Bitcoin Temporarily Tops $18k, ETH Below $1,300, XDC Soars 11%: Market Watch

- Bitcoin was able to break $18k but failed to retain it while Ether also failed to retain $1,300 price level.

- The worst performing tokens are Fantom (FTM), Flow (FLOW), Neutrino USD (USN), and Near Protocol (NEAR).

- The best performing cryptocurrencies are Bitcoin SV (BSV), ImmutableX (IMX), XDC Network (XDC), and Decred (DCR).

- The total crypto market liquidation in the last 24 hours amounts to $73.34 million of which BTC makes up around $31.86 million.

The crypto market turned slightly bullish late Wednesday when the world’s biggest cryptocurrency, Bitcoin (BTC), was successful in breaking the $18,000 price level. However, traders came in as the take-profit sentiment rose, and therefore, the leading crypto coin failed to hold above this price region, which came as a shocker to the community. As a result, the back and forth movement of BTC between $16,000 and $18,000 continues.

On the other hand, an optimistic scenario for Bitcoin (BTC) can be reported as it was able to retain the $17,000 price level and therefore, another retest of $18k is very likely. However, it is crucial to consider the fact that if BTC fails to push through this resistance level multiple times, bears might actually take over, leading to a retest of the nearest support at $16k. Such a scenario has occurred multiple times in the past.

As of 2:40 am ET Thursday, the price of 1 Bitcoin (BTC) is around $17,735 and is down 0.33% in the last 24 hours. This scenario is not helping the current lack of investments that are pouring in the crypto space and there is a chance that we might not see another all-time high in the coming years. Major institutional companies like Standard Chartered has predicted that the largest cryptocurrency will drop to $5,000 in 2023, a prediction which is extremely bearish and not very much suitable for the booming industry.

Additionally, in the last seven days, Bitcoin (BTC) has risen 5.34%, which means that this week’s candle might end on a bullish note. On the other hand, the trading volume of the token rose 2.35%, while the market dominance of BTC stands at 39.61%. Furthermore, the market cap of BTC stands at $341.1 billion, which is significantly lower (about 74%) than its all-time high of $1.27 trillion.

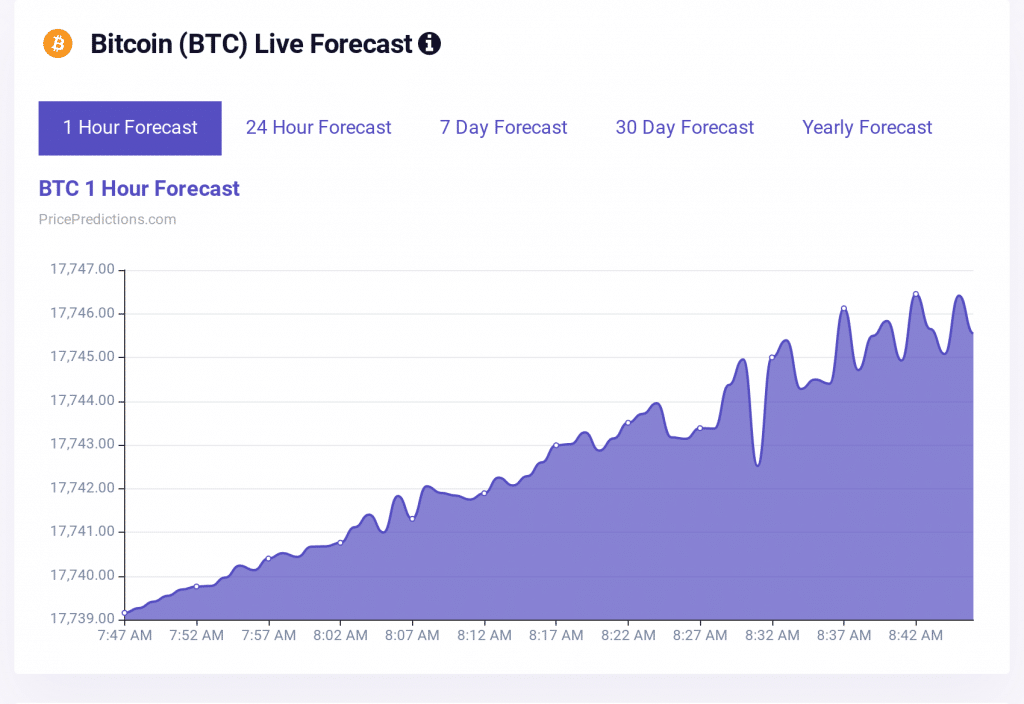

According to the chart below from PricePredictions, Bitcoin is still forming higher highs on the hourly chart, which means that another retest of $18,000 is still quite possible. However, traders are still advised to remain cautious since the crypto space can sometimes be extremely unpredictable.

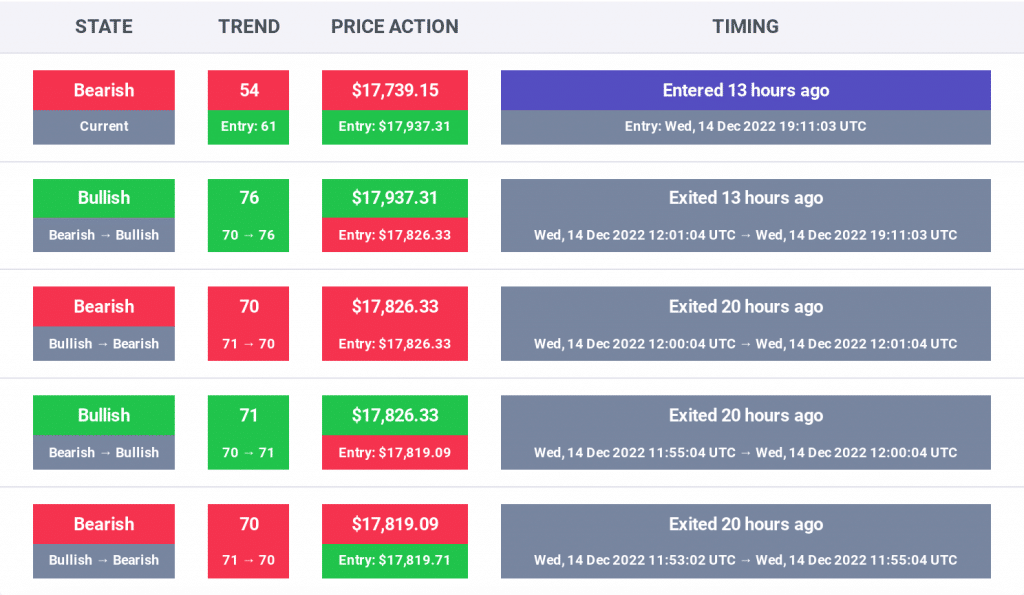

Interestingly, as per the current trend, the leading crypto coin is turning bearish. However, the trend can change when the US market wakes up.

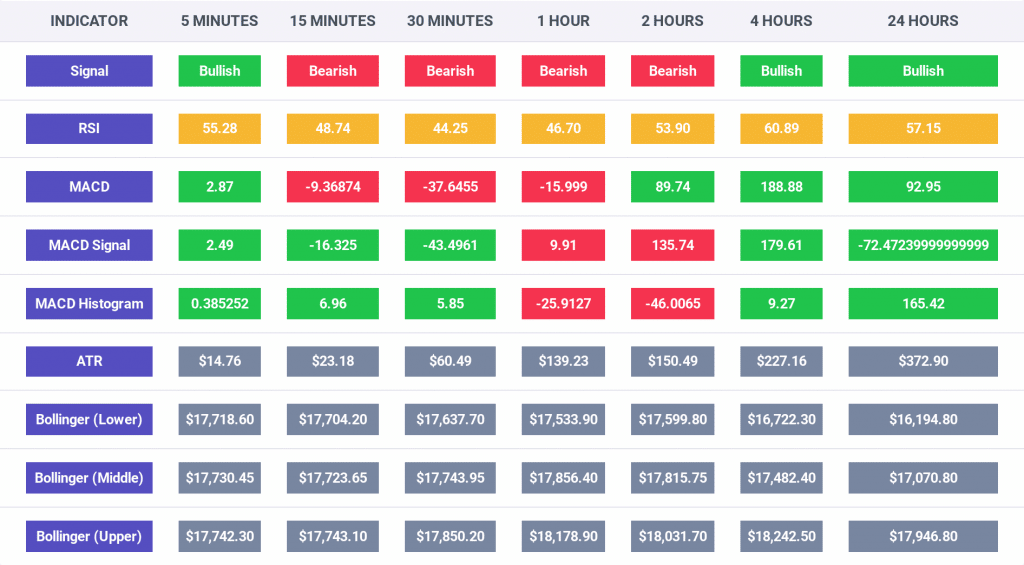

The chart below displays readings from some of the major indicators for the Bitcoin price action, and it is clear from their readings that BTC is bullish on the 5 minute, 4 hour, and 24 hour time frames. This means that longer trades can be placed, while shorter trades of 15 minutes, 30 minutes, 1 hour, and 2 hour are bearish for the oldest cryptocurrency in the market.

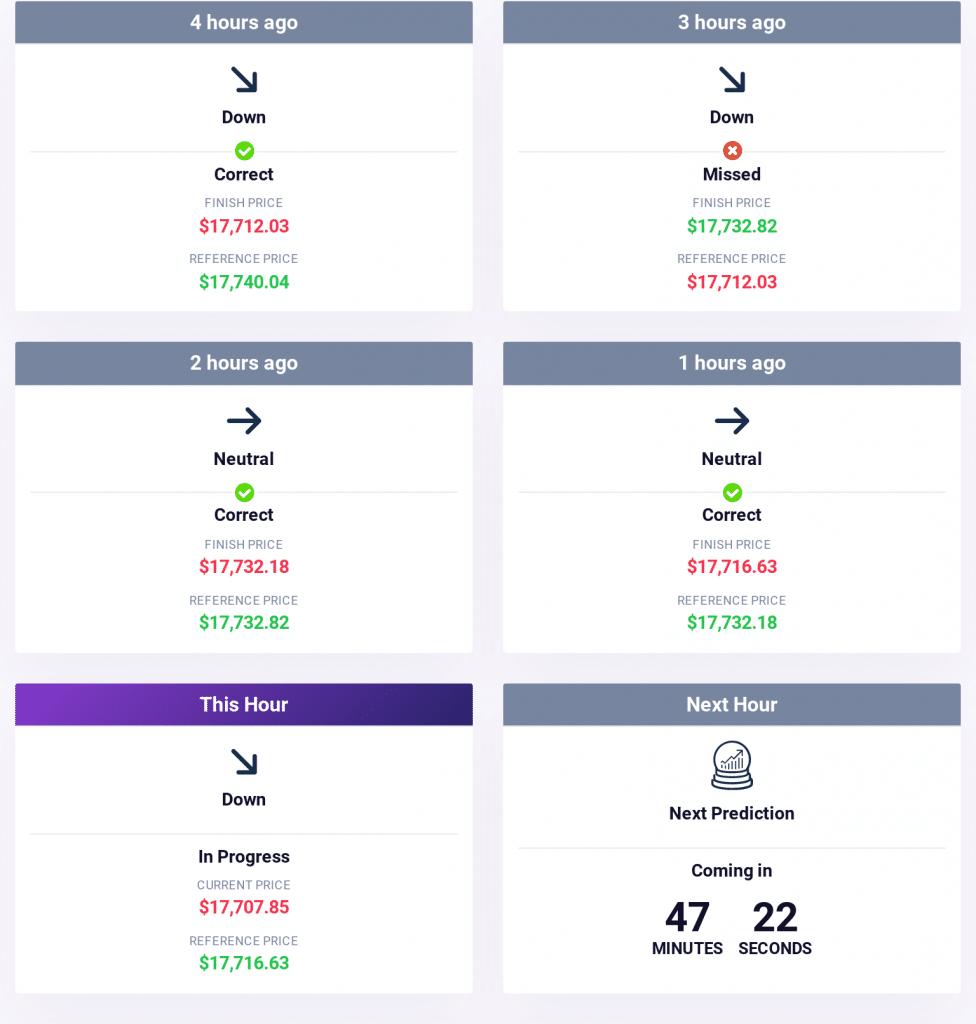

Additionally, the prediction data from the chart below shows that BTC will be trending “downwards to neutral” in a shorter time frame. For similar timely predictions, traders can register on PricePredictions.

Furthermore, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has risen to 31, after rising to 30 from 27 as per our Crypto Market Performance Report for Dec. 14. Although, it is also a fact that the market sentiment still reads “fear,” which means that the investors are not entirely bullish on the future of Bitcoin price action.

Furthermore, the market cap of the entire crypto space at the time of publication stands at $860 billion, and this value has decreased 1.23% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,035, as listed on CoinMarketCap.

Moreover, it is also crucial to note that the closest rival of Bitcoin, the world’s second-biggest cryptocurrency, the Ether (ETH) token is down 2.41% in the last 24 hours and is currently priced at $1,290. This confirms that it has been outperformed by BTC, and as a result, has also lost the $1,300 price region. The trading volume of the crypto coin has dropped by 2.28%, while the market dominance has dropped to 18.35%.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $73.34 million, of which, Bitcoin made up $31.86 million and Ether made up $23.47 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies show bearish movements with BNB down 3.58% to $265.14; XRP down 2.34% to $0.3814; DOGE down 3.66% to $0.08774; ADA down 2.52% to $0.3024 and MATIC down 2.16% to $0.8998.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Fantom (FTM), Flow (FLOW), Neutrino USD (USN), and Near Protocol (NEAR).

Interestingly, FTM was down 5.46% to $0.2379; FLOW was down 5.56% to $0.9033; USN was down 16.95% to $0.6376; and NEAR was down 4.81% to $1.64.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies are Bitcoin SV (BSV), ImmutableX (IMX), XDC Network (XDC), and Decred (DCR).

BSV was up 2.52% to $47.04; IMX was up 4.70% to $0.4675; XDC was up 11.17% to $0.02506; and DCR was up 2.22% to $21.60.