Mark Cuban dice que es casi imposible determinar qué criptomoneda es un valor

- Mark Cuban cree que la SEC de EE. UU. no ha proporcionado un camino claro hacia la regulación de las criptoempresas.

- Dijo que "sin un ejército de abogados de valores", es imposible determinar qué criptoactivo es un valor.

- La SEC recientemente etiquetó muchas monedas como SOL, MATIC, AXS, ADA, etc. como valores en una demanda contra Coinbase.

- Cuban señaló que otras industrias financieras están presenciando una mayor transparencia de la SEC.

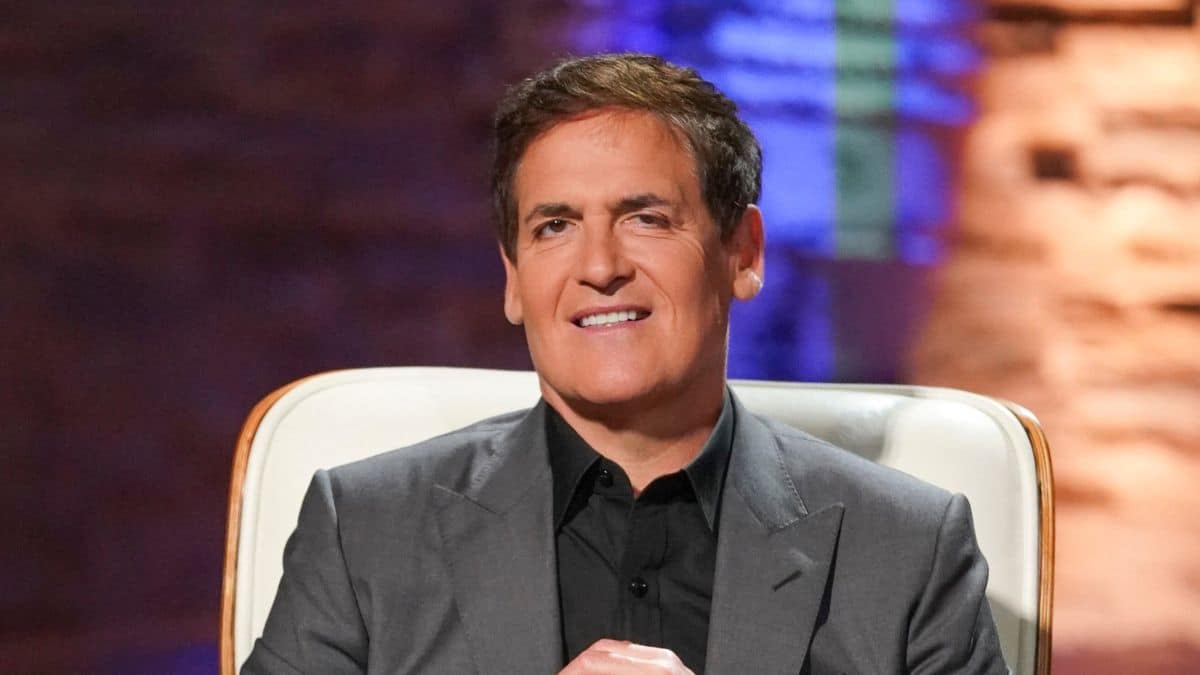

Mark Cuban, el propietario multimillonario de los Dallas Mavericks y el patrocinador de la solución de escalado de Ethereum Polygon (MATIC), es una de las muchas personas que se han manifestado en contra de la Comisión de Bolsa y Valores (SEC) por su regulación mediante tácticas de aplicación contra las empresas criptográficas. . El presidente de la agencia, Gary Gensler, ha declarado varias veces que, a excepción de Bitcoin (BTC), todas las demás criptomonedas son valores.

El multimillonario declaró que la SEC ha fallado visiblemente en proporcionar a las empresas de criptomonedas un proceso de registro claro y ha creado incertidumbre regulatoria en la industria, alejando a las empresas de blockchain de la economía estadounidense. Mark Cuban también señaló que no existe ningún registro en el "Marco para el análisis de activos digitales de 'Contratos de inversión' de la SEC" documento vía un 11 de junio Pío.

Como informó anteriormente Bitnation, el La SEC demandó al mayor criptointercambio en los EE. UU., Coinbase, y en la demanda, declaró que varias monedas ofrecidas por el intercambio son valores, incluidas Solana (SOL), Polygon (MATIC), Axie Infinity (AXS), Chiliz (CHZ), Nexo (NEXO), Cardano (ADA), etc

“Desafortunadamente ninguno de los elementos presentados en esta página son parte del proceso de registro. Lo que hace que sea casi imposible saber, con o sin un ejército de abogados de valores, qué es o no un valor en el criptouniverso”, dijo Cuban.

La SEC no proporciona un esquema paso a paso, pero el documento explica brevemente lo que se requiere para las criptoempresas que tienen como objetivo cumplir con las leyes del país. Las empresas están obligadas a divulgar toda la información crucial para que los inversores tomen "decisiones de inversión informadas" y otros "esfuerzos de gestión esenciales", entre otras cosas.

Mark Cuban señaló que otras industrias financieras están siendo testigos de una mayor transparencia de la SEC, y el multimillonario explicó que los "préstamos de acciones" no están etiquetados como valores por el regulador, y en lugar de demandar a los corredores y bancos, están participando en un "comentarios". proceso."

"Deberían hacer lo mismo con las criptomonedas como un esfuerzo por determinar qué aspectos de las criptomonedas son valores y cuáles no", dijo el inversionista de Shark Tank.