WisdomTree altera seu aplicativo Spot Bitcoin ETF

- A WisdomTree nomeou o Coinbase Custody Trust como o guardião do bitcoin do trust.

- Vários analistas esperam que a SEC cause mais atrasos antes de finalmente dar a sua aprovação.

WisdomTree, um provedor de fundos negociados em bolsa (ETF), apresentou um prospecto de ETF Bitcoin à vista do Formulário S-1 alterado à Comissão de Valores Mobiliários dos Estados Unidos (SEC). De acordo com o documento, o WisdomTree Bitcoin Trust seria negociado na CBOE BZX Exchange sob o símbolo BTCW. Além disso, o processo nomeou o Coinbase Custody Trust como o guardião do bitcoin do trust.

A WisdomTree, que supervisiona cerca de $97 bilhões, lançou o WisdomTree Prime, um aplicativo móvel que facilita a negociação de ativos digitais como éter e bitcoin, no início deste ano. Além disso, o aplicativo oferece suporte à negociação tokenizada de itens físicos como ouro na bolsa descentralizada Stellar.

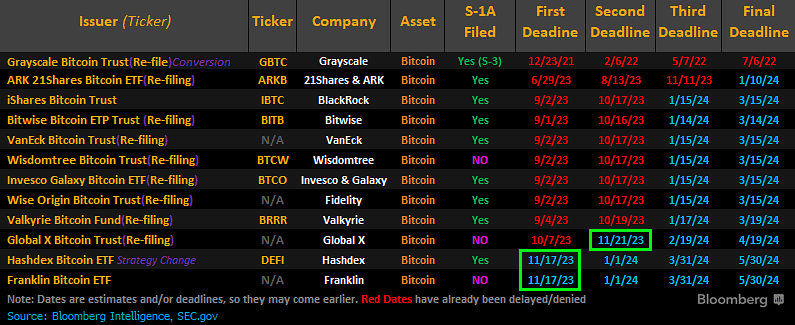

Além disso, o WisdomTree mantém conversas contínuas com a SEC, mas o arquivamento reflete os planos do gestor de ativos de lançar um ETF Bitcoin nos EUA. WisdomTree é um de um total de doze que estão disputando autorização para lançar um ETF Bitcoin.

Comentando a situação, o analista de ETF da Bloomberg, James Seyffart, escreveu no X que “esperava-se que todos os emissores tivessem que apresentar um desses para potencialmente lançar seu ETF em algum momento. Apenas uma etapa do processo. Nada crítico.

Seyffart também afirmou que das 12 empresas dos EUA que arquivam formulários S-1 na SEC, apenas dois arquivadores de ETF Bitcoin à vista – Franklin Templeton e Global X – ainda não alteraram seus arquivos.

A SEC adiou a tomada de decisão sobre os fundos negociados em bolsa (ETFs) de bitcoin propostos pela WisdomTree, VanEck e Fidelity Investments há alguns meses. WisdomTree e dez outros candidatos alterou os documentos depois que o regulador solicitou novas informações de todos os requerentes.

Vários especialistas em ETF prevêem que a SEC em breve causará mais atrasos no fornecimento de conclusões sobre os prazos iminentes. No entanto, Seyffart da Bloomberg acredita que há uma chance 90% de que a SEC aprove um ETF Bitcoin à vista antes do final de janeiro de 2024, apesar dos atrasos.

Curiosamente, o CEO da BitGo, Mike Belshe, trouxe boas e más notícias para os entusiastas do Bitcoin que esperam que a SEC aprove um ETF Bitcoin à vista. Belshe afirma que os sinais das conversas em andamento com a SEC mostram um progresso notável.

No entanto, Belshe acrescentou: “Acho que é bastante provável que tenhamos outra rodada de rejeições de ETF antes de recebermos notícias positivas”. Belshe destacou a posição da SEC sobre a divisão de custódia e responsabilidades cambiais, que tem sido uma fonte de desacordo em uma série de aplicações relacionadas à custódia da Coinbase.

Outros especialistas em criptografia, como Steven Schoenfield, ex-diretor administrativo da BlackRock, acreditam que um ETF Bitcoin provavelmente seria aprovado em três a seis meses. Ele observou que os recentes pedidos de comentários públicos da SEC foram uma indicação positiva de envolvimento, em vez de simples negações.