Bitcoin Addresses With 1+ BTC Reach One Million: Data

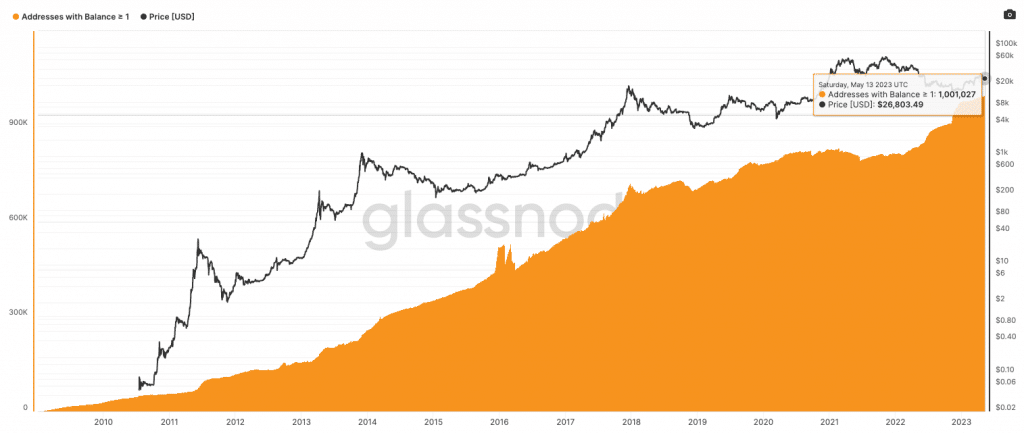

- The number of Bitcoin addresses with more than 1 BTC reached the 1 million milestone on May 13, according to Glassnode.

- The leading cryptocurrency has gone on to reclaim the $27,000 price level after falling below $26,000 last week.

- A huge number of BTC around 190,000 or so whole coins—were added in early February 2022 when its price collapsed significantly.

- The collapse of huge banking institutions in the US and recent Fed rate hikes will play an important role in BTC price action.

The crypto market slump might have affected the growth of crypto firms and entities, but investors in the world’s largest cryptocurrency, Bitcoin (BTC), remain unfazed despite regulatory uncertainty surrounding digital assets around the globe. Interestingly, as per blockchain data analytics platform Glassnode, the number of BTC addresses containing more than 1 BTC has hit the 1 million milestone, hinting at the fact that the crypto craze has not died yet.

As per Glassnode data, the number of Bicoin addresses with 1+ BTC hit the 1 million mark on May 13, and since then, the leading cryptocurrency has gone on to reclaim the $27,000 price level after falling below $26,000 last week. The $30,000 price level has presented a major resistance for the cryptocurrency, and there are chances of retesting the same, according to the prediction from PricePredictions.

It is important to note here that the price of Bitcoin went as low as $15,500 last year in November 2022 following the multi-billion dollar collapse of crypto exchange FTX under the leadership of Sam Bankman-Fried, also known as SBF in the crypto space.

Notable crashes were witnessed in the months of June and November 2022, and it is important to note that the market has been recovering significantly post the high profile collapses of crypto firms like lending platform Celsius Network and Three Arrows Capital (3AC).

Interestingly, a huge number of Bitcoins—around 190,000 or so whole coins—were added in early February 2022, after the price of the leading crypto coin fell from the 2021 November all-time high of $69,000. On the other hand, the founder of Glassnode Negentropic believes that the best time to purchase BTC is when there is “blood on the streets.”

Moreover, this new revelation comes amid the numerous bank collapses that the United States economy has witnessed in recent history. The crypto-friendly bank Signature Bank was recently shut down by the New York Department of Financial Services (NYDFS). The bank had a “solid loan book,” but was closed down “to send the message that crypto is toxic,” stated former US Congressman and a member of the Signature Bank board, Barney Frank.

“They closed us even though there was no good, compelling reason to do that because they wanted to show that banks shouldn’t be involved in crypto,” said Frank. “We were the kind of poster child for having been involved in crypto.”

Another important collapse witnessed was the bankruptcy of San Francisco-based banking institution First Republic Bank. The firm was shut down by the California Department of Financial Protection and Innovation (DFPI) and was acquired by JPMorgan Chase, a global leader in financial services that boasts the world’s most important entities as its clients.

More importantly, as reported earlier by Bitnation, the transaction fees for Bitcoin and the network congestion skyrocketed, with people paying above $20 for a single transaction. People on crypto Twitter claimed that this is the work of an attacker who is using a significant sum of money to cause the congestion.