Bitcoin Rallies Past $18k, Ether Below $1,400; AVAX Skyrockets: Market Watch

- Bitcoin finally broke above $18k and has formed eight consecutive bullish daily candles while Ether broke above $1,400 but was unable to retain it.

- The worst performers in the top 100, except top 10, are Lido DAO (LIDO), ApeCoin (APE), Neutrino USD (USN), and Bitcoin SV (BSV).

- The best performers in the top 100, except top 10, are Avalanche (AVAX), Near Protocol (NEAR), Helium (HNT), and Aave (AAVE).

- The total crypto market liquidation in the last 24 hours amounts to $247.24 million of which ETH makes up around $112.17 million.

The crypto market has continued its bullish streak as the capital inflow into blockchain tokens has increased recently, and so far, the year 2023 has been positive for crypto winters. However, the market is known for its volatility and abrupt price crashes, and therefore, the situation can change on a dime. The world’s biggest cryptocurrency, Bitcoin (BTC), has remained bullish for the past few days after the crypto coin successfully held above the $16,000 price region.

Bitcoin is currently witnessing the biggest rally since July last year when the Terra platform collapsed, which led to the collapse of other crypto firms like Three Arrows Capital and Celsius Network. The year 2022 was marked by intense bearish pressure, and even the best performers of the 2021 bull run failed to make higher highs in the crypto industry and fell significantly in the past couple of months. The institutional inflow of capital remains low in the crypto space, despite the fact that many countries have adopted Bitcoin (BTC) as legal tender.

It is also crucial to note that the crypto market has started to heal from the damage caused by the collapse of crypto exchange FTX under the leadership of Sam Bankman-Fried, and other crypto firms. Meanwhile, due to similar collapses, institutional investors seem to have lost interest in blockchain-based assets. However, Bitcoin (BTC) still interests companies like MicroStrategy (MSTR), while social media giant Meta has invested heavily in the metaverse.

Another factor to note is that the world’s oldest cryptocurrency has remained bullish for close to eight days, making it the biggest bullish streak since July. Also, Bitcoin ended last week on a bullish note, and it seems that this week might also end on a similar note. In order to break the long-term downtrend that has haunted the price action of this crypto coin, BTC needs to maintain this bullish streak and break above $20k.

If the crypto space regains confidence and the situation becomes less bearish, institutions might return to risky assets like cryptocurrencies. Interestingly, as of 4:19 am ET, the price of 1 Bitcoin stands at $18,144, and this value is up almost 4% in the past 24 hours. In the same duration, the trading volume of BTC went up by 48.97% while the market dominance of the oldest crypto coin went up to 39.48%, and this value might break the 40% mark soon.

While the price of the leading crypto coin is down almost 74% from the all-time high of $69,000 noted in the month of November, 2021. The market capitalization of Bitcoin at the time of writing stands at around $350 billion and is up 3.90% in the last 24 hours. It is clear that the market cap of BTC has declined by a significant amount since it was valued at $1.2 trillion in November 2021.

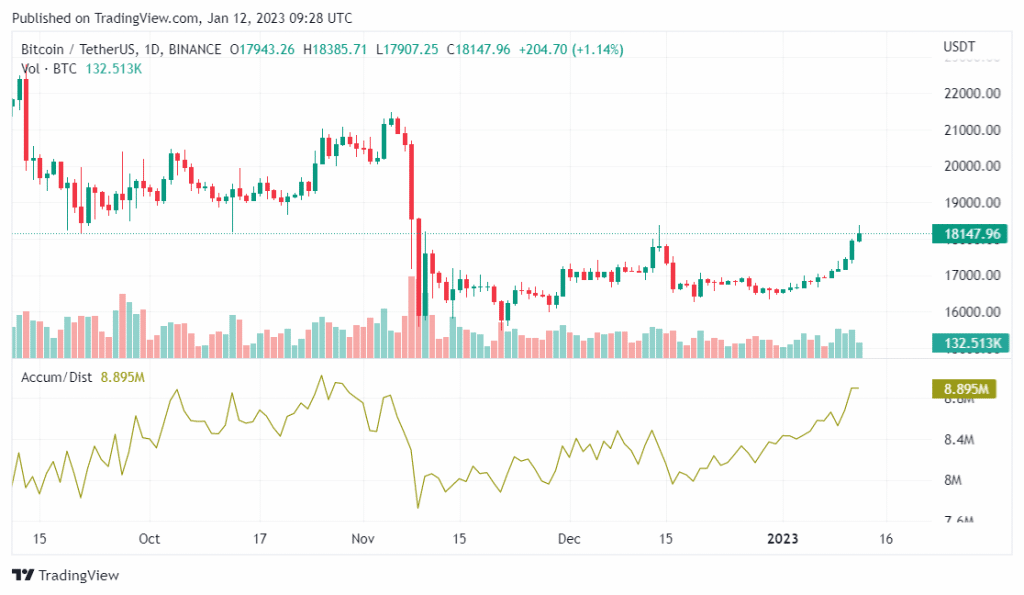

The accumulation of Bitcoin has once again begun, as the chart below confirms that the leading crypto coin has seen a huge number of wallets buying the dip. The sharp rise in the accumulation/distribution line confirms that bullish sentiment is taking over the crypto space.

Furthermore, Ether (ETH), the world’s 2nd largest cryptocurrency, has retained the $1,300 price region, and briefly broke above the $1,400 price region but failed to retain it. It is crucial to note that almost every coin follows the BTC price action and is bullish for the past few days. Interestingly, it is possible to witness Ether once again take a shot at the $1,400 price region and finally break above the $1,500 price level.

The leading crypto coins, Bitcoin and Ether, have risen 7.99% and 12.05%, respectively, in the last seven days, and their respective weekly candles remain bullish for a second consecutive week. Ethereum killer Solana (SOL), has been one of the biggest gainers in 2023, is up 23.21% in the last seven days, and is close to reclaiming its spot in the top 10 crypto coins in the industry.

On the other hand, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) are up 19.61% and 23.26%, respectively, this past week. Leading meme coins, Dogecoin (DOGE) and Shiba Inu (SHIB), are ranked among the top 20 coins in the crypto market, and DOGE is up 7.04% while SHIB is up 8.1% in the same duration.

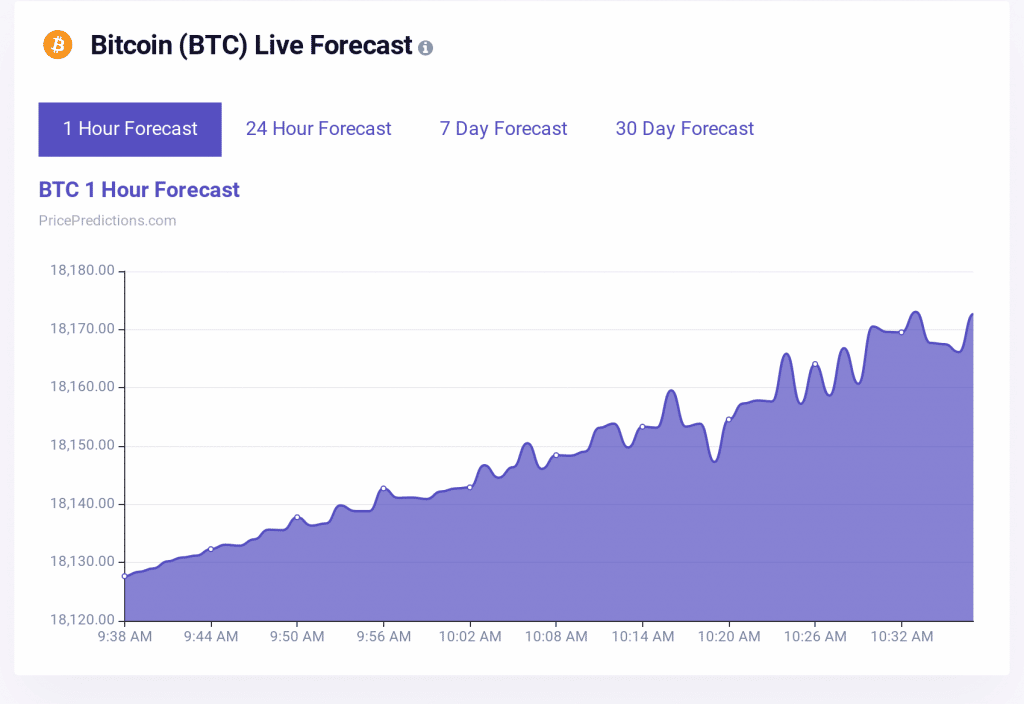

According to the prediction algorithm from PricePredictions, the Bitcoin price action continues to make higher highs, and investors can expect the leading crypto coin to follow an uptrend in the short term because the bulls continue to remain in control of the BTC price trajectory. Moreover, the trading range for BTC in the next hour is expected to be between $18,180 and $18,120.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

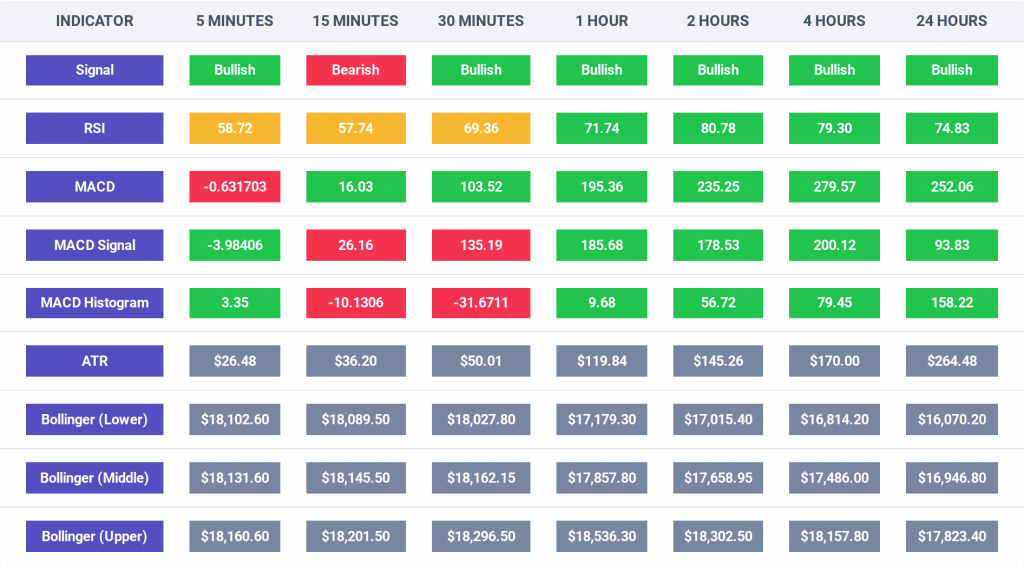

The indicators in the chart below confirm that the Bitcoin price action is bullish on all time frames except the 15 minute time frame. However, it is also expected to turn bullish since the shorter and longer time frames are all green. Moreover, the RSI indicator confirms that the buying pressure for the leading crypto coin is currently very high as compared to the selling pressure, and confidence in the crypto sector is being regained.

The RSI indicator reads a value above 50 for all the time frames listed below, which further confirms that there is a surge in the number of buying orders for BTC.

The PricePredictions algorithm confirms via the Trend Score that all the time frames of 5 minute, 15 minute, 30 minute, 1 hour, 2 hour, and 4 hour are good for placing trades. On the other hand, the 24 hour time frame is currently neutral and not ideal for placing trades.

A major bullish fundamental reading was found by blockchain analysis firm Glassnode, which stated that the “Bitcoin Percent Addresses in Profit (7d MA) just reached a 1-month high of 57.033%.” Earlier, the number of Ethereum addresses in profit also hit a 1-month high. This confirms that wallets have accumulated BTC and ETH during the bearish phase, and now the leading crypto coins have generated huge profits for them.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $247.24 million, of which Bitcoin made up $77.07 million and Ether made up $112.17 million.

Additionally, as per the publicly available data, the crypto market’s Fear and Greed Index’s value stands at 30, after dropping to 26 earlier this week, as noted in our Crypto Market Performance Report for January 11. It is also crucial to note that the investors’ sentiment reads “fear.”

Additionally, the market cap of the entire crypto space at the time of publication is moving closer to the $900 billion mark and currently stands at $886.3 billion, and this value has gone up by 3.42% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,265, as listed on CoinMarketCap.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies displayed bullish movements, with BNB up 1.96% to $283.46; XRP up 2.58% to $0.373; DOGE up 2.16% to $0.07872; ADA up 2.36% to $0.3229; and MATIC up 2.18% to $0.8825.

On the other hand, the worst performing tokens in the last 24 hours are Lido DAO (LIDO), ApeCoin (APE), Neutrino USD (USN), and Bitcoin SV (BSV).

Interestingly, USN was down 11.16% to $0.3961; APE was down 3.83% to $4.69; LIDO was down 3.07% to $1.81; and BSV was down 8.35% to $40.78.

Finally, the best performers among the top 100 cryptocurrencies, not considering the top 10 cryptocurrencies, are Avalanche (AVAX), Near Protocol (NEAR), Helium (HNT), and Aave (AAVE).

AVAX was up 22.59% to $15.34, NEAR was up 10.88% to $1.78, HNT was up 7.53% to $2.09, and AAVE was up 6.81% to $65.79.