Do Kwon Rejects the SEC’s Push to Question Him in the US

- Do Kwon claims a written testimony could violate his due process rights under US laws and rejected the SEC’s claim to return him to the US.

- The SEC believes Kwon and his associates committed financial fraud by misleading investors.

- Kwon was arrested in Montenegro in March alongside an associate for traveling with forged documents.

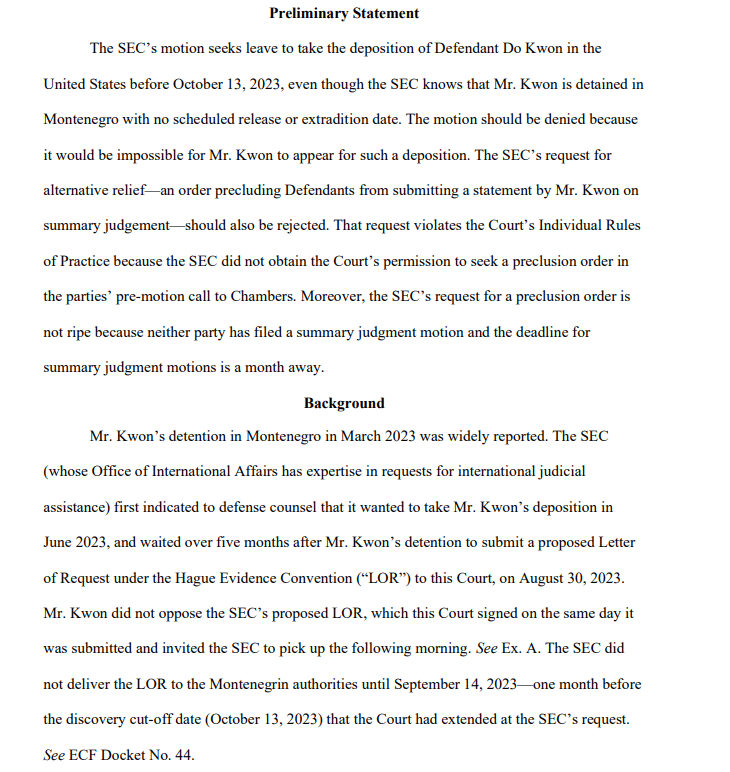

A court filing on Wednesday revealed that Terraform Labs founder Do Kwon does not want to be interrogated by the US Securities and Exchange Commission (SEC) and has asked his attorneys to prevent that. Kwon’s lawyers have asked a federal court to reject the SEC’s attempts to question their client in the US over the fall of the Terra financial ecosystem.

Kwon’s lawyers claimed in their filing that attempts to have Kwon testify before US regulators would be “impossible” since he has been indefinitely detained in Montenegro. Recall that the Terraform Labs founder was arrested in Montenegro for traveling with false documents in March.

In addition, Kwon’s lawyers claim the former Terra executive cannot provide written testimony to the SEC as that would violate his rights to due process under US laws.

The lawyers wrote:

An order mandating something that is impossible serves no practical purpose and risks undermining judicial authority.

Additionally, Kwon’s attorneys argued that Kwon did not expressly object to a deposition but pointed out that it would have to occur in Montenegro since the Terra developer is currently on bail there. Also, Wednesday’s filing comes a week after the SEC requested permission from the court to speak with Kwon regarding the Terra/Luna collapse ahead of the case’s October 13 discovery deadline.

Kwon’s lawyers claimed that a Montenegrin court informally said it might schedule a hearing on October 13 or October 26 in which it would examine Kwon with the SEC’s questions. The SEC noted, nevertheless, that it might find this procedure to be “inadequate” and seek another interrogation of Kwon after the October 13 date.

Do Kwon became a person of interest to the SEC following the collapse of the Terra/Luna ecosystem, which wiped off a reported $40 billion of investors’ funds. The SEC believes Kwon and his associates committed one of the biggest securities frauds by misleading investors about the stability of their offerings.