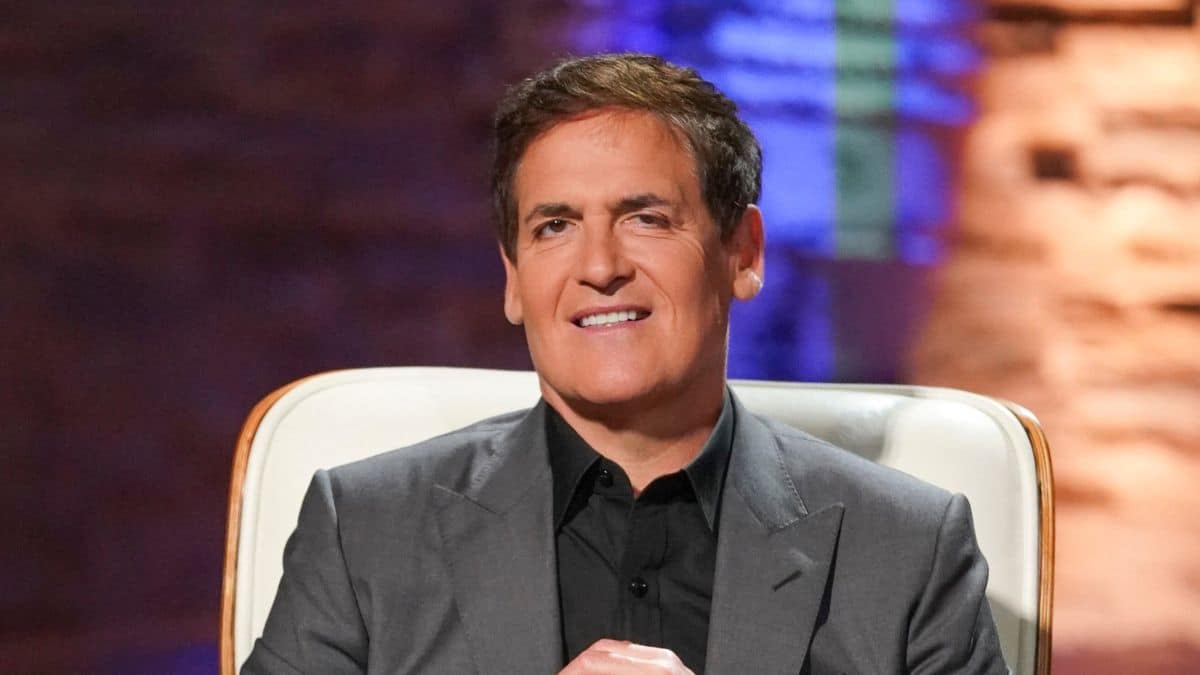

Mark Cuban säger att det är nästan omöjligt att avgöra vilken krypto som är en säkerhet

- Mark Cuban anser att US SEC har misslyckats med att tillhandahålla en tydlig väg till reglering för kryptoföretag.

- Han sa att "utan en armé av värdepappersadvokater" är det omöjligt att avgöra vilken kryptotillgång som är en säkerhet.

- SEC märkte nyligen många mynt som SOL, MATIC, AXS, ADA, etc. som värdepapper i en rättegång mot Coinbase.

- Cuban noterade att andra finansiella industrier upplever mer transparens från SEC.

Mark Cuban, miljardärsägaren till Dallas Mavericks och stödjaren till Ethereums skalningslösning Polygon (MATIC), är en av de många personer som har gått ut mot Securities and Exchange Commission (SEC) för dess reglering av genomdrivande taktik mot kryptoföretag . Byråns ordförande, Gary Gensler, har flera gånger sagt att, förutom Bitcoin (BTC), alla andra kryptomynt är värdepapper.

Miljardären uppgav att SEC synbart har misslyckats med att ge kryptovalutaföretag en tydlig registreringsprocess och har skapat osäkerhet i branschen, vilket driver blockchain-företag bort från den amerikanska ekonomin. Mark Cuban påpekade också att det inte finns någon registrering i SEC:s "Framework for 'Investment Contract' Analysis of Digital Assets" dokumentera via en 11 juni tweeta.

Som rapporterats tidigare av Bitnation, den SEC stämde den största kryptobörsen i USA uppgav Coinbase och i färgen att flera mynt som erbjuds av börsen är värdepapper, inklusive Solana (SOL), Polygon (MATIC), Axie Infinity (AXS), Chiliz (CHZ), Nexo (NEXO), Cardano (ADA) osv.

"Tyvärr är inget av elementen som presenteras på denna sida en del av registreringsprocessen. Vilket gör det nästan omöjligt att veta, med eller utan en armé av värdepappersadvokater, vad som är eller inte är en säkerhet i kryptouniversumet, säger Cuban.

En steg-för-steg-översikt tillhandahålls inte av SEC, men dokumentet förklarar kortfattat vad som krävs för kryptoföretag som strävar efter att följa landets lagar. Företagen är skyldiga att avslöja all information som är avgörande för att investerare ska kunna fatta "informerade investeringsbeslut" och andra "väsentliga förvaltningsinsatser", bland annat.

Mark Cuban noterade att andra finansiella industrier bevittnar mer transparens från SEC, och miljardären förklarade att "aktielån" inte märks som värdepapper av tillsynsmyndigheten, och snarare än att stämma mäklare och banker, deltar de i en "kommentarer" bearbeta."

"De borde göra samma sak med krypto som ett försök att avgöra vilka aspekter av krypto som är värdepapper och vilka som inte är det", sa Shark Tank-investeraren.