WisdomTree modifie son application Spot Bitcoin ETF

- WisdomTree a nommé Coinbase Custody Trust comme dépositaire du bitcoin de la fiducie.

- Plusieurs analystes s'attendent à ce que la SEC provoque davantage de retards avant de finalement donner son approbation.

WisdomTree, un fournisseur de fonds négociés en bourse (ETF), a soumis un prospectus modifié du formulaire S-1 spot Bitcoin ETF à la Securities and Exchange Commission (SEC) des États-Unis. Selon le dossier, le WisdomTree Bitcoin Trust serait négocié sur le CBOE BZX Exchange sous le symbole BTCW. En outre, le dossier nomme Coinbase Custody Trust comme dépositaire du bitcoin de la fiducie.

WisdomTree, qui supervise environ $97 milliards, a présenté WisdomTree Prime, une application mobile qui facilite le commerce d'actifs numériques comme l'éther et le bitcoin, plus tôt cette année. De plus, l'application prend en charge le commerce tokenisé d'objets physiques comme l'or sur l'échange décentralisé Stellar.

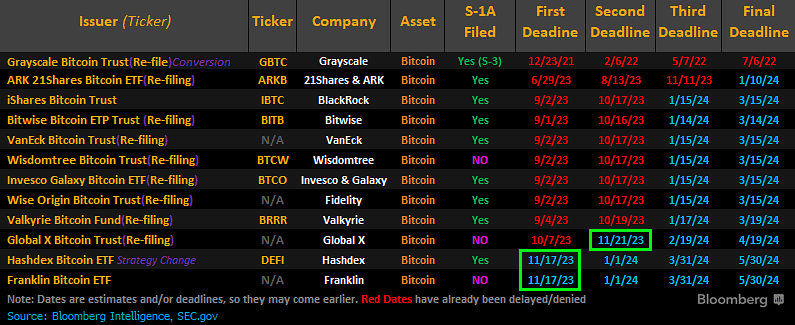

De plus, WisdomTree a des conversations en cours avec la SEC, mais le dépôt reflète les projets du gestionnaire d'actifs de lancer un ETF Bitcoin aux États-Unis. WisdomTree fait partie d’un total de douze qui se disputent l’autorisation de lancer un ETF Bitcoin.

Commentant la situation, James Seyffart, analyste de Bloomberg ETF, a écrit sur X que « tous les émetteurs devaient déposer l'un de ces documents pour potentiellement lancer leur ETF à un moment donné. Juste une étape dans le processus. Rien de critique.

Seyffart a également affirmé que sur 12 sociétés américaines qui déposent des formulaires S-1 auprès de la SEC, seules deux déposants ponctuels d'ETF Bitcoin – Franklin Templeton et Global X – n'ont pas encore modifié leurs fichiers.

La SEC a reporté il y a quelques mois sa décision sur les fonds négociés en bourse (ETF) Bitcoin proposés par WisdomTree, VanEck et Fidelity Investments. WisdomTree et dix autres candidats a modifié les documents après que le régulateur a demandé de nouvelles informations à tous les candidats.

Plusieurs spécialistes de l'ETF prédisent que la SEC retardera bientôt encore davantage ses conclusions sur les échéances imminentes. Cependant, Seyffart de Bloomberg estime qu'il existe 90% de chances que la SEC approuve un ETF Bitcoin au comptant avant la fin janvier 2024, malgré les retards.

Il est intéressant de noter que le PDG de BitGo, Mike Belshe, a eu une bonne et une mauvaise nouvelle pour les passionnés de Bitcoin qui attendent que la SEC approuve un ETF Bitcoin au comptant. Belshe affirme que les signaux issus des conversations en cours avec la SEC montrent des progrès remarquables.

Cependant, Belshe a ajouté : « Je pense qu'il est fort probable que nous ayons une autre série de refus d'ETF avant d'avoir des nouvelles positives. » Belshe a souligné la position de la SEC sur la répartition des responsabilités de garde et d'échange, qui a été une source de désaccord dans un certain nombre de demandes liées à la garde de Coinbase.

D'autres experts en cryptographie, tels que Steven Schoenfield, ancien directeur général de BlackRock, estiment qu'un ETF Bitcoin serait probablement approuvé dans trois à six mois. Il a noté que les récentes demandes de commentaires publics de la SEC étaient une indication positive d'engagement plutôt que de purs refus.