WisdomTree Spot Bitcoin ETF Başvurusunu Değiştirdi

- WisdomTree, Coinbase Custody Trust'ı tröstün Bitcoin'inin koruyucusu olarak adlandırdı.

- Birçok analist, SEC'in nihayet onay vermeden önce daha fazla gecikmeye neden olmasını bekliyor.

Borsa yatırım fonu (ETF) sağlayıcısı WisdomTree, Amerika Birleşik Devletleri Menkul Kıymetler ve Borsa Komisyonu'na (SEC) değiştirilmiş bir Form S-1 spot Bitcoin ETF izahnamesi sundu. Başvuruya göre WisdomTree Bitcoin Trust, CBOE BZX Borsasında BTCW sembolü altında işlem görecek. Ek olarak, dosyada Coinbase Custody Trust'ın, tröstün Bitcoin'inin koruyucusu olduğu belirtiliyor.

Yaklaşık $97 milyarı denetleyen WisdomTree, bu yılın başlarında eter ve bitcoin gibi dijital varlıkların alım satımını kolaylaştıran mobil uygulama WisdomTree Prime'ı tanıttı. Ek olarak uygulama, Stellar merkezi olmayan borsada altın gibi fiziksel öğelerin tokenize edilmiş alım satımını da destekliyor.

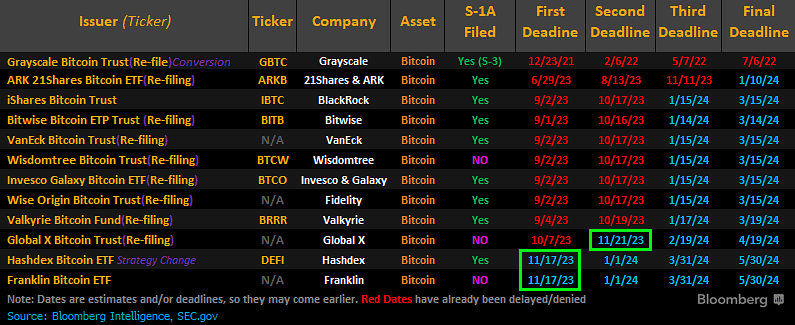

Ayrıca WisdomTree'nin SEC ile devam eden görüşmeleri var, ancak dosyalama varlık yöneticisinin ABD'de bir Bitcoin ETF başlatma planlarını yansıtıyor. WisdomTree, Bitcoin ETF'si başlatmak için yarışan toplam on iki şirketten biri.

Durum hakkında yorum yapan Bloomberg ETF analisti James Seyffart, X hakkında şöyle yazdı: "Tüm ihraççıların bir noktada ETF'lerini potansiyel olarak başlatabilmeleri için bunlardan birini dosyalamaları bekleniyordu. Süreçte sadece bir adım. Kritik bir şey yok.”

Seyffart ayrıca SEC'e S-1 formları sunan 12 ABD şirketinden yalnızca iki spot Bitcoin ETF başvurusu yapanın (Franklin Templeton ve Global X) dosyalarını henüz değiştirmediğini iddia etti.

SEC, birkaç ay önce WisdomTree, VanEck ve Fidelity Investments tarafından teklif edilen bitcoin borsa yatırım fonları (ETF'ler) hakkında karar almayı erteledi. WisdomTree ve on kişi daha başvuranlar Düzenleyicinin tüm başvuru sahiplerinden yeni bilgiler talep etmesi üzerine belgelerde değişiklik yapıldı.

Bazı ETF uzmanları, SEC'in yaklaşan son tarihler hakkında sonuç vermede yakında daha fazla gecikmeye neden olacağını öngörüyor. Ancak Bloomberg'den Seyffart, gecikmelere rağmen SEC'in Ocak 2024'ün sonundan önce bir spot Bitcoin ETF'sini onaylama ihtimalinin 90% olduğuna inanıyor.

İlginç bir şekilde BitGo CEO'su Mike Belshe, SEC'in spot Bitcoin ETF'sini onaylamasını bekleyen Bitcoin meraklılarına bir iyi bir de kötü haber verdi. Belshe, SEC ile devam eden görüşmelerden elde edilen sinyallerin dikkate değer bir ilerleme gösterdiğini iddia ediyor.

Ancak Belshe şunu ekledi: "Olumlu haberi almadan önce ETF'nin bir tur daha reddedilmesinin oldukça muhtemel olduğunu düşünüyorum." Belshe, SEC'in, Coinbase saklamayla ilgili bir dizi başvuruda anlaşmazlık kaynağı olan saklama ve takas sorumluluklarının bölünmesi konusundaki pozisyonunu vurguladı.

BlackRock'un eski genel müdürü Steven Schoenfield gibi diğer kripto uzmanları, Bitcoin ETF'nin muhtemelen üç ila altı ay içinde onaylanacağına inanıyor. Kendisi, SEC'in son dönemdeki kamuya açık yorum taleplerinin açık bir inkardan ziyade katılımın olumlu bir göstergesi olduğunu belirtti.