BlackRock si muove verso il lancio di un ETF sull'Ether

- BlackRock è in attesa dell'approvazione della SEC per un ETF spot su Bitcoin.

- Giovedì il prezzo di Ether è aumentato di oltre 7%.

- Ark Invest sta pianificando di lanciare una nuova suite di ETF su asset digitali con 21Shares.

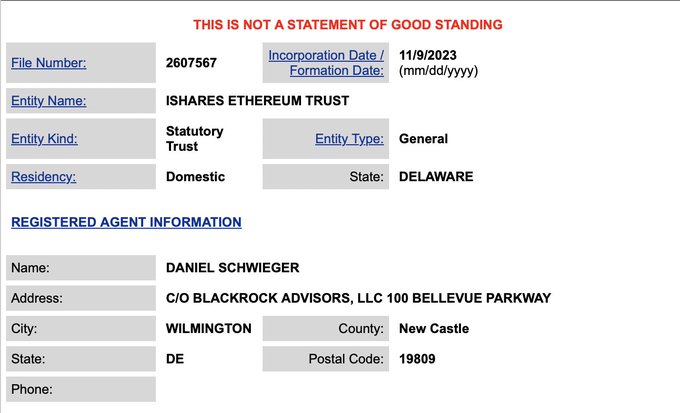

Ethereum, la seconda criptovaluta per capitalizzazione di mercato, ha registrato un'enorme crescita giovedì, causata dal primo passo di BlackRock verso un ETF su Ether. BlackRock, un gestore patrimoniale, avrebbe registrato un iShares Ethereum Trust nello stato del Delaware.

Il sito web della Divisione delle Società del Delaware ha mostrato che un'entità identificata come BlackRock Advisors ha presentato la documentazione. Daniel Schwieger è elencato nel fascicolo come agente registrato. Il profilo LinkedIn di Schweiger mostra che lavora come amministratore delegato presso BlackRock.

Il prodotto iShares di BlackRock è il principale ETF con oltre 1.400 miliardi di dollari di asset in gestione. BlackRock ha registrato il suo Bitcoin Trust a giugno e ha depositato la domanda di un ETF Bitcoin presso la Securities and Exchange Commission (SEC) degli Stati Uniti.

Il prezzo di Ether ha reagito alla nuova mossa di BlackRock, salendo di 7% e superando quota $2.000 per la prima volta da aprile. Il principale concorrente di Ether, Bitcoin, ha registrato un'impennata simile durante l'estate, quando i gestori patrimoniali hanno lanciato offerte per gli ETF Bitcoin.

Il mercato delle criptovalute rimane ottimista riguardo alla possibilità di vedere un ETF su Bitcoin quest'anno. Tuttavia, la SEC non ha ancora concesso tale approvazione. L'autorità di controllo statunitense ha espresso preoccupazione per un ETF su Bitcoin e ha impedito a Grayscale di trasformare il suo prodotto fiduciario Bitcoin in un ETF. Un giudice ha annullato la decisione della SEC ad agosto.

Il SEC La SEC ha scelto di non presentare ricorso contro la sentenza, ma potrebbe addurre altre motivazioni per bloccare la conversione di Grayscale e di qualsiasi altro fondo Bitcoin preso in considerazione. Molti ritengono che la SEC potrebbe approvare i fondi Ether dopo aver autorizzato gli ETF Bitcoin.

BlackRock proposto Secondo quanto riferito, l’ETF spot bitcoin ha un forte sostegno da parte del mondo finanziario. Secondo i rapporti, le principali società commerciali come Jane Street, Virtu Financial e Jump Trading stanno valutando la possibilità di fornire liquidità al nuovo prodotto se approvato dalle autorità di regolamentazione.

Passando ad altre notizie, l'esperta di investimenti in Bitcoin Cathie Wood di ARK Invest e il fornitore di prodotti negoziati in borsa (ETP) 21Shares hanno collaborato per introdurre una nuova linea di ETF su asset digitali. La nuova partnership fornirà presumibilmente agli investitori che desiderano includere asset digitali nel proprio portafoglio di trading una gamma più ampia di opzioni.

21Shares ha scritto in una dichiarazione:

Sfruttando i segnali onchain e la nostra esperienza cripto-nativa, la suite mira a fornire un apprezzamento del capitale a lungo termine attraverso investimenti strategici in contratti futures su Bitcoin ed Ethereum e l'applicazione delle tecnologie blockchain.

Secondo l'annuncio, il Chicago Board Options Exchange, o Cboe, elencherà gli ETF. Inoltre, secondo 21Shares, cinque prodotti inizieranno a essere negoziati la prossima settimana.

Ark, tuttavia, ha osservato che i fondi non offrono agli investitori la possibilità di investire direttamente in asset digitali. La società di investimento ha osservato che "né i fondi né l'ETF sottostante investono direttamente in bitcoin o altri asset digitali, né mantengono un'esposizione diretta al prezzo spot di bitcoin... Gli investitori che cercano un'esposizione diretta al prezzo di bitcoin dovrebbero prendere in considerazione un investimento diverso dai fondi".“