WisdomTree modifica la sua richiesta per l'ETF Spot Bitcoin

- WisdomTree ha nominato Coinbase Custody Trust come custode dei bitcoin del trust.

- Diversi analisti si aspettano che la SEC provochi ulteriori ritardi prima di dare finalmente la sua approvazione.

WisdomTree, fornitore di fondi negoziati in borsa (ETF), ha presentato alla Securities and Exchange Commission (SEC) degli Stati Uniti un prospetto informativo modificato per un ETF spot su Bitcoin, Modulo S-1. Secondo quanto riportato nel documento, il WisdomTree Bitcoin Trust sarà negoziato sul CBOE BZX Exchange con il simbolo BTCW. Inoltre, il documento indica Coinbase Custody Trust come depositario dei Bitcoin del trust.

WisdomTree, che supervisiona circa $97 miliardi, ha introdotto WisdomTree Prime, un'applicazione mobile che facilita lo scambio di asset digitali come ether e bitcoin, all'inizio di quest'anno. Inoltre, l'app supporta lo scambio tokenizzato di oggetti fisici come l'oro sull'exchange decentralizzato Stellar.

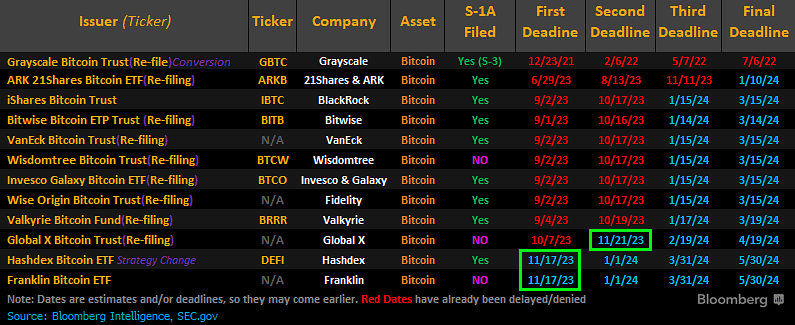

Inoltre, WisdomTree ha conversazioni in corso con la SEC, ma il deposito riflette i piani del gestore patrimoniale di lanciare un ETF su Bitcoin negli Stati Uniti. WisdomTree è una delle dodici società in lizza per ottenere l'autorizzazione a lanciare un ETF su Bitcoin.

Commentando la situazione, l'analista di Bloomberg ETF James Seyffart ha scritto su X che "ci si aspettava che tutti gli emittenti dovessero presentare una di queste richieste per lanciare potenzialmente il loro ETF a un certo punto. Solo una fase del processo. Niente di critico".“

Seyffart ha inoltre affermato che su 12 società statunitensi che presentano i moduli S-1 alla SEC, solo due depositanti spot di ETF Bitcoin, Franklin Templeton e Global X, non hanno ancora modificato i propri documenti.

La SEC ha rinviato la decisione sulla proposta di fondi negoziati in borsa (ETF) bitcoin da WisdomTree, VanEck e Fidelity Investments alcuni mesi fa. WisdomTree e altri dieci richiedenti ha modificato i documenti dopo che l'autorità di regolamentazione ha richiesto nuove informazioni a tutti i richiedenti.

Diversi esperti di ETF prevedono che la SEC causerà presto ulteriori ritardi nel fornire conclusioni sulle scadenze imminenti. Tuttavia, Seyffart di Bloomberg ritiene che ci siano 901 probabilità su 3T che la SEC approvi un ETF spot su Bitcoin prima della fine di gennaio 2024, nonostante i ritardi.

È interessante notare che il CEO di BitGo Mike Belshe ha dato una buona e una cattiva notizia agli appassionati di Bitcoin in attesa che la SEC approvi un ETF Bitcoin spot. Belshe sostiene che i segnali provenienti dalle conversazioni in corso con la SEC mostrano notevoli progressi.

Tuttavia, ha aggiunto Belshe, "Penso che sia molto probabile che dovremo affrontare un altro giro di rifiuti di ETF prima di ricevere notizie positive". Belshe ha evidenziato la posizione della SEC sulla divisione delle responsabilità di custodia e di scambio, che è stata fonte di disaccordo in diverse domande di Coinbase relative alla custodia.

Altri esperti di criptovalute, come Steven Schoenfield, ex amministratore delegato di BlackRock, ritengono che un ETF sul Bitcoin verrebbe probabilmente approvato entro tre-sei mesi. Ha osservato che le recenti richieste di commenti pubblici da parte della SEC sono un segnale positivo di impegno, piuttosto che semplici smentite.