Bitcoin nears $17k, Ether Reclaims $1,200; SOL, LDO, OKB Skyrocket: Monday Market Watch

- Bitcoin (BTC) turned slightly bullish on Monday, while Ether has once again reclaimed the $1,200 price level.

- The best performers in the top 100, except top 10, are Solana (SOL), OKB (OKB), Frax Share (FXS), and Lido DAO (LIDO).

- The worst performers in the top 100, except top 10, are Neutrino USD (USN), XDC Network (XDC), Nexo (NEXO), and UNUS SED LEO (LEO).

- The total crypto market liquidation in the last 24 hours amounts to $65.23 million of which ETH makes up around $16.23 million.

The crypto market has been having a rough couple of weeks, and as a new year begins, investors are hoping that 2023 will be better for the crypto sector than 2022. After a number of days of struggling to maintain $16,000, the world’s biggest crypto asset, Bitcoin (BTC), has finally shown some signs of bullishness as it moves closer to the $17,000 price level on Monday.

Over the weekend, the trading volume of Bitcoin dipped, and it was feared that the leading crypto coin might not be able to maintain $16,000 as support. However, that wasn’t the case, and now it will be interesting to see if BTC is able to push above $17k. The last time BTC was above $17k, it broke past the $18k price region but failed to retain that region and dropped to $16k as a result.

It is crucial to note that Ether (ETH), the 2nd biggest crypto asset, has been able to hold above the $1,100 price region, and in the last 24 hours, it successfully reclaimed the $1,200 price level as well. It is possible that investors might witness a surge in prices if the $1,200 level becomes the support region for higher prices. Moreover, altcoins like Solana (SOL), which were on a downward streak, finally broke their bearish trend and rose in double digits.

As of 3:21 am ET, the price of 1 bitcoin stands at $16,742 and is up 1.28% in the last 24 hours. In the same duration, the trading volume of BTC token has dropped 1.85% but the bulls remain in control of the price action. It is crucial to note that due to low volumes, this price surge could just be a dead cat bounce, and investors are therefore advised to maintain caution and not place any trades.

The market dominance of Bitcoin has dropped to 39.98% despite the price surge, while the market capitalization of the crypto coin stands at $322.388 billion, which is quite lower than the all-time high of $1.2 trillion witnessed in November 2021. In the last seven days, BTC went down by 0.60%, which suggests that the weekly chart for the crypto coin shows a significant lack of volume.

According to the analysis from blockchain firm Glassnode, the “Bitcoin Amount of Supply Last Active 2y-3y (1d MA) just reached a 1-year high of 1,656,707.318 BTC,” which means that the percentage of BTC supply that remains inactive is increasing as buyers continue to grab and store more and more BTC in their wallets. The market bulls continue to purchase the current dip as BTC fails to break through $17k for a few weeks in a row.

In the past seven days, Ether’s (ETH) price, has gone down by 0.35% along with the trading volume for the coins. Leading meme coins, Dogecoin (DOGE) and Shiba Inu (INU), both crashed 4.30% and 1.12%, respectively, and it seems that the bullish growth enjoyed by these tokens in 2021 might not be seen anymore.

The metaverse tokens The Sandbox (SAND) and Decentraland (MANA) crashed 8.21% and 5.65%, respectively, this past week as well. Furthermore, Solana (SOL) also dipped close to 0.05% in the same duration.

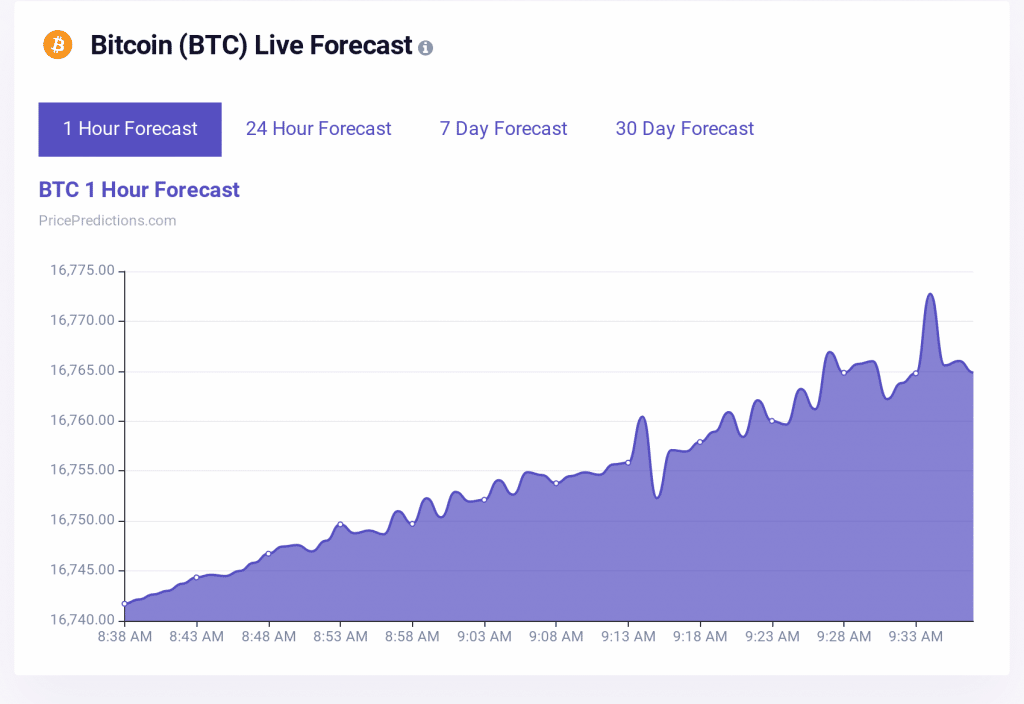

According to the prediction algorithm from PricePredictions, Bitcoin is expected to follow an uptrend in the next hour as the bulls are taking over and driving the prices higher. However, it is also crucial to note that while the $16k price level currently holds, it is very much possible to retest lower levels as the trading volume is not high enough to reclaim the resistance zones present beyond the $17k price zone.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

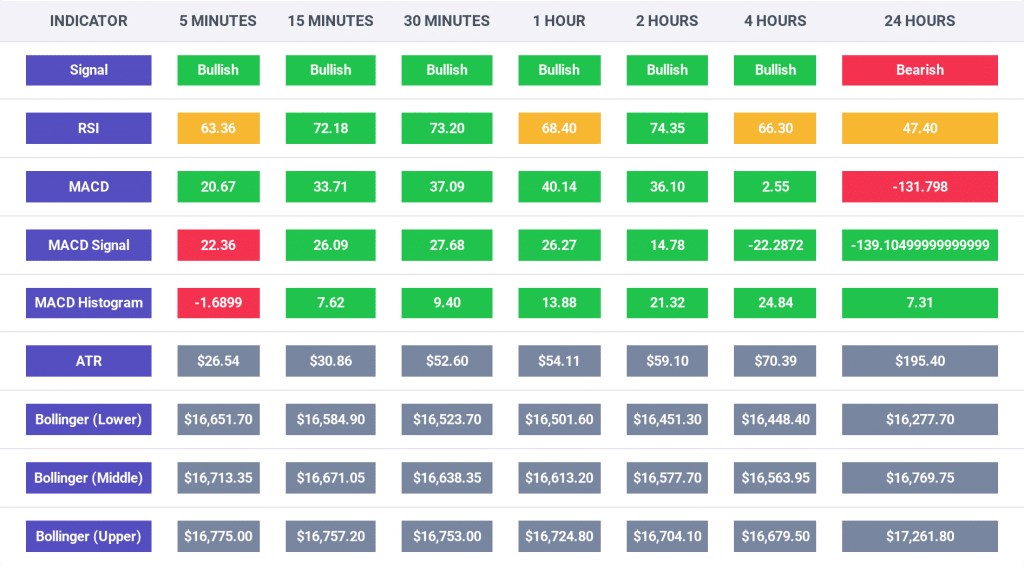

The indicators seen on the chart below have all turned bullish, and it is clear that we can witness higher prices on the shorter time frames. However, the daily time frame remains bearish, and to change it into green, the bulls need to pick up the pace.

As is clear from the image below, the RSI indicator is bullish for the 5 minute, 15 minute, 30 minute, 1 hour, 2 hour, and 4 hour time frames. On these time frames, the indicator reads above 50, while it reads below 50 for the 24 hour time frame, which suggests that this bullish growth is not sustainable for a longer period of time.

Also, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has risen to 27 after rising to 26 from 25, as noted in our Crypto Market Performance Report for January 1. It is also crucial to note that the investors’ sentiment currently reads “fear.”

Moreover, the market cap of the entire crypto space at the time of publication is once again above the $800 billion mark and currently stands at $805 billion, and this value has gone up by 1.41% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,162, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is up 1.73% in the last 24 hours and is currently priced at $1,215.97. The trading volume of the cryptocurrency is up by 4.85%, while the market dominance has risen to 18.43% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $65.23 million, of which, Bitcoin made up $8.23 million and Ether made up $16.23 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies showed bullish movements, with BNB up 1.34% to $247.19; XRP up 1.75% to $0.343; DOGE up 4.02% to $0.07218; ADA up 3.90% to $0.2546; and MATIC up 3.48% to $0.7794.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are Neutrino USD (USN), XDC Network (XDC), Nexo (NEXO), and UNUS SED LEO (LEO).

Interestingly, USN was down 3.44% to $0.4436; XDC was down 0.14% to $0.02545; NEXO was down 5.96% to $0.6785; and LEO was down 3.29% to $3.51.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies, are Solana (SOL), OKB (OKB), Frax Share (FXS), and Lido DAO (LIDO).

SOL was up 15.22% to $11.22, OKB was up 12.05% to $30.20, FXS was up 10.82% to $4.61, and LIDO was up 14.32% to $1.15.