Hong Kong Discusses Tokenization Plans with Saudi Arabia

- Hong Kong already takes part in a number of inter-jurisdictional tokenization projects.

- Saudi Arabia is slowly becoming receptive to blockchain technology.

- Hong Kong recently allowed retail investors to trade cryptocurrencies.

Saudi Arabia and Hong Kong are working to promote and develop fintech in their respective countries and to cooperate to push financial innovation projects. Central bank officials from both sides recently strengthened their financial agreement, this time focusing on tokenization and payment infrastructure.

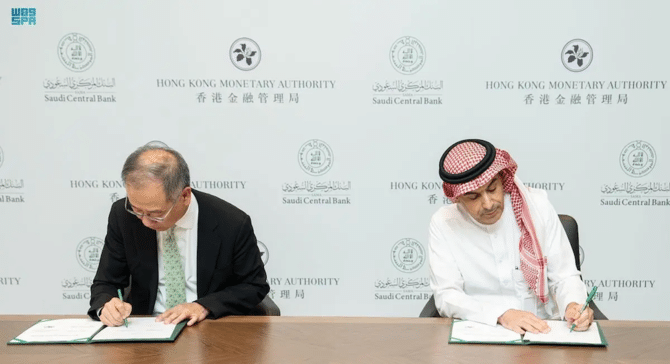

Recent discussions between the Hong Kong Monetary Authority (HKMA) and the Saudi Central Bank (SAMA) focused on open market operations, market interconnection, and sustainable growth. Both financial regulators reportedly signed a Memorandum of Understanding (MoU) to encourage exchanges on financial innovations. SAMA governor Ayman Alsayari noted that the MoU will further improve relations between both sides and encourage cooperation in the future.

Yue said in a statement,

The MOU will further enhance cooperation as well as the exchange of information and expertise between the SAMA and the HKMA in financial innovation and fintech. We look forward to working with the SAMA to promote investment and financial market connectivity between the Middle East and Asia.

HKMA chief executive Eddie Yue remarked that “there is a lot of room for cooperation between the Kingdom of Saudi Arabia and Hong Kong in the fields of economy and trade, sustainable development, finance, and fintech.”

The recent meeting between both central banks did not mention the development of cryptocurrencies. However, Hong Kong has made huge progress in adopting cryptocurrencies. The HKMA recently allowed retail investors to trade crypto, resulting in a surge in digital activities in the region.