Mark Cuban dit qu'il est presque impossible de déterminer quelle crypto est une sécurité

- Mark Cuban estime que la SEC américaine n'a pas réussi à fournir une voie claire vers la réglementation des entreprises de cryptographie.

- Il a déclaré que "sans une armée d'avocats en valeurs mobilières", il est impossible de déterminer quel actif cryptographique est un titre.

- La SEC a récemment qualifié de nombreuses pièces comme SOL, MATIC, AXS, ADA, etc. de titres dans le cadre d'un procès contre Coinbase.

- Cuban a noté que d'autres industries financières assistent à une plus grande transparence de la part de la SEC.

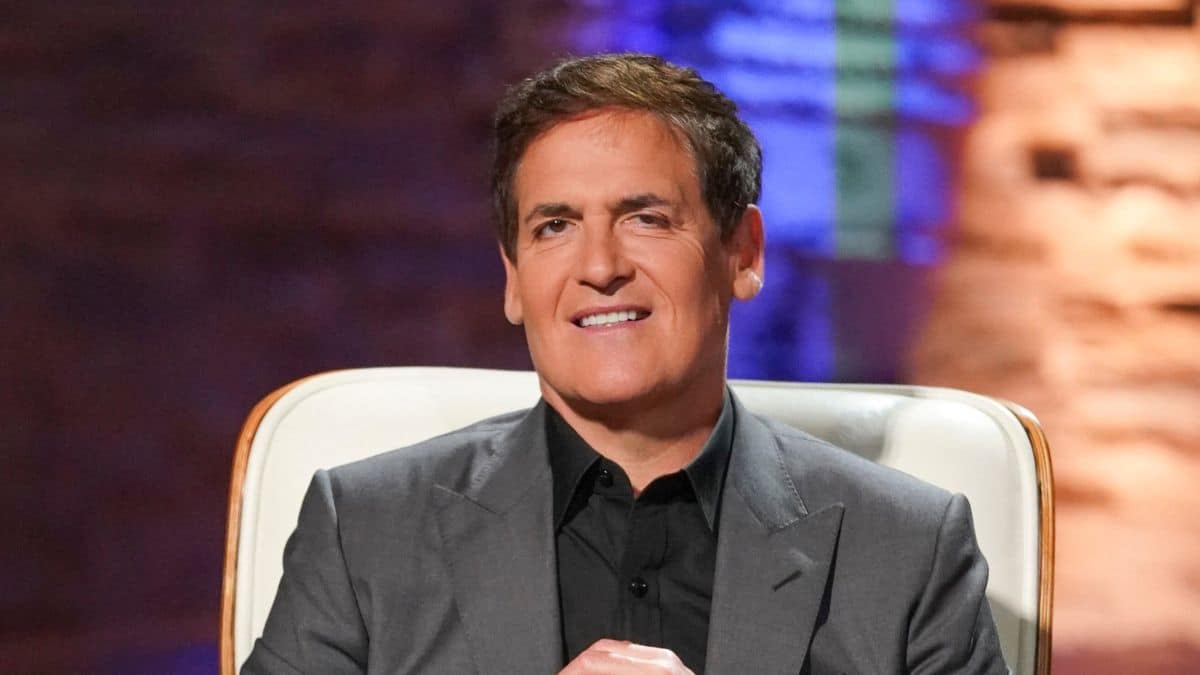

Mark Cuban, le propriétaire milliardaire des Dallas Mavericks et le soutien de la solution de mise à l'échelle d'Ethereum Polygon (MATIC), est l'une des nombreuses personnes qui se sont prononcées contre la Securities and Exchange Commission (SEC) pour sa réglementation par des tactiques d'application contre les sociétés de cryptographie. . Le président de l'agence, Gary Gensler, a déclaré à plusieurs reprises qu'à l'exception de Bitcoin (BTC), toutes les autres crypto-monnaies sont des titres.

Le milliardaire a déclaré que la SEC n'a visiblement pas fourni aux entreprises de crypto-monnaie un processus d'enregistrement clair et a créé une incertitude réglementaire dans l'industrie, éloignant les entreprises de la blockchain de l'économie américaine. Mark Cuban a également souligné qu'aucun enregistrement n'existe dans le "Framework for 'Investment Contract' Analysis of Digital Assets" de la SEC. document via un 11 juin tweeter.

Comme indiqué précédemment par Bitnation, le La SEC a poursuivi le plus grand échange de crypto aux États-Unis, Coinbase et dans la poursuite, ont déclaré que plusieurs pièces offertes par la bourse sont des titres, notamment Solana (SOL), Polygon (MATIC), Axie Infinity (AXS), Chiliz (CHZ), Nexo (NEXO), Cardano (ADA), etc.

“Malheureusement aucun des éléments présentés dans cette page ne fait partie du processus d'inscription. Ce qui rend presque impossible de savoir, avec ou sans une armée d'avocats en valeurs mobilières, ce qui est ou n'est pas un titre dans l'univers de la cryptographie », a déclaré Cuban.

Un aperçu étape par étape n'est pas fourni par la SEC, mais le document explique brièvement ce qui est requis pour les entreprises de cryptographie qui visent à se conformer aux lois du pays. Les entreprises sont tenues de divulguer toutes les informations cruciales pour que les investisseurs puissent prendre des "décisions d'investissement éclairées" et d'autres "efforts de gestion essentiels", entre autres.

Mark Cuban a noté que d'autres industries financières assistent à une plus grande transparence de la part de la SEC, et le milliardaire a expliqué que les «prêts d'actions» ne sont pas étiquetés comme des titres par le régulateur, et plutôt que de poursuivre les courtiers et les banques, ils s'engagent dans un «commentaires processus."

"Ils devraient faire la même chose avec la crypto afin de déterminer quels aspects de la crypto sont des titres et lesquels ne le sont pas", a déclaré l'investisseur de Shark Tank.