Biden Expresses Disapproval of a Pro-Crypto Deal: Details

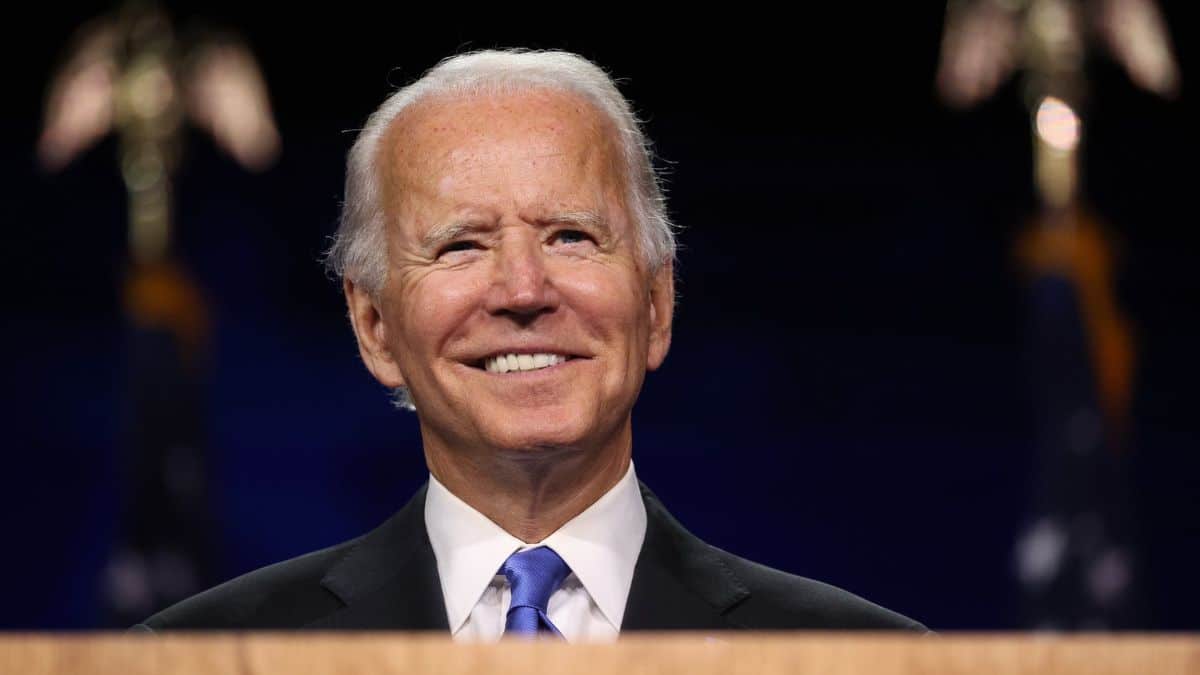

- US President Joe Biden has expressed disapproval of a debt ceiling agreement that could benefit crypto traders.

- “I’m not going to agree to a deal that protects wealth tax cheats and crypto traders,” he said at the G7 Summit.

- Biden remains skeptical of tax-harvesting for crypto traders and seeks to end the same, while Republicans disagree.

- The White House also presented a proposal to the Republicans to bar investors from deferring taxes on real estate swaps.

The United States, under the leadership of President Joe Biden, has been increasingly skeptical of cryptocurrencies and their widespread adoption around the globe. Moreover, many crypto entrepreneurs and even Congressmen have expressed disapproval of the government’s crackdown on crypto assets. Interestingly, the US President has opposed a debt ceiling agreement with Republican leaders that could have reportedly benefited crypto traders amid the harsh crypto winter that wiped off billions from the industry and led to the collapse of many crypto firms as well.

At the Group of Seven (G7) Summit, Biden stated that Republicans’ proposed terms were “unacceptable” during a press conference, according to a report. The proposed terms could benefit crypto traders by allowing them to offset losses against gains made on their investments.

“I’m not going to agree to a deal that protects wealth tax cheats and crypto traders while putting food assistance at risk for nearly 1 million Americans,” said the American President.

In the above statement, Biden expresses disapproval of the tax-loss harvesting. As per a report from the Washington Post, the White House and Republican leaders are currently engaged in discussions regarding a permanent stop on tax-loss harvesting for crypto traders, which could be disastrous for those who have lost significant money on their investors in the bear market of 2022 and the collapse of the UST token.

Tax-loss harvesting is a tax-saving strategy that allows investors to reduce the overall amount that they have to pay to the government. This is done by allowing the investors to sell those cryptocurrencies at a loss to offset the capital gains made from those digital assets that have been sold in profit. However, it is imperative for the coin to be sold and the proceeds used to purchase a similar asset within 30 days before or after the sale. Moreover, this strategy is applicable for stocks as well.

Along with putting a stop to the tax-loss harvesting strategy, the White House also presented a proposal to the Republicans to bar investors from deferring taxes on real estate swaps. The two changes are estimated to bring a total of $40 billion in tax revenue to the US government. However, the Republicans are skeptical of these proposals and have rejected them, a source told the Washington Post.

On the other hand, House Speaker Kevin McCarthy believes that this situation that has resulted in the rise of the US debt is a “spending problem, not a revenue problem.” McCarthy noted that the Biden administration spent a significant amount of money on the pandemic, which has resulted in the current situation.

However, the White House has blamed the rise in US debt on the tax cuts from previous administrations, adding that revenue has been significantly affected by these reductions in taxation.

The Republicans have decided to close the deficit by implementing spending cuts worth $4.8 trillion, but it is crucial to note that this could affect the budgets of many federal agencies. If the debt ceiling is not raised before June 1, the US could default on it. This ceiling is the limit Congress has set on how much money the federal government can borrow to pay bills.

As reported earlier by Bitnation, Biden reaffirmed his faith in the US banking system following the collapse of Signature Bank and the Silicon Valley Bank, adding that the banking system is “safe.” He stated that the US will do “whatever is needed” to protect banks.