Bitcoin holds $16k; DOGE down 12%, SOL crashes 15% this Week: Market Watch

- Bitcoin and Ether dropped 1.71% and 1.93% in last 7 days while DOGE and SOL crashed 12% and 15% in the same duration.

- The best performers in the top 100, except top 10, are Internet Computer (ICP), OKB (OKB), Curve DAO Token (CRV), and Aptos (APT).

- The worst performers in the top 100, except top 10, are GMX (GMX), Hedera (HBAR), Luna Classic (LUNC), and Aave (AAVE).

- The total crypto market liquidation in the last 24 hours amounts to $45.91 million of which BTC makes up around $16.59 million.

As another week comes to an end, the crypto market continues to witness a decline in the prices of some of the biggest crypto coins in the industry. Even the best performers of 2021 failed to maintain their bullish nature this year, causing a major setback in their prices. Interestingly, the world’s biggest cryptocurrency, Bitcoin (BTC), has witnessed a decline of more than 75% since November last year, and it seems that the crypto winter is not over yet.

The past few weeks have been a simple back and forth movement for Bitcoin as it tries to hold above the $16k price level as support. After spending most of the time at $16.8k the past few days, the leading crypto coin has dropped to $16.5k and is now aiming to make another move towards the $17k price zone, beyond which lies an area of massive resistance.

Additionally, the price of a single Bitcoin as of 12 am ET on December 31st stands at $16,556 and is down 0.29% in the last 24 hours. The volatility of the crypto space has declined sharply in the past few weeks after the oldest cryptocurrency in the market was rejected at the $18k price level and it failed to break through the $20K price region. Interestingly, the market dominance of BTC has risen gradually in the past few days and at the time of writing, stands at 40.12%.

It is also crucial to note that, as the year ends, Bitcoin has printed a huge red candle for the year 2022. The year was initiated at a price of $46,311 after BTC lost the $50k price region post last year’s Santa bull run. However, as the news of Russia’s invasion of Ukraine broke out, the crypto market collapsed and BTC dropped to the $40k price zone, a rather unfavorable outcome for the new participants in the crypto industry.

In the last 24 hours, the trading volume of Bitcoin went up by 14.38%, which suggests that traders might be gathering to push BTC prices as the last day of the year has already begun. The market cap of the oldest crypto coin currently stands at $318 billion, which is quite lower than its all-time high value of $1.2 trillion. The declining interest of institutions is also a reason why BTC prices continue to decline.

In the past seven days, the price of Bitcoin has dipped 1.71% while its nearest competitor, Ether’s (ETH) price, has gone down 1.93%. On the whole, BTC and ETH performed better than the rest of the altcoins, which were shorted heavily in the crypto market in the past few days. Moreover, the trading volume has also declined quite heavily for altcoins as well as the big two.

The leading meme coins, Dogecoin (DOGE) and Shiba Inu (INU), both crashed heavily in the past week with the latter losing almost 3% of its value while Elon Musk’s favorite crypto coin dropped close to 12%. Furthermore, the metaverse tokens The Sandbox (SAND) and Decentraland (MANA) crashed 15.14% and 11.80%, respectively, this past week as well. Furthermore, Solana (SOL) also dipped close to 15% in the same duration.

According to blockchain analysis firm Glassnode, the Adjusted Spent Output Profit Ratio (aSOPR), a metric that indicates whether holders are selling at a profit or loss, has reached a 1-month low of 0.96742. The previous 1-month low of 0.96766 was observed on 29 December 2022, revealed the firm. This confirms that investors are selling their Bitcoin at a loss, and the bottom might be in.

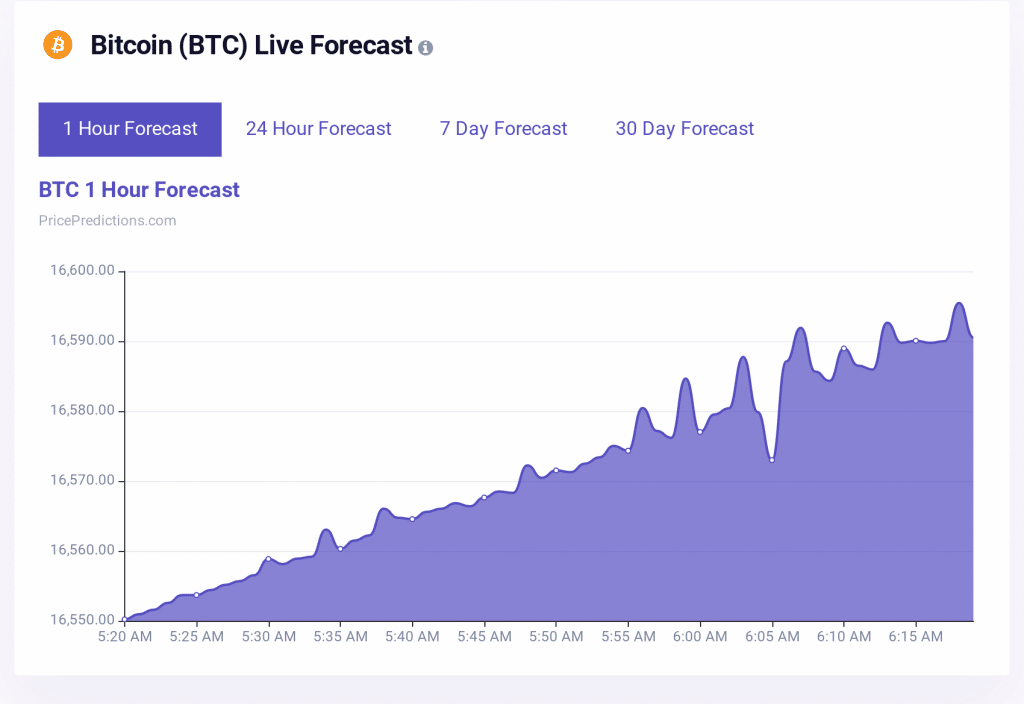

The algorithm from PricePredictions stated in its hourly forecast that Bitcoin is expected to make higher highs and retain the $16k price region. Interestingly, it seems that we might see BTC turn slightly bullish by the time the year ends.

Additionally, for similar, timely predictions, traders can register on PricePredictions and enjoy full access to predictions of countless cryptocurrencies.

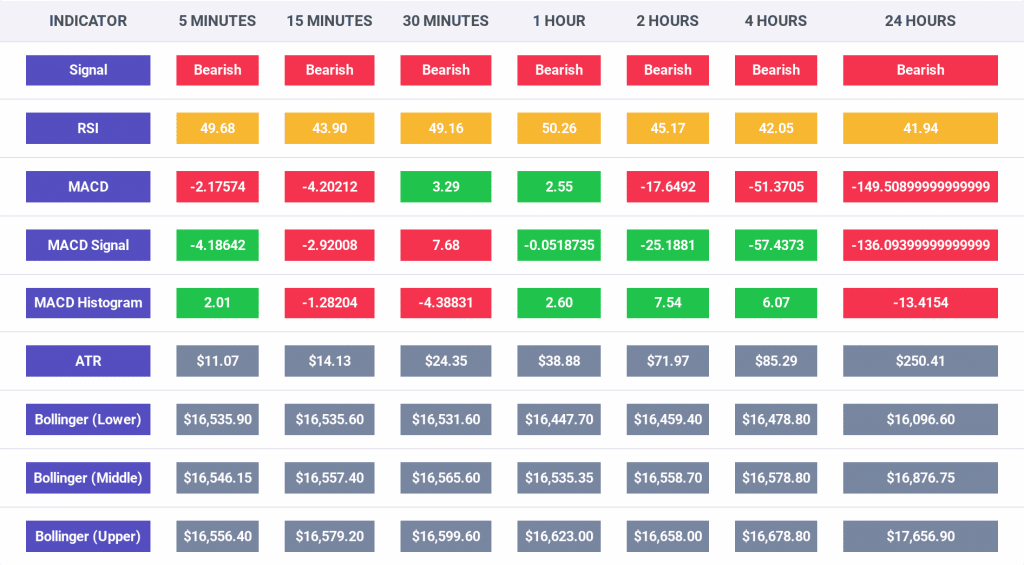

According to the data in the image below, it is clear that the indicators for the Bitcoin price action are bearish on all time frames, which confirms that the current trend will remain bearish. However, the situation might change if the trading volume of the leading crypto coin increases further and the bulls take over.

The RSI indicator is below 50 for all the time frames except the 30 minute time frame, on which the RSI reads 50.26. Surprisingly, on all the other frames, the RSI is not that far off from 50. If the indicator reads above 50 for the entire time frame, we can expect Bitcoin to turn bullish, but eventually, it will all depend on the volume.

Also, as per the publicly available data, the crypto market’s Fear and Greed Index’s value has dropped to 25, after maintaining a constant value of 28 for the past few days, as noted in our Crypto Market Performance Report for Dec. 29. It is also crucial to note that the investors’ sentiment currently reads “extreme fear,” and there are once again fears of a massive sell-off taking place.

Moreover, the market cap of the entire crypto space at the time of publication remains below the $800 billion mark and currently stands at $794.55 billion, and this value has gone down by 0.18% in the last 24 hours. Additionally, the number of cryptocurrencies is 22,157, as listed on CoinMarketCap.

Moreover, the world’s second-biggest cryptocurrency, Ether (ETH), is down by 0.01% in the last 24 hours and is currently priced at $1,195. The trading volume of the cryptocurrency is up slightly, by 5.40%, while the market dominance has dipped to 18.41% in the past 24 hours.

According to the data from Coinglass, the total crypto market liquidation in the last 24 hours amounted to $45.91 million, of which, Bitcoin made up $16.59 million and Ether made up $9.94 million.

Excluding Bitcoin and Ether, the other top 10 cryptocurrencies in the industry are Binance Coin (BNB), Ripple (XRP), Dogecoin (DOGE), Cardano (ADA), and Polygon (MATIC).

The other top 10 cryptocurrencies showed mixed movements with BNB up 0.12% to $245.57; XRP up 0.68% to $0.341; DOGE down 2.94% to $0.06834; ADA up 0.31% to $0.2448, and MATIC down 0.87% to $0.7566.

On the other hand, the worst performing tokens in the last 24 hours among the top 100, excluding the top 10, are GMX (GMX), Hedera (HBAR), Luna Classic (LUNC), and Aave (AAVE).

Interestingly, GMX was down 4.80% to $40.67; HBAR was down 4.42% to $0.03699; LUNC was down 4.74% to $0.0001424; and AAVE was down 4.12% to $52.01.

Finally, the best performers in the top 100, not considering the top 10 cryptocurrencies, are Internet Computer (ICP), OKB (OKB), Curve DAO Token (CRV), and Aptos (APT).

ICP was up 4.56% to $4.10, OKB was up 5.30% to $25.30, CRV was up 4.03% to $0.5266, and APT was up 4.85% to $3.36.