Bitcoin Unappealing for Investors, Altcoins Remain Red: Monday Market Report

- Crypto market turned red on Monday with leading cryptocurrency Bitcoin retaining $16,000 and ETH failing to break $1,200.

- The worst performing tokens are GMX (GMX), UNUS SED LEO (LEO), Mina (MINA), and Stacks (STX).

- The best performing cryptocurrencies are Toncoin (TON), XDC Network (XDC) , THORChain (THOR), and Gemini USD (GUSD).

- The total crypto market liquidation in the last 24 hours amounts to $17.26 million of which BTC makes up around $5.02 million.

The crypto market opened on a rather unappealing note for the investors as all the gains made in the first half of last week were wiped off by the bears over the weekend. Additionally, almost every altcoin is bearish today and hasn’t moved much in the last 24 hours, while Bitcoin (BTC) is also experiencing the effects of the prevailing crypto winter.

Mostly, the crypto market remains stationary during the weekend, but this time, traders seem to have sold the gains they made earlier the week when the world’s biggest crypto coin, Bitcoin (BTC), broke the $18k price level for a small duration. On the other hand, Ether (ETH), the world’s second largest cryptocurrency, broke the $1,300 price level as well but was unable to retain it.

One of the biggest gainers of the past few days has been Toncoin (TON), and it is up more than 33% in the last seven days. The bullish nature of the token has made it claim the 20th position in the crypto space, which is justified given the increased presence of the blockchain in the NFT, DeFi, and crypto spaces. Also, the support from the messaging application Telegram has been helpful for TON’s price action.

On the other hand, Bitcoin (BTC) continues to hold support at the $16,000 price level, and it is crucial to note that if this zone does not hold, a crash can be expected and panic might take over. However, looking at the current scenario, the nearest resistance towards the $17k–$18k price level has been holding for a very long time. Investors are waiting for BTC to break above $20k as 2022 comes to an end.

This has been one of the worst years for the crypto sector, where investors saw a huge decline of more than 70% in the price of Bitcoin, along with the bankruptcy of multiple crypto firms that had attained sky-high valuations amid the 2021 crypto bull run. 2022 was also filled with crypto exploits and scams, especially in the month of October.

As of now, it is clear that the selling pressure of Bitcoin is way higher than the buying pressure, and also, the accumulation of the leading cryptocurrency has gone down. However, long term holders continue to buy Bitcoin as prices continue to fall.

The price of 1 BTC as of 1:36 am is $16,724.75, down 0.15% in the last 24 hours. In the last seven days, BTC has dropped 1.31% while the trading volume of the coin is up by 5.77%. Additionally, the market capitalization of BTC stands at $321.7 billion, much lower than its all-time high.

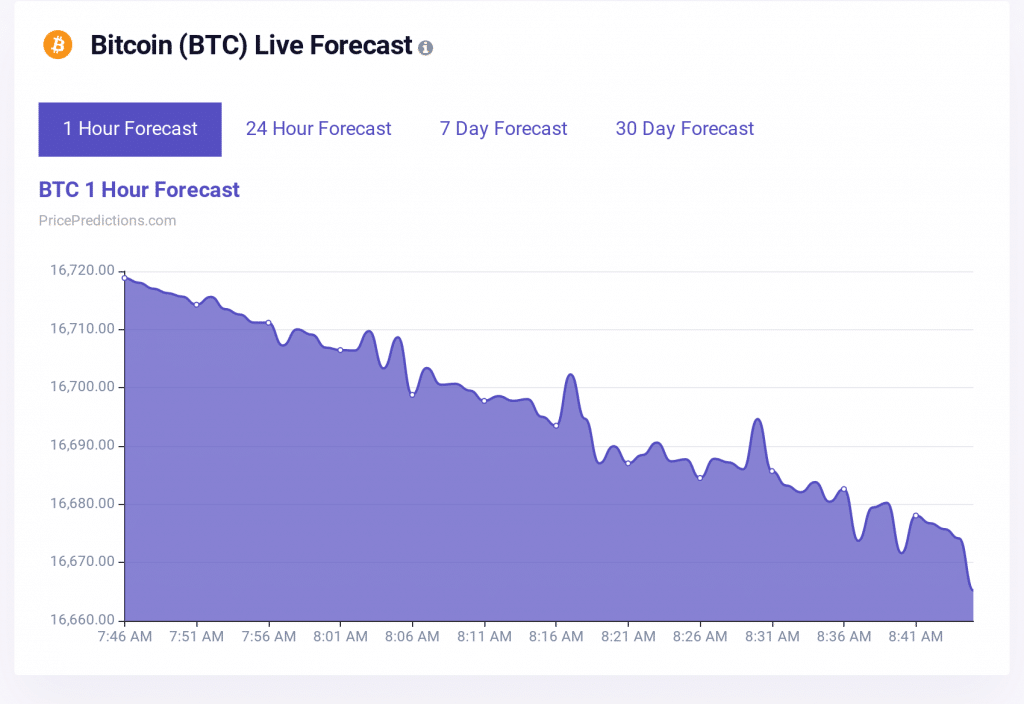

Moreover, according to the chart below from PricePredictions, Bitcoin continues to form lower lows on the hourly chart, and the trading range of the crypto coin is relatively on the lower side, i.e., between $16,660 and $16,720. The trading volume is down significantly in the past few hours, and investors are still jittery from the effects of the prolonged crypto winter.

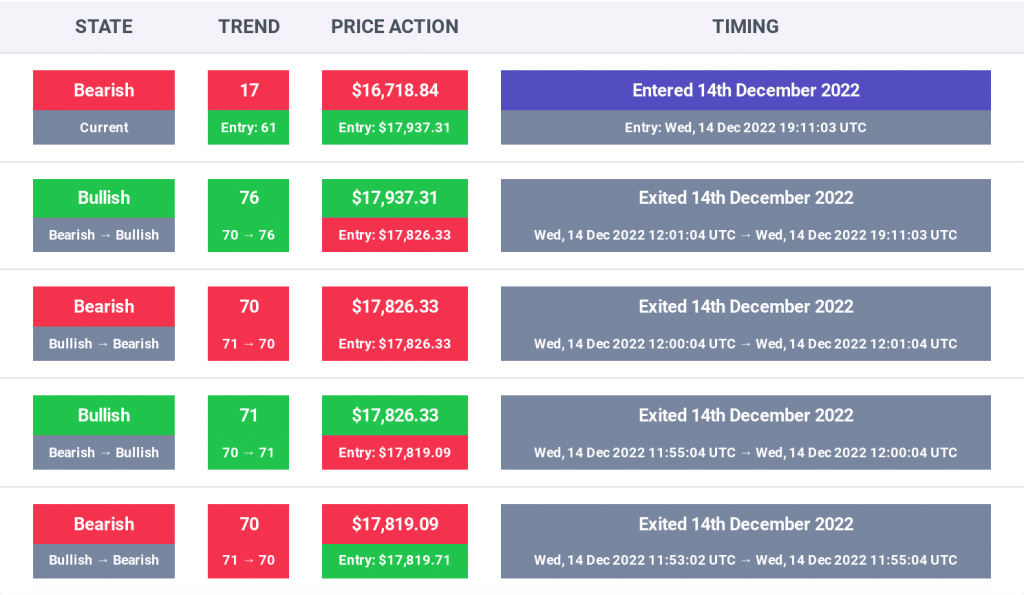

As per the chart below, traders are advised not to place any trades in the current market conditions, and there is a possibility of lower prices if the $16k region doesn’t hold. Nothing is certain in the world of crypto, and therefore, it is preferable to stay out until a clear path is formed.

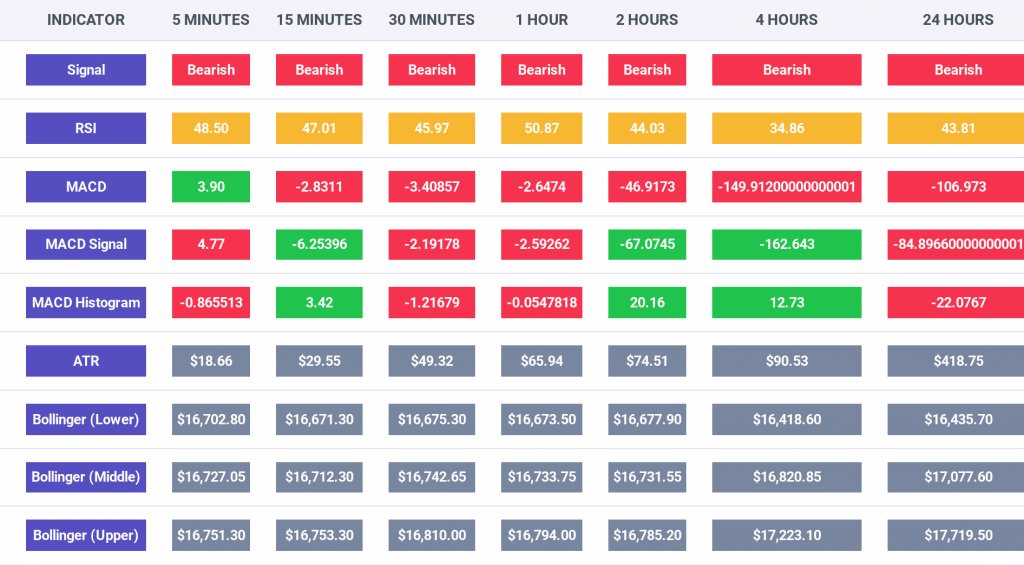

The indicators for the Bitcoin price action in the chart below confirm that bearish conditions prevail and that the demand for the leading cryptocurrency has dropped as well. The RSI line is bearish on the 5 minute, 15 minute, 30 minute, 1 hour, 4 hour, and 24 hour time frames, which confirms that the sellers are dominating in the current scenario.

Additionally, the MACD indicator is slightly green on the 5 minute time frame, while for the 15 minute, 30 minute, 1 hour, 4 hour, and 24 hour time frames, the indicator is bearish.

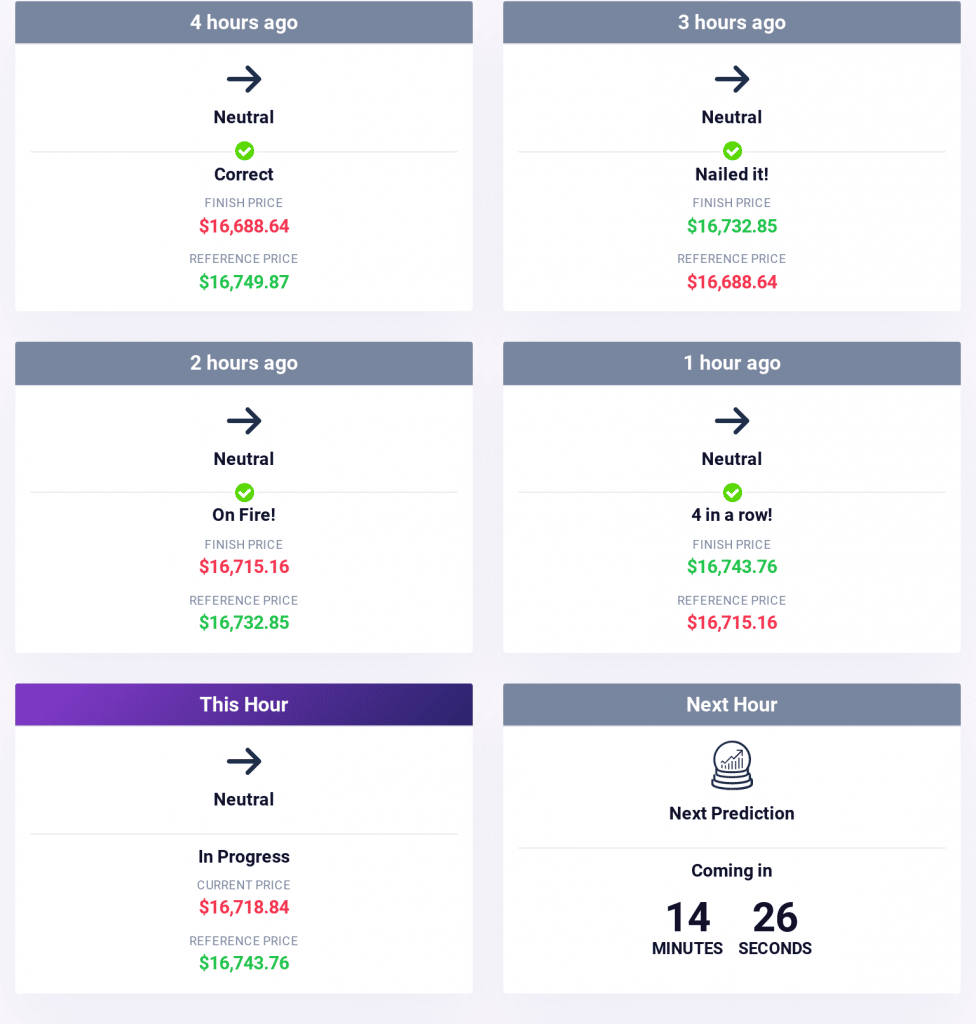

In the past few hours, the Bitcoin price action has been neutral, and not much has been seen due to a drop in general interest in the crypto sector. Furthermore, on a larger scale, the crypto market has been trending bearish-neutral for a long period of time. For similar, timely predictions, traders can register on PricePredictions.

Moreover, as per the publicly available data, the crypto market’s Fear and Greed Index’s value currently rests at 26, and it dropped from 31 to 26 last week, as noted in our Crypto Market Performance Report for Dec. 18. Furthermore, the sentiment currently reads “fear,” and the situation might change to “extremely fear” if the current support of $16k does not retain.

Furthermore, the market cap of the entire crypto space at the time of publication stands at $806 billion, and this value has dropped 0.62% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,070, as listed on CoinMarketCap.

Additionally, the world’s second-biggest cryptocurrency, Ether (ETH), is down 0.63% in the last 24 hours and is currently priced at $1,181. Ether, the biggest rival to Bitcoin’s dominance, was unable to push higher and reclaim the $1,200 price region. The trading volume of the cryptocurrency has also jumped by 9.57%, while the market dominance has surged to 17.91% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $17.26 million, of which, Bitcoin made up $4.48 million and Ether made up $5.02 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies show bearish movements with BNB down 0.50% to $246.97; XRP down 2.61% to $0.3443; DOGE down 1.7% to $0.07784; ADA down 1.27% to $0.264, and MATIC down 1.75% to $0.8017.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are GMX (GMX), UNUS SED LEO (LEO), Mina (MINA), and Stacks (STX).

Interestingly, GMX was down 5.27% to $45.10; LEO was down 5.35% to $3.77; MINA was down 3.85% to $0.4636; and STX was down 3.79% to $0.2294.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are Toncoin (TON), XDC Network (XDC) , THORChain (THOR), and Gemini USD (GUSD).

TON was up 5.14% to $2.71, XDC was up 5.19% to $0.02476, THOR was up 2.11% to $1.33, and GUSD was up 2.14% to $1.01.