assets, such as fiat cash held in connected digital wallets. Staking is another term for this practice. Customers are essentially doing something analogous to putting money into a bank or buying shares in a mutual fund or exchange-traded fund.

By utilizing a smart contract, one can borrow: The smart contract may help with a variety of tasks, such as lending money or increasing market liquidity for bitcoin exchanges.

Payout conditions: Financial incentives like interest, bonuses, and awards may change based on the production of the farm. Your payment schedule might be weekly, biweekly, monthly, or on a set date in the future.

Note

When you “harvest” your crop farming rewards, you may have to pay a modest cost.

Yield farming Platforms

To take part in yield farms, you need one of the supported cryptocurrencies. It is possible that each service for increasing crop yields has its own set of regulations and procedures. Different companies that specialize in increasing agricultural output are listed below.

The Aave app enables you to stake or borrow a variety of cryptocurrencies by linking your wallet to the Aave network. Both the total number of assets and the total liquidity on Aave are highest for Ethereum-based cryptocurrencies.

Lending in ETH, DAI, and other currencies at interest rates of up to about 3% APY can be done on Compound, a market where various currencies are traded.

Stack or collect revenue by providing liquidity or lending your cash on the decentralized exchange SushiSwap.

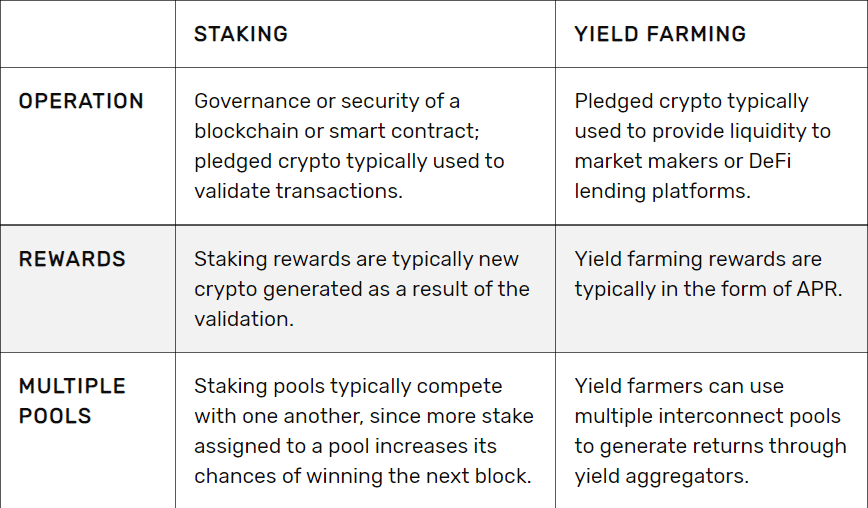

Staking vs. Yield Farming

To stake is to make a bitcoin deposit. Staking refers to any process by which a cryptocurrency holder receives incentives for keeping their coins in a certain wallet. This may be done automatically or with some additional steps depending on the exchange and currency.

Some key distinctions exist between yield farming and staking:

However, the terms staking and yield farming are commonly used interchangeably since they both amount to the same thing: receiving rewards based on a pool of money. A slight but crucial distinction has to be made here. For religious reasons, some bitcoin investors choose not to lend their funds out in the hopes of earning a return. In that situation, they may want to consider staking as an alternative to yield farming.

Note

Although not every sort of staking is a part of yield farming, all yield farms include staking in some way.

Yield Farming: The Pros and Cons

Pros

Possibility of obtaining disproportionately high rates of interest via the Internet

Using computerized contract management

Integration into the international DeFi network

Cons

Impermanence loss potentials

Scams and frauds

Problems in Filing Taxes

Benefits of Yield farming strategy

Possibility of Obtaining Substantial Interest Online: Investments in high-yield farms may offer annualized rates of return in excess of 100%.

Smart contracts take care of the management. Smart contracts eliminate the need for intermediaries and open participation to anybody with a bitcoin wallet that supports the relevant blockchain.

A component of the worldwide DeFi network: Across national boundaries, new decentralized finance applications allow for the creation of novel financial products.

Demerits of Yield farming platforms

Possible temporary losses occur when the value of a cryptocurrency you own drops while it is stored in a yield farm.

Cons and frauds: Bad actors are actively seeking to steal cash from the cryptocurrency ecosystem as a whole, and bogus yield farms and other schemes are only one method they use to do so.

Difficulties in filing tax returns: Yield farming adds to the difficulty of keeping track of and reporting on cryptocurrency transactions, which may already be complicated.

Beginning Yield Farming Strategies and Tactics

Here’s what you need to do to take part in yield farming:

Money spent on yield farming as a result of research: Get going with some preliminary study of yield-farm investment opportunities. In order to get entry to yield-farming marketplaces, a number of DeFi providers and centralized exchanges are available.

You may fund your account or link your payment method by: To take part in a yield farm, you must have a suitable account, financed in the appropriate currency. Use a wallet that can receive cryptocurrency from decentralized yield farms, such MetaMask or Coinbase Wallet. In order to farm for yields, you will need to acquire or otherwise acquire the appropriate currency and deposit it into your account through an exchange.

Put your bitcoin at risk by staking it. When you’re ready to stake your cash, head to the relevant yield farming platform after you’ve linked or financed your account. Once you stake, the yield farmers may keep your money for a set period of time.

Earnings withdrawal may require returning to the yield-farm decentralized exchange depending on the yield farm and the type of deposit.

Is It Beneficial to Focus on Yield Farming?

The concept of “yield farming” is an intriguing one, offering cryptocurrency fans a chance to profit from their investments in ways other than merely a rise in the value of their coin. Many investors, especially those who are just starting out, may find the dangers associated with yield farming to make it a poor choice.

Earning 100%, 200%, or even more in interest each year as the annual percentage yield is an attractive prospect. You shouldn’t get engaged, though, unless you have a firm grasp on the ins and outs of yield farming. Do your homework on the yield farming platform, including the exchangers, currencies, liquidity providers, nd teams behind it. All of those things are necessary to reduce the dangers of this investment.