Bitcoin Almost Touches $19k, Ether above $1,400; APT Explodes: Market Watch

- Bitcoin finally touched the $19,000 price level but was unable to retain it while Ether reclaimed $1,400 and now eyes $1,500.

- The worst performers in the top 100, except top 10, are Avalanche (AVAX), Gala (GALA), ApeCoin (APE), and Nexo (NEXO).

- The best performers in the top 100, except top 10, are Helium (HNT), Frax Shares (FXS), Aptos (APT), and Decentraland (MANA).

- The total crypto market liquidation in the last 24 hours amounts to $208.42 million of which BTC makes up around $81.02 million.

The crypto market has finally assumed a bullish outlook after months of price crashes and downward movement. It seems that the bottom for the world’s biggest cryptocurrency, Bitcoin (BTC), is finally in, and now, investors can expect the industry to regain some of the value that it had lost in the previous year. BTC has formed nine straight green candles, and this is the most bullish it has been since the first quarter of 2022. The second weekly candle for BTC is also expected to end on a bullish note.

As noted previously, to confirm a bullish trajectory and an uptrend, the world’s oldest crypto coin, Bitcoin (BTC), will have to break through the $20,000 price region and aim higher. Currently, it is clear that the token is down more than 70% from its all-time high noted in the month of November 2021. Since then, the crypto space has resumed a downtrend despite many countries showing acceptance of the leading cryptocurrency.

The fundamentals for Bitcoin (BTC) are also bullish, and there has been a huge surge in the trading volume of all the major cryptocurrencies in the space recently. If the BTC bulls want the trend to change into an upward movement in the long term, the current scenario needs to prevail. If BTC breaks the $20k price level and continues this bullish outbreak, investors can expect a change in market sentiment, and institutions that have left the crypto space might return.

Furthermore, Bitcoin has regained access to the $19,000 price level, and the last time it touched that level was in October. However, this is the region that acted as a huge resistance, pushing BTC back to $17.3k, which is a major region of price support. It is crucial to note that a similar movement is definitely possible, and if BTC fails to hold $17.3k, we can witness the oldest crypto coin dropping to $16k. The resistance beyond the $19,000 price level is quite strong as well.

Bitcoin experienced increased volatility following December’s CPI inflation of 6.5%, which matched the expectation of analysts. Interestingly, as of 12 a.m. ET, the price of 1 bitcoin stands at $18,874, and this value is up almost 3.56% in the past 24 hours. In the same duration, the trading volume of BTC went up by 42.49% while the market dominance of the oldest crypto coin went up to 40.18%, and it is clear that BTC’s dominance is not as high as it used to be.

While the price of the leading crypto coin is down more than 70% from the all-time high of $69,000 noted in the month of November 2021, the market capitalization of Bitcoin at the time of writing stands at around $363.5 billion and is up 3.55% in the last 24 hours. It is clear that the market cap of BTC has declined by a significant amount since it was valued at $1.2 trillion in November 2021.

As is clear from the image below, the accumulation/distribution line for Bitcoin is making sharp higher highs, and it is clear that there has been a sudden surge in the inflow of capital in the world’s biggest crypto coin as it continues to make higher highs on the daily chart. Moreover, this also confirms that the trading volume has increased for BTC and the confidence of investors is gradually returning.

Additionally, Ether (ETH), the world’s 2nd largest cryptocurrency, has retained the $1,300 price region, and briefly broke above the $1,400 price region as the bulls aim for the $1,500 price zone. It is crucial to note that almost every coin follows the BTC price action and has been bullish for the past few days. As Bitcoin nears the $19,000 price level, every cryptocurrency has regained some of the losses made in the past few months.

The two leading crypto coins, Bitcoin and Ether, have risen 12.06% and 13.02%, respectively, in the last seven days, and their respective weekly candles remain bullish for a second consecutive week. Ethereum killer Solana (SOL), has been one of the biggest gainers in 2023, is up 27.84% in the last seven days, and is close to reclaiming its spot in the top 10 crypto coins in the industry.

On the other hand, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) are up 32.75% and 41.67%, respectively, this past week. Leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), are ranked among the top 20 coins in the crypto market, and DOGE is up 13.23% while SHIB is up 12.75% in the same duration.

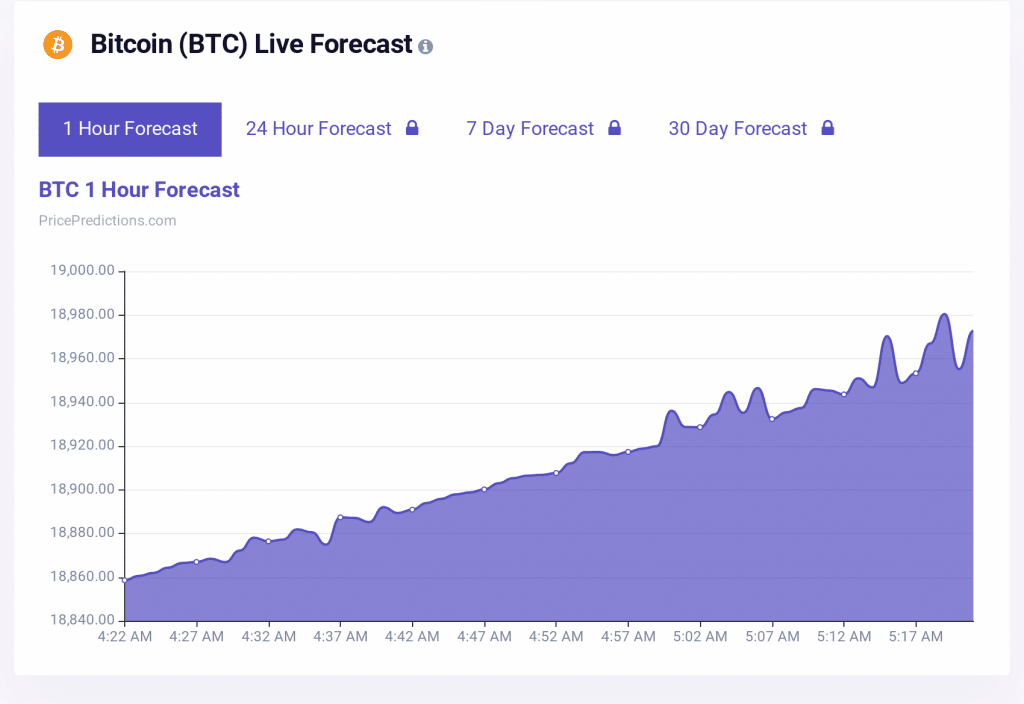

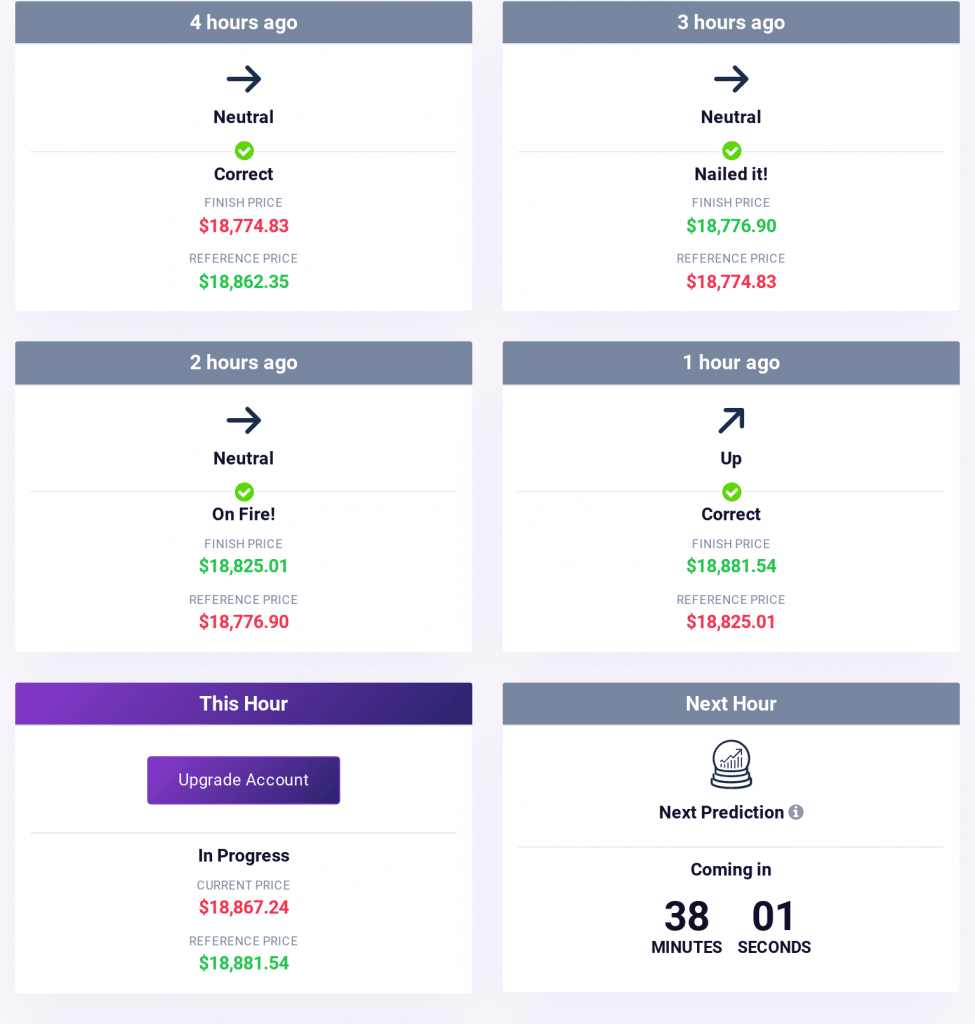

According to the prediction algorithm from PricePredictions, the Bitcoin price action is currently bullish, and in the next hour, investors can expect the world’s largest crypto coin to retest the $19,000 price level. However, we can expect a retest of $17k if the leading cryptocurrency fails to break above this resistance zone. Moreover, the trading range in the next hour for BTC is expected to be between $18,840 and $19,000.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

The Bitcoin price action sentiment is currently down and for the past few hours has been neutral. In order to see more, viewers will have to register on PricePredictions. However, it is clear that BTC has not been able to breach and retain the $19k price region, and investors can expect this rally to cool down if $19k isn’t breached.

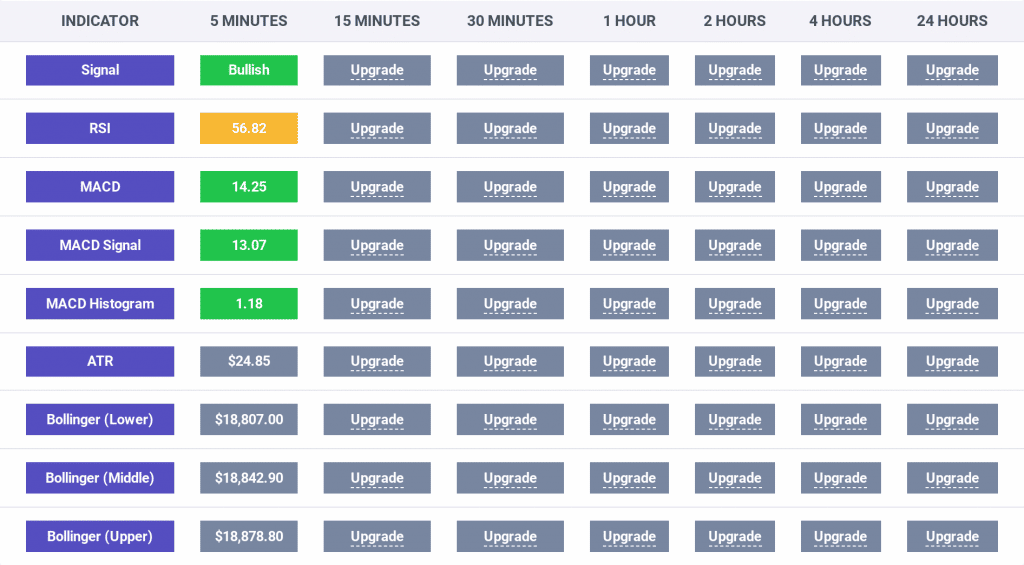

The 5 minute time frame is bullish, as seen in the image below, but if you register on PricePredictions, you’ll be able to see that all the time frames are currently green and bullish, which means that there is a strong possibility of higher highs in the near future. Moreover, the RSI indicator is also above 50 for the 5 minute, 15 minute, 30 minute, 1 hour, 2 hour, 4 hour, and 24 hour time frames, which confirms that the buying pressure for Bitcoin is higher than the selling pressure.

The PricePredictions algorithm confirms via the Trend Score that all the time frames of 5 minute, 15 minute, 30 minute, 1 hour, 2 hour, and 4 hour are good for placing trades as long as they read a value above 75. On the other hand, the 24 hour time frame is currently neutral and not ideal for placing trades because it reads a value of 46.

An interesting analysis from blockchain intelligence firm Glassnode confirms that the “Bitcoin Number of UTXOs in Profit (7d MA) just reached a 1-month high of 98,604,768.101,” which means that the current rally of the BTC price action has made significant profit to the investors who had accumulated BTC in the past few days when it was priced around $16k. It will be interesting to see what happens in the near future as $19k presents a major resistance for the leading crypto coin.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $208.42 million, of which Bitcoin made up $81.02 million and Ether made up $71.97 million.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value stands at 31, after dropping to 26 earlier this week, as noted in our Crypto Market Performance Report for January 12. It is also crucial to note that the investors’ sentiment reads “fear.”

Additionally, the market cap of the entire crypto space at the time of publication is finally above the $900 billion mark and currently stands at $904.78 billion, and this value has gone up by 1.71% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,275, as listed on CoinMarketCap.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies displayed bullish movements, with BNB up 1.30% to $290.71; XRP up 0.36% to $0.3788; DOGE up 1.09% to $0.0811; ADA up 0.34% to $0.3302; and MATIC up 2.43% to $0.9157.

On the other hand, the worst performing tokens in the last 24 hours are Avalanche (AVAX), Gala (GALA), ApeCoin (APE), and Nexo (NEXO).

Interestingly, AVAX was down 2.98% to $15.48; GALA was down 3.50% to $0.4025; APE was down 2.63% to $4.82; and NEXO was down 5.13% to $0.7184.

Finally, the best performers among the top 100 cryptocurrencies, not considering the top 10 cryptocurrencies, are Helium (HNT), Frax Shares (FXS), Aptos (APT), and Decentraland (MANA).

HNT was up 10.74% to $2.35, FXS was up 10.87% to $6.42, APT was up 19.54% to $6.35, and MANA was up 10.62% to $0.4528.