WisdomTree ändert seinen Spot-Bitcoin-ETF-Antrag

- WisdomTree ernannte den Coinbase Custody Trust zum Verwahrer der Bitcoins des Trusts.

- Mehrere Analysten gehen davon aus, dass die SEC weitere Verzögerungen verursachen wird, bevor sie endgültig ihre Genehmigung erteilt.

WisdomTree, ein Anbieter von börsengehandelten Fonds (ETF), hat der US-amerikanischen Börsenaufsichtsbehörde Securities and Exchange Commission (SEC) einen geänderten Spot-Bitcoin-ETF-Prospekt in Form S-1 vorgelegt. Laut der Einreichung würde der WisdomTree Bitcoin Trust an der CBOE BZX Exchange unter dem Symbol BTCW gehandelt. Darüber hinaus wurde in der Einreichung der Coinbase Custody Trust als Verwahrer der Bitcoins des Trusts genannt.

WisdomTree, das rund $97 Milliarden verwaltet, hat Anfang des Jahres WisdomTree Prime eingeführt, eine mobile Anwendung, die den Handel mit digitalen Vermögenswerten wie Ether und Bitcoin erleichtert. Darüber hinaus unterstützt die App den tokenisierten Handel mit physischen Gegenständen wie Gold an der dezentralen Börse Stellar.

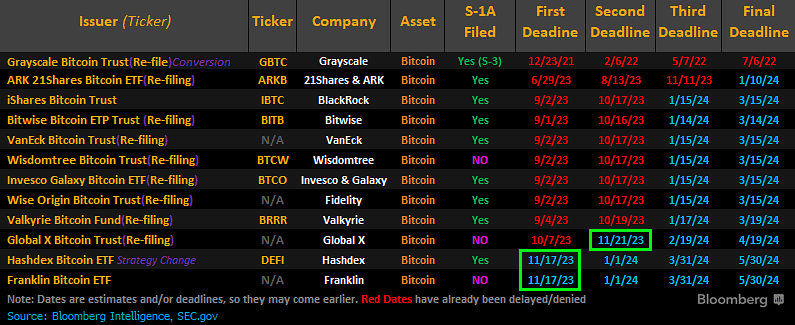

Darüber hinaus führt WisdomTree laufende Gespräche mit der SEC, aber die Einreichung spiegelt die Pläne des Vermögensverwalters wider, einen Bitcoin-ETF in den USA aufzulegen. WisdomTree ist eines von insgesamt zwölf Unternehmen, die sich um die Genehmigung zur Einführung eines Bitcoin-ETF bewerben.

James Seyffart, ETF-Analyst bei Bloomberg, kommentierte die Situation auf Nur ein Schritt im Prozess. Nichts Kritisches.“

Seyffart behauptete außerdem, dass von den zwölf US-Unternehmen, die S-1-Formulare bei der SEC einreichen, nur zwei Spot-Bitcoin-ETF-Anmelder – Franklin Templeton und Global X – ihre Dateien noch nicht geändert hätten.

Die SEC hat vor einigen Monaten eine Entscheidung über die vorgeschlagenen Bitcoin Exchange Traded Funds (ETFs) von WisdomTree, VanEck und Fidelity Investments verschoben. WisdomTree und zehn weitere Bewerber änderte die Dokumente, nachdem die Regulierungsbehörde von allen Antragstellern neue Informationen angefordert hatte.

Mehrere ETF-Spezialisten gehen davon aus, dass die SEC bald weitere Verzögerungen bei der Bereitstellung von Schlussfolgerungen zu den bevorstehenden Fristen verursachen wird. Seyffart von Bloomberg glaubt jedoch, dass trotz der Verzögerungen eine 90%-Chance besteht, dass die SEC vor Ende Januar 2024 einen Spot-Bitcoin-ETF genehmigen wird.

Interessanterweise hatte Mike Belshe, CEO von BitGo, eine gute und eine schlechte Nachricht für Bitcoin-Enthusiasten, die darauf warten, dass die SEC einen Spot-Bitcoin-ETF genehmigt. Belshe behauptet, dass Signale aus laufenden Gesprächen mit der SEC bemerkenswerte Fortschritte zeigen.

Belshe fügte jedoch hinzu: „Ich halte es für sehr wahrscheinlich, dass wir eine weitere Runde von ETF-Ablehnungen erleben, bevor wir die positiven Nachrichten erhalten.“ Belshe hob die Position der SEC zur Aufteilung der Verwahrungs- und Börsenverantwortung hervor, die in einer Reihe von Anträgen im Zusammenhang mit der Verwahrung von Coinbase zu Meinungsverschiedenheiten geführt hat.

Andere Krypto-Experten wie Steven Schoenfield, ein ehemaliger Geschäftsführer von BlackRock, glauben, dass ein Bitcoin-ETF voraussichtlich in drei bis sechs Monaten genehmigt werden würde. Er wies darauf hin, dass die jüngsten Anfragen der SEC nach öffentlichen Kommentaren eher ein positives Zeichen des Engagements als bloße Dementis seien.