Binance Confirms Support for Elon Musk’s Twitter Bid

- Elon Musk announced his plans to purchase Twitter in April but backed out of the deal in July.

- Binance and a series of other investment firms have confirmed their plans to support Musk’s takeover bid.

- Twitter recently announced plans to close the deal at $54.20 per share.

Crypto exchange, Binance, has announced its support for Elon Musk’s ongoing bid for Twitter. The trading platform told Cointelegraph that it is still committed to Elon’s $44 billion takeover. In May, the platform’s CEO, Changpeng ”CZ” Zhao, expressed his intention to merge social media with Web 3. He wrote at the time,

We hope to be able to play a role in bringing social media and Web3 together and broadening the use and adoption of crypto and blockchain technology.

According to a representative, Binance has committed $500 million to the Twitter bid. The revelation comes as Musk recently renewed his interest in the Twitter deal. The Tesla boss surprisingly filed a notice with the Delaware Chancery Court, confirming his interest in the “closing of the transaction contemplated by the April 25, 2022 Merger Agreement.”

Binance joins tech investor, Sequoia Capital, to support Musk’s ambition. The investment firm was among the early backers of the bid, committing $800 million to the purchase. However, things appeared to have slowed down after the SpaceX boss grew cold feet.

Regardless, an unnamed source recently confirmed that the investment company has not changed its plans to support Musk and will keep the allocation following the revival of the deal. Musk shares a deep history with the investment firm, as it was an early-stage investor in his payment platform, which became known as PayPal. Musk sold the company for $1.5 billion in 2002. Sequoia also led a $675 million funding round for Musk’s Boring Company earlier this year.

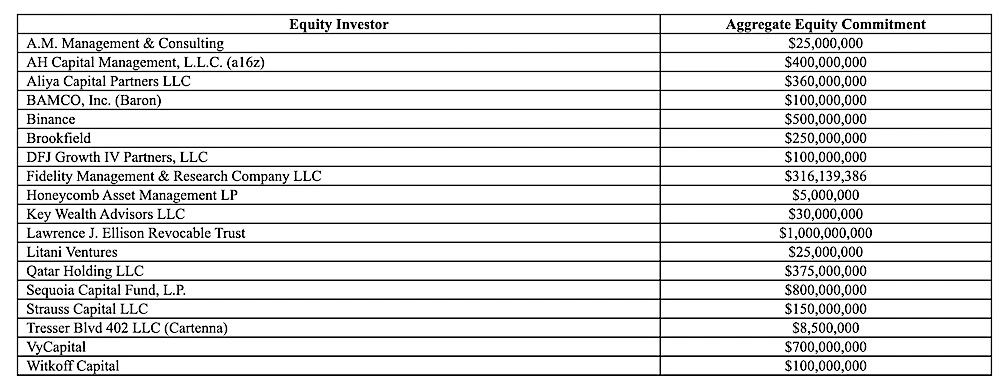

Since he announced his intention to purchase Twitter, Musk has enjoyed remarkable support from the investment community. Almost two dozen investors, including Binance, Sequoia Capital, Andreessen Horowitz, and asset management firm Fidelity, have invested more than $7.1 billion to support Musk.

Furthermore, Oracle co-founder and Tesla investor Larry Ellison reportedly committed $1 billion to the deal, while VyCapital offered $700 million. The popular investment firm Andreessen Horowitz invested $400 million.

Ben Horowitz, the co-founder of Andreessen Horowitz, took to Twitter in May to express his faith in Musk’s ability to finalize one of the biggest takeovers in modern history. He wrote,

Elon is the one person we know and perhaps the only person in the world who has the courage, brilliance, and skills to fix all of these and build the public square that we all hoped for and deserve.

He added,

We invested, because we believe in Ev and Jack’s vision to connect the world and we believe in Elon’s brilliance to finally make it what it was meant to be. While Twitter has great promise as a public square, it suffers from a myriad of difficult issues ranging from bots to abuse to censorship. Being a public company solely reliant on an advertising business model exacerbates all of these

Following months of back and forth, Twitter seems set to accept the terms of the deal, announcing in a tweet that it intends to close the deal at $54.20 per share.