WisdomTree modifica su aplicación Spot Bitcoin ETF

- WisdomTree nombró a Coinbase Custody Trust como custodio del bitcoin del fideicomiso.

- Varios analistas esperan que la SEC provoque más retrasos antes de dar finalmente su aprobación.

WisdomTree, un proveedor de fondos cotizados en bolsa (ETF), ha presentado un prospecto modificado del ETF de Bitcoin al contado del Formulario S-1 a la Comisión de Bolsa y Valores de los Estados Unidos (SEC). Según la presentación, WisdomTree Bitcoin Trust cotizaría en el CBOE BZX Exchange bajo el símbolo BTCW. Además, la presentación nombró a Coinbase Custody Trust como custodio del bitcoin del fideicomiso.

WisdomTree, que supervisa alrededor de $97 mil millones, presentó WisdomTree Prime, una aplicación móvil que facilita el comercio de activos digitales como ether y bitcoin, a principios de este año. Además, la aplicación admite el comercio tokenizado de artículos físicos como oro en el intercambio descentralizado Stellar.

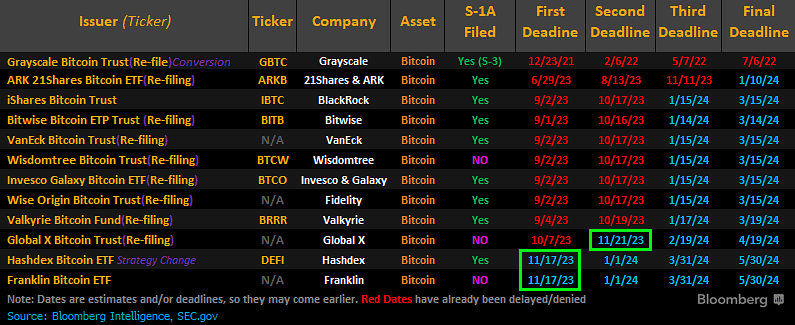

Además, WisdomTree tiene conversaciones en curso con la SEC, pero el presentación refleja los planes del administrador de activos de lanzar un ETF de Bitcoin en EE. UU. WisdomTree es uno de un total de doce que compiten por la autorización para lanzar un ETF de Bitcoin.

Al comentar sobre la situación, el analista de ETF de Bloomberg, James Seyffart, escribió en X que “se esperaba que todos los emisores tuvieran que presentar uno de estos para lanzar potencialmente su ETF en algún momento. Sólo un paso en el proceso. Nada crítico”.

Seyffart también afirmó que de 12 corporaciones estadounidenses que presentan formularios S-1 ante la SEC, solo dos declarantes puntuales de ETF de Bitcoin (Franklin Templeton y Global X) aún no han modificado sus archivos.

La SEC pospuso la toma de una decisión sobre los fondos cotizados en bolsa (ETF) de bitcoin propuestos por WisdomTree, VanEck y Fidelity Investments hace unos meses. WisdomTree y otros diez solicitantes modificó los documentos después de que el regulador solicitó nueva información de todos los solicitantes.

Varios especialistas de la ETF predicen que la SEC provocará pronto más retrasos a la hora de sacar conclusiones sobre los plazos inminentes. Sin embargo, Seyffart de Bloomberg cree que existe una probabilidad de 90% de que la SEC apruebe un ETF de Bitcoin al contado antes de finales de enero de 2024, a pesar de los retrasos.

Curiosamente, el director ejecutivo de BitGo, Mike Belshe, tuvo buenas y malas noticias para los entusiastas de Bitcoin que esperaban que la SEC aprobara un ETF de Bitcoin al contado. Belshe afirma que las señales de las conversaciones en curso con la SEC muestran un progreso notable.

Sin embargo, Belshe añadió: "Creo que es muy probable que tengamos otra ronda de rechazos de ETF antes de recibir noticias positivas". Belshe destacó la posición de la SEC sobre la división de las responsabilidades de custodia e intercambio, que ha sido una fuente de desacuerdo en varias aplicaciones relacionadas con la custodia de Coinbase.

Otros expertos en criptografía, como Steven Schoenfield, ex director general de BlackRock, creen que un ETF de Bitcoin probablemente se aprobaría en tres a seis meses. Señaló que las recientes solicitudes de comentarios públicos de la SEC eran una indicación positiva de compromiso en lugar de simples negaciones.