Mark Cuban, Hangi Kriptonun Güvenlik Olduğunu Belirlemenin Neredeyse İmkansız Olduğunu Söyledi

- Mark Cuban, ABD SEC'in kripto firmaları için net bir düzenleme yolu sağlamakta başarısız olduğuna inanıyor.

- “Bir menkul kıymet avukatları ordusu olmadan” hangi kripto varlığının menkul kıymet olduğunu belirlemenin imkansız olduğunu söyledi.

- SEC geçtiğimiz günlerde Coinbase aleyhine açılan bir davada SOL, MATIC, AXS, ADA vb. birçok madeni parayı menkul kıymet olarak etiketledi.

- Cuban, diğer finans sektörlerinin SEC'den daha fazla şeffaflığa tanık olduğunu kaydetti.

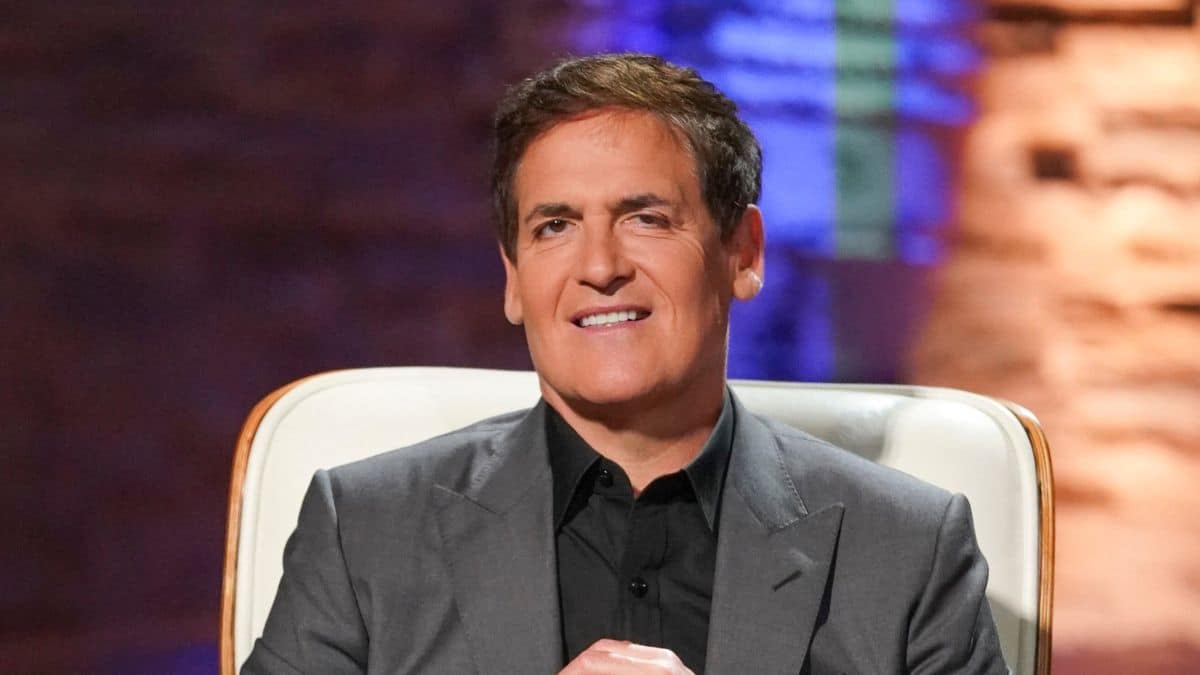

Dallas Mavericks'in milyarder sahibi ve Ethereum ölçekleme çözümü Polygon'un (MATIC) destekçisi Mark Cuban, kripto şirketlerine karşı uygulama taktikleri yoluyla düzenlemesi nedeniyle Menkul Kıymetler ve Borsa Komisyonu'na (SEC) karşı çıkan birçok kişiden biri. . Ajansın başkanı Gary Gensler, Bitcoin (BTC) dışındaki tüm kripto paraların menkul kıymet olduğunu defalarca ifade etti.

Milyarder, SEC'in kripto para şirketlerine net bir kayıt süreci sağlamada gözle görülür şekilde başarısız olduğunu ve sektörde düzenleyici belirsizlik yaratarak blockchain işletmelerini ABD ekonomisinden uzaklaştırdığını belirtti. Mark Cuban ayrıca SEC'in "Dijital Varlıkların 'Yatırım Sözleşmesi' Analizi Çerçevesi"nde herhangi bir kaydın bulunmadığına dikkat çekti. belge 11 Haziran aracılığıyla cıvıldamak.

Bitnation tarafından daha önce bildirildiği üzere, SEC en büyük kripto borsasına dava açtı ABD'de Coinbase ve davada, Solana (SOL), Polygon (MATIC), Axie Infinity (AXS), Chiliz (CHZ), Nexo (NEXO), Cardano dahil olmak üzere borsa tarafından sunulan birden fazla koinin menkul kıymet olduğunu belirtti. (ADA), vb.

"Maalesef bu sayfada sunulan öğelerin hiçbiri kayıt sürecinin bir parçası değil. Bu da, menkul kıymetler avukatları ordusu olsa da olmasa da, kripto evreninde menkul kıymetin ne olup olmadığını bilmeyi neredeyse imkansız kılıyor” dedi.

SEC tarafından adım adım bir taslak sunulmamaktadır, ancak belge, ülkenin yasalarına uymayı amaçlayan kripto firmaları için neyin gerekli olduğunu kısaca açıklamaktadır. Firmaların, diğer şeylerin yanı sıra, yatırımcıların "bilgiye dayalı yatırım kararları" ve diğer "temel yönetim çabaları" vermesi için hayati önem taşıyan tüm bilgileri ifşa etmesi gerekmektedir.

Mark Cuban, diğer finans sektörlerinin SEC'den daha fazla şeffaflığa tanık olduğunu kaydetti ve milyarder, "hisse senedi kredilerinin" düzenleyici tarafından menkul kıymet olarak etiketlenmediğini ve komisyonculara ve bankalara dava açmak yerine "yorumlar" yürüttüklerini açıkladı. işlem."

Shark Tank yatırımcısı, "Kripto paranın hangi yönlerinin menkul kıymet olup hangilerinin olmadığını belirleme çabası olarak kripto ile aynı şeyi yapmalılar" dedi.